The UAE Golden Visa is a prestigious long-term residency programme, usually valid for 10 years, created to attract and keep global talent, investors, and entrepreneurs. It gives foreign nationals the freedom to live, work, and study in the UAE without needing a local sponsor, offering a level of stability that’s hard to find elsewhere.

Decoding the UAE Golden Visa Programme

So, what exactly is the Golden Visa beyond the official jargon? Think of it less like a typical visa and more like an exclusive key to one of the world's most dynamic economic hubs. This isn't just a piece of paper; it’s a strategic move by the UAE government to build a sustainable, knowledge-based economy by bringing in the world's brightest minds and most successful investors.

Unlike traditional residency permits that are tied to an employer, the Golden Visa decouples your right to live in the UAE from your job. This simple change provides a level of security and autonomy that was, for a long time, out of reach for most expats. It’s a direct invitation from the government to become a long-term stakeholder in the country's future.

More Than Just a Long-Term Stay

The programme is all about granting holders unparalleled stability and opportunity. It’s a signal from the UAE that you're seen as a valuable contributor to its society and economy—whether you're an investor fuelling its growth, an innovator creating new industries, or a talented professional enriching its workforce. This long-term commitment works both ways, giving you the confidence to truly plant roots and plan your future.

The programme's popularity has absolutely soared, which says a lot about its appeal. The number of Golden Visas issued shot up from 47,150 in 2021 to a massive 158,000 in 2023. This surge shows just how successful Dubai's strategy has been in attracting global talent, especially as the non-oil sector grows to contribute over 70% of the UAE's GDP. You can dig into more of these Golden Visa trends on jsb.ae.

UAE Golden Visa At a Glance

To give you a quick snapshot before we dive into the nitty-gritty, here’s a table summarising the core features of this premier residency option.

| Feature | Description |

|---|---|

| Duration of Stay | A 10-year renewable residency visa, providing long-term stability. |

| Sponsorship | No national sponsor is required, giving you complete independence. |

| Family Inclusion | You can sponsor your spouse, children (with no age limit), and domestic staff. |

| Flexibility | You can remain outside the UAE for extended periods without the visa being cancelled. |

| Business Ownership | Allows for 100% ownership of businesses on the UAE mainland. |

This table covers the highlights, but as you'll see, the real value lies in how these benefits come together to create a truly unique lifestyle and investment environment.

Exploring Your Eligibility for the Golden Visa

So, do you qualify for a Golden Visa? This is the first practical question on your journey. The UAE has thoughtfully designed several distinct routes to eligibility, each one mirroring its strategic goal of attracting specific kinds of talent and capital.

Think of it less as a rigid, one-size-fits-all checklist and more about finding the category that perfectly aligns with your professional standing or financial profile.

These pathways aren't just random rules; they're built to fuel the nation's incredible growth story. Whether it's through property investment that bolsters the real estate market or by welcoming entrepreneurs who will build the industries of tomorrow, every category has a clear purpose.

Let’s break down the most common routes to help you see exactly where you fit in.

The Real Estate Investor Pathway

For many of our clients, the most straightforward path to a Golden Visa is through real estate. This route is incredibly popular because it kills two birds with one stone: you get a long-term residency solution and a tangible asset in one of the world's most dynamic property markets.

The magic number here is an investment of at least AED 2 million in property.

You can hit this threshold by purchasing a single property or a portfolio of properties that add up to this value. And in a game-changing update, the rules have become much more flexible and investor-friendly.

You can now qualify through:

- Off-Plan Properties: Buying a property directly from an approved developer before it’s even built is now a valid route. This was a huge and welcome change.

- Mortgaged Properties: You can absolutely use a loan from specific local banks to fund your purchase. The critical point is that your own capital—the amount you've actually paid, not the borrowed sum—must be at least AED 2 million.

These updates show just how serious the UAE is about making long-term residency a reality for committed investors. Getting your head around these options is key, and a great starting point is to explore the available Dubai freehold properties to see what kind of qualifying assets are on the market.

Other Key Routes for Investors and Entrepreneurs

Beyond buying a home, the UAE has opened other investment-focused doors designed to pull in significant capital and business talent. These pathways are for people who want to play a more active role in the UAE's economic engine.

Golden Visa Eligibility Pathways Compared

To make things clearer, let's compare the main investment-based options side-by-side. This table breaks down the core financial commitments and conditions for each pathway.

| Category | Minimum Investment | Key Conditions |

|---|---|---|

| Real Estate Investor | AED 2 million | Can be met with off-plan or mortgaged properties. Personal equity must meet the threshold. |

| Public Investment Fund | AED 2 million | Must be deposited into an accredited UAE-based investment fund for a set period. |

| Entrepreneur | Varies (value-based) | Project must be innovative/technical and approved by a UAE business incubator or relevant authority. |

As you can see, while the financial figures are similar for direct investment, the entrepreneur route focuses more on the idea than a specific capital amount. It’s all about finding the best fit for your circumstances.

Let’s look a little closer at the non-property options.

The Public Investment Fund Investor category is a strong choice if you want to invest in the UAE's wider economy. Here, you'll need to deposit AED 2 million into an accredited local investment fund. This shows your commitment to the country’s financial ecosystem, as your capital gets put to work across different sectors.

Then there's the Entrepreneur Pathway, which is built for the innovators and the creators. This route isn't just about money; it’s about the potential and value of your business concept.

An entrepreneur must have an economic project of a technical or future-oriented nature based on risk and innovation. Your idea needs a stamp of approval from an accredited business incubator in the UAE, the Ministry of Economy, or another competent local authority.

This laser focus on innovation really speaks volumes about the UAE's ambition to become a global launchpad for start-ups and forward-thinking companies.

Exceptional Talents and Top-Tier Professionals

The UAE knows a country's greatest asset is its people. That’s why it created a broad and exciting category for Exceptional Talents. This isn't about how much you can invest financially; it's about the intellectual and creative capital you bring to the table.

This category is intentionally wide-ranging, designed to attract true pioneers:

- Scientists and Researchers: Individuals with major contributions and high-impact achievements in their scientific domains.

- Creative Individuals: Acclaimed artists, authors, and cultural figures who are recognised by the relevant government bodies.

- Inventors: Anyone holding patents that bring significant value to the UAE's economy.

- Athletes: Renowned sports figures with international awards and recognition.

- Specialised Doctors and Professionals: Experts in high-priority fields like engineering, IT, and life sciences. This often comes with a minimum salary requirement (e.g., AED 30,000 per month) and specific educational degrees.

Each of these sub-categories has its own set of criteria and an approval process to match. The goal is to ensure the visa goes to people who will genuinely enrich the UAE’s cultural, scientific, and professional fabric. Finding your path is the first, and most important, step toward building your future here.

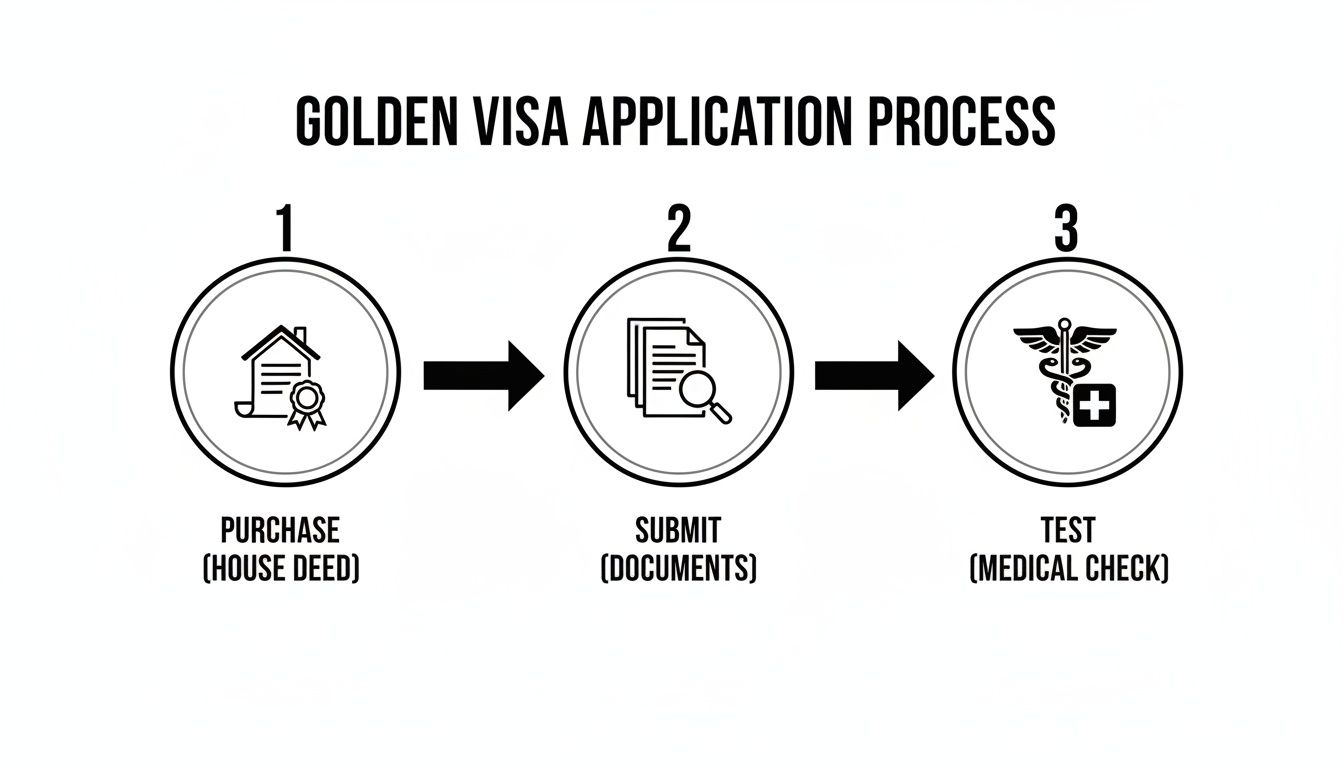

Navigating the Application Process Step by Step

Knowing you're eligible is the first big win; tackling the application is the next. The paperwork might look intimidating at first glance, but when you break it down into a clear roadmap, it transforms from a mountain into a series of manageable hills. Let's walk through it as if it's a project plan, focusing on the popular route for real estate investors.

This journey is logical. Each step builds on the one before it, starting with the most important one: actually securing your property. With a bit of prep and a clear head about what’s needed, you can navigate the bureaucracy with confidence.

Phase 1: The Foundation of Your Application

Before a single form gets filled out, the foundation of your application needs to be rock-solid. This first phase is all about locking down your qualifying property and getting the ironclad proof of ownership.

Purchase Your Qualifying Property: It all kicks off with buying real estate valued at AED 2 million or more. This could be a single villa, a handful of apartments, or even an approved off-plan unit directly from a developer. This purchase is the cornerstone of your entire application.

Secure the Title Deed: Once the deal is done, you need the official Title Deed from the Dubai Land Department (DLD). If it's an off-plan property, you'll get an Initial Sale Contract. This piece of paper is the ultimate proof of your investment and is completely non-negotiable. For anyone new to this market, understanding the ins and outs of buying property in Dubai for foreigners is a crucial first step to make sure the transaction goes smoothly.

Phase 2: Compiling and Submitting Your Dossier

With your property deed in hand, the next stage is all about paperwork. You’ll be assembling a comprehensive file of personal and official documents. Accuracy and ensuring everything is properly attested are the keys to avoiding frustrating delays.

Your core document checklist will usually include:

- A clear copy of your valid passport (with at least six months left on it).

- A recent, passport-sized photo with a crisp white background.

- The original Title Deed or other official proof of your AED 2 million property investment.

- Your valid Emirates ID, if you’re already a resident in the UAE.

- Proof that you have valid health insurance coverage here in the UAE.

Once your documents are all lined up, you're ready to officially submit. This is usually done through official government service centres.

Your main channels for submission are the government-run AMER Centres in Dubai or the online portal of the Federal Authority for Identity, Citizenship, Customs & Port Security (ICP). Think of these centres as one-stop shops for all residency-related tasks.

Choosing between going in person or doing it online really comes down to what you’re comfortable with. The AMER centres offer hands-on help, which can be a huge relief for first-timers who want to double-check that every 'i' is dotted and every 't' is crossed.

Phase 3: The Final Hurdles

After your application is submitted and gets the initial green light, you move into the final verification stage. This part involves a couple of mandatory in-person appointments to confirm your identity and health status.

Medical Fitness Test: You’ll need to go for a standard medical check-up at a government-approved health centre in the UAE. The test screens for certain communicable diseases and is a standard requirement for every single residency visa.

Biometrics Appointment: Your last active step is to pop into a designated centre to give your biometric information—that means fingerprints and a photo. This data gets linked to your Emirates ID card.

After that, all you have to do is wait for the final approval. The processing time can vary but generally takes a few weeks. Once it's approved, your 10-year Golden Visa will be stamped into your passport, and you’ll receive your new, long-term Emirates ID. That's it—journey complete.

What Are The Real Benefits Of Golden Residency?

Getting a UAE Golden Visa isn't just about finishing an application; it's about completely transforming your relationship with the country. This is so much more than a long-term residency permit. Think of it as a fundamental upgrade to your personal and professional life, offering a degree of stability, freedom, and family security that other visas just can't touch.

The most immediate relief is breaking free from the constant cycle of visa renewals. A standard two-year visa creates a feeling of temporary status, where every long-term plan comes with a question mark. With a 10-year residency, you gain the confidence to put down real roots, plan your future with certainty, and invest in your life and business without that nagging administrative pressure.

This long-term stability is the bedrock for all the other advantages. It lets you operate with a different mindset entirely—one of a long-term stakeholder, not just a temporary resident.

Unprecedented Freedom And Flexibility

One of the biggest game-changers with the Golden Visa is the independence it provides. Standard employment visas chain your residency status directly to your job. The Golden Visa breaks those chains completely. You are no longer tied to a single employer or local sponsor, giving you total control over your career and life.

This freedom means you can work, live, and study anywhere you choose across all seven emirates. It also offers incredible flexibility for those of us who live global lives. Golden Visa holders can stay outside the UAE for extended periods—much longer than the typical six-month limit on other visas—without worrying about their residency being cancelled. This is a massive plus for investors and professionals managing interests in multiple countries.

For a property investor, the path from purchase to approval is designed to be quite straightforward, as you can see below.

This process is built to efficiently turn a qualifying property investment into long-term residency and all the freedoms that come with it.

Comprehensive Family Sponsorship

Where the Golden Visa programme truly stands out is in its generous approach to family sponsorship, which really reflects the UAE's family-first culture. While other visas are quite restrictive, the Golden Visa allows you to sponsor your loved ones with far more ease.

Here’s what that looks like in practice:

- Spouse and Children: You can sponsor your spouse and children with no age restrictions. This is a major difference from other visas, which often impose age limits on sons.

- Domestic Staff: Sponsoring domestic help is also included, which helps simplify household management for your family.

- Extended Visa Duration: Your sponsored family members get the same 10-year residency as you do, ensuring everyone enjoys the same long-term stability.

In the unfortunate event that the primary Golden Visa holder passes away, their family members are permitted to stay in the UAE until the visa’s original expiry date. This compassionate rule provides an invaluable layer of security and peace of mind when it’s needed most.

This all-encompassing approach means your family can build a genuine life in the UAE right alongside you, with access to world-class schools and healthcare.

Business And Investment Advantages

For entrepreneurs and investors, the Golden Visa is an incredibly powerful tool. It grants you the ability to have 100% ownership of your businesses on the UAE mainland—a privilege that used to be reserved only for free zones. This eliminates the need for a local Emirati partner, giving you complete control over your company’s direction and profits. If you're just starting to explore the market, our guide on how to invest in Dubai real estate is a great place to begin.

On top of that, the UAE's tax-friendly environment is a huge draw. With no personal income tax, capital gains tax, or inheritance tax, the financial upside is substantial. This allows you to keep more of your earnings and capital growth, making the UAE one of the most attractive places on the planet to live, work, and invest. Together, these benefits create a unique ecosystem where personal stability and professional ambition can truly flourish.

How the Golden Visa Stacks Up Against Other UAE Visas

To really get a feel for what the UAE Golden Visa brings to the table, you have to see it in context. The UAE has a whole spectrum of residency options, each tailored for different goals and levels of commitment. Figuring out where the Golden Visa fits in is the key to making the right move for your future.

Think of the different visas like tiers of a private club membership. A standard work visa gets you through the door, but your access is tied directly to your employer. The Golden Visa, on the other hand, is the lifetime, top-tier membership — it gives you complete freedom and autonomy.

Let's break down the key differences to see why it’s in a league of its own.

Golden Visa Versus the 2-Year Property Visa

For real estate investors, the most frequent comparison is between the 10-year Golden Visa and the 2-year Property Investor Visa. Both are obviously linked to property, but they’re designed for completely different long-term ambitions and investment scales.

The 2-year property visa is a fantastic way to get your foot in the door. It requires a lower investment of just AED 750,000, making it a solid route to residency through a more accessible property purchase.

But the Golden Visa, which demands a AED 2 million investment, is an entirely different proposition. It's not just about a longer stay; it's a declaration of long-term commitment that comes with a much better set of perks. The biggest draw is the 10-year duration, which offers incredible stability and completely eliminates the hassle of renewing every couple of years.

The Golden Visa is more than just extended residency. It unlocks superior family sponsorship rights, like sponsoring sons with no age limit, and gives you the freedom to stay outside the UAE for as long as you want without your visa being cancelled. The 2-year visa is much stricter on these points.

At its core, the 2-year visa is a residency permit. The Golden Visa is a complete residency solution built for people putting down deep, lasting roots in the UAE.

Golden Visa Versus the Green Visa

Another important option on the table is the Green Visa. This is a 5-year, self-sponsored permit for skilled employees, freelancers, and investors. It’s a huge step up from typical employment visas because it removes the need for a direct employer to sponsor you.

The Green Visa is a brilliant, flexible choice for professionals who crave independence. Still, it differs from the Golden Visa in a few critical ways:

- Duration: The most obvious difference is the length—5 years for the Green Visa versus the Golden Visa's 10 years.

- Who Qualifies: The Green Visa for skilled workers has specific boxes to tick, like needing a bachelor's degree and earning at least AED 15,000 a month. The Golden Visa’s pathways for investors and special talents have different—often higher—thresholds but offer more varied ways to qualify.

- Prestige and Perks: Let's be frank, the Golden Visa carries more weight. It comes with a higher level of prestige and more expansive benefits, especially around sponsoring family and the freedom to travel.

Think of the Green Visa as the perfect bridge between traditional sponsorship and elite, long-term residency. It’s ideal for skilled professionals wanting more control, but the Golden Visa remains the undisputed champion for anyone seeking the ultimate in stability and benefits.

Golden Visa Versus Standard Employment Visas

This is where the difference is most dramatic. A standard, 2-year employment visa is completely tied to your job. If you lose that job, your residency is immediately on the line, which creates a constant, low-level hum of uncertainty.

Your entire life in the UAE is tethered to your employer.

The Golden Visa cuts that cord completely. It gives you total freedom to work for anyone, launch your own business, or even choose not to work at all while living in the UAE. This independence fundamentally changes your relationship with the country—from a temporary work arrangement to a genuine home base.

The Golden Visa: Your Questions Answered

As you get closer to a decision, the practical questions always start to bubble up. It's completely natural. Securing a Golden Visa is a big move, and you need clarity on the finer details before you commit. This section is all about tackling those common—and critical—questions head-on, giving you the final pieces of the puzzle.

We'll move past the big-picture benefits and get into the real-world mechanics of holding this prestigious visa. Think of it as your final checklist, designed to give you complete confidence as you move forward.

Can You Use a Mortgaged Property to Qualify?

This is easily the most common question we hear, and the answer is a big yes—but with one very important condition. In a welcome move to make the real estate route more accessible, the UAE authorities now allow mortgaged properties to qualify for the Golden Visa.

The critical factor, however, is your personal equity. It's not the total price of the property that counts, but the amount you've personally invested, clear of any loan.

To be eligible, the non-mortgaged portion of your property's value must be at least AED 2 million.

Let's break it down with a simple example:

- You buy a villa for AED 5 million.

- You secure a mortgage from an approved UAE bank for AED 3 million.

- Your down payment, plus what you've paid off, totals AED 2 million.

In this scenario, your personal stake in the property hits the magic number, making you eligible for the Golden Visa. You'll just need an official letter from your bank confirming your paid-up amount to include with your application.

What Happens If You Sell Your Qualifying Property?

Life moves, and so do investment strategies. You might not hold the same property for the full ten years of your visa. So, what happens if you decide to sell the very asset that secured your Golden Visa?

The good news is that the rules are built for this kind of flexibility. You are absolutely allowed to sell your qualifying property, but you must maintain your investment level to keep your visa status.

To keep your Golden Visa after selling your initial property, you must reinvest in another property worth at least AED 2 million. This needs to be done within a specific grace period, which is typically around 30 days, but it’s always smart to confirm the latest regulations.

This gives you the freedom to capitalise on market opportunities—maybe you want to upgrade, or perhaps shift your investment to a new, up-and-coming area—without putting your long-term residency at risk. It ensures that while your specific asset might change, your commitment to the UAE's real estate market remains.

Do Family Members Get the Same 10-Year Visa?

One of the most powerful and appealing aspects of the Golden Visa programme is its strong focus on family unity. When you, as the main applicant, are granted a 10-year visa, that incredible benefit extends directly to your loved ones.

Yes, your sponsored family members—including your spouse and children of any age—will also receive a 10-year residency visa.

This isn't just a minor perk; it's a cornerstone of the programme's value. It provides every member of your immediate family with the same long-term stability and peace of mind you have. No more administrative headaches or worries about staggered visa expiry dates. It allows your family to truly settle in and build a life here in the UAE.

Can You Work for a Company with a Golden Visa?

Here's another point that often causes confusion. People sometimes see the Golden Visa purely through an investor lens and wonder if it allows for traditional employment. The answer is an emphatic yes. The Golden Visa grants you the full right to live, work, and study in the UAE without any restrictions.

This independence is one of its core strengths. You are not tied to a specific employer, which opens up a world of possibilities:

- Work for any company in the UAE without needing their sponsorship.

- Switch jobs whenever you like, without a complicated visa transfer process.

- Start and run your own business with 100% ownership on the mainland.

For professionals, this offers career flexibility that is simply unmatched. It’s also a huge plus for employers, as hiring a Golden Visa holder frees them from the usual administrative and financial burdens of visa sponsorship.

Is There a Minimum Stay Requirement?

For the global citizens, the high-flying professionals, and the international investors, this question is a deal-breaker. Standard residency visas often get cancelled if you're out of the UAE for more than six months straight.

The Golden Visa throws that rule out the window.

There is no minimum stay requirement to keep your Golden Visa valid. This gives you incredible freedom to manage your business interests and personal life across multiple countries without the constant pressure of flying back just to maintain your residency. It's a feature designed for the way modern life works, recognising that your world isn't confined to one location.

Navigating the nuances of the Golden Visa is the first step toward unlocking a future of stability and opportunity in the UAE. At Proact Luxury Real Estate LLC, we specialise in guiding discerning investors through every stage of this journey, from identifying the perfect qualifying property to ensuring a seamless application process. Let our expertise empower your investment strategy.

Explore your options and book a personalised consultation with our advisory team today by visiting us at https://ritukant.com.