In a market as dynamic as Dubai’s, relying on luck is a strategy for leaving money on the table. We are currently witnessing a maturity in the real estate sector that demands more than just a listing on a portal; it requires a calculated exit strategy. Successfully selling a property in 2026 isn't about guessing where the market is going—it's about interpreting the data that is already here. With transaction volumes hitting record highs and buyer sophistication increasing, the difference between a standard sale and a premium exit often comes down to three variables: precise valuation, the legal readiness of your asset, and the narrative you build around it. Whether you are rebalancing a portfolio or selling a family home, you need to navigate the noise. This guide cuts through the complexities of the process, offering a clear, analytical roadmap to liquidating your asset efficiently in the current cycle.

Understanding the Dubai Real Estate Market

Before you even think about listing, you need to get a handle on what the Dubai property market is doing right now. This goes deeper than just looking at general price trends. It’s about understanding the speed of sales, the sheer volume of transactions, and who is actually buying. A seller who is genuinely in the know can make strategic calls that lead to a faster sale at a better price.

The market’s recent momentum has been nothing short of remarkable. For example, the first half of 2025 saw explosive activity, with around 94,000 residential sales transactions hitting the books. That's a 23% jump in volume compared to the previous year, with the total value hitting a staggering AED 262.7 billion (USD 71.5 billion).

What does that tell you? It’s a clear signal of a high-velocity market with incredibly strong buyer demand. This is the environment you're operating in.

The Seller's Strategic Mindset

Having the right mindset is crucial. You need to stop thinking of your property as just a home and start seeing it as a valuable asset competing in a very active marketplace. This means taking an objective, data-driven approach and understanding what makes today's buyers tick.

Here are a few things every strategic seller should be thinking about:

- Market Positioning: How does your place stack up against similar listings right in your neighbourhood? Think about recent upgrades, the view, which floor you're on—it all matters.

- Buyer Profile: Who are you trying to attract? Is it an end-user looking for their forever home, or an international investor chasing the best rental yields? Your marketing and even how you stage the property should speak directly to them.

- Timing: Is it a seller's market, or is it more balanced? Lining up your sale with peak demand can make a massive difference to your final sale price.

A deep understanding of market behaviour is your greatest advantage. While agents provide expertise, your own knowledge empowers you to ask the right questions and set realistic expectations from the beginning. For a more detailed breakdown, check out our guide on comprehensive Dubai real estate market analysis.

To give you a clear roadmap, let's break down the journey of selling properties in Dubai. The whole process can be boiled down to a few key stages, each with its own goals and essential paperwork. The table below provides a quick, high-level overview to get you started.

The Dubai Property Sale Process at a Glance

| Stage | Key Objective | Critical Document or Action |

|---|---|---|

| Preparation & Listing | Set a competitive price & market effectively | Title Deed, Broker Agreement (Form A) |

| Negotiation & MOU | Agree on terms & secure the deal with a deposit | Memorandum of Understanding (MOU/Form F) |

| NOCs & Legalities | Obtain clearance from developer & authorities | Developer No Objection Certificate (NOC) |

| Mortgage Settlement | Clear any outstanding home loan (if applicable) | Mortgage Liability Letter |

| Property Transfer | Legally transfer ownership at the DLD | Manager's Cheque, DLD Transfer Appointment |

| Post-Sale & Handover | Settle final bills & hand over keys to the buyer | Final DEWA bill, Handover formalities |

This table simplifies a complex process, but it highlights the critical milestones you'll encounter. Each step, from getting your initial paperwork in order to the final handover, is a building block toward a successful and profitable sale.

How to Price Your Dubai Property to Sell

Let’s be honest: setting the asking price for your Dubai property is the single most critical decision you'll make in this entire process. It's a real balancing act. Price it too high, and your property gets stale, sitting on the market for months while buyers scroll right past. Price it too low, and you're leaving a serious amount of money on the table.

The secret isn't in guessing or relying on those generic online estimators. It's about getting strategic with a data-driven approach.

A rock-solid pricing strategy starts with a detailed Comparative Market Analysis (CMA). And no, this isn't just a quick browse through listings on Property Finder. A professional CMA is a deep dive into multiple layers of data to figure out what your property is truly worth right now.

This analysis is all about meticulously comparing your property to others, zeroing in on the subtle differences that justify a higher—or lower—price tag.

Building Your Comparative Market Analysis

To get an accurate picture, your analysis needs to focus on three distinct groups of properties right in your immediate area or even your specific building:

- Recently Sold Properties: This is your gold-standard data. It tells you what buyers have actually been willing to pay in the last 3-6 months. It's not theoretical; it's fact.

- Active Listings: These are your direct competitors. Sizing them up helps you position your property to be the most appealing option on the market today.

- Expired Listings: These are the cautionary tales. Properties that failed to sell, usually because they were overpriced. They show you the price ceiling the market simply won't accept.

Your goal is to find that sweet spot. The price where your property is seen as the best value among the competition, sparking quick, serious offers without you giving it away.

A classic mistake I see is sellers pricing their property based on what a neighbour claims they were offered, or worse, using an old valuation. The Dubai market is incredibly dynamic. A valuation from six months ago might as well be from another era.

Just look at the recent market shifts. The Residential Market Sales Price Index climbed by approximately 15.6% year-on-year, with apartment prices jumping 15.22% and villas showing a 17.81% surge. This is exactly why current, hyper-local data is non-negotiable. You can find more detailed information about Dubai's property price history on Global Property Guide.

Beyond the Basics: Factors That Really Influence Price

Simply comparing square footage and the number of bedrooms isn’t enough, especially in a market as diverse as Dubai. Micro-market trends are everything. A two-bedroom apartment in Downtown Dubai has a completely different pricing dynamic than a similar-sized unit in Dubai Hills Estate.

You have to dig into the nuances:

- View and Floor Level: A full sea view from a high floor in Jumeirah Beach Residence can easily command a premium of 20% or more compared to the exact same unit with a community view on a lower level.

- Upgrades and Condition: Have you renovated the kitchen with high-end European appliances? Upgraded the flooring from standard tiles to real wood? These tangible improvements justify a higher price than a unit with a dated, original developer finish.

- Amenities and Building Reputation: The quality of the building's gym, pool, concierge service, and its overall maintenance record directly impacts value. A well-managed building with a stellar reputation will always attract more serious buyers. To understand more about what makes certain areas stand out, have a look at our guide on the best areas to invest in Dubai.

The Psychology of Strategic Pricing

Finally, don't underestimate the psychological impact of your asking price. Pricing your property at AED 2,995,000 instead of a round AED 3,000,000 isn't just a retail trick; it works wonders in real estate. It keeps your property visible in searches for listings "under AED 3 million," which dramatically expands your pool of potential buyers.

In a strong seller's market, you can even play a more advanced game. Slightly underpricing your property can spark a bidding war. This creates a powerful sense of urgency and competition among buyers, often pushing the final sale price well above your initial asking price. It’s a calculated risk, but when done with expert market knowledge, it can pay off brilliantly.

Getting Your Property in Front of a Global Audience

Once you’ve nailed down your pricing strategy, it's time to shift gears and create a powerful pull for potential buyers. In a market as dynamic as Dubai's, just listing your property and hoping for the best simply won't cut it. You need to craft a compelling story that grabs the attention of local residents and, just as importantly, the flood of international investors looking for their next opportunity. This is where smart, strategic marketing becomes your best friend.

First things first: invest in top-notch visuals. This is non-negotiable. I’ve seen it time and time again—professional photography is the difference between a listing that gets thousands of clicks and one that gets completely ignored. Grainy, poorly lit phone pictures scream "unprofessional" and can instantly shave value off your property in a buyer's mind.

And it doesn’t stop with photos. Immersive 3D virtual tours have gone from a nice-to-have to an absolute must. For the huge number of overseas buyers interested in selling properties in Dubai, a virtual tour is often their first real walkthrough. It gives them a genuine feel for the space from thousands of miles away, building the confidence they need to put in a serious offer without ever stepping foot inside.

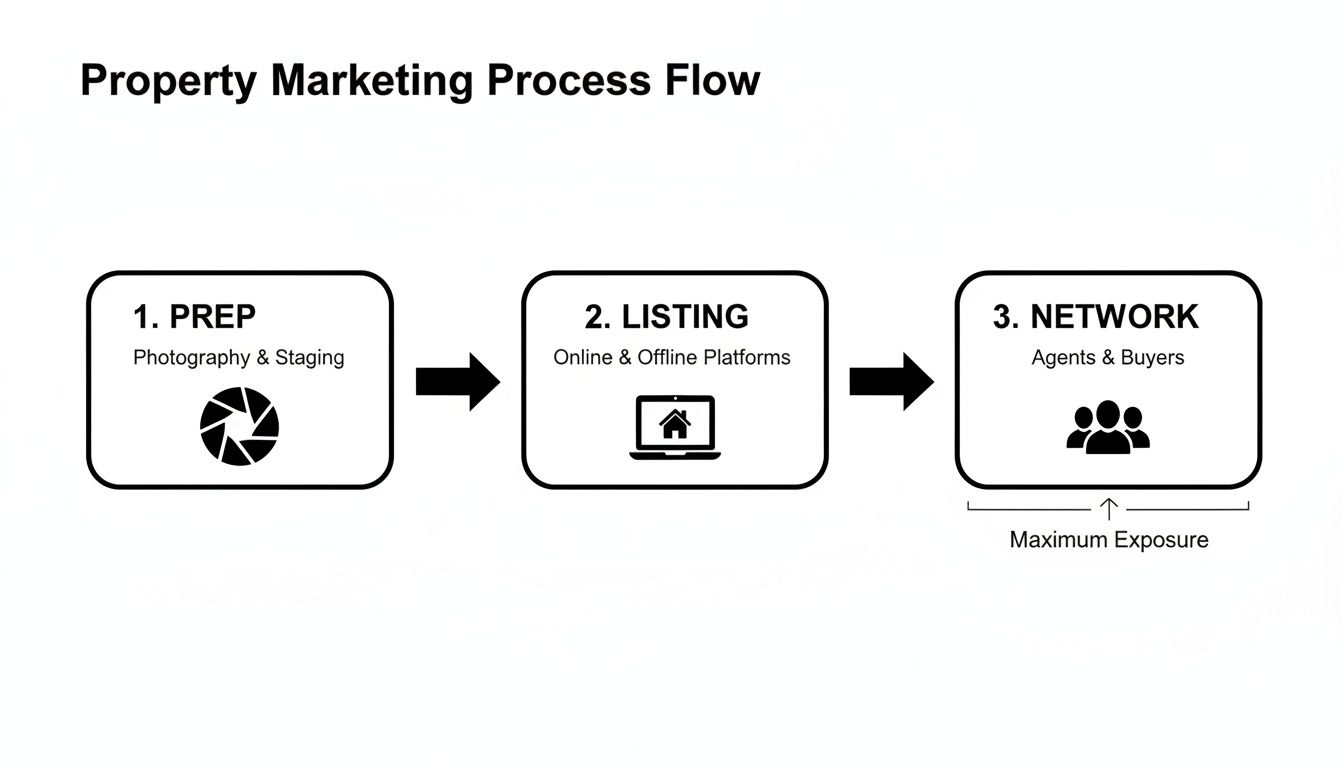

Building a Multi-Channel Marketing Plan

With your visuals ready to impress, the next step is launching a coordinated marketing push across several channels. Don't make the mistake of relying on a single platform; that’s a surefire way to limit your reach. A successful campaign blends the power of the top online portals with laser-focused digital ads and the invaluable network of a skilled real estate agent.

The main battle for buyer attention in Dubai happens online. Your property needs a premium, featured spot on the two platforms that dominate the market:

- Bayut: Known for its massive number of listings and a really clean user interface, it’s a go-to for pretty much everyone.

- Property Finder: This one is another heavyweight, especially popular with serious buyers and investors who are deep in their research phase.

But don’t just stop at the portals. Targeted social media campaigns can be incredibly powerful. Imagine a slick video tour of your Marina apartment popping up as an ad for high-net-worth individuals in London, Mumbai, or Riyadh who’ve already shown an interest in Dubai real estate. That’s the kind of precision modern marketing offers.

The goal is to create multiple touchpoints. A buyer might first see your villa on a Facebook ad, then look it up on Property Finder for more details, and finally reach out to your agent to book a viewing. Every channel has a role to play in that journey.

Speaking the Right Language to the Right Buyer

Great marketing means tailoring your message. The things that excite an investor are completely different from what a family looking for their forever home wants to see. If you don't customise your listing's story, you're not going to make a real connection.

Let's say you're selling a one-bedroom flat in Downtown Dubai with a solid rental history. Your marketing needs to shout "high-yield investment."

Your listing description should lead with things like:

- Proven ROI: "Achieve an impressive 7.5% net rental yield with this turnkey investment property."

- Occupancy Rate: "Boasts a 95% occupancy rate over the past three years."

- Service Charge Details: "Low annual service charges to maximise your profitability."

On the other hand, if you're selling a four-bedroom villa in Arabian Ranches, the focus flips entirely to lifestyle and family.

Your marketing should be all about:

- Community and Schools: "Located just minutes from top-rated international schools and family-friendly parks."

- Space and Amenities: "Features a private landscaped garden, swimming pool, and dedicated children's play area."

- Lifestyle Benefits: "Enjoy a serene, secure community perfect for a growing family."

This tailored approach makes sure your property’s best features hit home with the people most likely to buy it. By investing in a professional presentation and rolling out a smart, multi-channel plan, you change your listing from being just another option into an opportunity that serious buyers feel they can’t afford to miss.

Once you've got your pricing and marketing dialled in, the next step is navigating the legal maze that every property sale in Dubai must go through. It might sound daunting, but it's actually a very clear-cut process designed to protect everyone involved. Getting your paperwork sorted isn't just a box-ticking exercise; it's a strategic move that shows buyers you're serious and ready to move quickly.

The absolute cornerstone of this phase is the No Objection Certificate (NOC).

This is an official letter from your property’s developer stating they have no issues with you selling. In simple terms, it's their confirmation that you're all paid up on service charges and any other community fees. You literally cannot proceed to the Dubai Land Department (DLD) for the final transfer without it. Think of it as the developer's green light for the sale.

The journey from marketing your property to getting that final sign-off is a connected one. Each step relies on the one before it.

This process shows just how critical it is to have everything, including your legal documents, lined up and ready to go for a smooth transaction.

Getting the Developer NOC

To kick off the NOC process, you'll need to head to the developer's management office with an application. Every developer has its own quirks, but the basics are pretty standard: they’ll want to see the signed Memorandum of Understanding (MOU) with your buyer, plus copies of your passport and Emirates ID.

Next, the developer will schedule a final inspection of your property. They're mainly checking for any unauthorised modifications you might have made. Once they're satisfied and confirm all your dues are settled, they'll issue the NOC. The cost for this certificate varies, typically falling between AED 500 and AED 5,000, and it's a cost the seller usually covers.

My advice? Start this process the moment the MOU is signed. It can take a week or more, and the certificate itself is usually only valid for about 15 days, so you don’t want to be caught scrambling.

To keep everything organised and ensure no last-minute surprises, here’s a straightforward checklist of the documents and fees you'll be dealing with.

Essential Documents and Fees Checklist

| Item (Document or Fee) | Purpose and Notes | Typical Cost or Responsibility |

|---|---|---|

| Original Title Deed | The primary legal proof of your ownership. For off-plan, this is the Oqood. | Seller's responsibility to provide |

| Passport & Emirates ID Copies | Required for all owners listed on the Title Deed for identity verification. | Seller's responsibility to provide |

| Memorandum of Understanding (MOU) | The binding sales agreement (Form F) signed with the buyer, outlining the terms. | Jointly signed; typically drafted by the agent |

| Developer NOC Fee | Paid to the developer to issue the No Objection Certificate. | Seller pays; AED 500 - AED 5,000 |

| Mortgage Liability Letter | If the property is mortgaged, this bank-issued letter states the outstanding amount. | Seller's responsibility to request from the bank |

| DLD Transfer Fees | A mandatory government fee to transfer ownership, calculated at 4% of the property price. | Typically paid by the Buyer |

| Real Estate Agency Commission | The fee paid to the broker for their services in facilitating the sale. | Typically 2% of the sale price, paid by the Seller |

| Registration Trustee Fees | Administrative fees for processing the transfer at a DLD-approved trustee office. | AED 4,000 + VAT, typically paid by the Buyer |

Having these items ready not only speeds up the process but also builds immense confidence with your buyer, signalling a smooth and professional transaction ahead.

In a competitive market, preparation is your biggest advantage. A buyer is far more likely to commit to a deal with a seller who has all their documents ready to go. It signals a fast, hassle-free transaction.

This proactive approach is more important than ever in Dubai's current climate. A flood of new properties hit the market in 2024–2025, and some analysts predict nearly 300,000 new units could be added across the UAE by 2028. With so much choice, buyers won't wait around. Having your NOC and legal paperwork ready for a swift closing can give you a real edge, preventing delays that might send your buyer looking at the next listing. You can explore more analysis of the Dubai property supply on Air DXB.

What If There's an Existing Mortgage?

If your property has a mortgage, there’s one extra but very standard step in the process. Once the buyer pays their deposit (usually held in escrow), you'll need to use those funds, or your own, to settle the outstanding balance with your bank as per the liability letter.

Once paid, your bank will issue a clearance letter and, crucially, will send a representative to the DLD on the day of the transfer. Their job is to formally release the mortgage from the property’s title. It’s a well-oiled machine, and your agent or conveyancer will coordinate all the moving parts—you, the buyer, and the bank—to ensure it all goes off without a hitch. This is a key part of successfully selling properties in Dubai when a loan is in the picture.

Closing The Deal: From DLD Transfer To Handover

You've navigated the pricing, marketing, and legal hurdles. Now comes the best part: the official transfer of ownership. This isn't just a formality; it's a highly organised process designed to protect everyone involved, making sure all funds and documents are exchanged securely.

The entire sale culminates in the transfer meeting. This appointment happens either directly at a Dubai Land Department (DLD) branch or, more commonly these days, at a DLD-approved Trustee Office. These offices are essentially authorised third parties that make the final transaction seamless and secure.

The Transfer Meeting Demystified

On transfer day, a few key players gather to finalise the deal. It’s a well-coordinated effort where everyone has a specific role.

- You (the Seller) and the Buyer: The main event, of course.

- Real Estate Agents: Your agent and the buyer's, making sure everything aligns with the MOU.

- Bank Representative: If you have a mortgage to clear, your bank's representative will be there to release the loan.

- Trustee Office Staff: The official who oversees the whole thing, verifies every document, and executes the transfer in the DLD system.

This meeting is where the money changes hands. The buyer will arrive with one or more manager's cheques for the outstanding balance. This is the standard, secure way to handle large sums in Dubai—the funds are guaranteed, giving you complete peace of mind.

Once the trustee has verified all the paperwork and confirmed receipt of the payments, they process the transfer right then and there. Within minutes, the DLD system is updated, and a new Title Deed is issued in the buyer’s name. This document is the definitive legal proof of new ownership.

The moment that new Title Deed is printed, the sale is officially done. It’s a transparent and incredibly efficient system that provides immediate legal certainty, which is a massive reason why international investors feel so confident when selling properties in Dubai.

Post-Transfer Responsibilities: The Final Handover

With the legal side wrapped up, there are just a few housekeeping items left to ensure a clean break and a smooth handover to the new owner. Don't skip these—they're crucial for finishing the sale professionally.

Your first stop should be a DEWA (Dubai Electricity and Water Authority) happiness centre. Here, you'll settle your final utility bill and request a service disconnection. The buyer can't register the utilities in their name without the final bill receipt from you, so this is a priority.

Next up is the physical handover of the property itself. This is more than just tossing the keys over. It’s a formal process where you equip the new owner with everything they need to access and manage their new home.

A good handover package should always include:

- All keys to the property—main doors, bedrooms, mailboxes, and storage.

- Access cards or fobs for building entry, parking garages, and community facilities like the pool or gym.

- Any appliance manuals or warranty information you have on hand.

This final step closes the loop on your journey as the owner. By handling the handover meticulously, you ensure a positive end to the transaction for everyone involved, leaving no loose ends. It's the professional finish to a well-executed sale.

For overseas sellers, it's also wise to get a handle on any tax implications back home. Our detailed guide offers valuable insights into managing taxes on property sales abroad for non-resident owners.

Common Questions on Selling Properties in Dubai

Even with the best game plan, selling a property in Dubai can throw up some questions. It's only natural. Sellers often want to nail down the specifics: How long will this really take? What’s the final bill going to look like? Can I even do this if I’m not living in the UAE?

Getting clear, straight answers to these common queries isn't just about peace of mind—it's about building the confidence you need to make smart, strategic moves.

How Long Does It Typically Take to Sell a Property in Dubai?

This is the classic "how long is a piece of string?" question, but based on real-world experience, we can give you a pretty reliable timeframe. For a well-priced property in a good location, you’re generally looking at 30 to 90 days from listing to the final transfer. Of course, a prime villa or a sought-after apartment can get snapped up much faster.

Here’s a rough breakdown of that timeline:

- Finding a Buyer: The active marketing phase usually takes about two to six weeks to attract serious offers.

- The Paperwork Dance: Once you've accepted an offer, allow another two to four weeks for signing the Memorandum of Understanding (MOU) and for the buyer to get their financing sorted, if they need it.

- Getting the Green Light: The No Objection Certificate (NOC) from the developer typically takes one to two weeks.

- The Final Handshake: The transfer meeting at the Dubai Land Department is a one-day affair.

Want to speed things up? Have all your documents ready from day one. It's the single biggest thing you can do to avoid hitting frustrating, and totally avoidable, snags.

A prepared seller is a fast seller. I've seen deals get shaky simply because a Title Deed was missing or service charges weren't cleared. In a market this competitive, being organised isn't just a virtue—it's a massive advantage.

What Are the Total Costs Involved When Selling My Property?

This is one of the best parts about selling in Dubai. The cost structure is incredibly favourable, especially when you compare it to other global property hubs. The big one? There are no capital gains taxes on property sales. That’s a huge win right there.

As the seller, your main costs are pretty straightforward:

- Agent's Commission: This is your primary expense, and it's typically 2% of the final sale price.

- Developer's NOC Fee: This is an admin fee that can range from AED 500 to AED 5,000, depending entirely on the developer.

- Mortgage Settlement Fee: If you have a mortgage, your bank will likely charge an early settlement fee, which is often around 1% of the outstanding loan balance.

It's important to remember that the buyer shoulders the biggest cost: the 4% Dubai Land Department (DLD) transfer fee, plus the trustee office fees. This clear split makes it much easier to budget for your sale.

Can I Sell My Property If I Am Not in the UAE?

Absolutely. This is a very common scenario in Dubai's international market, and there’s a well-oiled process for it. The key to making it happen smoothly is a legally appointed Power of Attorney (POA).

You’ll need to grant a POA to a trusted representative in the UAE—a friend, family member, or your lawyer. This isn't just a simple permission slip; it's a formal legal document that has to go through a specific process:

- First, it must be drafted by a legal expert, with specific clauses allowing the sale of your property.

- Then, it needs to be notarised in the country where you currently live.

- Next, it has to be attested by the UAE Embassy in that country.

- Finally, once it arrives in the UAE, it needs a final attestation from the Ministry of Foreign Affairs.

Once this is done, your representative has the full legal authority to sign documents, attend the transfer meeting, and handle the entire sale on your behalf.

How Do I Sell an Off-Plan Property Before Handover?

Selling an off-plan property—often called a resale or a secondary market transaction—is also a very standard procedure in Dubai. The most critical piece of the puzzle is getting the developer's official approval.

First, you and the new buyer will sign a sales agreement. With that in hand, you’ll apply for an NOC from the developer. Most developers require you to have paid a certain amount of the original price before they'll allow a resale—usually 40% or more.

Once that condition is met, you and the buyer will visit the developer’s office together. You'll settle any outstanding payments and pay the developer’s admin fees for the transfer. The developer then officially transfers ownership by re-issuing the Oqood (the initial off-plan contract) in the new buyer's name. And just like that, the sale is done. Selling property in Dubai is rarely just a transaction; for most, it is a significant financial event involving a major component of their net worth. It deserves the same rigor and analysis as any other institutional investment decision.

At Proact Luxury Real Estate, we don't just list homes; we manage the lifecycle of your asset. My background in financial journalism drives our agency’s ethos: we prioritize clarity, data integrity, and protecting your bottom line over quick, low-effort deals. The market is active, but it favors the prepared. If you are looking for a valuation based on actual market depth—not just asking prices—or need guidance on structuring a complex exit, let’s have a conversation.Book a strategic consultation with Ritu Kant Ojha At Proact Luxury Real Estate LLC, we guide our clients through every single stage of their property sale. From nailing the pricing strategy to untangling complex legal requirements, our team is here to ensure your transaction is as seamless as it is profitable.

Ready to maximise your return? Book a one-on-one consultation with our advisors.