Last year's benchmarks were defined by ultra-luxury villas in established districts. For asset managers analyzing the 2026 outlook, the strategic playbook has flipped. Passo by Beyond is not a speculative play; it is a calculated entry into Dubai's primary southern growth corridor, engineered to capture demand driven by state-level infrastructure development.

This is not a project brochure breakdown. This is a dissection of a portfolio asset.

Analyzing the Passo by Beyond Investment Thesis

The 2025 market narrative became saturated with premium launches in areas approaching valuation ceilings. Entering 2026, the strategic capital is shifting towards quality and value in emerging master communities. Passo by Beyond is positioned to capture this demand, targeting a gap between generic mid-market projects and the pricing of legacy areas.

Developer Credibility and Market Positioning

The project is a venture by BEYOND Development, operating under the Omniyat umbrella. Omniyat's track record for delivering architecturally distinct, high-concept projects like The Opus and One Palm provides assurance on two fronts: build quality and adherence to revised handover timelines—a critical factor for an off-plan acquisition.

Unlike the speculative cycle of the post-Covid boom, the current Dubai real estate market analysis suggests a stabilization in price-per-square-foot growth. BEYOND has structured Passo to appeal to a sustainable buyer profile: end-users and long-term investors whose livelihoods are tied to the economic engine of Dubai South.

For an asset manager, the developer's financial stability and project delivery history are non-negotiable due diligence points. Omniyat's portfolio demonstrates a capacity to execute complex projects, which mitigates a primary risk in off-plan acquisitions.

A Response to Maturing Payment Structures

Payment plan evolution is a clear indicator of market health. The 1% monthly schemes prevalent last year have been replaced by more disciplined 60/40 or 70/30 structures. This shift has direct, positive implications for an investment in Passo by Beyond:

- Filters out Speculators: Higher initial capital requirements deter short-term flippers, fostering a more stable community of end-users and serious investors.

- Aligns with Construction: Payments are now tethered to tangible construction milestones, with funds protected in a RERA-mandated escrow account.

- Signals Developer Confidence: A structured payment plan indicates the developer is not reliant on low-commitment sales to finance the project.

This project is an intelligent response to market maturation. The investment thesis is built on three pillars: a credible developer, a strategic location within an infrastructure growth zone, and a financial structure that promotes long-term value over speculative churn.

Passo by Beyond is engineered for the current cycle of sustainable growth. It is a compelling option for investors rebalancing portfolios away from the overheated segments of last year, requiring a deeper look at capital appreciation drivers.

Location as a Play on Future Infrastructure

The savviest investors understand it is not about buying where value is, but where value will be. The investment case for Passo by Beyond hangs on this principle. You are acquiring an asset based on its strategic position at the center of Dubai's southern economic expansion, driven by the multi-billion-dirham expansion of Al Maktoum International Airport (DWC).

This is not a remote, speculative community. This is an early entry into what is engineered to become one of the world's most significant logistics and aviation hubs. We observed a similar pattern in communities like Dubai Hills Estate, which now command premiums because the infrastructure is complete. Passo offers the opportunity to enter before that growth is fully priced into the land value.

[Map: Passo by Beyond relative to Al Maktoum Airport and Expo City]

The "Aerotropolis" Effect in Action

An 'aerotropolis' is a city built around its airport. The expansion of Al Maktoum International is creating precisely this. This project is designed to handle over 260 million passengers annually, spawning an economic ecosystem powered by a skilled workforce of pilots, engineers, and corporate executives who will require high-quality housing.

Passo by Beyond is positioned to capture this inbound demand. It offers direct access to the airport and the evolving Expo City district. This geographic advantage will translate directly into rental demand and stronger resale values as the airport scales up operations post-2026.

Learning from Precedent

Consider the growth curve of Dubai Hills Estate. The first investors acquired assets while surrounding roads and facilities were under construction. As that critical infrastructure was delivered, property values saw a material increase.

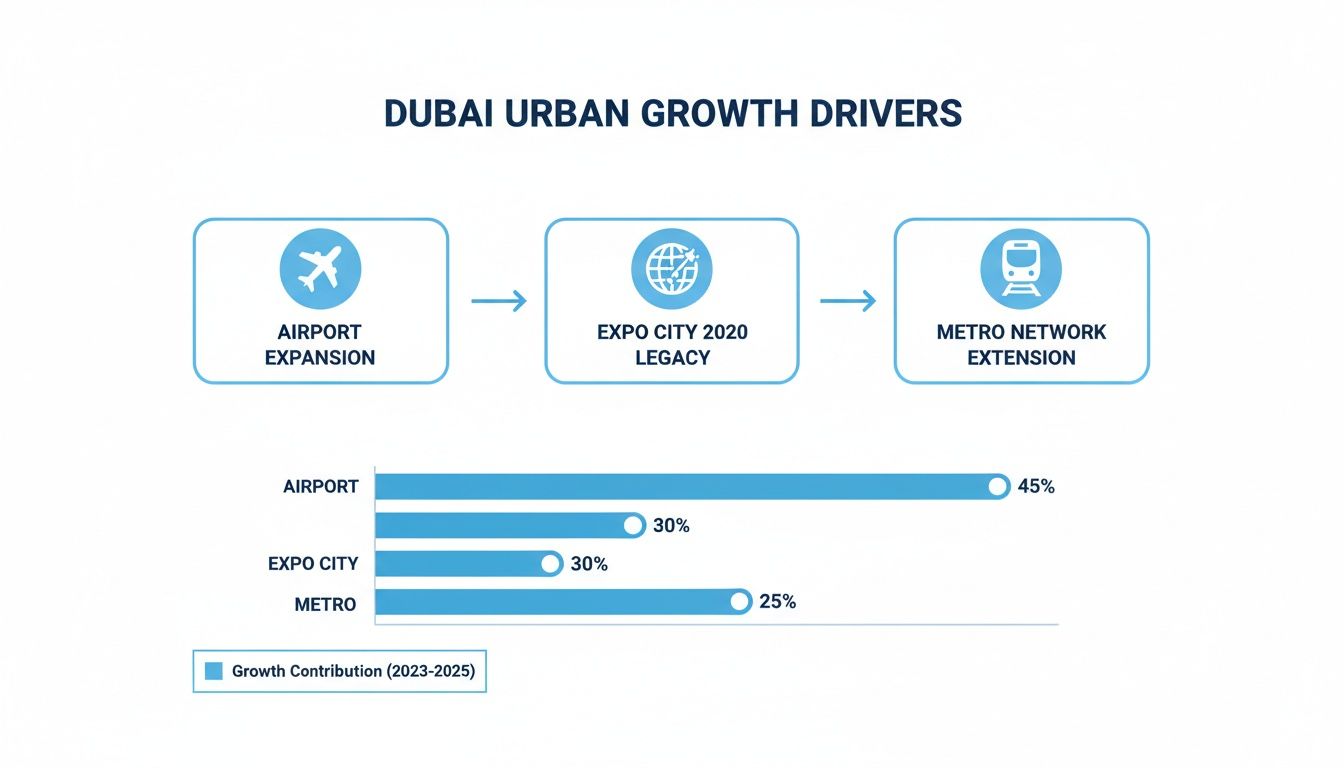

Dubai South is a similar pattern on a different scale. The infrastructure being built is city-level, including planned extensions to the Dubai Metro's Red Line and new arterial roads connecting to major highways. Our analysis of the best areas to invest in Dubai consistently shows that infrastructure delivery is the single most reliable catalyst for capital appreciation.

The core strategy is straightforward: acquire the asset before the full economic impact of the surrounding megaprojects is reflected in market prices. The current land valuation in this corridor presents a clear arbitrage opportunity compared to mature master communities at a similar point in their development cycle.

Future Connectivity and Unlocking Value

The investment case for Passo by Beyond strengthens with each infrastructure update. Key catalysts to watch between 2026 and 2028 include:

- Metro Line Expansion: The planned Red Line extension connecting Expo City to the DWC terminal will make this corridor one of the best-connected non-central locations in Dubai. This enhances its rental appeal to professionals who rely on public transport.

- Road Network Upgrades: Ongoing enhancements to E311 and E611 will reduce commute times to Abu Dhabi and the northern emirates, widening the potential tenant pool.

- Economic Zone Incentives: As more corporations establish logistics headquarters in Dubai South's free zones, the demand for executive housing will intensify.

These are tangible, government-backed projects with defined timelines. An investment in Passo by Beyond is a direct play on this publicly-funded growth—a strategic move to place capital in a location set to become a vital economic nerve center.

Running the Numbers: Passo's Financials and ROI

A solid investment decision is built on a clear financial model. For a project like Passo by Beyond, we must analyze its price per square foot and layout against similar launches in other growth hotspots like The Valley Phase 2. This is the only way to build an accurate picture of future returns.

[Chart: 2026 Payment Plan Breakdown]

Here is a top-line look at the financial projections for the townhouses and villas at Passo. These numbers are based on initial launch prices and conservative rental estimates for handover in 2027-2028, factoring in the expected influx of professionals for the airport expansion.

Passo by Beyond Unit Financial Projections (2027-2028)

The table below breaks down the launch pricing and projected returns for each main unit type.

| Unit Type | Size (sq. ft.) | Launch Price (AED) | Price per sq. ft. (AED) | Projected Annual Rent (AED) | Projected Gross Yield (%) |

|---|---|---|---|---|---|

| 3-Bed Townhouse | 2,150 | 2,800,000 | 1,302 | 180,000 | 6.4% |

| 4-Bed Townhouse | 2,600 | 3,500,000 | 1,346 | 225,000 | 6.4% |

| 4-Bed Villa | 3,800 | 5,500,000 | 1,447 | 325,000 | 5.9% |

| 5-Bed Villa | 4,500 | 6,800,000 | 1,511 | 390,000 | 5.7% |

These gross yields are strong for a new community, positioning Passo to compete against more established areas with higher acquisition costs. The real story, however, is in the net yield.

From Gross to Net: Calculating Actual Return

To derive the net return from the gross figure, operational costs must be factored in. The main cost for an off-plan property in Dubai is the annual service charge, which covers the upkeep of common areas and amenities. Based on last year's benchmarks in similar master-planned communities, it is prudent to project service charges for Passo at AED 6-8 per square foot annually.

Applying that to the 4-bedroom townhouse:

- Annual Service Charge: 2,600 sq. ft. x AED 7/sq. ft. = AED 18,200

- Net Annual Rent: AED 225,000 - AED 18,200 = AED 206,800

- Projected Net Yield: (206,800 / 3,500,000) x 100 = ~5.9%

A net yield around 5.9% is an attractive figure, particularly given that rental income is not taxed in Dubai. We have seen similar projects with strong yield potential, like Hyati Residence Dubai, which also appealed to a specific investor demographic by focusing on sustainable returns.

Capital Outlay and the Payment Plan

Understanding the deployment of capital is critical. The developer has implemented a 60/40 payment plan, a structure increasingly common in Dubai’s maturing market. This plan requires 60% of the property’s value to be paid in stages during construction, with the final 40% due at handover.

The investment case is tied directly to the expansion of Al Maktoum Airport, the economic activity of Expo City, and the planned metro line.

Breaking down the capital required for a 4-bedroom townhouse valued at AED 3,500,000:

- Booking Fee (Down Payment): 10% (AED 350,000) + 4% DLD Fee

- During Construction: 50% (AED 1,750,000) paid in installments

- On Handover (2027-2028): Final 40% (AED 1,400,000)

Key Financial Consideration: The final 40% handover payment is a major capital event requiring a clear plan, either through liquid cash or mortgage pre-approval. This structure deters short-term flippers and helps build a more stable community of end-users and long-term investors.

The financial model for Passo by Beyond is compelling. It offers a solid net yield projection supported by a payment structure suited to the current market. The investment thesis is not about speculative flips; it is about acquiring a well-priced asset in the path of strategic, government-led growth.

Resale Outlook and Target Tenant Profile

An asset's value is determined by what another party is willing to pay for it later. For an off-plan investment like Passo by Beyond, forecasting future liquidity requires a clear picture of the eventual buyer and tenant. This is about long-term asset management.

By the time these units enter the resale market in the 2028-2029 timeframe, the speculative waves of 2025 will have receded. Buyers for Passo will be end-users seeking stability and a short commute, creating a healthier secondary market. A community anchored by end-users tends to see steadier, more sustainable capital growth.

The Future Buyer Pool

The primary buyer for a Passo home will be a mid-to-senior level professional whose career is tied to the 'Aerotropolis' forming around Al Maktoum International Airport. This is a specific, high-income group with a non-negotiable, geographically-fixed housing requirement.

Expected buyer profiles:

- Aviation Captains and Senior Crew: Seeking family homes with commutes measured in minutes.

- Logistics and Supply Chain Directors: Executives from multinationals establishing hubs in Dubai South's free zones.

- Senior Engineers and Project Managers: Professionals leading the airport's expansion phases and surrounding infrastructure projects.

These buyers do not prioritize proximity to Downtown Dubai; their focus is this new economic hub. As the Passo community matures, its proposition for this captive audience becomes stronger. The process of selling properties in Dubai will become more straightforward as the area's value proposition solidifies.

The engine for capital growth post-handover will not be market hype. It will be the phased delivery of infrastructure. Each new school, retail center, and road connection directly boosts the asset's underlying value.

Pinpointing the Target Tenant

For investors, the tenant profile mirrors the buyer pool but includes a broader professional base. Precision in identifying job titles that will fill this economic corridor is what separates a solid rental forecast from speculation. The ideal tenant for a Passo property seeks a practical solution to a long commute.

Primary Tenant Demographics:

| Professional Category | Key Housing Needs | Anticipated Rental Budget (Annual) |

|---|---|---|

| Airline Pilots & First Officers | 3-4 bedroom units, secure community, airport access. | AED 180,000 - 240,000 |

| Air Traffic Controllers | Low-maintenance townhouses, proximity for shift patterns. | AED 170,000 - 210,000 |

| Expo City Senior Management | Larger villas for families, quality schools nearby. | AED 250,000 - 350,000 |

| Logistics Firm Executives | Premium finishes, home office space, road connectivity. | AED 220,000 - 300,000 |

This level of detail provides a more robust rental strategy. It confirms demand is anchored in the fundamental economic growth of a major national project, reinforcing the long-term viability of the investment.

Risk Assessment and Due Diligence Checklist

Any off-plan purchase includes risks, which for a calculated investor are variables to be managed. Rigorous, data-driven due diligence and knowledge of existing safeguards turn uncertainty into a calculated risk for a project like Passo by Beyond.

The primary concerns in any off-plan purchase are construction delays and market swings. While the post-Covid boom saw revised handover timelines, the market has since matured. Developers like BEYOND, with Omniyat's track record, operate in a more stable environment, and payment plans are now tied directly to RERA-enforced construction progress.

Dubai's real estate market fundamentals remain strong. Foreign investors are drawn by annual price growth of 8-10% and rental yields of 5-8%. The absence of property tax solidifies Dubai's status as a destination for international capital.

Understanding Market and Construction Variables

Market risk in 2026 is not about a speculative bubble but a potential price adjustment as the market stabilizes. Passo by Beyond's value is anchored to the non-speculative growth of Dubai South's infrastructure. This creates a buffer against wider market corrections, as its demand is tied to a specific economic zone.

Construction risk is addressed by RERA's mandatory escrow account system. All payments are deposited into a project-specific account monitored by RERA. Funds are released to the developer only upon verification of construction milestones. This framework is a cornerstone of the legal protections detailed in our guide to buying off-plan property in Dubai, preventing the misuse of investor funds.

Pre-Acquisition Due Diligence Checklist

A thorough verification process is non-negotiable before signing a Sales and Purchase Agreement (SPA).

- Developer and Project Verification:

- Confirm the developer’s RERA registration is valid.

- Verify the project's official registration and approved escrow account number on the Dubai Land Department (DLD) portal.

- Contractual and Financial Scrutiny:

- Have legal counsel review the SPA, focusing on clauses related to handover dates, delay penalties, and estimated service charges.

- Clarify all costs beyond the purchase price, including DLD fees and administrative charges, to avoid future discrepancies.

- Master Plan and Future Development:

- Request the latest version of the community master plan.

- Identify the phasing of amenities like schools and retail centers to understand how the community's value will grow post-handover.

A common oversight is failing to check the master plan for future developments. Proximity to a future high-rise or major road can impact a property's long-term value. This forward-looking analysis is a critical part of due diligence.

Final Thoughts: Strategy Over Speculation

The window for easy flips has narrowed. Success in 2026 requires targeting communities with genuine infrastructure growth—specifically those connected to the expanding logistics and aviation hub in Dubai South. The investment case for Passo by Beyond is a calculated, medium-term position in a community whose future value is tied to Dubai's primary economic projects.

For an investor, an asset like Passo by Beyond provides a strategic hedge against price plateaus in established districts and offers direct exposure to infrastructure-driven growth. For overseas investors, an acquisition of this quality can be a cornerstone for securing residency through the Golden Visa UAE program, connecting a tangible asset to personal and financial ambitions.

If you are rebalancing your portfolio for 2026, let's run the numbers. At Proact Luxury Real Estate, we track these infrastructure corridors daily.

Frequently Asked Questions

A sharp investor looks at a deal from every possible angle. Here are straight answers to the questions that matter when considering Passo by Beyond for a 2026 portfolio.

How Is Passo Different From Last Year's Launches?

The difference lies in the investment thesis. Launches from last year, especially in mature areas, were priced for an established market, which limited capital growth potential.

Passo by Beyond is priced for future growth fueled by infrastructure development. You are acquiring a position in the path of the Al Maktoum Airport expansion. This model offers higher potential for appreciation. The shift from 1% monthly plans to a 60/40 payment structure also indicates a focus on serious, long-term investors.

How Does RERA Protect My Off-Plan Investment?

Dubai's Real Estate Regulatory Agency (RERA) has a solid system to protect your capital. For a project like Passo by Beyond, all payments are mandated to go into a RERA-approved, project-specific escrow account.

The developer can only access these funds in stages after a RERA-certified inspector verifies a construction milestone has been met. This is a key component of modern UAE property law that prevents misuse of investor funds and guarantees your capital is used for its intended purpose. It is a significant layer of financial security.

What Is The Purchase Process Like for Overseas Investors?

The process is streamlined for foreign buyers and can be managed almost entirely remotely.

- Reservation: Sign a reservation form (Form B) and pay a token deposit to secure the unit.

- SPA and DLD Registration: The developer issues the Sales and Purchase Agreement (SPA). Upon signing and making the first payment (typically 10-20% plus the 4% DLD fee), the deal is registered with the Dubai Land Department, generating your 'Oqood' (initial ownership certificate).

- Scheduled Payments: Follow the payment schedule, making payments directly into the secure escrow account.

The entire process can be managed through a legally appointed Power of Attorney. We often assist clients in structuring ownership for maximum efficiency, which can involve a Dubai LLC company for larger portfolios. This approach centralizes management.

Understanding the nuances of title deed registration and associated taxes on property is critical. The 4% DLD fee is the main cost, but factoring in all fees from the start provides a complete financial picture.

At Proact Luxury Real Estate, our role is to provide the granular analysis required to make these forward-thinking strategic decisions. If rebalancing your portfolio for 2026 is a priority, let's analyze the data. https://ritukant.com