While many investors ask whether to put capital into Dubai or Abu Dhabi, the smart money frames the question differently. It's not a choice between "better" markets; it's a strategic decision between two distinct investment theses for your 2026 portfolio.

You are allocating capital to either Dubai's high-velocity, transactional market engineered for aggressive capital growth, or Abu Dhabi's stable, sovereign-backed environment built for long-term wealth preservation. Your portfolio's mandate must dictate the direction.

The Core Decision for Your 2026 UAE Real Estate Strategy

Last year's benchmarks tell the story. In Q4 2025, Dubai's off-plan market saw transaction volumes jump another 12% quarter-over-quarter. This surge was fuelled by new launches in master communities like Dubai South, attracting capital comfortable with longer development timelines in exchange for higher appreciation potential. [Map: Location relative to Al Maktoum Airport]

Abu Dhabi, in contrast, showcased its signature stability. The ready property market held firm, with prime areas like Saadiyat Island delivering consistent rental yields around 6.2%. This predictability attracts risk-averse capital—family offices and institutional funds—that prioritize steady income streams over speculative gains.

The market has matured from the post-Covid boom into a sustainable growth cycle. Unlike the speculative frenzy of 2024, the current Dubai real estate market analysis suggests a stabilization in price per square foot. This fundamental difference in market velocity is the first filter for allocating capital in the UAE.

Investor Snapshot: Dubai vs. Abu Dhabi

This is the top-level data that should guide your initial allocation thinking.

| Metric | Dubai | Abu Dhabi |

|---|---|---|

| Primary Investor Goal | Capital Appreciation & High Liquidity | Wealth Preservation & Stable Yields |

| Market Velocity | High Transaction Volume | Measured, Lower Transaction Volume |

| Dominant Sector | Off-Plan & New Master Communities | Prime Ready Properties & Long Leases |

| Typical Gross Yield | 6-8% (Higher volatility) | 5-6.5% (Greater stability) |

| Economic Driver | Diversified (Tourism, Trade, Finance) | Sovereign Wealth & Government Sector |

The takeaway is straightforward: Dubai is the engine for a portfolio seeking growth. Abu Dhabi is the anchor, providing stability and predictable returns. The following analysis will drill down into the economic drivers underpinning this core strategic decision.

Analyzing The Economic Engines Driving Each Market

To forecast a property's performance, an investor must analyze the city's economic engine. One is a high-velocity, diversified global hub; the other is a calculated, sovereign-backed economy.

Dubai’s real estate market is a direct mirror of its non-oil GDP, welded to logistics, tourism, and financial services. When tourist arrivals jumped 9.5% year-over-year and trade volumes hit records at Jebel Ali Port last year, it triggered immediate demand for both short-term lets and executive housing. This creates a highly responsive, liquid market where asset values react quickly to global economic shifts.

Dubai’s strategic pivot from oil dependency is complete; oil is now less than 5% of its GDP. This transformation into a global trade and finance hub fuels the fast-paced, transactional nature of its property sector.

Dubai: A Market Driven by Global Commerce

The emirate operates as a dynamic, transactional ecosystem. Capital moves fast, drawn by the ease of setting up a Dubai LLC company setup and world-class infrastructure. For a property investor, this translates into key realities:

- Higher Liquidity: Assets can be bought and sold with greater speed due to a large, diverse pool of international buyers.

- Sensitivity to Global Trends: A strong tourism season or a new trade agreement can have an immediate positive effect on rental demand.

- Growth-Oriented: The economy's expansion constantly fuels demand for new real estate, especially in emerging master communities.

This structure also shapes residency policies, fine-tuned to attract capital. The streamlined process for the Golden Visa UAE has been a key policy lever.

Abu Dhabi: An Economy of Strategic Stability

Abu Dhabi’s real estate market is anchored by the gravity of its sovereign wealth and hydrocarbon revenues. This market isn't driven by quarterly tourism figures but by long-term government strategic planning and massive state expenditure.

The emirate's economic model provides a powerful foundation of stability. Development is methodical and master-planned, often backed by state-owned enterprises. This approach de-risks major projects and ensures infrastructure is built ahead of population growth, creating a predictable investment environment.

For an asset manager, Abu Dhabi represents a strategic allocation for wealth preservation. The market is insulated from the sharp volatility of commerce-driven economies, offering a 'sovereign guarantee' of stability reflected in its property values.

This state-led approach means the supply pipeline is carefully managed, preventing the oversupply that can plague developer-led markets. The focus is on long-term value and a stable tenant base, often connected to government entities and a growing professional class, supported by clear UAE property law.

This creates a different risk-reward profile, favoring consistent income over rapid, speculative gains. An HNWI must align capital with the economic engine that matches the portfolio’s core objective.

A Comparative Breakdown of Real Estate Market Performance

While both markets are performing well, they are built on different engines designed for different investor goals. The Dubai vs. Abu Dhabi question comes down to your strategy: are you chasing velocity and capital growth, or building a portfolio based on stability and long-term yield? Last year's benchmarks draw a clear line.

Dubai’s market is about transactional speed. Last year's data show a market dominated by off-plan sales, where appreciation in new master communities outpaced ready properties. This high-velocity environment is engineered for growth, attracting global investors willing to accept longer development timelines for higher returns.

Abu Dhabi plays a more measured game. Transaction volumes are lower, and the market is weighted towards prime, ready assets on islands like Saadiyat and Yas. The investment case is about locking in consistent rental income from a solid tenant base of government and corporate professionals. Returns are predictable, underpinned by a state-controlled supply pipeline that prevents sharp corrections.

Capital Appreciation and Rental Yields

Capital growth in Dubai is a tale of two markets. While established areas like Downtown saw steady value increases last year, the real action was in the off-plan sector. Projects along new infrastructure corridors, particularly around Al Maktoum International Airport, saw aggressive growth. These assets offer high potential for value uplift, with risks mitigated by RERA's mandatory escrow accounts.

Rental yields in Dubai follow a similar pattern, with gross yields for new residential properties averaging a healthy 6-8% last year. For hands-on investors, short-term rentals in high-demand tourist spots can push yields past 10%, though this requires active management. Our full Dubai property market forecast contains granular data.

Abu Dhabi presents a conservative but stable profile. Capital appreciation is steady and less dramatic, reflecting the emirate’s focus on sustainable, long-term value. Rental yields are more compressed, averaging 5-6.5% for similar prime properties. The crucial difference is the quality of the tenant; long-term corporate leases provide a reliable, low-maintenance income stream perfect for wealth preservation.

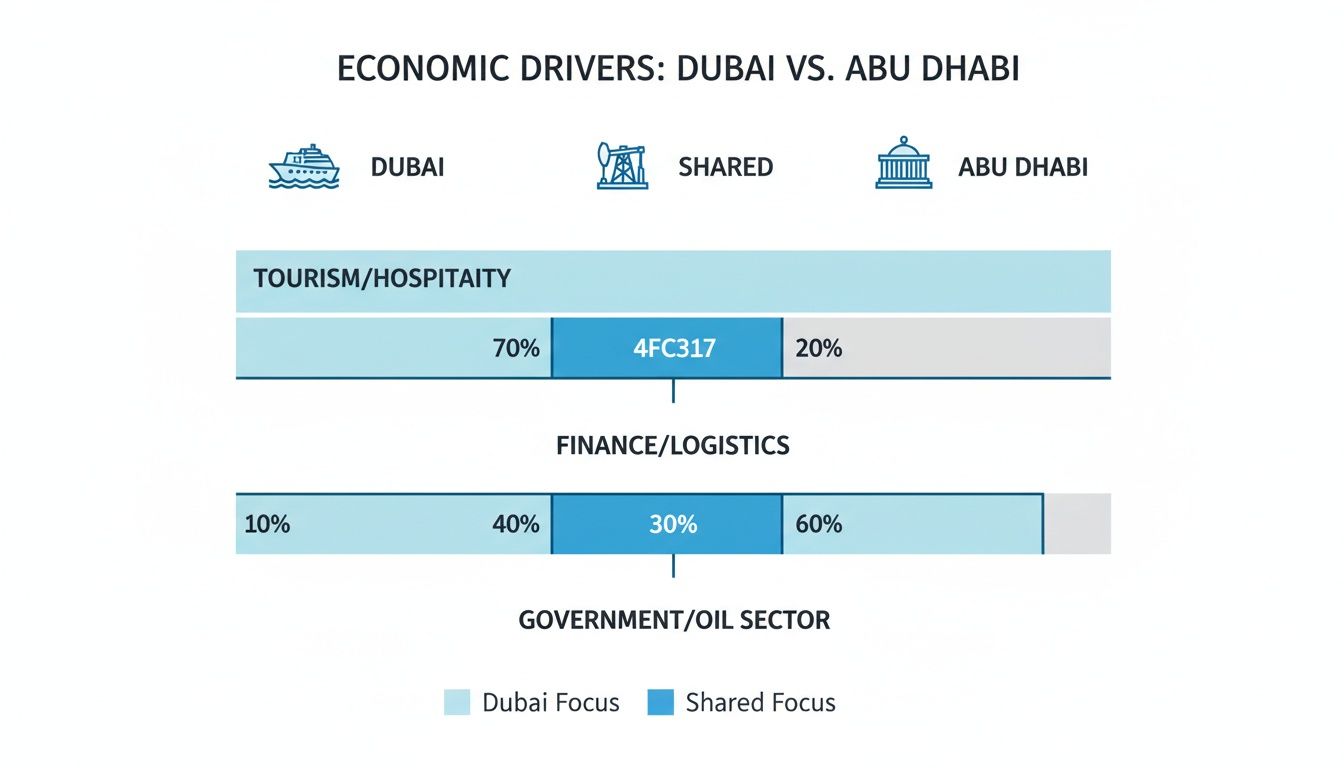

This chart illustrates the core economic models driving each emirate's property market.

Dubai’s engine is fuelled by diversified commerce, while Abu Dhabi’s is built on a foundation of sovereign capital. This economic DNA directly shapes their real estate markets.

Benchmark Price and Yield Comparison for Prime Locations

The price per square foot is the raw number that builds the financial case for an acquisition. The table below breaks down last year's benchmark figures for similar, prime new-build properties. Use these as a baseline for evaluating new launches in 2026.

| Location/Property Type | Dubai (Price/sqft AED) | Dubai (Gross Yield %) | Abu Dhabi (Price/sqft AED) | Abu Dhabi (Gross Yield %) |

|---|---|---|---|---|

| Prime 2-Bed Waterfront Apt. | 2,800 - 3,500 | 6.5% - 7.5% | 2,200 - 2,800 | 5.5% - 6.5% |

| Luxury 4-Bed Villa | 2,100 - 2,700 | 5.0% - 6.0% | 1,800 - 2,300 | 4.5% - 5.5% |

| Branded Residence 2-Bed Apt. | 3,800 - 5,000 | 7.0% - 8.5% | 3,000 - 4,200 | 6.0% - 7.0% |

| Off-Plan Townhouse (Emerging) | 1,400 - 1,800 | 7.5% - 9.0% (proj.) | 1,300 - 1,600 | 6.5% - 7.5% (proj.) |

The data is clear. Dubai commands a price premium tied to higher potential for capital growth and rental yields. Investors pay for access to a more liquid, high-velocity environment.

Abu Dhabi offers a more accessible entry point, reflecting its value proposition: stability and moderate, predictable returns. The choice is a strategic decision based on capital allocation goals.

Examining The Off-Plan and New Development Pipeline

Success in 2026 is less about timing the market and more about anticipating supply. Understanding where new inventory will land is critical for projecting capital appreciation. Dubai and Abu Dhabi's development pipelines reveal two different strategic philosophies.

Dubai's pipeline is defined by the scale and speed of its private sector. We've moved past the 1% monthly payment plans of the post-pandemic boom. Developers now favor more sustainable 60/40 and 70/30 structures, a sign of market maturation. [Chart: 2026 Payment Plan Breakdown] This shift requires more upfront capital, filtering out short-term speculators. Our firm details these evolving structures for anyone considering a Dubai off-plan property investment.

Dubai: The Private Sector Growth Corridors

For 2026, the strategic focus is on the growth corridors around Al Maktoum International Airport. This is about creating entire ecosystems.

- Dubai South: The scale here is immense. As aviation operations consolidate at Al Maktoum, this area shifts from speculative bet to core, infrastructure-backed investment. Revised handover timelines for new phases align with the airport's expansion.

- The Valley Phase 2: Master developers are targeting the mid-market luxury segment. The investment case is built on delivering high-quality community amenities—schools, retail, and green spaces—that create genuine residential demand.

- Branded Residences: This niche continues to expand, with new launches in prime locations like Business Bay. These assets command a premium but offer a powerful mix of yield potential and brand-assured quality.

Abu Dhabi: The Sovereign-Backed Master Plan

Abu Dhabi’s new supply is a state-directed affair. The pipeline is the calculated execution of a long-term vision, not a reaction to market demand. This methodical rollout provides exceptional stability.

The emirate's tourism sector is a key part of its strategy. In the first quarter of last year, Dubai's tourism sector attracted 7.15 million overnight visitors, a 7% year-over-year jump, as detailed on the Central Bank's website. This demonstrates the value of a diversified economy—a model Abu Dhabi is replicating.

For 2026, the focus is on two key giga-projects:

- Saadiyat Vision 2030: This is the crown jewel of Abu Dhabi's strategy. New phases of ultra-luxury residences are released in tandem with cultural assets. Supply is tightly controlled to protect property values.

- Yas Island Expansion: As new entertainment assets come online, developers are launching residential clusters aimed at both long-term residents and the tourism market. The strategy is to create an integrated environment that drives its own demand.

Investing in Dubai’s pipeline is a bet on private sector agility. Investing in Abu Dhabi’s pipeline is an alignment with a sovereign-backed economic vision. One offers higher velocity; the other offers unparalleled stability.

Navigating Regulatory Frameworks and Investor Protections

The legal system underpinning an asset is as critical as the asset itself. Both emirates offer solid foreign ownership laws in designated zones. The difference is in regulatory philosophy and operational speed, not security.

Dubai's Real Estate Regulatory Agency (RERA) operates with maturity born from immense transaction volume. Its systems, like Oqood registration for off-plan properties and mandatory escrow accounts, are engineered for speed and clarity. The framework allows investors to move capital with confidence and efficiency.

Abu Dhabi’s regulatory environment is just as secure but moves at a deliberate, state-guided rhythm. The Department of Municipalities and Transport (DMT) oversees the sector with a focus on long-term stability. The process is more consultative, offering assurance rooted in sovereign oversight rather than transactional speed.

Foreign Ownership and Residency Pathways

Both emirates offer clear routes to long-term residency through real estate. While the requirements for understanding what is Golden Visa UAE are standardized federally, the qualifying assets differ in practice.

- Dubai: The volume of new projects provides a wide array of qualifying assets in the AED 2 million range. RERA's fast-paced services expedite property registration and title deed issuance, speeding up the visa application.

- Abu Dhabi: The market has fewer new launches at the Golden Visa entry threshold. The focus is on established, higher-value properties in zones like Saadiyat Island, appealing to investors wanting a premium, ready asset for residency.

Economic Underpinnings and Risk Assessment

Abu Dhabi is the economic powerhouse of the UAE, thanks to its vast hydrocarbon reserves. Last year, the UAE economy grew by 4.0%, with Abu Dhabi's petroleum-driven wealth providing strategic security for its master-planned developments.

This economic structure shapes the risk profile. Dubai's diversified economy ties its real estate market more closely to global commercial cycles, offering higher growth potential but also greater sensitivity to international shifts. Abu Dhabi’s sovereign-backed economy acts as a buffer against this volatility, offering lower but more predictable returns. While there are minimal taxes on property in either emirate, the source of economic stability is a key differentiator.

The choice comes down to risk appetite. RERA’s framework in Dubai is designed for a dynamic, fast-moving market. Abu Dhabi's state-led oversight offers fortress-like stability for wealth preservation.

Both frameworks protect foreign investment. The decision hinges on whether your strategy demands the agility of Dubai’s system or the deliberate assurance of Abu Dhabi’s. Understanding the differences between freehold vs leasehold ownership is another critical layer of due diligence.

Final Thoughts: Strategy Over Speculation

The Dubai vs. Abu Dhabi debate has no single "better" market. An HNWI portfolio has diverse needs—aggressive growth, stable income, long-term wealth preservation—and each emirate is engineered to serve one of these goals with remarkable efficiency. Treating them as interchangeable is a fundamental mistake in asset allocation for 2026.

For portfolios calibrated for aggressive growth, the strategic play is Dubai. The key is focusing on emerging infrastructure corridors and new off-plan launches where value is being created. Following the expansion of Al Maktoum International Airport and its surrounding communities presents the most compelling path to returns for a medium to long-term outlook.

For investors prioritizing wealth preservation and predictable income, Abu Dhabi is the clear choice. The emirate’s government-backed developments offer a level of stability not found elsewhere. Investing here is aligning with a sovereign vision, providing a buffer against market adjustments that can hit private-sector-driven environments.

Success in the current sustainable growth cycle requires a clear investment thesis before any capital is deployed. The market no longer rewards speculation; it rewards strategy. You must manage the asset, not just acquire it.

Aligning your choice of emirate with your portfolio's core goal is the only path to success. The window for easy flips has narrowed since last year. Today's market demands a sophisticated approach based on data, infrastructure analysis, and a sharp understanding of what each emirate offers.

At Proact Luxury Real Estate, our advisory is built on this principle. If you are rebalancing your portfolio for 2026, let's run the numbers.

Investor FAQs: The Strategic Questions We Hear Most

When HNWIs evaluate where to allocate capital, the questions are direct and focused on the bottom line. Here are the answers to the most common strategic inquiries when comparing the Dubai and Abu Dhabi real estate markets for a 2026 portfolio.

Which Emirate Offers Better Long-Term Capital Appreciation?

Historically, Dubai has been the engine for higher capital appreciation, especially for off-plan assets in new master communities. This performance results from its market velocity and global demand, which brings a higher degree of volatility. For an investor with a healthy risk tolerance targeting growth, the right projects in Dubai are the superior instrument.

Abu Dhabi offers more stable, predictable appreciation tied to its controlled supply pipeline and steady, sovereign-backed economic growth.

The Takeaway: For an asset manager focused on wealth preservation with moderate, consistent growth, Abu Dhabi is the more prudent allocation. The choice is a function of your portfolio's risk parameters.

Is Foreign Ownership More Secure in Dubai or Abu Dhabi?

Both emirates provide secure, legally robust freehold ownership for foreign nationals in designated investment zones. The security of your title is not in question in either market.

The difference lies in the operational maturity and pace of their regulatory bodies.

Dubai’s RERA is more battle-tested due to its immense transaction volume, forging a transparent and efficient process. Abu Dhabi’s laws are equally strong, backed by state oversight, but the market is less transactional, so processes can feel more deliberative. Security is excellent in both; the core difference is administrative velocity.

How Do Rental Yields Compare for a Similar Asset?

Based on last year's benchmarks, gross rental yields in Dubai for new residential properties typically fall in the 6-8% range. This can be pushed higher by actively managing short-term lets in prime tourist hotspots, which introduces operational complexity.

Abu Dhabi’s yields are more compressed, averaging 5-6.5% for similar-quality assets.

The critical distinction is not just the percentage but the tenant profile. Dubai's rental market is diverse and fast-moving. Abu Dhabi's is heavily anchored by government and corporate long-term leases, providing exceptional income stability. An investor prioritizing consistent, low-management cash flow might find the quality of Abu Dhabi's tenant base more appealing.

At Proact Luxury Real Estate, our advisory is built on one thing: aligning your capital with the market that precisely matches your financial objectives. If you are structuring your UAE real estate allocation for 2026, we should connect.