Last year, the 1% monthly payment plan was a standard market feature. Entering 2026, major developers have pivoted to 60/40 and 70/30 structures. This shift signals a maturing market, but it changes the entry barrier for new investors and requires a more sophisticated capital strategy.

Defining Off-Plan Assets In The 2026 Market

From an asset manager's perspective, off-plan property is a tool for portfolio growth. It represents a commitment to acquire a unit based on architectural plans, with the physical asset delivered at a future date. This approach differs fundamentally from acquiring ready assets in the secondary market, especially regarding initial capital outlay and appreciation potential.

Unlike the speculative frenzy of the post-Covid boom, the 2026 market approaches off-plan investment with greater analytical rigour. Last year's benchmarks showed off-plan transactions consistently outpacing ready unit sales, signalling a mature investor base focused on securing tomorrow's assets at today's prices.

The Core Concept Explained

An off-plan acquisition is analogous to a pre-IPO stock purchase. An investor is capitalizing on a project's future value, driven by developer reputation, master community infrastructure growth, and broader economic currents. The key difference is the asset is tangible, physical, and operates within a highly regulated framework.

The components of an off-plan investment include:

- Phased Payments: Capital is deployed over the construction timeline, typically 2-4 years, rather than in a single lump sum.

- Regulated Framework: Transactions are governed by the Real Estate Regulatory Agency (RERA), with funds secured in mandatory escrow accounts. This mechanism ensures capital is released only upon hitting certified construction milestones.

- Potential for Capital Growth: The primary financial driver is the potential for the property's market value to increase between the booking date and handover.

For HNWIs, allocating capital to this asset class is a strategic move. It is about leveraging Dubai’s shift from the post-covid speculative boom to a sustainable growth cycle, a trend indicated by the current Dubai real estate market analysis.

Legal And Financial Safeguards

The structure of an off-plan purchase in Dubai is designed to protect the buyer. Upon signing a Sale and Purchase Agreement (SPA), the developer is legally required to register it with the Dubai Land Department (DLD) via the Oqood system. This provides an initial, legally recognized title to the property.

Furthermore, under current UAE property law, developers cannot launch a project without proving outright land ownership and securing all necessary permits and financial guarantees. This regulatory oversight minimizes project failure risk and ensures capital is directed solely toward asset completion. Exploring some of the best off-plan projects in Dubai reveals how top-tier developers structure these legally sound opportunities. This disciplined environment sets Dubai's market apart, providing a secure foundation for strategic asset acquisition.

The Financial Mechanics Of Off Plan Investments

The payment structure is the core of any off-plan deal. Aggressive 1% monthly plans have been replaced by more balanced 60/40 or 70/30 models as we enter 2026. This is a fundamental shift that impacts an investor's cash flow, entry barrier, and the asset's overall risk profile.

Understanding these mechanics is critical for efficient capital deployment. Previously, developers used long post-handover payment plans to attract a wider buyer pool. The market has now matured. The dominant structures require the bulk of capital during the construction phase, a signal that developers are prioritizing project stability over sales velocity. This indicates a less speculative, more sustainable market.

Deconstructing The Payment Plan

An off-plan payment journey is a structured, milestone-based timeline. Each payment is tied to tangible progress, a process overseen by RERA to ensure funds fuel the completion of your property.

Here is a typical breakdown:

- Booking Fee: An initial amount paid to reserve the unit.

- Down Payment: A payment of 10-20% of the property value, due upon signing the official Sale and Purchase Agreement (SPA).

- Construction-Linked Instalments: The largest portion, spread across the construction period and linked to specific, verified milestones like foundation completion or structure topping out.

- Handover Payment: The final payment, due just before receiving the keys.

[Chart: 2026 Payment Plan Breakdown]

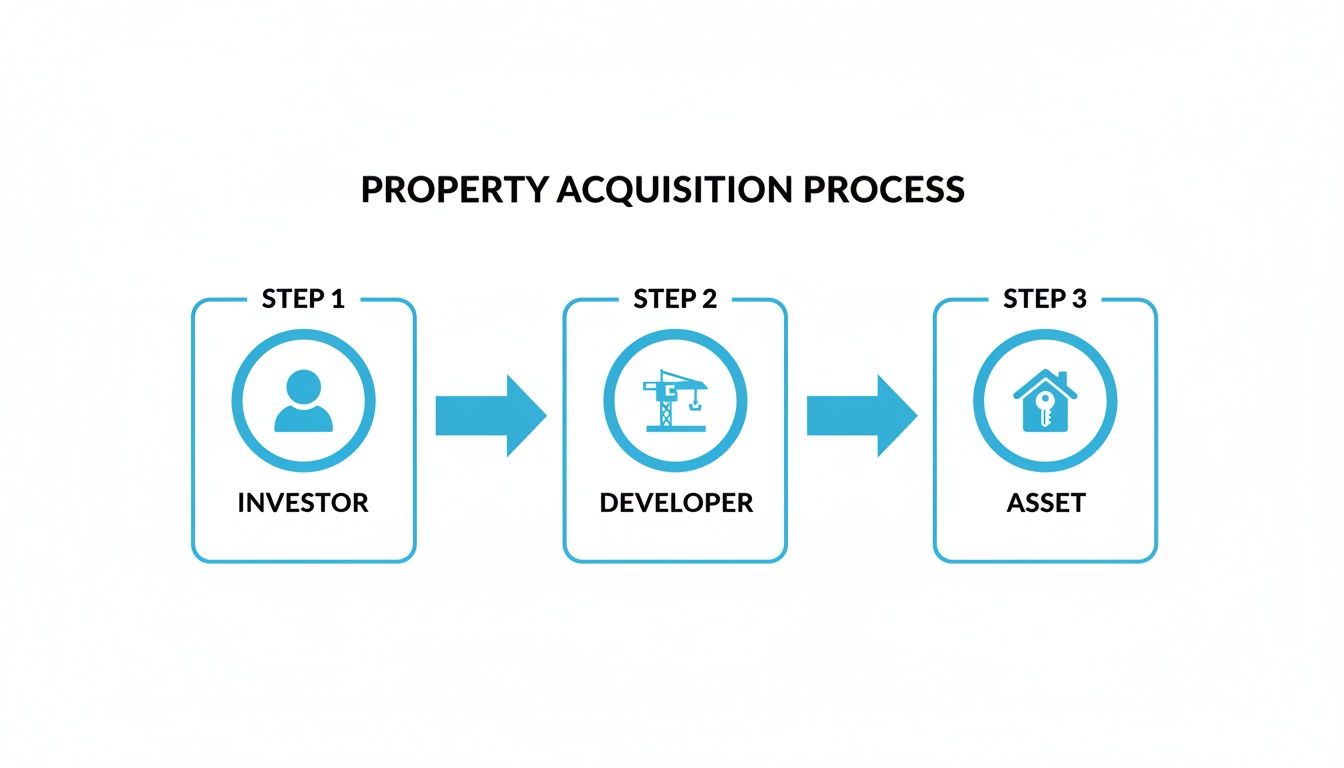

The flowchart below provides a high-level view of this journey, from initial commitment to holding the title deed.

This visual shows how capital is secured in regulated channels and deployed by the developer to create a physical, titled asset.

Payment Plan Evolution A Comparative Analysis

The shift in payment structures indicates the market's health. The table below breaks down how typical payment plans have evolved from buyer-centric post-handover models to more balanced structures that signal greater stability.

| Payment Stage | Typical 2025 Structure (Post-Handover) | Dominant 2026 Structure (During Construction) | Implication For Investor |

|---|---|---|---|

| Down Payment | 10% on Booking | 20% on Signing SPA | Higher initial capital required, filtering for more committed buyers. |

| Construction Phase | 40% in instalments over 3 years | 50% tied to construction milestones | Investor's capital is more closely aligned with tangible progress. |

| On Handover | 10% on Completion | 30% on Completion | Significant payment due before taking possession. |

| Post-Handover | 40% over 2-3 years after getting keys | 0% (in most new launches) | Eliminates developer financing risk; requires investor to have full funds ready. |

This evolution shows a clear trend: developers are now better capitalized and are not relying on extended payment plans to drive sales, which reduces systemic market risk.

Associated Acquisition Costs

Beyond the SPA price, mandatory government fees must be budgeted for. These non-negotiable costs are a crucial part of the total investment. A transparent understanding of these charges is essential for calculating true ROI.

The main acquisition costs include:

- Dubai Land Department (DLD) Fees: A one-off charge of 4% of the property’s purchase price.

- Oqood Registration: A fee for registering your off-plan property, legally documenting ownership rights with the DLD before the final title deed is issued.

- Administrative Fees: Nominal fees charged by the developer to cover paperwork processing.

Forgetting these costs is a common error. On an AED 2 million property, DLD fees alone are AED 80,000. Accurately forecasting all associated taxes on property is fundamental to sound financial planning.

The move from post-handover payment plans defines the current market cycle. It pressures investor liquidity during construction but also filters the market, attracting more well-capitalized buyers. For a deeper dive, learn more about these shifts in our analysis of Dubai's real estate market trends.

Crucially, every dirham is channeled through RERA-mandated escrow accounts. This is the most important mechanism protecting you. The developer cannot access these funds directly. Money is only released by an approved trustee after they have independently verified that a specific construction milestone has been met. This system ties payments directly to real progress, securing your investment.

Analysing Capital Appreciation And ROI Potential

Buying off-plan property is a calculated investment. From an asset manager’s view, the goal is to acquire a property poised for capital appreciation during construction that will deliver strong rental yields post-handover. The objective is to lock in a price today for an asset that will be worth more tomorrow by capitalizing on a growth story before the broader market.

The numbers from last year's benchmarks tell this story. The April 2025 surge saw AED 46 billion in transactions, a 77% year-on-year increase. Off-plan sales constituted nearly 60% of those deals. This is not a niche strategy; it is where strategic capital is flowing, especially in high-growth corridors.

Key Drivers Of Off Plan Appreciation

Growth in an off-plan property is fueled by measurable factors. Understanding these catalysts separates a high-potential investment from a standard apartment. The period of easy flips seen before 2025 is over. Success in 2026 requires a sharper, more analytical approach.

What drives the value up?

- Infrastructure Development: The most powerful force. A new Metro line extension, a major road network, or the expansion of a hub like Al Maktoum International Airport increases surrounding land value.

- Master Community Maturity: Early investors in communities like Dubai Hills Estate or Emaar South saw property values soar as schools, retail centers, and parks were completed. An asset's value grows with community amenities.

- Developer Pricing Strategy: Developers release projects in phases, increasing the price with each launch. Investing in the first phase positions you to benefit from these built-in price hikes.

- Market Momentum: A healthy economy and positive city-wide sentiment contribute to overall value accretion during the construction years.

ROI Projections New Versus Established Communities

While established areas like Downtown or Dubai Marina offer security, the primary opportunity for capital appreciation in 2026 is in emerging master communities like The Valley Phase 2 or areas around the Dubai South expansion. These developing areas offer a lower entry price per square foot, providing more room for value to climb as the community develops.

[Map: Location relative to Al Maktoum Airport]

A direct comparison highlights the difference in potential returns. The table below breaks down projected ROI based on performance benchmarks from last year.

| Metric | Established District (e.g., Downtown) | Emerging Community (e.g., The Valley) | Strategic Implication |

|---|---|---|---|

| Average Entry Price PSF | AED 2,200 - AED 3,500 | AED 1,200 - AED 1,600 | Initial capital goes further, creating a larger base for percentage growth. |

| Projected Appreciation (to Handover) | 8% - 15% | 20% - 35% | The risk is higher, but the potential for capital gains is substantially greater. |

| Primary Growth Driver | General market price increases | New infrastructure & community completion | Growth is directly tied to tangible, project-specific development milestones. |

| Rental Yield on Handover | 4% - 6% | 6% - 8% | A lower purchase price almost always translates to a higher rental yield percentage. |

This data indicates that while prime locations offer stability, strategic investment in up-and-coming zones is the engine for portfolio growth in 2026.

The core of a winning off-plan strategy is identifying where infrastructure is going, not where it already is. Value is created by investing ahead of the curve, in areas set to benefit from major projects like the Dubai South expansion.

Balancing Appreciation With Future Rental Yields

Capital appreciation during construction is compelling, but the long-term view is essential. An asset's sustainable value depends on its rental potential after handover. A property with strong appreciation can be a poor investment if rental demand is weak or the area is oversupplied with similar units.

The rental yield is a future promise, dependent on market absorption of new supply at project completion. This is why a thorough Dubai real estate market analysis is an ongoing process of assessing sub-market dynamics to ensure the investment performs as expected. Buying off-plan is a bet on the future desirability of a location. It must be well-researched.

Navigating The Legal Framework And RERA Protections

Investor confidence in Dubai's off-plan market is anchored by a robust and transparent legal framework. From an asset management perspective, understanding this structure is non-negotiable. It is the mechanism that turns a purchase agreement into a secure, tangible asset.

The system is governed by the Real Estate Regulatory Agency (RERA), the regulatory arm of the Dubai Land Department (DLD). RERA’s function is to create a stable and protected environment for real estate investment through strict developer licensing, project approval protocols, and buyer protection mechanisms. This oversight is a core reason why global capital continues to flow into Dubai’s off-plan sector.

The Cornerstone Of Investor Security: Escrow Accounts

The most critical component of this protective shield is the mandatory use of escrow accounts. This is a legal requirement for any developer launching an off-plan project.

An escrow account functions as a secure holding for investor funds. It is a special, RERA-approved bank account where all payments are deposited. The developer cannot access these funds directly. The money is held by an independent, accredited trustee and is released to the developer in stages only after an official inspection confirms that specific construction milestones have been met. This system links payments to tangible on-site progress, mitigating the risk of fund misuse.

Developer Prerequisites And Project Launch Criteria

Before accepting funds from a buyer, a developer must clear a series of legal hurdles. This front-loaded due diligence by RERA acts as a filter, removing under-capitalized or inexperienced players.

Key requirements for any developer include:

- Full Land Ownership: They must provide absolute proof of complete and unencumbered ownership of the project land.

- Initial Financial Commitment: A significant portion of the total construction cost must be deposited by the developer as a bank guarantee before sales can commence.

- All Necessary Permits: This includes approvals from the DLD, Dubai Municipality, and other key authorities, ensuring the project complies with all building codes and master plan regulations.

This vetting process means that by the time a project is offered, it has already passed critical financial and legal stress tests.

The legal framework is designed to de-risk the investment from the outset. RERA's role is not just to regulate but to actively safeguard buyer capital, ensuring the off-plan market matures with stability.

Securing Your Legal Title: The SPA and Oqood

Once an investor commits to a property, ownership is cemented through two key legal documents. The first is the Sale and Purchase Agreement (SPA), a detailed contract outlining all deal specifics, from the payment schedule to the handover date.

After the SPA is signed, the developer is legally bound to register the purchase with the DLD through the Oqood system. This process generates an initial title deed, providing an immediate, legally recognized claim to the property long before it is built. Understanding property ownership nuances, such as the difference between freehold vs leasehold rights, is also a vital part of this process.

Off-Plan Property And The Golden Visa Pathway

For many HNWIs, real estate is a direct route to long-term residency. A powerful advantage of the current legal framework is that off-plan properties can now qualify for the Golden Visa UAE.

To be eligible, the property must have a value of at least AED 2 million. The general requirement is that a significant portion of the property's value must be paid (often over 50% or a specific amount like AED 1 million) to initiate the visa application. This provision links strategic asset acquisition directly to residency benefits, making it a potent tool for global investors.

A Due Diligence Checklist For The Savvy Investor

Relying on luck is not a viable strategy. While the upside of off-plan is compelling, the potential for revised handover timelines or market corrections demands a structured, clinical approach to due diligence. Success in 2026 is about de-risking capital before signing.

The market volume underscores the necessity of a rigorous vetting process. Your checklist must cover three pillars: the developer, the legal agreement, and the specific sub-market. Last year's benchmarks, which saw off-plan deals dominating total transaction volume, confirm this. You can review these off-plan transaction trends on Statista.com for more context.

Before committing capital, a methodical due diligence process is non-negotiable. This is a strategic framework designed to protect capital and validate the investment's potential. The following checklist breaks down the critical areas to investigate.

Investor Due Diligence Checklist For Off Plan Purchases

| Verification Area | Key Questions To Ask | Where To Find Information |

|---|---|---|

| Developer Track Record | Have they delivered their last 3-5 projects on time? What is the build quality and maintenance level of their completed buildings? | Visit their previous projects. Speak to residents. Check online forums for unfiltered feedback. |

| Legal & Financials | Is the project registered with DLD/RERA? Does it have a RERA-approved escrow account? | Use the official Dubai REST app to verify the project's registration and escrow account number. |

| The SPA Contract | What are the specific penalty clauses for handover delays? Are the unit specifications (size, materials) detailed precisely? | Request a copy of the Sale and Purchase Agreement (SPA) and have it reviewed by a qualified property lawyer. |

| Sub-Market Analysis | How many other projects are launching in the same area? What is the future supply pipeline for the next 2-3 years? | Review reports from real estate consultancies. Use the Dubai Land Department's open data platforms. |

This checklist is a starting point. It forces an investor to move beyond the sales pitch and engage with the hard data that defines a project's viability.

Vetting The Developer Beyond The Brochure

A developer's marketing is irrelevant. Focus on their track record for execution and financial stability. Past performance is the most reliable predictor of future results.

- Scrutinise Past Projects: Investigate their history of delivering projects on schedule. Were there revised handover timelines on their last three projects? Visit their completed buildings to assess build quality and ongoing maintenance.

- Verify RERA Registration and Escrow: This is non-negotiable. Use the Dubai REST app to confirm the project’s registration number and the existence of its RERA-approved escrow account. This account guarantees your funds are ring-fenced for construction.

- Assess Financial Health: While financials for private companies are not public, stability can be gauged by their project pipeline and financing partners. A developer launching multiple projects with reputable financing is a positive sign. Our guide on the top 10 developers in Dubai provides a pre-vetted list.

Deconstructing The Sale And Purchase Agreement

The Sale and Purchase Agreement (SPA) is your most important legal shield. It is a binding contract that outlines your rights and the developer's obligations. Always have it reviewed by a qualified legal professional.

Key clauses to analyze include:

- Handover Date and Penalty Clauses: What happens if the developer misses the anticipated completion date? The contract must clearly state the grace period and specific penalties for excessive delays.

- Unit Specifications: The SPA must detail the exact size, layout, and finishing materials for your unit. Vague language is a red flag.

- Dispute Resolution: Understand the process for resolving disagreements. Most SPAs specify arbitration through the Dubai Land Department or other recognized bodies.

A strong SPA protects both parties. A weak one disproportionately favors the developer. Your objective is to ensure the terms are balanced and enforceable under current UAE property law.

Analysing Sub-Market Risk And Supply

Even with a top-tier developer and an ironclad SPA, market risk remains. The final layer of due diligence is to assess the specific sub-market. The goal is to avoid buying into an area that might become oversupplied by the time your property is ready.

Analyze the supply pipeline. How many other projects are scheduled for completion in the same area within a similar timeframe? An influx of thousands of similar units can put downward pressure on both rental yields and resale value. Target communities with clear, sustained demand drivers. Proximity to new metro lines, major economic hubs around Al Maktoum Airport, or top-tier schools can help insulate your investment from this supply-side risk.

Final Thoughts: Strategy Over Speculation

The speculative days that defined the post-Covid boom are behind us. Last year's performance established a new reality: the market now rewards investors who secure strategic assets in locations with fundamental strength. Success in 2026 is an exercise in deliberate asset management, not trade timing.

The conversation has shifted from the initial purchase to the strategy behind it. It demands a serious look at future infrastructure, population movement, and the developer's track record. The focus has shifted from gambling on price appreciation to confidence in delivery and location.

Buying off-plan is no longer just a transaction. It is the calculated addition of a future-proof asset to a managed portfolio. The question has changed from, "How much can I make?" to "What are the economic drivers supporting this community?"

This market dynamic forces a forward-looking perspective to pinpoint the next growth corridors. The game is now about tangible value—new metro lines, expanding business hubs, and master communities that offer genuine lifestyle propositions. If you are rebalancing your portfolio for 2026, let's run the numbers.

Frequently Asked Questions About Off-Plan Property

My team and I field questions daily from HNWIs rebalancing their portfolios for 2026. Below are direct answers to the most common queries regarding off-plan acquisitions.

What Is The Primary Financial Advantage Of Buying Off-Plan?

The core advantage is capital leverage. You secure a future asset at today's price but deploy a fraction of the total cost upfront. As the property's value appreciates during the construction cycle, your return on invested capital is magnified.

For example, a 20% down payment on a property that appreciates by 15% by handover yields a 75% return on invested cash, before fees. This leverage is the primary wealth-creation engine in off-plan investing.

Are There Protections If A Developer Delays Handover?

Yes, the system is structured to protect buyers. Your Sale and Purchase Agreement (SPA) is a legally binding contract that must state a handover date. Reputable developers include clauses detailing compensation for significant delays—a critical point to verify during due diligence.

Furthermore, RERA's oversight ensures developers must meet construction milestones before accessing funds from the escrow account. This creates a financial incentive to adhere to the timeline. Any deviation is scrutinized under current UAE property law.

Can I Sell An Off-Plan Property Before Completion?

This secondary market sale, or "flip," is permissible under certain conditions. Typically, a developer requires a certain percentage of the property's value—often between 30% and 50%—to be paid before allowing a sale.

You will also need a No Objection Certificate (NOC) from the developer and must settle any associated DLD fees. While profitable in a rising market, this strategy has become less common as the market has matured beyond previous speculative cycles.

How Does An Off-Plan Investment Affect My Residency Status?

An off-plan property can be a direct pathway to securing a long-term residency visa. An investment of AED 2 million or more makes you eligible to apply for the 10-year Golden Visa. The key condition is that a minimum amount, usually AED 1 million, must be paid to the developer.

This approach aligns strategic asset acquisition with personal residency goals. You can learn more by understanding what a Golden Visa in the UAE is. This integration of investment and residency is a cornerstone of Dubai's appeal.

Is The Off-Plan Market Still Growing?

The data is unequivocal. Last year's benchmarks showed off-plan properties accounting for over 60% of total sales value. In early 2026, transactions continue to show strong year-on-year growth, with off-plan sales volume consistently outpacing ready units. For a deeper dive into this sustained demand, you can review comprehensive market analyses on placeoverseas.com. This trend confirms that sophisticated capital continues to favor pre-construction assets.

At Proact Luxury Real Estate LLC, we provide data-driven advisory to ensure your capital is positioned for optimal growth in Dubai's maturing market. If you are structuring your portfolio for 2026, let's analyse the opportunities together.