In Q4 2025, off-plan transactions outpaced ready units by a factor of 1.8x, a clear signal that investor focus remains fixed on future supply. Unlike the speculative cycle of 2023-2024, the current dubai-real-estate-market-analysis indicates a pivot towards a sustainable growth cycle. Portfolio growth in 2026 hinges on aligning with the right developer whose products meet specific demand segments, from branded residences attracting golden-visa-uae applicants to mid-market luxury in expanding economic zones.

This analysis moves beyond brand reputation to provide a quantitative assessment of the developers shaping Dubai's next phase. For each entity, we will dissect their strategic direction, financial stability, and, most critically, their pipeline of investable assets for the coming 36 months. We move past glossy brochures to examine tangible metrics: delivery track records, typical yields, resale performance, and off-plan opportunities.

You will find a structured profile for each developer, including their approach to ESG, potential risk factors, and recommended use-cases for different investor profiles. This is not a list of websites; it is a due diligence framework. The goal is to equip you with the data needed to make calculated asset allocation decisions in Dubai's maturing, post-boom market. Each profile provides the direct link to the developer's official platform.

1. Emaar Properties: The Market Anchor for Capital Preservation

As the institutional benchmark for Dubai real estate, Emaar Properties remains a foundational component of any well-diversified, low-volatility portfolio. While its prime assets in Downtown Dubai and Dubai Marina are now mature holdings, the focus for new capital allocation in 2026 has shifted decisively towards its expansive master communities.

Last year’s benchmarks confirmed consistent capital appreciation across Emaar's established communities. This track record provides a reliable floor for valuing its new off-plan launches, making it a predictable, albeit premium, entry point. For high-net-worth individuals, Emaar represents a capital preservation play, especially for securing assets that align with the long-term rental market.

Strategic Focus and Investor Suitability

Emaar’s strategy heading towards 2027 is clear: the expansion of integrated communities. The build-out of Dubai Hills Estate, Emaar South, and Rashid Yachts & Marina prioritises social infrastructure, creating enduring rental demand. This focus on holistic living environments solidifies Emaar's position among the top developers for long-term holds.

Advisor's Insight: The primary value proposition of Emaar is not speculative gain but asset stability. Its brand equity translates directly into high secondary market liquidity, ensuring a clear exit strategy and insulating investments from acute market corrections.

- Investment Pros: High liquidity, proven track record, strong community management.

- Investment Cons: Lower short-term ROI potential, premium pricing, oversubscribed launches.

- Best Suited For: Risk-averse investors, family offices, and buyers seeking stable, long-term rental yields.

Off-Plan Pipeline and Access

Emaar's popular launches are notoriously oversubscribed. Gaining access requires pre-registration and established relationships with priority-access brokers. The payment plans have evolved from post-handover models to more conservative, construction-linked structures, typically in 60/40 or 70/30 splits. All transactions are secured via RERA-compliant escrow accounts, a key aspect of uae-property-law that protects investor capital.

| Metric | Details |

|---|---|

| Typical Payment Plan | 60/40 to 80/20 (Construction-Linked) |

| Estimated ROI (Rental) | 4-6% (Stable) |

| Target Investor | Capital Preservation / Long-Term Hold |

Key Off-Plan Opportunities for 2026:

- Rashid Yachts & Marina: New phases targeting the luxury waterfront segment.

- The Valley: Continued expansion of its family-oriented villa and townhouse community. [Map: Location relative to Al Maktoum Airport]

- Branded Residences: Select launches in prime corridors.

Visit Emaar Properties Website

2. Bayut: The Digital Nexus for Off-Plan and Secondary Market Intelligence

For investors conducting initial due diligence, Bayut has solidified its position as the primary digital portal for both off-plan and secondary market analysis. It functions as an essential aggregator, offering a macro-level view of available inventory and pricing benchmarks. Its utility in 2026 extends beyond simple listings; it is a crucial tool for competitive analysis.

The platform's dedicated "New Projects" section provides a centralised hub for tracking upcoming off-plan launches from top developers in Dubai. This feature allows investors to compare payment plans, unit configurations, and completion timelines. For portfolio managers, its transaction data and price trend tools offer a transparent mechanism for validating asset valuations against current market activity.

Strategic Focus and Investor Suitability

Bayut’s core value lies in market transparency and data centralisation. The introduction of features like the ‘TruCheck’ badge, which validates a listing's availability, streamlines the initial research phase. This focus on verified data reduces time wasted on phantom listings and empowers buyers with the information needed to engage brokers from a position of knowledge. It is the definitive starting point for mapping out investment opportunities.

Advisor's Insight: Bayut is not a direct sales channel but an intelligence-gathering instrument. Use it to identify price outliers, track competing inventory in your target building, and gauge agent activity. The true value is unlocked when you cross-reference its public data with proprietary insights from a specialist broker.

- Investment Pros: Comprehensive market overview, free access to data, direct comparison tool.

- Investment Cons: Does not provide direct allocation access, data can lag real-time transactions.

- Best Suited For: Investors in the discovery phase and analysts tracking market trends.

Off-Plan Pipeline and Access

While Bayut aggregates information on new launches, securing a unit still requires navigating the developer’s network of preferred agencies. The platform serves as the alert system, but execution remains relationship-driven. Investors can leverage the portal to identify which agencies are most active in a specific project. This makes it a powerful tool for understanding the landscape of Dubai's top real estate companies.

Key Platform Features for 2026:

- New Projects Section: A dedicated portal for all major off-plan launches.

- TruCheck™ & Checked Badges: Verification systems to filter for authentic listings.

- Market Intelligence Reports: Quarterly reports detailing transactional trends and rental yields.

3. DAMAC Properties: Branded Residences as a High-Yield Asset Class

DAMAC Properties has carved out a distinct niche, moving beyond conventional luxury to master the art of branded residences. For investors targeting high-yield rental streams and capital appreciation driven by brand equity, DAMAC represents a primary allocation. Their model translates global brand recognition from names like Cavalli and de GRISOGONO into tangible real estate value.

Last year’s performance benchmarks for their branded towers showed a clear rental premium over non-branded assets in comparable locations. This premium is the core of DAMAC’s value proposition, attracting a specific tenant demographic. This makes DAMAC a strategic choice for investors looking to build a portfolio of high-performing, niche assets.

Strategic Focus and Investor Suitability

DAMAC's 2026-2027 strategy is doubling down on ultra-luxury and master community development. The focus has expanded to their large-scale communities like DAMAC Hills 2 and the recently announced Dubai South expansion. This dual approach allows investors to acquire either high-density urban assets or family-oriented community villas.

Advisor's Insight: DAMAC's value is intrinsically linked to brand execution. The primary risk is not construction quality but brand sustainability. Investors are buying into a marketing concept as much as a physical property. Due diligence should assess the partner brand's long-term global appeal.

- Investment Pros: Potential for high rental premiums, unique product differentiation, frequent launch cycles.

- Investment Cons: Higher service charges, value tied to brand perception, revised handover timelines on some past projects.

- Best Suited For: Investors seeking brand-driven rental premiums and those targeting the luxury short-term rental market.

Off-Plan Pipeline and Access

DAMAC maintains a frequent launch cadence. Access to high-demand units, particularly in their iconic branded towers, is competitive and requires pre-registration through accredited brokerage channels. Their payment plans are typically construction-linked, often structured as 70/30 or 80/20, with all funds managed through RERA-compliant escrow accounts. All associated taxes-on-property and DLD fees should be factored into the initial calculation.

| Metric | Details |

|---|---|

| Typical Payment Plan | 70/30 or 80/20 (Construction-Linked) |

| Estimated ROI (Rental) | 6-8%+ (Variable on brand) |

| Target Investor | High-Yield / Capital Appreciation Focus |

Key Off-Plan Opportunities for 2026:

- DAMAC Lagoons: Continued release of Mediterranean-themed villa and townhouse clusters.

- Branded Towers: New launches in prime corridors with international luxury fashion partnerships.

- DAMAC Hills & Hills 2: New phases of villas and apartments within these established golf communities. More information on their large-scale projects can be found here: DAMAC Islands and its offerings.

Visit DAMAC Properties Website

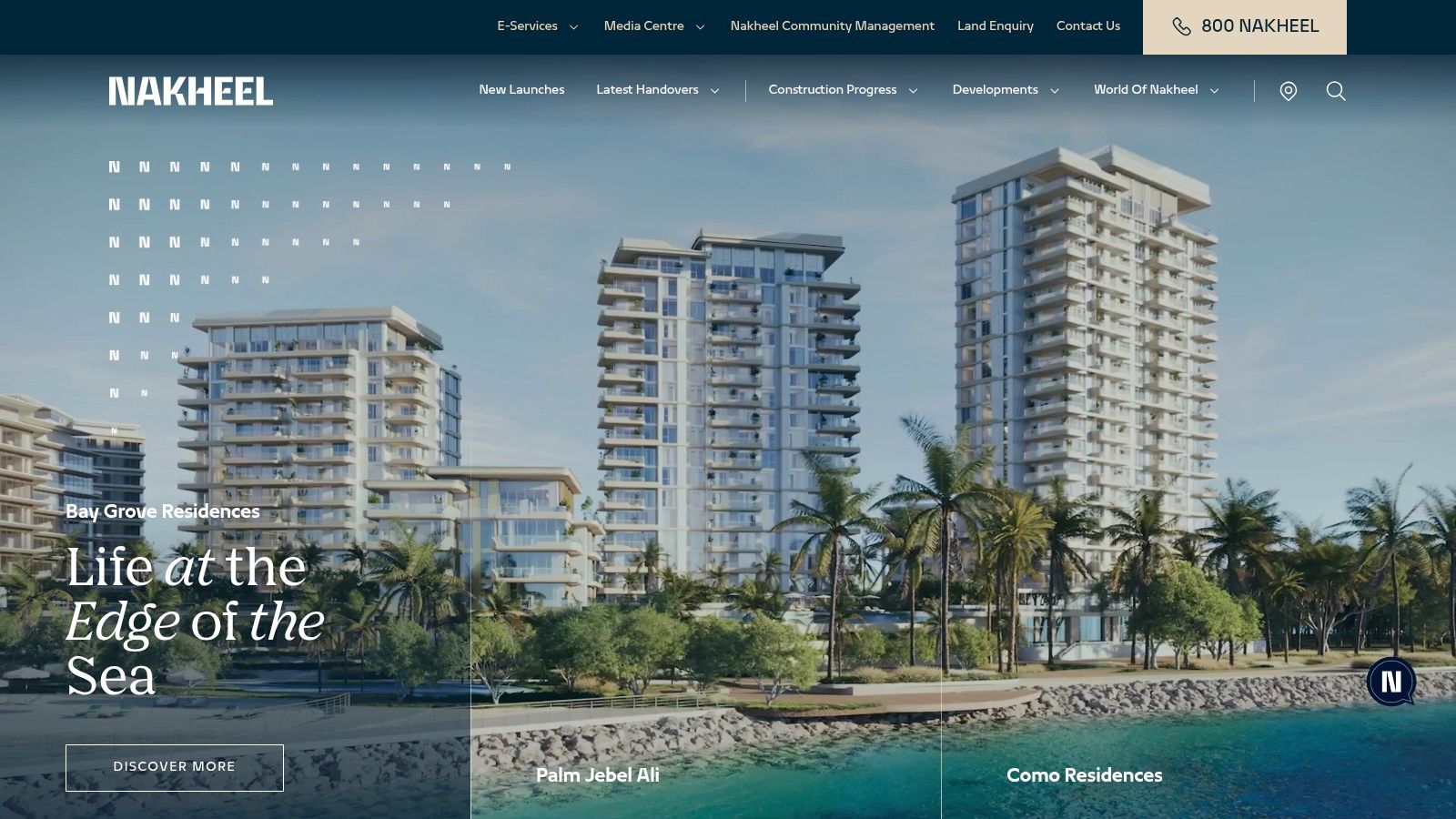

4. Nakheel: The Architect of Waterfront Supremacy

Nakheel is synonymous with Dubai's coastal identity. For investors in 2026, Nakheel represents a strategic play on ultra-prime waterfront real estate, a segment that commands a price premium and attracts a specific, high-demand buyer profile. Their projects are not just properties; they are global landmarks.

Last year’s performance benchmarks for Palm Jumeirah villas underscored the asset class's resilience and sustained capital appreciation. This established track record provides a robust valuation framework for its upcoming megaprojects like Dubai Islands and the revived Palm Jebel Ali.

Strategic Focus and Investor Suitability

Nakheel’s 2027 vision is an ambitious expansion of its waterfront master plan. The development of Dubai Islands and the phased release of Palm Jebel Ali are designed to meet global demand for beachfront living. This focus ensures long-term rental demand from both residents and the tourism sector.

Their projects are an ideal match for high-net-worth investors aiming to acquire trophy assets. The unique nature of island-based real estate creates a supply-constrained market, which historically supports higher resale values and rental yields compared to inland communities.

Advisor's Insight: Nakheel’s core value is its monopoly on new, large-scale island development. Investing here is a bet on the enduring appeal of a waterfront Dubai lifestyle. The secondary market for these properties is global, offering excellent liquidity for assets that are often key qualifiers for the golden-visa-uae programme.

- Investment Pros: Trophy asset class, supply-constrained locations, strong global brand recognition.

- Investment Cons: High capital entry point, opaque pricing on new launches, longer development horizons for master communities.

- Best Suited For: Investors seeking trophy assets, legacy buyers, and those targeting high-yield holiday home rentals.

Off-Plan Pipeline and Access

Accessing Nakheel's primary launches, particularly for premium villa plots on Palm Jebel Ali, requires deep-rooted broker relationships. Payment plans are construction-linked, with a 60/40 or 80/20 split becoming the standard. All off-plan sales are processed through secure, RERA-regulated escrow accounts.

Key Off-Plan Opportunities for 2026:

- Palm Jebel Ali: Phased releases of villa plots and branded residential towers.

- Dubai Islands: Continued development of residential and wellness-focused districts.

- Jumeirah Islands: Limited new launches of luxury villas.

5. Meraas (by Dubai Holding Real Estate): The Architect of Urban Destinations

Meraas, integrated within Dubai Holding, operates as a master placemaker. Its core competency lies in creating high-street, design-led urban and waterfront destinations that command a premium on both sales and rental markets. For investors, Meraas represents an allocation into assets defined by unique lifestyle concepts.

Last year’s performance benchmarks for completed projects like City Walk and Bluewaters Island confirmed robust rental yields and strong secondary market demand. This established track record provides a strong valuation basis for its new off-plan launches, positioning it as a key player for portfolio diversification.

Strategic Focus and Investor Suitability

For 2026, Meraas's strategy is anchored in monetising its prime land bank with exclusive, low-density projects that prioritise design. Projects such as Nad Al Sheba Gardens and the new phases at Port de La Mer target a sophisticated buyer seeking a differentiated product. This focus on niche luxury solidifies enduring value and attracts a high-quality tenant base, often linked to the golden-visa-uae programme.

Advisor's Insight: The primary investment thesis for Meraas is not volume but scarcity and brand identity. Its projects function as self-contained destinations, creating a 'moat' that protects capital values from broader market fluctuations. The resale market for Meraas properties is driven by the uniqueness of the asset class.

- Investment Pros: Unique, design-led projects; prime, non-replicable locations; strong rental demand.

- Investment Cons: Limited inventory per launch, premium pricing, less focus on large-scale master communities.

- Best Suited For: Investors focused on brand equity, boutique luxury buyers, and those seeking assets in prime locations.

Off-Plan Pipeline and Access

Meraas launches are typically targeted and less frequent, leading to significant demand. Access is best secured through brokers with a transactional history with the developer. Payment plans are in line with the 2026 market standard, favouring construction-linked schedules, often around 70/30 or 80/20, with all funds managed through RERA-mandated escrow accounts.

Key Off-Plan Opportunities for 2026:

- Nad Al Sheba Gardens: Continued release of villa and townhouse phases.

- Port de La Mer: Final phases of its Mediterranean-inspired island retreat.

- New Waterfront Projects: Anticipated launches along the Jumeirah coastline.

Visit Meraas (by Dubai Holding Real Estate) Website

6. Sobha Realty: The Quality Benchmark for End-User Assets

Sobha Realty has carved out a market position by prioritising build quality. Its backward-integrated model, where it controls design to construction, results in a final product that commands a premium in rental and secondary sales markets. This makes Sobha a strategic choice for investors focused on attracting high-quality tenants and ensuring long-term asset value.

Last year’s data from Sobha Hartland confirmed that its units achieve higher-than-average rental yields for their categories. The meticulous attention to finishing resonates strongly with the end-user market. This reputation for excellence solidifies Sobha’s place among top developers for investors seeking a durable, high-performance asset.

Strategic Focus and Investor Suitability

Sobha's 2026-2027 strategy is the continued build-out of its flagship master community, Sobha Hartland II. The developer’s core philosophy remains unchanged: create self-contained communities with superior amenities that foster stable rental demand. This focus on a premium living experience makes its assets less susceptible to market fluctuations.

Advisor's Insight: Sobha is an end-user-driven developer. Its value proposition is less about timing the market for a quick flip and more about acquiring a top-tier asset that will outperform in the long-term rental and resale market. The premium price point is justified by lower maintenance costs and higher tenant retention rates.

- Investment Pros: Superior construction quality, high tenant retention, strong capital appreciation potential.

- Investment Cons: Higher price per square foot, fewer launches compared to volume developers.

- Best Suited For: Buy-to-let investors, HNWIs seeking tangible quality, and end-users looking for a primary residence.

Off-Plan Pipeline and Access

Accessing Sobha's launches requires proactive engagement, as popular projects often sell out quickly. Their payment plans are construction-linked, often following 80/20 structures, reflecting confidence in their delivery timelines. For instance, the payment schedule for projects like Sobha Hartland Waves was tied directly to construction milestones.

| Metric | Details |

|---|---|

| Typical Payment Plan | 80/20 (Construction-Linked) |

| Estimated ROI (Rental) | 5-7% (Quality Premium) |

| Target Investor | Quality-Focused / Buy-and-Hold |

Key Off-Plan Opportunities for 2026:

- Sobha Hartland II: New clusters of villas, mansions, and apartments.

- Sobha SeaHaven: Continued phases of its luxury waterfront tower in Dubai Harbour.

- Branded Residences: Forthcoming ultra-luxury projects.

Visit Sobha Realty Website

Top Dubai Property Developers Comparison: 2026 Outlook

| Developer | 2026 Strategic Focus | Ideal Investor Profile | Key Advantage |

|---|---|---|---|

| Emaar | Master Community Expansion | Capital Preservation / Low-Risk | Market Liquidity & Stability |

| Bayut | Data Aggregation & Verification | Research & Due Diligence Phase | Comprehensive Market Overview |

| DAMAC | Branded Residences & Ultra-Luxury | High-Yield / Brand-Driven | Niche Market Dominance |

| Nakheel | Waterfront & Island Megaprojects | Trophy Asset / Legacy Buyer | Monopoly on Island Development |

| Meraas | Design-Led Urban Destinations | Boutique Luxury / Diversification | Scarcity & Placemaking Premium |

| Sobha | Quality-Centric Construction | Long-Term Hold / End-User | Superior Build Quality & Finishes |

Final Thoughts: Strategy Over Speculation

The era of uniform market lifts has passed. As we navigate 2026, asset performance is intrinsically linked to the strategic capabilities of the developer. The selection process is no longer about location; it is about aligning capital with the developer whose business model and delivery capacity match your portfolio’s objectives.

The window for easy speculative flips has narrowed. Success in this cycle demands a granular, project-level analysis backed by a deep understanding of a developer's track record and commitment to master community infrastructure. For instance, an investor focused on capital preservation might find Emaar’s predictable delivery schedules appealing.

Conversely, an investor with a higher risk appetite could find DAMAC’s high-concept, branded residences in emerging locations more suitable. This approach requires careful analysis of payment plans but the potential upside can be substantial. Similarly, discerning the difference between Sobha Realty’s meticulous construction quality and Meraas’s focus on unique lifestyle destinations is critical.

Actionable Framework for Investor-Developer Alignment

Your due diligence should be structured around a clear framework. Before committing capital, consider these alignment points:

- Portfolio Objective vs. Developer Specialisation: Are you targeting high-yield rental income? If your goal is legacy asset acquisition, a villa in a Nakheel or Sobha master community could be more appropriate.

- Risk Tolerance vs. Delivery Track Record: Analyse past project handovers. Has the developer met its announced timelines consistently? Revised handover schedules are part of the industry, but chronic delays signal operational challenges. RERA protections, including mandatory Escrow accounts, offer a safety net.

- Financial Strategy vs. Payment Plan Structure: Last year’s 1% monthly payment plans are rare. The shift towards heavier down payments and 60/40 or 70/30 structures favours well-capitalised investors. Ensure the payment schedule aligns with your liquidity. [Chart: 2026 Payment Plan Breakdown]

- Long-Term Vision vs. Infrastructure Commitment: Sustainable capital appreciation will occur in communities with committed infrastructure development. Look beyond the project brochure and analyse the wider area’s master plan. Developers like Emaar and Nakheel excel at creating entire ecosystems that support long-term value.

Ultimately, successful investors in 2026 will treat their Dubai property acquisitions not as simple purchases, but as strategic partnerships with the developers. Your returns are directly correlated to their ability to execute. Choosing from the top developers in Dubai requires moving beyond brand recognition and into a rigorous, data-led assessment of their operational and financial strengths.

If you are rebalancing your portfolio for 2026, let's run the numbers. At Proact Luxury Real Estate LLC, we specialise in identifying off-plan opportunities and ready assets that align with sophisticated investment objectives. Schedule a confidential consultation on our website: Proact Luxury Real Estate LLC.