Last year's 1% monthly payment plan was standard. Entering 2026, major developers are pivoting to 60/40 structures, a shift signaling a market moving from the post-Covid boom into a sustainable growth cycle. This alters the entry barrier and financial calculus for investors targeting any new development in Dubai.

This adjustment, detailed in the latest dubai-real-estate-market-analysis, requires investors to move beyond generic portals and engage with data-driven tools. Identifying a high-potential off-plan asset is no longer about finding a listing; it is about verifying escrow compliance under updated uae-property-law, analyzing infrastructure-led growth corridors, and structuring the acquisition correctly. This roundup provides a curated list of essential resources for HNWIs to navigate this evolved market.

We will focus on platforms providing verifiable data, direct developer access, and the analytical depth needed for informed capital allocation. Each entry includes an analysis of its specific utility for the investor. Forget promotional listings; these are the definitive tools for securing assets in Dubai’s 2026 off-plan market.

1. Proact Luxury Real Estate LLC

For high-net-worth investors and family offices, standard brokerage services are insufficient. The requirement is for strategic asset management grounded in financial expertise. Proact Luxury Real Estate LLC functions as a high-level investment advisory, moving beyond transactions to deliver data-led portfolio strategy.

The primary focus is structuring acquisitions within Dubai's luxury and high-yield segments. This includes prime off-plan projects in strategic growth corridors where understanding the developer’s financial standing and delivery track record is as crucial as the unit itself. Proact’s advisory extends across the entire investment lifecycle, from market entry timing to yield optimization and eventual exit planning.

Core Advisory & Differentiators

What distinguishes this firm is its analytical depth. Rather than presenting generic project brochures, the advisory provides comparative analyses, benchmarking a new development Dubai opportunity against assets in other global hubs. This is a crucial value-add for investors weighing cross-border allocations.

Further, the firm maintains a forward-looking perspective. Its analysis incorporates the future impact of asset tokenization and factors in ESG (Environmental, Social, and Governance) metrics, recognizing that sustainability is a key driver of long-term capital appreciation in new master communities. This advanced insight ensures portfolios are not just profitable but are also future-proofed against emerging market shifts.

[Map: Location relative to Al Maktoum Airport]

Investment Pros/Cons

- Pros: Senior-led advisory with credible financial credentials; specialized focus on high-yield luxury and off-plan assets; end-to-end strategic support from acquisition to exit; forward-looking analysis on technology and ESG.

- Cons: Advisory fees are not transparent and require direct consultation; the firm’s deep focus on the UAE market is less suitable for investors seeking a globally diversified real estate portfolio.

Website: https://ritukant.com

2. Property Finder – New Projects (UAE)

For a broad, high-level overview of the primary market, Property Finder’s “New Projects” section is an indispensable starting point. Its scale provides an aggregated catalogue of most major off-plan launches, making it an efficient tool for initial discovery and comparison of any new development in Dubai.

Unlike direct developer websites, Property Finder offers a centralized view, displaying launch prices, unit configurations, and estimated handover dates from multiple sources. This facilitates direct comparisons between, for instance, a new Emaar launch in The Valley and a competing project from another developer in Dubai South.

Strategic Use for the 2026 Investor

The value of Property Finder for the sophisticated investor is as a price discovery tool. By tracking asking prices and availability for a new launch over several weeks, one can gauge initial sales velocity and market sentiment. This data offers a real-time pulse on buyer demand.

A key strategy is to monitor the “Verified” listings. These have been authenticated by the portal, reducing the risk of outdated information. While it doesn't replace formal due diligence, it adds a layer of confidence during initial research.

Investment Pros/Cons

- Pros: Comprehensive inventory of new projects; many listings include starting prices, offering a baseline for financial modeling; direct lead-generation forms connect you with sales representatives.

- Cons: Variable listing quality, some lacking critical details like payment plans or RERA escrow numbers; enquiries may go to one of many agents, requiring extra vetting; the platform is designed for discovery, not deep analysis.

For investors aiming to understand the full scope of opportunities, this platform is an essential first step. It is particularly useful for those new to the market who are still defining their investment criteria for a Dubai off-plan property investment.

Website: https://www.propertyfinder.ae/en/new-projects

3. Bayut – New Off‑Plan Projects (Dubai)

Bayut offers an expansive view of the market with a distinct focus on curated project directories and detailed payment plan breakdowns. Its dedicated “New Projects in Dubai” section is a powerful tool for investors looking to quickly compare the financial structures of competing launches.

This categorization allows an investor to contrast a new branded residence in Downtown with a value-focused launch in a burgeoning community like Arjan. Bayut acts as a central aggregator, publishing developer-supplied data on starting prices, payment schedules, and anticipated handover dates.

Strategic Use for the 2026 Investor

Bayut's primary strategic advantage lies in its clear presentation of payment plans. For the 2026 investor analyzing cash flow, this is critical. The platform often displays the exact percentages required for booking, during construction, and upon handover, facilitating a direct financial comparison between projects.

[Chart: 2026 Payment Plan Breakdown]

Use Bayut’s community guides as a starting point for due diligence. They often provide valuable context on freehold zones and highlight infrastructure developments that support capital appreciation forecasts. Cross-reference this information with official sources like the DLD and RERA.

Investment Pros/Cons

- Pros: Excels at displaying price bands and detailed payment plan structures; large network of agents ensures rapid responses to enquiries; curated categories for different investment theses simplify the search.

- Cons: Project availability and pricing can sometimes lag behind real-time developer inventory; editorial content can have a promotional bias; enquiries are often routed to third-party agents.

For investors who prioritize comparing the financial viability and payment structures of a new development in Dubai, Bayut provides an exceptional framework for shortlisting the best off-plan projects in Dubai.

Website: https://www.bayut.com/new-projects/dubai/

4. Emaar Properties – Off‑Plan Projects (official)

For investors who prioritize developer credibility, Emaar's official off-plan portal is the definitive destination. Going straight to the developer bypasses the intermediary layer of agents and aggregators, providing authoritative data on masterplans, unit releases, and official payment schedules.

Unlike multi-developer portals, Emaar’s website offers a deep-dive into its own ecosystem. Each project page features official brochures, detailed floor plans, construction updates, and transparent handover windows. The platform is designed to guide an investor through the entire purchase cycle.

Strategic Use for the 2026 Investor

The primary advantage for a 2026 investor is gaining access to pre-launch information. By registering interest directly on the Emaar portal for an upcoming new development in Dubai, you position yourself to be among the first to receive details on unit releases. This provides a critical timing advantage for highly sought-after inventory.

Use the portal to download official payment plans and compare them against market standards. In 2026, Emaar’s payment structures are a key market benchmark. Analyzing their post-handover payment terms versus the construction-linked schedule provides insight into the developer’s confidence.

Investment Pros/Cons

- Pros: Emaar's proven delivery track record mitigates project completion risk; access to official Sales and Purchase Agreements (SPA) directly from the source; registered buyers may gain priority access to unit selections.

- Cons: Pricing often includes a premium reflecting the brand's reputation; the portfolio is restricted to Emaar’s own projects; the most attractive launches can be highly competitive, requiring swift decision-making.

For investors focused on building a portfolio with assets from one of the top 10 developers in Dubai, the official Emaar site is an indispensable tool for research and acquisition.

Website: https://properties.emaar.com/en/off-plan-projects/

5. Nakheel – Developments (official)

For investors targeting Dubai's most iconic and supply-constrained assets, the official Nakheel Developments website is the primary source. As the master developer behind projects like Palm Jumeirah and Palm Jebel Ali, Nakheel's portal offers direct, verified information on its marquee waterfront communities.

Unlike aggregated portals, the Nakheel site provides unfiltered, direct-from-developer announcements. This is where new phases are first revealed and project timelines are confirmed. For an investor, monitoring this portal is less about browsing and more about strategic intelligence gathering.

Strategic Use for the 2026 Investor

The primary strategic function of this website is to gain a first-mover advantage. High-demand Nakheel launches are often oversubscribed within hours. Sophisticated investors use the "Press Room" and development updates to anticipate launch windows, preparing documentation and financing well in advance.

Pay close attention to masterplan updates. A change in a community layout or the announcement of new infrastructure can impact the future valuation of adjacent land plots. This is granular, forward-looking data that secondary portals rarely capture.

Investment Pros/Cons

- Pros: All information is official and verified; provides direct access to some of the world's most sought-after waterfront real estate; the earliest source for information on new phase releases.

- Cons: Prime waterfront assets command a significant premium; new launches are extremely competitive, with units often allocated to pre-registered VIP clients; a given launch may focus exclusively on one product type.

For investors with the capital to pursue trophy assets, the Nakheel portal is non-negotiable. It is the definitive source for understanding some of Dubai's most ambitious property projects of 2026.

Website: https://www.nakheel.com/en/developments

6. DAMAC Properties – Corporate/Official Projects Gateway

For investors targeting developer-direct access to a portfolio known for branded residences and large-scale communities, the DAMAC Properties corporate website is the primary source. This platform functions as a direct channel to the developer’s entire inventory, from high-rise towers to sprawling villa communities.

The DAMAC gateway provides detailed narratives on their brand collaborations with names like de GRISOGONO and Cavalli. This is critical for investors who understand that the premium associated with branded residences often translates to stronger rental yields and higher capital preservation. The site serves as the launchpad for their frequent project releases.

Strategic Use for the 2026 Investor

An astute investor uses the DAMAC portal as an intelligence tool to anticipate market trends. Monitoring their "coming soon" sections and new master plan announcements allows for pre-emptive analysis of the next major growth corridors. Their frequent launches offer a real-time barometer of developer confidence and buyer demand.

The most effective strategy is to establish a direct relationship with a DAMAC sales representative via the portal. This provides access to pre-launch events and Expression of Interest (EOI) opportunities, which are often essential for securing prime units.

Investment Pros/Cons

- Pros: Bypasses third-party agents, ensuring access to accurate pricing and official payment plans; unmatched portfolio of luxury branded properties; high launch frequency provides a steady stream of opportunities.

- Cons: Popular launches can be fully subscribed almost immediately; branded inventory carries a price premium; the corporate site often requires direct engagement for full details.

For investors prioritizing developer credibility and access to high-profile branded projects, engaging directly through DAMAC's official channel is the most effective approach.

Website: https://www.damacgroup.com/en-ae/damac-properties/

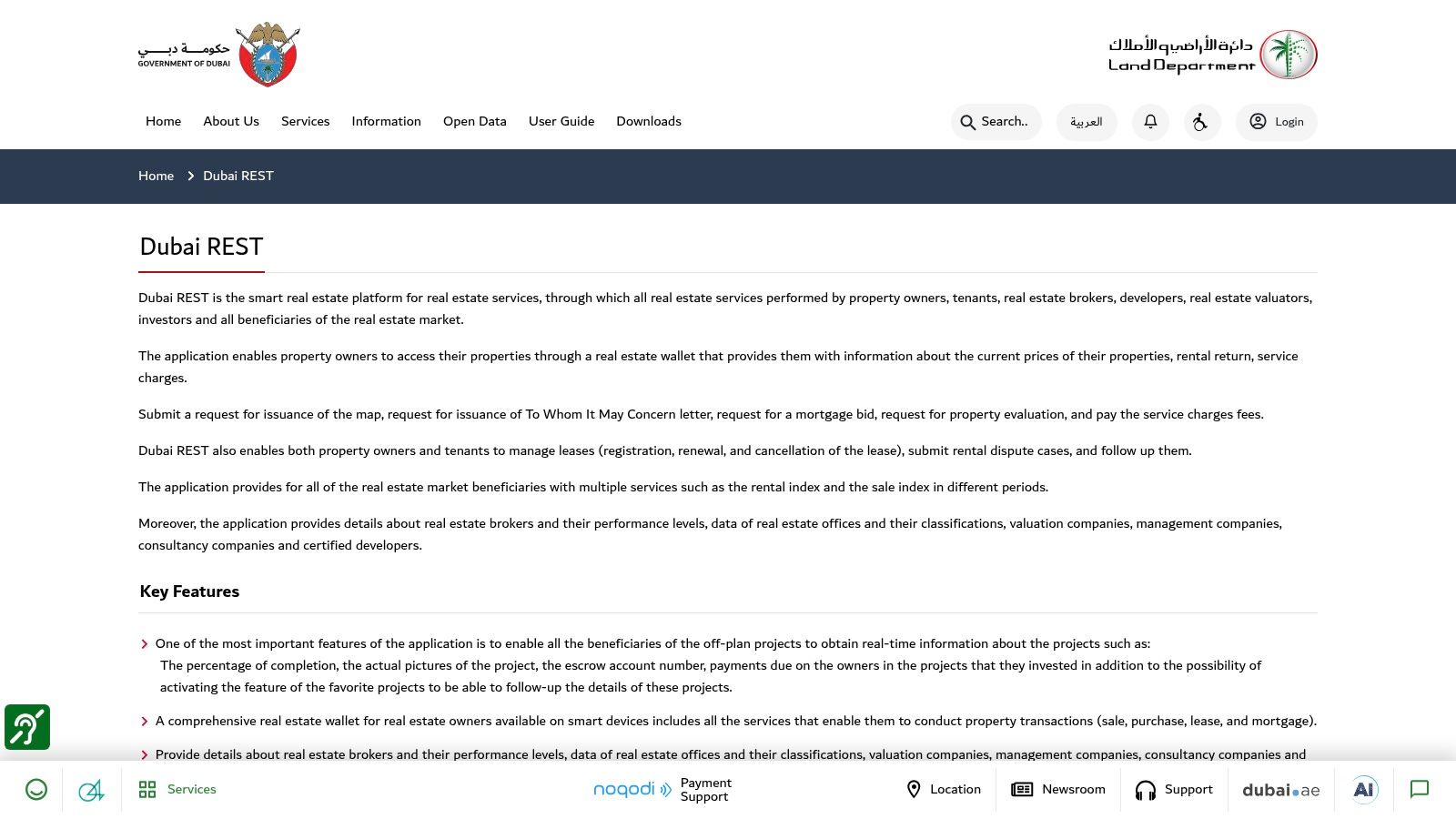

7. Dubai Land Department (DLD) – Dubai REST (official regulator app)

While property portals offer a market view, the Dubai REST app from the Dubai Land Department (DLD) provides the official truth. For any serious investor evaluating a new development in Dubai, this platform is a mandatory due diligence tool. It is the government's single source of truth, designed to provide transparency and protect investors.

Unlike a commercial marketplace, Dubai REST is a regulatory utility. Its core function is to allow buyers to cross-reference claims made by developers against official records. You can check a project's RERA approval, verify its escrow account number, and monitor the real-time construction completion percentage. This data comes directly from DLD inspectors.

Strategic Use for the 2026 Investor

For the 2026 investor, Dubai REST acts as a crucial risk-mitigation checkpoint before funds are committed. After shortlisting a project, the first step should be verifying its details on this app. This simple action confirms whether the developer has met all RERA protections and regulatory requirements.

A key strategy is using the app to verify broker and developer credentials. Before engaging with any agent, use Dubai REST to confirm their RERA registration number is active. This eliminates the risk of dealing with unauthorized intermediaries.

Investment Pros/Cons

- Pros: Unquestionable data on project legality, construction progress, and escrow account verification; reduces counterparty risk by providing proof of a developer's compliance; the app is free and accessible.

- Cons: It is a verification tool, not a sales platform; the user experience is functional rather than intuitive; lacks commercial data like sales velocity or pricing trends.

For investors who prioritize security and due diligence, Dubai REST is the most powerful tool in their arsenal. It transforms the off-plan buying process from one based on trust to one based on verifiable, government-backed data.

Website: https://dubailand.gov.ae/en/eservices/dubai-rest/

Comparative Analysis: 2026 Investor Toolkit

| Platform | Type | Key Utility | Ideal For | Data Integrity |

|---|---|---|---|---|

| Proact Luxury Real Estate | Advisory | Strategic Asset Management | HNWIs, Portfolio Investors | High (Proprietary Research) |

| Property Finder | Portal | Market Discovery | Initial Project Shortlisting | Medium (Agent-Supplied) |

| Bayut | Portal | Financial Comparison | Payment Plan Analysis | Medium (Agent-Supplied) |

| Emaar Properties | Developer Direct | Source Verification | Tier-1 Asset Acquisition | High (Official Data) |

| Nakheel | Developer Direct | First-Mover Intelligence | Trophy Waterfront Assets | High (Official Data) |

| DAMAC Properties | Developer Direct | Branded Residence Access | High-Yield, Frequent Launches | High (Official Data) |

| Dubai REST App | Regulatory | Legal & Escrow Verification | Mandatory Due Diligence | Very High (Government Data) |

Final Thoughts: Strategy Over Speculation

The suite of digital tools we have examined provides an unprecedented level of market access. Portals offer a wide-angle view for initial comparisons, while developer websites provide granular detail. However, for any investor targeting a new development Dubai in 2026, these platforms are merely the starting point.

The most effective investment strategy involves a triangulation of data. An investor might identify a promising launch on a portal, verify the developer's track record on their corporate site, and then authenticate the project's legal standing on the Dubai Land Department's REST application. This final step, confirming the escrow account status and RERA registration, is non-negotiable.

This process mitigates risk and grounds decision-making in official records. Furthermore, understanding the legal and financial structures is essential. Reviewing the latest regulations on [uae-property-law] or the fee structures detailed under [taxes-on-property] can profoundly affect net returns. For overseas entities, structuring the purchase correctly, perhaps through a [dubai-llc-company-setup], can yield long-term benefits, especially when paired with a program like the golden-visa-uae.

The window for passive, market-wide capital appreciation seen in last year’s benchmarks has narrowed. Success in 2026 requires targeting communities with genuine infrastructure growth—specifically those connected to expanding metro lines or the Al Maktoum Airport corridor. The current environment demands an active, analytical approach, treating each property acquisition as a strategic asset allocation.

The shift from a momentum-driven market to one that rewards analytical precision requires more than just access to data; it requires expert interpretation. At Proact Luxury Real Estate LLC, we specialize in providing this analysis for high-net-worth investors navigating Dubai's off-plan sector. If you are rebalancing your portfolio for 2026, let's run the numbers. Connect with us at Proact Luxury Real Estate LLC.