For high-net-worth investors, a visa amnesty in the UAE is not a personal residency route. It functions as a critical market stabilizer, a periodic government program allowing individuals with irregular visa statuses to regularize or exit without penalties. This regulatory reset protects the health of the property market you operate in.

Deconstructing UAE Visa Amnesty for Property Investors

From an asset management standpoint, visa amnesty is a macroeconomic tool. Its primary function is to ensure the expatriate workforce—the core of the high-yield rental market—remains legally compliant.

A legally sound tenant base secures rental income and protects asset value. Widespread risk tied to tenants with irregular visa statuses is a direct threat to portfolio performance, impacting everything from rent collection to property liquidity.

The Investor's Perspective on Market Health

The distinction between an amnesty and a residency visa is fundamental to investment strategy. One is a reactive, temporary fix for market-wide legal hygiene; the other is a proactive tool for asset control.

- Amnesty's Role: It regularizes the status of a large segment of the population. This includes tenants, service sector employees, and construction workers vital to the real estate ecosystem.

- Investor Visa's Role: Programs like the golden-visa-uae provide you with legal standing, banking control, and the power to manage assets directly, without sponsor reliance.

Relying on a future amnesty is not a viable strategy; securing personal residency through a qualifying investment is. To fully grasp the environment for property investors, it's beneficial to consult a comprehensive guide to living and visa requirements in Dubai.

For the HNWI, the key takeaway is this: an amnesty stabilizes the market in which you operate, but a Golden Visa secures your position within that market. Understanding this difference is central to mitigating risk.

Implications for Due Diligence

Periodic visa amnesties underscore the importance of rigorous due diligence. When screening a tenant or vetting a buyer, their visa status is a non-negotiable data point. A tenant with an expired visa poses a direct risk to the validity of a tenancy contract under RERA regulations.

Similarly, a buyer with an unstable legal status can cause serious delays or the collapse of a sales transaction. Smart investors build visa compliance checks into standard operating procedures, a topic detailed in our guide on https://www.ritukant.com/buying-property-in-dubai-for-foreigners/. An amnesty is a stark reminder that legal compliance underpins financial returns in the UAE.

Who Qualifies For A UAE Visa Amnesty?

From an investor's viewpoint, a UAE visa amnesty is a market correction tool. It regularizes the status of individuals whose legal residency has lapsed, reinforcing the economic stability on which the real estate sector is built. This is not an open-door policy but a targeted program.

Eligibility typically extends to specific groups whose presence has become irregular. These are corrective measures for existing situations, not new pathways to residency.

Primary Eligibility Categories

The government initiates these programs to address systemic risks within the expatriate population. The primary groups qualifying for a visa amnesty in the UAE include:

- Expired Residency Visa Holders: The largest group and the one most directly impacting landlords. These are individuals whose permits have expired beyond the legal grace period.

- Expired Visit or Tourist Visa Holders: Individuals who have overstayed temporary visas. While less likely to be long-term tenants, their status can affect the short-term rental market.

- Absconding Cases: Individuals reported as absconding by a previous sponsor may be eligible under certain conditions, allowing them to rectify their status or exit.

These amnesties operate within a strict, non-negotiable timeframe. For a property owner, this period is a window to ensure the tenant base is fully compliant with the law.

Scale and Market Impact

The scale of these programs is a critical data point. Previous amnesties demonstrate their widespread effect on the residential market, removing legal uncertainties for tens of thousands of residents. This is a large-scale recalibration of the workforce.

For instance, a past visa amnesty initiative in Dubai alone saw 27,173 individuals either regularize their status or secure exit passes. That number indicates the volume of people whose legal standing was uncertain—many of whom participate in the rental economy. More details on the significant uptake of this programme are available.

A non-compliant tenant base introduces portfolio risk. This can manifest as voided rental contracts under RERA regulations or create severe complications during a property sale. The amnesty directly reduces this systemic risk.

Exclusions And Important Distinctions

It is equally important to understand who does not qualify. A visa amnesty is not a blanket pardon for those with pending criminal cases or individuals who entered the country illegally. It is a program for regularizing an existing status, not for bypassing the rule of law.

Furthermore, it should not be confused with corporate compliance. While an individual might benefit from an amnesty, it doesn’t absolve a company of its legal duties under uae-property-law. Issues related to corporate structure, like a Dubai LLC company setup, fall under a different legal framework.

The amnesty's purpose is clear: to ensure the labor force remains stable and documented. For a property investor, this translates directly into a more secure and predictable rental market.

How the Amnesty Application Process Works

For a property investor in the UAE, understanding the visa amnesty process is a critical part of risk management. It is an administrative procedure with potential balance sheet impact. The process runs on a tight, non-negotiable schedule, introducing temporary uncertainty into the market.

The procedure is straightforward but inflexible. Applicants must compile core documents—valid passport copies, previous visa details—and submit them at designated government service centres like Amer or Tasheel. From an asset manager's perspective, this is a period that must be monitored.

The Landlord's View: What to Watch For

When a tenant enters the amnesty process, they are in a temporary legal grey area. This can directly affect their ability to pay rent or renew a lease, creating a potential income gap. A property sale can also be affected, as a buyer with an irregular visa status can halt a transaction, freezing capital.

For overseas investors unfamiliar with the UAE's administrative rhythms, the process can appear opaque. Viewed through the lens of due diligence, it becomes clearer. This is about having the knowledge to accurately assess the risk profile of both tenants and potential buyers.

- Document Check: The first step is ensuring a tenant or buyer has their paperwork in order. A valid passport and a copy of their old visa are the basics.

- Official Channels Only: The entire process is handled through official centres. No workarounds exist.

- The Clock is Ticking: Amnesties operate within a strict timeframe. Missing the deadline means the opportunity is lost.

This is why thorough tenant screening is a non-negotiable part of property management. Verifying a potential tenant’s visa status before signing a contract is a fundamental risk-mitigation tactic.

A visa amnesty is more than an immigration procedure; for tenants in your portfolio with an irregular status, it’s a financial stress test. A proactive landlord will use this period to audit their entire tenant base for compliance.

The Two Possible Outcomes: Regularize or Exit

Once an application is submitted, it generally leads to one of two outcomes. The individual will either regularize their status—by finding a new sponsor and getting a new visa—or receive an exit pass to leave the country without overstay fines. For a landlord, these two possibilities have direct consequences.

A tenant who successfully regularizes their status becomes a stable, compliant occupant, securing your rental income. A tenant who chooses the exit pass will vacate the property, creating an unexpected vacancy. Understanding these potential outcomes allows you to forecast vacancies and prepare your leasing strategy.

Amnesty Application Checklist

For an investor, it helps to see the process as a series of checks. The table below summarizes the core requirements, providing a clear checklist when assessing a tenant or buyer's situation.

| Document/Requirement | Purpose | Submission Centre |

|---|---|---|

| Valid Passport & Visa Copy | Essential for confirming identity and previous legal status. | Provided by the applicant. |

| Application Form | The official request to regularize status or receive an exit pass. | Submitted at Amer or Tasheel centres. |

| Biometric Data Capture | Standard security screening for all amnesty applicants. | Completed at designated government centres. |

| Proof of Travel Ticket | Required for those exiting, proving intent to leave. | Presented at the service centre for an exit pass. |

This checklist provides a high-level view of what’s involved. A solid grasp of the UAE visa amnesty process is a crucial part of any robust due diligence framework, enabling you to manage tenant-related risks before they escalate into financial liabilities.

Amnesty Programs Versus Strategic Investor Visas

For any high-net-worth individual, drawing a sharp line between a temporary amnesty program and a long-term residency solution is critical. A visa amnesty in the UAE is a reactive, corrective measure. A strategic investor visa is a proactive tool for securing assets and cementing your presence.

One fixes a past problem; the other secures your future. For a sophisticated investor, banking on the chance of a future amnesty is not a viable strategy. It introduces a level of uncertainty that has no place in a data-driven portfolio decision.

The Purpose of an Amnesty: A Corrective Measure

An amnesty program is a regulatory reset. It is designed to bring a segment of the expatriate population back into legal compliance, reducing systemic risks in the labor and rental markets. It is a temporary, time-bound initiative with a specific goal: market hygiene.

It is not a pathway to permanent residency or a strategic advantage for an investor. It is a mechanism that reinforces the legal framework your property investments depend on.

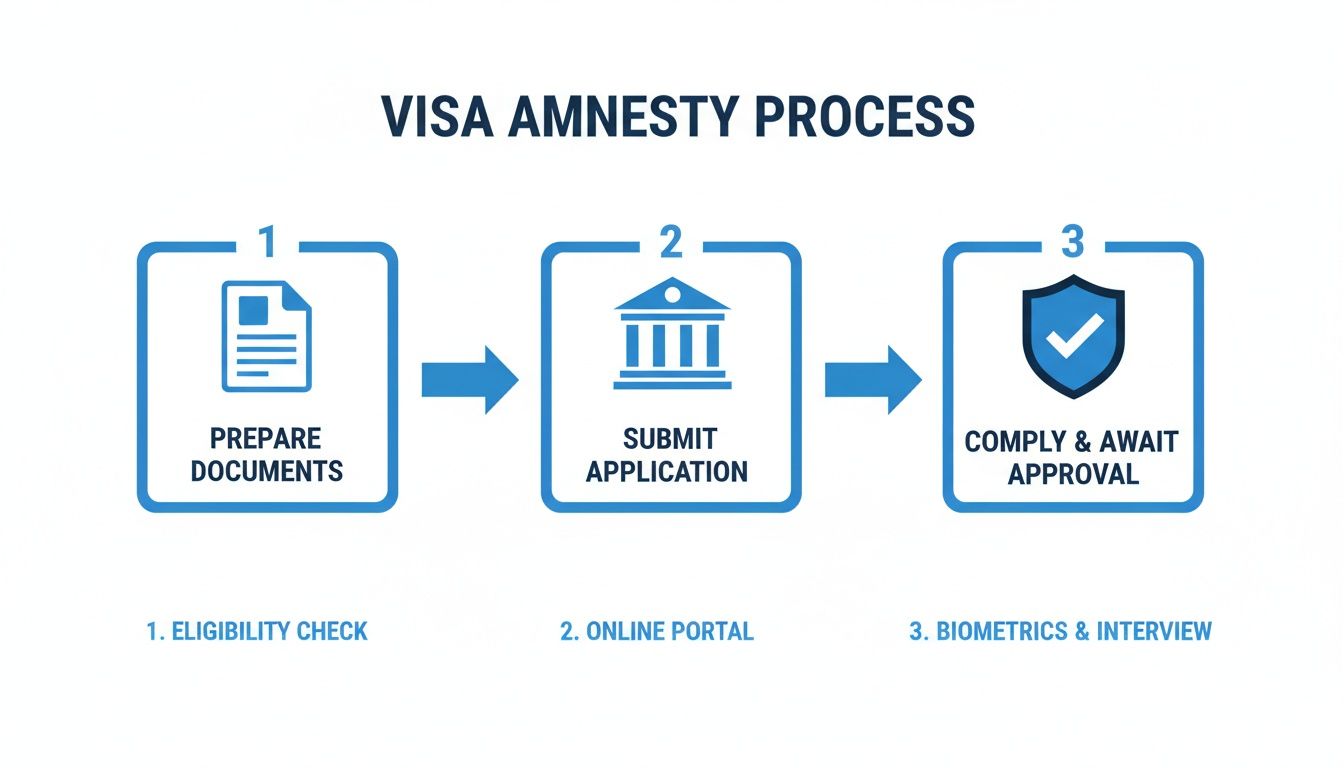

The graphic below illustrates the administrative nature of the amnesty process.

This flow highlights its function: prepare, submit, and comply. It is a transactional procedure designed to resolve an immediate legal issue, not a long-term residency plan.

Strategic Visas: The Proactive Approach

In contrast, investor visas are built for asset protection and long-term planning. The UAE Golden Visa, secured through a qualifying property investment, is the prime example. It decouples your residency status from employment sponsorship, giving you direct control over your assets.

This control is absolute. It means smoother banking operations, simpler property transactions, and the legal certainty required to manage a substantial real estate portfolio. Understanding the specific Dubai Golden Visa requirements is the first step toward this strategic alternative.

An amnesty resolves a problem. An investor visa creates an opportunity. The former is about compliance; the latter is about control. For the serious asset manager, control is the only variable that matters.

Comparing Key Differences

The functional gap between these two visa categories is massive. Seeing them side-by-side clarifies why one is a temporary fix and the other is a cornerstone of a sound investment strategy. For HNWIs, understanding what is the Golden Visa in the UAE is the first step toward building a resilient portfolio.

The table below offers a clear comparison from an investor's point of view.

| Feature | Visa Amnesty Program | Strategic Investor Visa (e.g., Golden Visa) |

|---|---|---|

| Primary Function | Corrective; rectifies visa irregularities. | Proactive; establishes long-term residency. |

| Investor Control | None; participant is subject to program rules. | High; investor has direct control over status. |

| Duration | Temporary; a short window for action. | Long-term; typically 10 years and renewable. |

| Basis of Eligibility | Based on visa overstay or other infractions. | Based on qualifying investment (e.g., property). |

| Portfolio Impact | Indirect; stabilizes the broader rental market. | Direct; secures the investor's ability to own/manage. |

| Strategic Value | Low; a reactive measure, not a planning tool. | High; a foundational element of asset management. |

This comparison makes the distinction undeniable. For a serious, long-term investment strategy in Dubai, a proactive approach to residency is integral to sound asset management. Relying on periodic amnesties leaves portfolio security to chance.

How A Visa Amnesty Affects Landlords And Asset Managers

When the UAE announces a visa amnesty, it creates ripples in the property market. It is a double-edged sword: a serious risk for the unprepared, but a strategic opportunity for the proactive. Understanding both sides is essential for protecting rental yields and asset value.

The most immediate risk involves tenants whose residency permits have expired. A tenant with an irregular visa status introduces legal vulnerabilities into a rental agreement.

Tenancy Contract Validity and RERA

Under RERA regulations, a valid residency visa is a non-negotiable part of an enforceable tenancy contract. If a tenant's visa expires, the legal standing of your contract becomes precarious. This can complicate actions for non-payment or eviction proceedings through the Rental Disputes Center.

An invalid visa can weaken your legal position, dragging out a simple case into a lengthy legal battle. An amnesty period highlights this vulnerability across your portfolio.

The opportunity, however, is just as powerful. An amnesty provides a defined window to bring every tenant into full legal compliance. This is a chance to de-risk future rental income and solidify the legal foundation of every lease.

Proactive portfolio management involves anticipating regulatory shifts like a visa amnesty and using them to fortify assets. A portfolio-wide compliance audit during an amnesty should be standard procedure for any diligent asset manager.

Implications for Tenant Screening And Renewals

The existence of amnesty programs underscores the critical nature of tenant screening. Verifying a potential tenant's visa status before registering any new Ejari contract is an absolute must. It is a fundamental due diligence step.

For existing tenants, the renewal process becomes a key checkpoint. An amnesty period provides a non-confrontational reason to request updated visa documentation. It is a natural opportunity to ensure all paperwork is in order, a practice detailed in our guide to the tenancy contract in Dubai.

Red Flags In Property Sales And Transactions

The impact of a visa amnesty extends into property sales. A potential buyer with an irregular visa status is a major red flag that can derail a transaction.

- Mortgage Approvals: Banks will not approve a mortgage for a buyer without a valid residency visa. A buyer planning to use an amnesty introduces unacceptable uncertainty and delay.

- NOC and Title Deed Transfer: Obtaining a No Objection Certificate (NOC) and completing the title transfer at the Dubai Land Department requires valid identification, including a residency visa.

- Source of Funds: Buyers in a precarious legal situation often face tougher scrutiny over their source of funds, adding another layer of complexity.

A strategic asset manager uses an amnesty period as a catalyst for a full portfolio health check. The goal is to identify and fix these risks before they turn into voided contracts, stalled sales, or financial losses.

Final Thoughts: Strategy Over Speculation

While a visa amnesty in the UAE reflects the government's practical approach to regulation, investors must see these programs as market correctives, not strategic tools. They are essential for economic stability but are no substitute for a robust personal residency strategy.

Proactive compliance is non-negotiable for any High-Net-Worth Individual. Waiting for a residency issue to surface introduces unacceptable risk into a data-driven investment. A stable, legally sound tenant base is the bedrock of maximizing ROI and ensuring long-term capital appreciation.

From Reactive Correction to Proactive Control

Serious investors should focus on structured residency through investment. Using a qualifying property acquisition to secure a long-term visa, such as the Golden Visa, changes your position in the market entirely.

This move shifts you from a passive observer to a proactive principal with a secure legal standing. This protects assets, simplifies transactions, and provides the control needed to manage a high-value portfolio.

An amnesty addresses a past irregularity for a segment of the population. A strategic investor visa secures your future in the market. For the asset manager, only the latter provides the certainty required for confident, long-term capital deployment.

Integrating Residency into Your Portfolio Strategy

As you rebalance your portfolio, your residency strategy is as crucial as analyzing rental yields. A secure legal status is a foundational pillar of asset protection in the UAE.

It affects everything, from financial transactions to your standing in potential legal disputes. A clear residency status also simplifies understanding various taxes on property and associated fees.

Your ability to operate with confidence is directly tied to your legal presence. The window for speculative plays has narrowed; success now demands a disciplined approach where legal compliance and strategic residency are central to your investment thesis.

If you are structuring your portfolio for sustained growth in 2026, let's run the numbers on how a strategic property acquisition can secure both your assets and your long-term residency.

Common Questions on Visa Amnesty

When managing property in Dubai, the topic of visa amnesty raises practical questions. Clear answers are about protecting assets and making informed decisions.

Can a Landlord Check a Tenant's Visa Status?

Yes, and they should. It is a fundamental part of due diligence. Before any Ejari contract is registered, a landlord or asset manager is expected to verify the tenant's Emirates ID and residency visa.

During an amnesty, requesting updated documents for a lease renewal is prudent management. It is a standard practice to ensure portfolio compliance and mitigate risks.

Does Visa Amnesty Cancel Overstay Fines?

In most cases, yes. This is a primary function of a visa amnesty in the UAE. It waives accumulated overstay fines, giving individuals a clean slate to either regularize their status or exit the country without a major financial penalty.

This removes a barrier for tenants, increasing the chance they can regularize their affairs without defaulting on rent due to government fines.

What Happens if My Tenant Applies for Amnesty?

If a tenant is applying for amnesty, their legal status is under review. This can temporarily complicate contract renewals or bank account usage.

Proactive communication is key. An asset manager must understand the tenant's goal: are they trying to regularize their visa or planning to exit? This knowledge helps forecast a potential vacancy or prepare to sign a renewed, compliant lease.

Can an Amnesty Affect a Property Sale?

It can halt a property sale. A buyer without a valid residency visa cannot obtain a mortgage from a UAE bank. They will also face roadblocks at the Dubai Land Department during the title deed transfer.

If a buyer's legal status depends on an amnesty application, it introduces a level of uncertainty most sellers find unacceptable, putting the transaction timeline and capital at risk.

Is Visa Amnesty a Path to a Golden Visa?

Not at all. These two programs are entirely separate and serve different purposes.

An amnesty is a temporary, corrective measure for individuals with existing visa problems. A Golden Visa is a proactive, long-term residency solution for those meeting specific, high-level investment criteria. There is no direct bridge from an amnesty program to a Golden Visa UAE.