A comprehensive look at the Dubai real estate market right now reveals one thing above all else: incredible growth and rock-solid investor confidence. The market isn't just warm; it's white-hot, fuelled by record-breaking transaction volumes and soaring property values that are capturing the attention of global capital. This isn't happening by accident—it's the direct result of strategic government initiatives and Dubai's well-earned status as a safe harbour for international investors.

Understanding The Dubai Real Estate Boom

Dubai's property market isn't just recovering from past cycles; it's accelerating at a pace that has put it firmly on the world stage. While other global markets are seeing fluctuations and uncertainty, Dubai presents a picture of robust health and sustained momentum. What we're witnessing is more than a fleeting trend; it's the outcome of powerful economic fundamentals meeting proactive, forward-thinking governance.

Think of the market as a high-performance engine. Several key components are firing in perfect sync, driving its impressive performance and creating an environment ripe for investment and growth. This synergy is attracting a diverse mix of buyers from every corner of the globe.

The Core Pillars of Dubai's Market Strength

To make any sense of the market, you have to understand these core drivers. They are the "why" behind the headline-grabbing numbers and offer a glimpse into the market's long-term stability.

- Strong Economic Fundamentals: Dubai's diversified, non-oil economy continues to expand. This creates high-quality jobs, attracting skilled professionals from all over the world who, of course, need a place to live.

- Strategic Government Incentives: Smart policies like the Golden Visa programme offer long-term residency for investors, property owners, and skilled talent, creating a stable and committed buyer base.

- A Global Safe-Haven: In a world of geopolitical and economic uncertainty, Dubai's reputation for safety, stability, and its famously pro-business policies make it a magnet for capital seeking a secure home.

These pillars form the very bedrock of the current boom. The powerful combination of a thriving economy and investor-friendly policies has kicked off a self-reinforcing cycle of demand, pushing both sales volumes and property values to new heights.

The data paints a very clear picture. Let's take a quick look at the first half of this year compared to the last.

Dubai Real Estate Market Snapshot H1 Current Year vs H1 Previous Year

Here’s a summary of the key performance indicators that really highlight the year-on-year growth we’re seeing.

| Metric | H1 Current Year Figure | Year-on-Year Growth |

|---|---|---|

| Total Sales Transactions | 94,000 | +23.04% |

| Total Transaction Value | AED 262.7 billion | +37.68% |

These aren't just small upticks; they represent a significant acceleration in market activity and value. It's clear that both the volume of deals and the prices being paid are on a strong upward trajectory, confirming the incredible dynamism at play. You can explore more on these historic price trends to get a better feel for the market's journey.

This introduction really just sets the stage. By grasping what's happening and, more importantly, why it's happening, you're in a much better position to navigate the opportunities that follow. The next sections will build on this foundation, diving deeper into specific price trends, supply dynamics, and actionable investment strategies.

How Property Prices And Rents Are Evolving

The raw numbers coming out of Dubai’s property market tell a pretty wild story of rapid growth. We're seeing serious upward momentum in both sales prices and rental rates, but the pace and patterns aren't the same everywhere. Digging into these nuances is the key to a smart market analysis and, ultimately, finding where the real opportunities are hiding.

The growth has been nothing short of explosive. Over the last five years, property prices in Dubai have shot up by an average of roughly 50% in real terms. That's faster than any other city tracked in the UBS Global Real Estate Bubble Index. This surge, which has pushed bubble risk into the high category for a second straight year, is being fanned by a 15% population boom since 2020 and has been accelerating with double-digit climbs since mid-2023.

But this incredible climb hasn't lifted all boats equally. Certain segments and prime locations have been leading the charge, creating a multi-tiered market that investors need to get their heads around.

Unpacking The Surge In Property Values

The villa market, in particular, has been a star performer. The post-pandemic craving for more space, privacy, and top-tier amenities hasn't gone away; it has pushed villa prices to record highs. It's the communities known for their luxury lifestyle offerings that have seen the most eye-watering appreciation.

Apartments, on the other hand, have had a more mixed journey. While the segment is definitely growing, the performance varies. New, high-end towers in central hotspots are fetching premium prices, but older buildings in less desirable areas are seeing much slower growth. For anyone chasing capital gains, that's a critical distinction.

The big takeaway here is that 'location' and 'property type' are more crucial than ever. The difference in appreciation between a prime villa on Palm Jumeirah and a standard apartment in an up-and-coming neighbourhood can be absolutely massive.

So, let's break down which areas are really leading the pack in price growth right now.

Hotspots For Capital Appreciation

A few neighbourhoods have become famous for their high growth, pulling in buyers from all over the world. These aren't just places to live; they are complete lifestyle destinations.

- Palm Jumeirah: This global icon for luxury living just keeps going. Waterfront properties are seeing relentless demand and constantly breaking sales records.

- Jumeirah Bay Island: An incredibly exclusive enclave that recently saw some of the highest-value villa sales in Dubai's history, cementing its status as an ultra-luxury titan.

- Dubai Hills Estate: This master-planned community is a magnet for affluent families, offering a perfect blend of luxury villas and modern apartments.

These prime areas are where you'll find the headline-grabbing price growth. But smart investors are also keeping a close eye on emerging districts that have strong potential for future gains as the city continues to expand.

Analysing The Rental Market Dynamics

While sales prices have been on a tear, the rental market has been on its own journey. After a period of intense, rapid growth where rents shot up across the city, the market is now shifting gears.

Rental growth is starting to stabilise. We’re still seeing increases, but the pace has definitely slowed down from its recent peak. This feels like a natural market correction, suggesting rents are hitting an affordability ceiling for many tenants. For landlords, this means that while yields are still very attractive, the days of dramatic, year-on-year rent hikes are probably behind us.

This stabilisation creates a different kind of opportunity. Investors who are focused on steady, reliable income can still find excellent yields, especially in high-demand rental communities. The game is no longer about chasing rapid rental growth. It's about securing good, long-term tenants in well-maintained properties in sought-after locations. The analysis now has to get more granular, focusing on net yields after factoring in service charges and other running costs.

Exploring The Core Drivers Of Market Demand

To really understand what's happening in the Dubai real estate market, you have to look past the flashy transaction numbers and dig into the powerful forces fuelling this incredible growth. The market's momentum isn't just a fluke; it's the direct result of smart economic policies, major demographic shifts, and strategic government moves all coming together at the right time. These drivers are creating a positive feedback loop of demand that just keeps pulling in global capital and talent.

Think of Dubai as a powerful economic magnet. Its pull comes from multiple sources, each one attracting new residents, investors, and businesses. A huge factor has been the wave of immigration we've seen since the pandemic, which has completely reshaped the demographic landscape and pumped fresh energy into the property sector. This isn't just a temporary bump; it represents a real shift in Dubai's global appeal as a top-tier place to live, work, and invest.

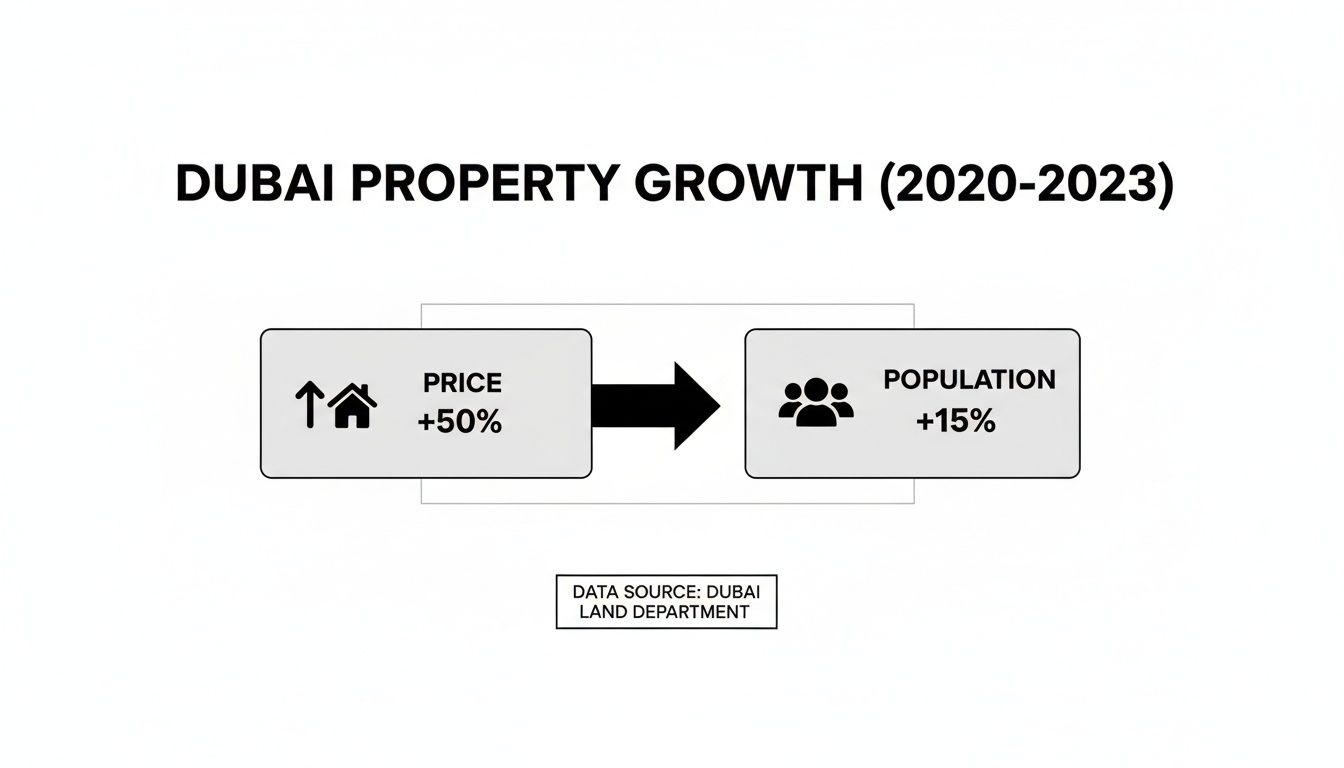

This infographic perfectly captures the direct link between population growth and the rise in property prices over the last few years.

The numbers are clear: a 15% surge in population has directly fuelled a remarkable 50% increase in property prices. It's a classic, powerful example of supply and demand in action.

Proactive Visa Policies and Population Growth

At the very heart of this population boom are the UAE's forward-thinking residency programmes. The government has been incredibly strategic, designing visa policies specifically to attract and, more importantly, retain a diverse pool of global talent, entrepreneurs, and high-net-worth individuals (HNWIs).

The expansion of the Golden Visa programme, in particular, has been a game-changer. By offering long-term residency to property investors, skilled professionals, and business owners, it has created a stable, committed base of residents who are genuinely invested in the city's future. This policy effectively turns what might have been transient expats into long-term stakeholders, which is a massive driver for home ownership demand.

On top of that, other initiatives like the Green Visa and retirement visas offer flexible, long-term options that appeal to an even wider audience. This proactive approach ensures a steady stream of new residents, which translates directly into sustained demand for both rental and sales properties.

Dubai’s visa strategy isn’t just about getting people here for a short time; it’s about making them want to stay for the long haul. By making it easier for the world’s best and brightest to call the city home, the government has laid a rock-solid foundation for long-term real estate demand.

An Unshakeable Reputation for Stability and Business

Beyond the sun and lifestyle, Dubai's reputation as a safe harbour for both economic and political stability is a massive draw. In a world full of uncertainty, the city offers a predictable, secure, and pro-business environment that international capital finds incredibly attractive. This safe-haven status is a critical driver of demand, especially from investors in regions facing instability.

The emirate's diversified economy plays a huge part in this. With thriving sectors in finance, technology, tourism, and logistics, Dubai is constantly creating high-value jobs that attract skilled professionals from all over the world. This continuous influx of talent keeps the rental market hot and creates a whole new generation of potential homebuyers.

- Ease of Doing Business: Simple regulations and a low-tax environment make Dubai a go-to destination for entrepreneurs and multinational corporations looking to set up shop.

- World-Class Infrastructure: The constant investment in transport, healthcare, and education seriously boosts the quality of life, making it an easy choice for families and professionals.

- Safety and Security: Being consistently ranked as one of the safest cities in the world gives HNWIs and expats the peace of mind they’re looking for.

These elements work together to create an irresistible pull. The dynamic economy creates jobs, and the high quality of life makes people want to put down roots. This virtuous cycle is a cornerstone of the powerful demand we're seeing in the Dubai real estate market. The city isn’t just selling properties; it’s offering a complete lifestyle and business ecosystem that’s tough to beat anywhere else.

What's In The Pipeline For Future Property Supply?

While scorching hot demand is grabbing all the headlines, a smart investor knows to look at the other side of the coin: supply. You simply can't get a complete dubai real estate market analysis without understanding what's being built. It's this pipeline of new properties that will ultimately shape the market for years to come.

Dubai’s skyline is never static; construction cranes are just part of the scenery. Developers are racing to keep up with the relentless appetite from buyers both at home and abroad, launching ambitious projects and expanding massive master communities. This constant development is great for accommodating the city's growth, but it means investors need to be picky.

It’s not just about the number of new units hitting the market. The real story is in the quality, location, and whether these new homes actually match what people want. Projects that deliver a unique lifestyle, world-class amenities, and killer connectivity will always stand out and hold their value, no matter how many other towers pop up.

The Unstoppable Rise of Off-Plan Sales

If there's one thing that defines Dubai's property market right now, it's the absolute dominance of off-plan sales. These are properties bought straight from the developer long before the first brick is even laid, usually with tempting prices and easy payment plans. In the first half of this year, a staggering 60% of all property deals were for off-plan units.

This isn’t just a trend; it's a massive vote of confidence in Dubai's developers and the city's long-term vision. People are essentially buying a piece of the future, trusting that their investment will be worth much more by the time they get the keys. It’s a powerful way to enter the market, but you’ve got to do your homework.

For savvy investors, the off-plan market is a strategic bet on Dubai's continued growth. You lock in a property at today's price, pay for it in stages, and watch its value climb as construction progresses. It's a classic way to maximise your return.

Of course, picking the right project is everything. To help you sort the winners from the rest, our detailed guide on the best off-plan projects in Dubai breaks down the top-tier opportunities you should have on your radar.

Landmark Projects Shaping Tomorrow's Dubai

We're not just talking about individual towers here. Several city-sized master communities are in the works, set to completely redefine what residential life in Dubai looks like. Think of them as self-sufficient destinations, not just places to live.

- Palm Jebel Ali: The comeback kid. This mega-project is going to be twice the size of the original Palm Jumeirah, bringing a huge amount of ultra-luxury waterfront homes to the market and creating entirely new investment hotspots.

- Dubai South: Built around the future Al Maktoum International Airport, this massive zone is primed for explosive growth. It’s a mix of residential, commercial, and logistics hubs that will become a city in its own right.

- Emaar South: A golfer’s paradise and a haven for families. This community is all about villas and townhouses surrounded by championship courses, lush parks, and retail centres, aimed squarely at the mid-to-upper end of the market.

These aren't just housing estates; they are future economic engines attracting huge institutional and private money. Their sheer scale means they'll create their own micro-markets, influencing property values far beyond their borders for decades.

As these projects are delivered, the market's ability to absorb the new supply will be tested. While Dubai's booming population is expected to soak up most of it, some areas with a lot of similar projects could see a temporary dip in prices and rents. A proper dubai real estate market analysis means keeping a close eye on handover schedules. This allows you to sidestep saturated areas or, even better, spot a tactical bargain when others aren't looking.

Actionable Investment Strategies For Every Goal

A detailed Dubai real estate market analysis is pointless unless it leads to a clear, confident decision. Now that we've got a handle on the market's pulse—what's driving demand, the price trends, and what's coming down the development pipeline—it's time to translate that insight into a real-world investment playbook.

Ultimately, your personal financial goals will steer the ship. Are you playing the long game for wealth accumulation, or do you need immediate, steady cash flow?

The trick is to match your ambition with the right kind of property in the perfect location. For one investor, that might mean a trophy villa in a blue-chip community, a solid store of value. For another, the smarter play is scooping up a handful of high-yielding apartments in a buzzy, up-and-coming neighbourhood. Let's walk through these two distinct paths.

Strategy 1 The Pursuit Of Luxury and Capital Growth

For investors with their sights set on the very top of the market, the game is all about exclusivity, scarcity, and prestige. This isn't really about generating monthly rent cheques; it’s about securing a significant, long-term jump in capital appreciation. High-net-worth individuals (HNWIs) are flocking to properties that deliver a unique lifestyle, world-class amenities, and an address that speaks for itself.

We’re seeing this play out in real time. Recent record-smashing sales, like a villa on Jumeirah Bay Island that went for a staggering $65.5 million, underscore just how fierce the demand is for these one-of-a-kind assets. Buyers at this level aren't just looking at square footage; they're paying for architectural brilliance, absolute privacy, and jaw-dropping waterfront views.

- Target Properties: Signature villas, branded residences from names like Four Seasons or Bvlgari, and sprawling ultra-luxury penthouses.

- Prime Locations: Stick to the established bastions of wealth like Palm Jumeirah and Emirates Hills, or get into emerging ultra-luxury hotspots like Dubai Hills Estate.

- The Playbook: The move here is to acquire a true trophy asset in a location where they simply can't build any more. You hold it for the long haul, capturing maximum value as Dubai's global influence continues to expand.

This strategy is essentially a bet on Dubai's magnetic pull for the world's wealthiest people. As global capital keeps flowing into stable, attractive hubs, these prime assets are perfectly positioned for incredible growth.

Strategy 2 Maximising Rental Income For Consistent Cash Flow

The second approach is for the investor whose number one goal is building a strong, reliable stream of rental income. Here, we shift our focus from prestige to pure practicality. The best rental workhorses are found in areas with massive tenant demand, great transport links, and the kind of community amenities that make people want to stick around.

To win in this arena, you need a more granular Dubai real estate market analysis. It’s not enough to look at the flashy gross yield figures everyone quotes. You have to get down to the net yield—that’s your actual return after all the bills are paid.

To calculate your net rental yield, subtract annual costs (service charges, maintenance, property management fees) from your total annual rent. Then, divide that net income by the property's total purchase price and multiply by 100 to get your percentage yield.

This simple bit of maths is your secret weapon. It helps you accurately compare different opportunities and sidestep properties where sky-high service charges quietly eat away all your profit.

Comparing Investment Strategies For Dubai Real Estate

To make this crystal clear, let's break down how different investor types should approach the market. Your profile and primary goal will dictate everything from the property you target to the locations you focus on. This table simplifies the decision-making process.

| Investor Profile | Primary Goal | Target Property Type | Key Dubai Areas | Risk Profile |

|---|---|---|---|---|

| Capital Growth Seeker | Long-term appreciation | Luxury villas, penthouses | Palm Jumeirah, Dubai Hills | Low to Moderate |

| Yield-Focused Investor | Steady rental income | 1-2 bed apartments | Dubai Marina, JVC | Low |

| Balanced Investor | Mix of growth and income | Townhouses, 2-3 bed apts | DAMAC Hills, Arabian Ranches | Moderate |

As you can see, there's a clear path for every objective. Whether you're aiming for a portfolio of rental units or a single landmark property, aligning your strategy from the start is the key to success.

Pinpointing High-Yield Communities

Certain neighbourhoods consistently deliver better rental returns than others, mainly because they're magnets for Dubai's huge expatriate workforce.

For investors who are all about that cash flow, communities like Jumeirah Village Circle (JVC) and Dubai Marina offer a fantastic blend of relative affordability and intense rental demand, especially for studios and one-bedroom apartments. The name of the game is finding that sweet spot where purchase prices are sensible and tenants are lining up. To dig deeper into the specific returns and lifestyles these areas offer, check out our comprehensive guide on the best areas to invest in Dubai.

At the end of the day, a winning Dubai property investment boils down to one thing: clarity of purpose. First, decide whether you're chasing capital growth or rental yield. Once you know your North Star, you can cut through the market noise and confidently choose the strategy that’s a perfect match for your financial future.

A Foreign Investor's Guide To Buying Property

Jumping into a new property market can feel like navigating a maze without a map. For foreign nationals, getting a handle on Dubai's legal and financial landscape is the first crucial step towards a secure and profitable investment. The good news? The system is surprisingly straightforward and built to welcome international capital.

The most critical concept to grasp is the difference between freehold and leasehold ownership. Think of freehold as owning a book outright—it's yours forever, and you can pass it down through generations. Leasehold is more like a long-term library loan, giving you the right to the property for a fixed period, typically up to 99 years.

Foreign investors can purchase freehold property, but only within specific, government-designated zones. These areas just happen to include Dubai's most desirable communities like Downtown Dubai, Dubai Marina, and Palm Jumeirah, offering a spectacular array of premium investment options. This policy ensures global buyers have direct access to the best real estate the city has to offer.

The Property Purchase Process Demystified

The journey from spotting a property you love to holding the title deed follows a well-defined path. It’s structured to protect both buyer and seller at every stage, with transparency and legal compliance baked into the process.

Here’s a simplified breakdown of what to expect:

- Memorandum of Understanding (MOU): Once you agree on a price, you and the seller sign an MOU (also known as Form F). This is a formal sales agreement that locks in the terms of the deal.

- Security Deposit: You'll typically provide a security deposit cheque, usually 10% of the property value. This is held safely by a registered agent until the transfer is complete.

- No Objection Certificate (NOC): The developer must issue an NOC to confirm there are no outstanding service charges or other liabilities on the property. This is a key step for your peace of mind.

- Transfer of Ownership: Finally, both parties meet at the Dubai Land Department (DLD) office to formally transfer the property. Once all fees are paid, a new title deed is issued in your name.

For a more granular walkthrough, our complete guide on buying property in Dubai for foreigners offers in-depth information on each step of this journey.

The entire process is highly regulated and digitised by the Dubai Land Department (DLD), creating a secure framework that minimises risk. Partnering with a reputable RERA-certified agent isn't just a good idea—it's essential to ensure every detail is handled correctly.

Understanding The Financial Commitments

Beyond the sticker price of the property, there are several standard transaction costs every investor must factor into their budget. Knowing these upfront prevents any last-minute surprises and ensures a smooth financial closing.

Here are the key costs to anticipate:

- DLD Transfer Fee: This is a mandatory government fee, set at 4% of the property's purchase price.

- Registration Fees: These are administrative fees paid to the DLD for issuing the title deed.

- Real Estate Agent Commission: Typically 2% of the purchase price, paid to the agent who facilitated the deal.

- Mortgage Registration Fee: If you're financing the purchase, this fee is 0.25% of the loan amount.

Non-resident investors also have access to mortgage options from various UAE banks, although loan-to-value ratios are generally a bit lower than for residents. Getting this financial groundwork in place early allows you to move confidently and efficiently, turning your market analysis into a tangible, high-performing asset.

Your Questions, Answered

Jumping into any new property market always kicks up a few questions. Let's tackle some of the most common ones we hear from investors digging into the Dubai real estate scene, giving you clear, straightforward answers on the practical side of things.

Can Foreigners Really Own Property in Dubai?

Yes, they absolutely can. The UAE government opened the doors years ago, allowing foreign nationals to purchase property on a freehold basis in specially designated areas all across Dubai.

What does "freehold" mean? It's the real deal: you get full ownership of the property and the land it's built on. You can sell it, rent it out, or pass it down as inheritance. These freehold zones cover most of the city’s prime real estate, including hotspots like Dubai Marina, Downtown Dubai, Palm Jumeirah, and Jumeirah Village Circle (JVC).

What Are the Main Costs Besides the Property Price?

Smart investors always look beyond the sticker price. When you're budgeting for a property here, you'll need to account for a few key one-off transaction costs.

- Dubai Land Department (DLD) Fee: This is the big one, set at 4% of the property’s purchase price.

- Agency Commission: Your real estate agent's fee is typically 2% of the purchase price.

- Administrative and Registration Fees: These are smaller fees for things like issuing the title deed and other paperwork.

Factoring these costs into your numbers from day one is crucial. It keeps the process transparent and saves you from any nasty financial surprises down the line.

Is Financing Available for Non-Resident Investors?

It certainly is. Getting a mortgage in Dubai as a non-resident is quite common. Plenty of UAE banks offer financing to foreign investors, though the terms might be a little different than for residents.

As a general rule, non-residents can usually secure a loan-to-value (LTV) ratio of around 50%. This means you'll need to have a down payment of roughly 50% of the property's value ready, plus the other purchasing costs we mentioned.

What Kind of Rental Yields Can I Expect?

This is where Dubai really shines. The rental yields here are globally competitive and a massive draw for investors. While returns will naturally vary depending on the specific location and type of property, they generally blow many other major world cities out of the water.

After you account for service charges and maintenance, you can realistically expect net yields for long-term rentals to fall between 5% and 8% annually. High-demand apartment hubs like Dubai Marina and JVC often hit the upper end of that range, making them favourites for investors who are all about generating solid, consistent cash flow. Any good Dubai real estate market analysis needs to zero in on the net yield—that's the number that truly reflects your profitability.

Ready to turn these market insights into a high-performing asset? The specialists at Proact Luxury Real Estate LLC provide expert guidance shaped by your unique investment goals. Explore prime opportunities and secure your foothold in one of the world's most dynamic property markets.