While media attention gravitates toward prime luxury, asset managers understand that superior net yields are often secured in high-volume, high-demand districts. As of early 2026, the market for rent in International City Dubai has moved past its post-boom volatility. It now represents a phase of sustainable growth, positioning it as a high-performance asset for any data-driven portfolio.

Analysing the International City Rental Market

The investment narrative for International City has pivoted. Previously viewed through a lens of affordability, it is now correctly identified as a strategic engine for stable, high-yield cash flow. Its core strength is a consistent tenant base of professionals and mid-income families employed in nearby economic hubs like Dubai Silicon Oasis and Academic City.

This demographic provides a natural buffer against the market fluctuations common in prime luxury districts. Unlike high-end areas dependent on senior executive relocations, International City's demand is fueled by a broader and more stable employment sector. For landlords, this translates directly into high occupancy rates and minimal vacancy risk.

Investment Metrics for 2026

For high-net-worth individuals and family offices, the key performance indicators are compelling. Last year's benchmarks showed studios delivering rental yields as high as 8.69%—a figure that outperforms many "premium" locations once operational costs are factored in.

Calculating net yield requires a clear picture of all expenses, from service charges and maintenance to the specific housing charges DEWA applied to rental properties.

Ongoing infrastructure upgrades, including improved road networks and proximity to the future Metro Blue Line, strengthen its investment case. These are not minor adjustments; they are factors that transition International City from a simple rental play into a long-term asset management decision focused on sustainable returns.

International City Rental Benchmarks (Early 2026)

This table provides a baseline for 2026 portfolio analysis, using last year's data as a benchmark for income and returns.

| Unit Type | Average Annual Rent (AED) | Estimated Net Yield |

|---|---|---|

| Studio | 31,000 | 8.0% - 8.7% |

| 1-Bedroom | 43,000 | 7.0% - 7.6% |

| 2-Bedroom | 59,000 | 6.0% - 6.5% |

| 3-Bedroom | 96,000 | 7.0% - 7.5% |

These numbers present a clear narrative. While larger units offer strong returns, the standout performers are studios and one-bedroom apartments, which consistently deliver some of the most attractive net yields in Dubai's real estate market.

What’s Driving the Returns in International City?

Gross yield is a vanity metric. Net yield—the actual cash flow after all operational costs—is what matters. To analyze International City's potential, one must look past headline rental numbers and examine service charges, maintenance, and vacancy periods.

This granular analysis reveals why the community consistently outperforms more expensive districts that may appear stronger on paper but fall short in net returns.

The area's financial engine is tied to a specific and reliable source of demand. International City serves as the primary housing hub for the workforce powering Dubai's key economic zones, particularly Dubai Silicon Oasis and Academic City. This is not speculative demand; it is a fundamental need for housing, which maintains high occupancy.

The Tenant Profile Is Your Biggest Asset

The typical tenant is a professional or a mid-income family, often on a multi-year employment visa. This demographic seeks value and stability, resulting in lower turnover rates compared to prime downtown areas.

For an asset manager, this tenant profile offers distinct advantages:

- Minimal Vacancy Risk: A steady influx of professionals from nearby employment hubs ensures voids are short and infrequent.

- Stable Cash Flow: These tenants are less exposed to economic shocks affecting the high-end luxury market, leading to steady rent payments.

- Predictable Returns: Demand is driven by economic need, not speculation, making the income stream more predictable.

This stability is the foundation of the investment thesis for International City. As we progress through 2026, the rental market is demonstrating healthy maturity. The aggressive year-over-year spikes have stabilized, settling into a sustainable growth rate of 4% to 6%.

Studios currently average around AED 5,000 per month, with units in more desirable clusters commanding up to a 40% premium. This makes it a suitable segment for overseas landlords seeking reliable cash flow without the high entry costs of luxury real estate. The average rent per square meter stands at AED 1,300 annually—approximately $354 or €325—figures that attract yield-focused investors.

A common error is pursuing higher rent without accounting for costs. In International City, lower acquisition prices and high occupancy often deliver a superior net return compared to properties in Dubai Marina or Downtown, where service charges can consume up to 25% of gross rental income.

The data points to a clear strategy. While our broader Dubai property market forecast indicates growth across multiple segments, the durable yields in International City support portfolio diversification. The objective here is not rapid capital appreciation but building a high-performance, long-term income stream.

The Asset Acquisition Process for Overseas Investors

For an overseas investor, acquiring a high-yield rental property in International City is a strategic execution, not a retail purchase. The process begins with forensic due diligence at the cluster level. One must analyze the performance difference between the England Cluster, known for better maintenance, and the China Cluster, which may offer a lower acquisition price but variable building quality.

Success depends on correct navigation of the legal framework. Every transaction must be structured with robust RERA protections, particularly the use of escrow accounts for all payments. This is a non-negotiable step that insulates capital from project delays, a cornerstone of secure investing in Dubai. Our guide on buying property in Dubai for foreigners provides essential context on this regulated environment.

Securing the Asset and Structuring Ownership

After identifying a target unit, the next phase is securing the title deed with the Dubai Land Department (DLD). For HNWIs, the ownership structure is a key strategic decision.

Options range from personal ownership to specialized vehicles like a JAFZA offshore company or a mainland LLC. These structures can hold the asset, offer liability protection, and simplify portfolio management.

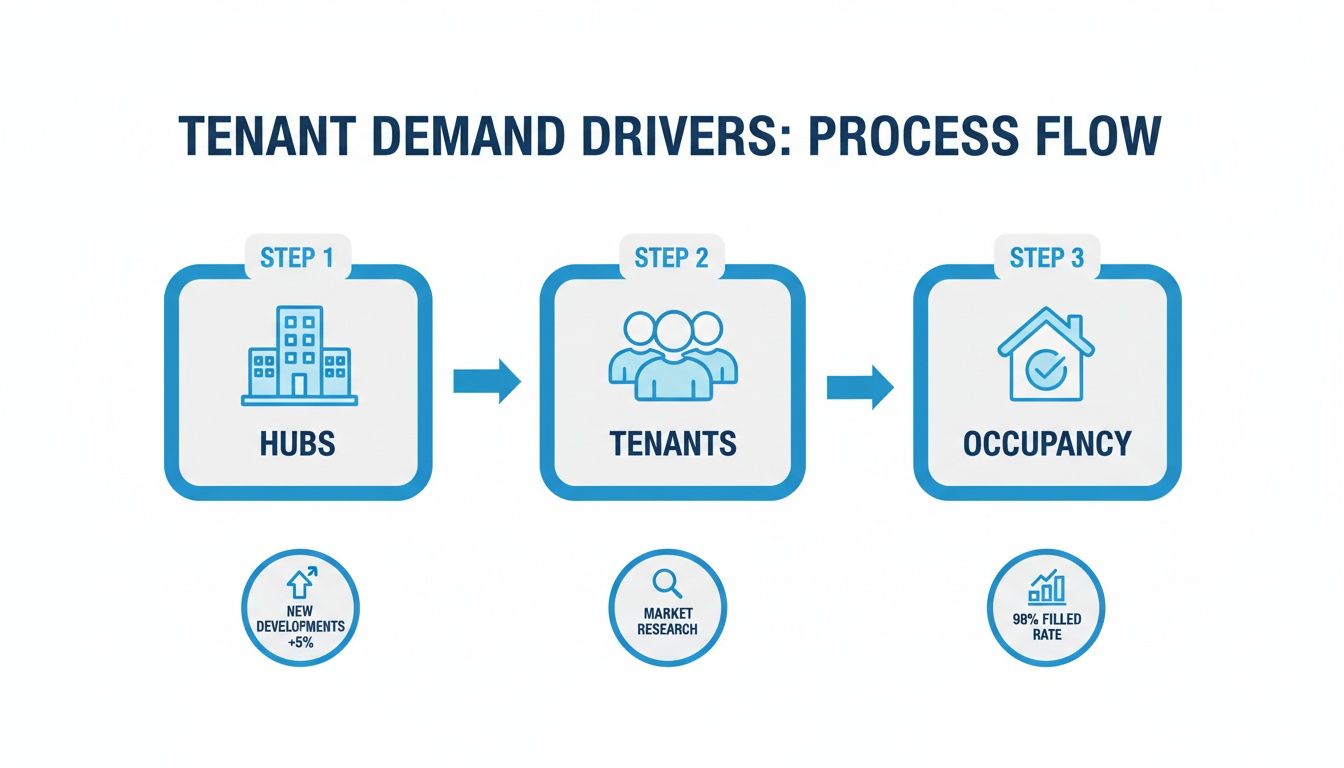

This diagram illustrates the fundamental drivers that sustain high tenant demand in communities like International City.

The flow from major economic hubs to a stable tenant base is the engine ensuring high occupancy and consistent rental income.

Financing is available for non-residents, but down payments are typically in the 40-50% range. Consequently, many investors opt for cash purchases to streamline the transaction and improve their negotiating position.

Acquiring property here is the first step in a long-term asset management strategy. A property purchase of AED 2 million or more can also serve as a pathway to a 10-year Golden Visa, integrating the investment with residency benefits and transforming the asset into a strategic component of a global footprint.

Maximizing Your Rental Income and Asset Performance

Acquiring an International City property is the starting point. Profitability is driven by disciplined, active management. To optimize returns on rent in International City Dubai, one must shift from a passive mindset to an active asset performance strategy. This involves a calculated approach to pricing, presentation, tenant relations, and legal compliance.

Engaging a professional property manager is often the most direct path. A competent manager handles all operational burdens, from tenant vetting to rent collection, converting a hands-on task into a predictable income stream. While this service costs 5-8% of the annual rent, it often pays for itself by minimizing vacancies and protecting the asset's long-term value.

Strategic Enhancements for Higher Yields

Setting the correct rent is a critical decision. We utilize real-time data from the Dubai Land Department's rental index and on-the-ground market intelligence to price units competitively. The objective is not the highest possible price but securing a quality tenant quickly. A single month of vacancy can negate the gains from an overly ambitious asking price.

Strategic, low-cost upgrades can deliver an outsized return. A professional deep clean, a fresh coat of neutral paint, and modern fixtures can elevate a unit above its competition.

For studios and one-bedroom apartments, offering a furnished option can command a premium of 10-15% from tenants seeking a turnkey solution.

This table compares common strategies for enhancing property yield.

Yield Enhancement Strategies: A Comparative Analysis

| Strategy | Upfront Cost (Est. AED) | Potential Annual Rent Increase (%) | Key Consideration |

|---|---|---|---|

| Furnishing | 10,000 - 20,000 | 10-15% | Best for studios & 1BRs targeting professionals or transient tenants. |

| Minor Upgrades | 3,000 - 7,000 | 5-8% | Fresh paint, modern fixtures, and deep cleaning can reduce vacancy periods. |

| Professional Management | 5-8% of annual rent | N/A (Yield protection) | Reduces vacancy and ensures timely rent collection, protecting overall returns. |

| All-Inclusive Bills | 800 - 1,500 / month | 15-20% | Attracts corporate tenants but requires active bill management. |

A relatively small upfront investment can lead to a substantial increase in annual rental income. The key is to select the strategy that aligns with the specific unit and target tenant profile.

The New vs. Renewed Lease Advantage

The Dubai rental market has a feature that astute landlords can leverage: new leases typically command higher prices than renewals. Last year's benchmarks, for instance, showed new apartment leases signed at rates 20.1% higher than renewed ones.

This presents a strategic choice. Instead of automatically renewing at a lower, RERA-capped rate, it is often more profitable to assess the open market when a contract ends. Securing a new tenant at the current market rate can substantially boost annual income. For further market dynamics, CBRE's detailed analysis offers excellent data.

Compliance and Contractual Obligations

Operating within Dubai's legal framework is non-negotiable. Every tenancy contract must be registered on the Ejari system to be legally enforceable. This is the landlord's responsibility and the foundation for protecting one's rights in a dispute.

Similarly, any rent increase must adhere strictly to the rules of the RERA Rental Increase Calculator. Attempting an unlawful increase will be challenged at the Rental Disputes Centre, resulting in legal costs.

Understanding the nuances of UAE property law is central to successful asset management. Adherence to these protocols ensures smooth and profitable operation, minimizing risks while maximizing returns.

How Does International City Stack Up Against Other High-Yield Areas?

No investment exists in a vacuum. To properly evaluate the rent in International City Dubai, a direct comparison with other rental powerhouses like Jumeirah Village Circle (JVC) and Dubai Silicon Oasis (DSO) is necessary. All three are key players in the mid-market segment but offer different propositions for an investor's portfolio.

International City's primary advantage is its low entry price, which translates into high gross yields, often approaching 8.5% for studios. The trade-off is the age of the buildings and the lack of a master-planned community feel found in JVC and DSO. It is a classic cash-flow play: lower capital outlay for higher immediate returns, with less potential for aggressive capital growth.

Jumeirah Village Circle (JVC): The Balanced Play

JVC offers a more balanced risk-reward profile. The buildings are newer, community amenities are superior, and property variety is greater, including townhouses.

- Average Yields: Typically range from 6.5% to 7.5%, slightly below International City's peak returns.

- Capital Appreciation: The potential for price growth is stronger due to ongoing development and a more central location.

- Tenant Profile: JVC attracts a mix of professionals and families willing to pay more for an improved lifestyle.

Dubai Silicon Oasis (DSO): The Tech Hub

DSO functions as a city-within-a-city, integrating residential towers with a technology park. This creates a built-in tenant base of tech professionals.

- Yields & Pricing: It sits between International City and JVC, offering solid returns for a mid-range purchase price.

- Infrastructure: The community benefits from a well-designed master plan and excellent access to major highways.

- Investment Angle: This is a stable, long-term hold, with demand fueled by the integrated free zone's employment engine.

Last year's REIDIN data supports this analysis. Average residential yields across Dubai reached 6.78%, with apartments showing 9.0% year-on-year rent increases. Mid-market hubs like JVC and DSO are capturing a large share of this demand. In Q1 2025, a two-bedroom unit in these areas averaged AED 84,835, demonstrating the high-yield potential across this segment.

A comparison of emirates provides a clearer picture of market dynamics. Our in-depth analysis of the Dubai vs Abu Dhabi real estate markets illustrates how different economic drivers shape investment outcomes.

Final Thoughts: Strategy Over Speculation

The post-Covid expansion cycle has concluded. As we move through 2026, the opportunity in high-density, high-yield communities like International City has matured. Success is now achieved through disciplined, long-term asset management focused on cash flow, not speculative flips.

For investors evaluating rent in International City Dubai, the key is to disregard macro-market noise and focus on micro-asset quality. This means identifying well-maintained buildings in desirable clusters with proactive owners' associations. These properties will consistently attract and retain quality tenants, ensuring stable occupancy and income.

The current market rewards operational excellence, not speculation. The difference between a 7% and an 8.5% net yield now depends on superior property management, not market timing.

Upcoming infrastructure, particularly the Metro's Blue Line extension, is a critical factor. Any asset within a 10-minute walk of a future transit hub is positioned for better long-term appreciation and rental demand. Navigating these details requires on-the-ground intelligence not found in generic reports. If your portfolio is being rebalanced for sustained rental income, let's run the numbers.

Frequently Asked Questions

When dealing with a specific asset class like real estate in International City, informed questions are a prerequisite for sound decision-making.

Here are answers to common queries from investors evaluating this high-yield area.

What Are the Typical Service Charges in International City and How Do They Affect Net Yield?

This is a critical question for any serious investor. In International City, service charges typically range from AED 8 to AED 12 per square foot annually, depending on the building's age, maintenance, and amenities. These fees cover security, cleaning, and common area upkeep.

For an average one-bedroom apartment, these charges can reduce the gross yield by 1.0% to 1.5%. Astute investors always review a multi-year service charge history before closing a deal.

What Is the Process and Cost for Registering an Ejari?

Ejari is the mandatory government registration of your tenancy agreement, making it legally enforceable. Without it, you have no legal standing at the Rental Disputes Center.

The process is completed online via the Dubai REST app or at an approved service center for a fee of around AED 220. While tenants customarily pay this fee, the legal responsibility for ensuring registration lies with the landlord.

Understanding the legalities of the tenancy contract Dubai is a non-negotiable part of asset protection.

Are There Restrictions on Rental Increases for Existing Tenants?

Yes, rental increases are strictly regulated by the RERA Rental Increase Calculator. A landlord can only legally raise the rent upon renewal if the current rent is more than 10% below the average market rate for a similar property in that area.

The allowable increase is tiered, starting at 5% and capped at a maximum of 20%. Any attempt to implement an increase outside this official framework is not legally recognized.

What Legal Protections Does RERA Offer Against Tenant Defaults?

RERA provides a robust legal framework through the Rental Disputes Center (RDC) to protect landlords. If a tenant defaults, a formal case can be filed to claim unpaid rent and, if necessary, secure a legally binding eviction order.

The process is structured and transparent, designed to protect landlord rights, provided the tenancy contract and Ejari are correctly registered. RERA's mandatory escrow account system for off-plan sales also offers powerful protection for investor capital during the initial property transaction.

At Proact Luxury Real Estate LLC, we provide the data-driven analysis and on-the-ground intelligence HNWIs need to make strategic, high-yield investment decisions in Dubai's dynamic property market.

https://ritukant.com