Last year's benchmarks are set: the post-Covid boom cycle has concluded, giving way to a sustainable growth phase. As we enter 2026, Dubai’s real estate market has pivoted from speculative velocity to strategic value creation.

In Q4 2025, off-plan transactions for branded residences outpaced ready secondary-market units, signaling a clear flight to quality among sophisticated investors. This is no longer a market for quick flips; it's a field for calculated asset management.

The Market Shift: From Velocity to Value

The 2021-2024 period was defined by hyper-growth, fueled by post-pandemic capital migration that drove prime residential prices up by 30-40%. 2025 capped this cycle with the Dubai Land Department recording transactions worth AED 682.49 billion—a 30.4% increase on the previous year.

Developers have recalibrated their offerings in response. The once-common 1%-per-month payment schemes are now being replaced by more robust 60/40 or 70/30 structures. This is a deliberate market maturation strategy, designed to filter out speculators and attract well-capitalized buyers with a long-term hold strategy.

From Speculative Plays to Strategic Asset Management

Success in 2026 requires a shift toward asset management aligned with Dubai’s D33 Economic Agenda. This means focusing on communities built around new infrastructure and emerging growth corridors.

Key indicators of this market shift include:

- Robust End-User Demand: A rising population and a healthy job market underpin solid rental yields.

- Revised Payment Plans: Stricter installment schedules reduce volatility and reward well-capitalized buyers.

- Focus on Master Communities: Integrated hubs like Dubai South and the revitalized Palm Jebel Ali are attracting fresh investment.

- Alignment with D33 Agenda: Properties near new logistics hubs or tourism centers are set for outperformance. A deeper dive is in our Dubai property market forecast.

The market’s current trajectory is not a slowdown but a recalibration. It rewards investors who prioritize due diligence and long-term fundamentals over short-term noise.

As Dubai’s market matures, the advantage belongs to those who pair thorough research with a clear, multi-year asset management plan.

Analyzing High-Yield Segments: Off-Plan vs. Ready Assets

For any HNWI rebalancing their portfolio in 2026, the primary strategic decision in Dubai's real estate market is between new off-plan launches and ready, income-generating assets. This choice pits the potential for high capital appreciation against the stability of immediate cash flow.

Last year’s benchmarks show a clear performance divergence between these two asset classes. One path targets growth; the other, yield.

Off-plan properties in emerging master communities present a compelling case for capital growth. Entry prices are lower than in established neighborhoods, creating a higher ceiling for appreciation as community infrastructure matures. The old 1% monthly payment plans are gone; major developers now demand more significant capital upfront, altering the risk-reward calculation.

Conversely, ready properties deliver immediate rental yields. In prime locations, these returns remain solid, averaging 4-6% for luxury villas and apartments. This provides a stable income stream, but the potential for explosive capital growth seen in new developments is limited.

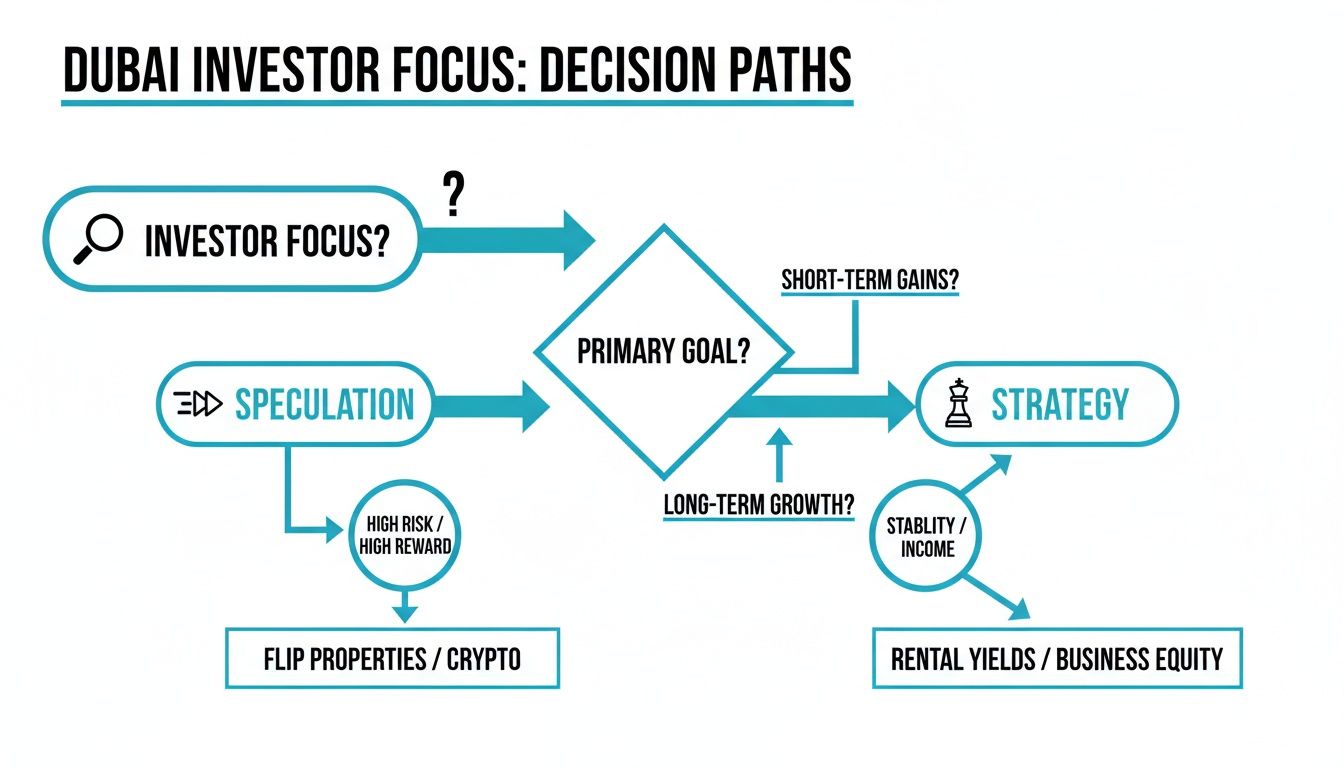

This flowchart maps the strategic decision paths for today’s investor, showing the shift from pure speculation to calculated, long-term asset management.

As the visual shows, while speculative plays chase rapid, high-risk gains, a strategic investor prioritizes creating lasting value through meticulous asset selection.

The Off-Plan Play for Capital Appreciation

The primary attraction of buying off-plan is the potential for a significant value uplift upon handover. An asset secured for AED 3 million during its launch can be worth substantially more once the community is fully developed. Deep market knowledge is essential to pinpointing projects with genuine growth catalysts.

Investor protection is anchored by the Real Estate Regulatory Agency (RERA). Every dirham paid for an off-plan unit is deposited into a secure, RERA-approved escrow account. This system mitigates risk by ensuring funds are used exclusively for construction progress, providing confidence for capital deployment years before delivery.

The Ready Asset Strategy for Yield Generation

For investors prioritizing portfolio income, ready properties offer a direct path. A villa in Dubai Hills Estate or a premium apartment in Downtown Dubai can generate rental income immediately upon closing, contributing directly to portfolio cash flow.

In these mature communities, rental demand is predictable and vacancy rates are low. The trade-off is a higher acquisition cost and a flatter appreciation curve. The value is tied to current market rates, offering less exposure to the exponential growth seen in new master communities. It's a conservative, income-focused play.

You can learn more by exploring our guide on buying off-plan property in Dubai.

Investment Profile: Off-Plan Branded Residence vs. Ready Villa

[Table: 5-Year Holding Period Comparison]

| Metric | Off-Plan Branded Residence (e.g., Downtown Launch) | Ready Villa (e.g., Dubai Hills Estate) | Strategic Consideration |

|---|---|---|---|

| Initial Capital Outlay | Lower (e.g., 20% down + 4% DLD fees) | Higher (Full price + 4% DLD + agency fees) | The off-plan route keeps more capital liquid for other investments. |

| Cash Flow (Years 1-3) | Negative (ongoing construction payments) | Positive (immediate rental income) | Ready assets provide immediate portfolio cash flow. |

| Capital Appreciation | High Potential (25-40% uplift on completion) | Moderate Potential (5-10% market-driven growth) | Off-plan is inherently a growth strategy targeting a value spike. |

| Risk Profile | Higher (construction delays, market shifts) | Lower (known asset, established demand) | Risk is managed by choosing top-tier developers and RERA protections. |

| 5-Year Projected ROI | Potentially 15-20% per annum (compounded) | 8-10% per annum (yield + appreciation) | The return profile directly reflects your risk appetite. |

This side-by-side analysis clarifies that the choice depends entirely on your financial objectives: building wealth through appreciation or securing a stable, income-producing asset.

Prime Communities: The New Epicenters Of Growth

While Downtown and the Marina remain relevant, the smart money is moving toward the next wave of growth corridors. The analysis for 2026 centers on master-planned communities set to deliver superior returns, driven by state-led infrastructure projects.

The focus has shifted from established districts to future economic hubs—integrated ecosystems designed around strategic assets like the expanding Al Maktoum International Airport. Understanding this pivot is central to any successful middle east real estate dubai strategy.

Dubai South: The Logistics and Aviation Nexus

Dubai South represents a calculated, long-term investment thesis. Its value is tied to its integration with what will become the world’s largest airport, creating a powerful, built-in demand driver for residential and commercial property.

[Map: Location relative to Al Maktoum Airport]

The growth of this aviation and logistics hub will attract a massive workforce requiring quality housing, translating directly into sustained rental demand and high potential for capital appreciation. Early investors are acquiring assets just ahead of a guaranteed demographic wave.

Investment Pros/Cons: Dubai South

- Pros: Directly tied to government infrastructure spending; built-in rental demand from airport and logistics staff; lower entry price compared to central Dubai.

- Cons: Early stage of development requires a longer holding period for maximum returns; public transport links are still developing.

The investment play in Dubai South is straightforward: you are buying into a future economic powerhouse before it hits critical mass. The growth isn't speculative; it is underwritten by government strategy.

For a comprehensive comparison, our guide explores the best areas to buy property in Dubai and how they stack up against these emerging hubs.

Palm Jebel Ali: A Renewed Waterfront Opportunity

The relaunch of Palm Jebel Ali provides a rare opportunity to acquire prime waterfront assets with a substantial runway for growth. Unlike the mature Palm Jumeirah, where prices have peaked, Palm Jebel Ali offers a second chance to enter an iconic, large-scale waterfront community from the ground floor.

The project is more than double the size of its predecessor, with plans for extensive green spaces and next-generation infrastructure. This scale ensures early investors will benefit from multiple phases of development and value uplift over the next decade.

Last year’s luxury segment performance highlights this potential. Luxury property prices surged, propelled by a jump in sales over AED 10 million. Experts forecast 5% to 8% annual appreciation in ultra-prime areas through 2026, driven by a 'scarcity premium' on unique assets like waterfront villas.

Investment Pros/Cons: Palm Jebel Ali

- Pros: The scarcity value of new waterfront plots and villas; significant long-term appreciation potential; association with an iconic global brand.

- Cons: Higher capital requirement compared to inland communities; a longer-term development timeline spanning over a decade.

For investors with sufficient capital and a long-term outlook, both Dubai South and Palm Jebel Ali represent the new centers of gravity for wealth creation in Dubai's real estate market.

The International Investor Framework: Legal and Financial Structures

The AED 682.49 billion in transactions processed by the Dubai Land Department in 2025 reflects strong confidence in the emirate’s legal system. A digital registry at the DLD ensures clear title deeds and swift ownership transfers.

RERA-mandated escrow accounts provide a powerful safeguard for off-plan payments, ensuring every dirham is protected in line with the uae-property-law.

Legal Framework and RERA Protections

RERA enforces strict escrow requirements, protecting buyers' funds from day one. Payments for off-plan units are held securely, and funds are released to the developer only upon hitting verified construction milestones. This provision reduces counterparty risk and brings transparency to the market.

RERA escrow provisions mean capital is discharged only when construction meets certified progress reports.

Dubai’s regulatory framework also includes mandatory warranty periods on new builds and the option for title insurance, creating a robust shield for international capital.

Residency Options and the Golden Visa

A Dubai property can be a gateway to residency. Allocating a minimum of AED 2 million to a freehold property qualifies an investor for the golden-visa-uae, a renewable 10-year residency permit. This visa extends to family members and removes the need for local sponsorship, offering long-term planning flexibility.

This structure is a clear signal of how middle east real estate Dubai is positioned to attract and retain global talent and capital. For a lower capital commitment, a property investment above AED 750,000 can secure a two-year investor visa.

Ownership Structures and Liability Implications

The method of holding property affects liability and succession. Foreign nationals can choose between direct personal ownership or establishing an LLC holding company. While direct ownership is simple for a single asset, a Limited Liability Company provides liability protection and simplifies succession planning for a portfolio. Unlike the speculative frenzy of 2024, the current dubai-real-estate-market-analysis suggests a stabilization in price per square foot.

| Structure | Setup Complexity | Liability Protection | Succession Impact |

|---|---|---|---|

| Direct Ownership | Low | Standard partner liability | Asset passes by will |

| LLC Holding Company | Medium | Corporate veil shields personal assets | Shares are easily transferable |

A corporate vehicle can be a powerful tool. For more detail, read our guide on dubai-llc-company-setup.

Transaction Costs and Financing

Dubai’s transaction fees are straightforward. Buyers pay a 4% DLD registration fee plus nominal agency fees. There is no capital gains tax or income tax on rental returns, a major advantage that boosts net returns. This is fully detailed in our guide on taxes-on-property.

Non-residents can access financing, with mortgages available for up to 75% of a completed unit's value. Interest rates have settled in the 3.5% to 4.5% range, making leverage an attractive option to amplify ROI.

Transparent fee structures and attractive financing terms set Dubai apart from many global markets.

Integrating smart financing with RERA’s protections and available residency options creates a powerful, risk-adjusted framework for entering the market.

Dubai Compared to Other Global Investment Hubs

For any global investor, capital flows to markets offering the optimal mix of yield, appreciation, and security. While hubs like London and Singapore have their appeal, a hard look at the numbers shows why real estate capital is targeting Dubai.

The analysis comes down to rental earnings, property value growth, and ownership costs. On these fronts, Dubai's performance is in a different league.

Yield and Appreciation: A Comparative Analysis

Net rental yields on luxury properties in Dubai consistently outpace those in other major cities. A prime apartment in Downtown Dubai can generate a net yield of 4-6%. Similar assets in prime central London or Singapore often struggle to deliver yields above 2%, suppressed by high purchase prices and taxes.

Capital appreciation tells a similar story. The market recorded 202,349 residential sales in 2025—a 464% increase from 2021. Since the pandemic, villa prices have risen 206%, and the overall REIDIN Residential Market Sales Price Index climbed 12.88% year-on-year by December 2025. This growth trajectory far outpaces the modest price movements in mature Western markets. You can explore the full market report on these figures.

[Chart: 2026 Global Property Yield Comparison]

| Metric | Dubai (Prime Villa) | London (Prime Flat) | Singapore (Condo) | Mumbai (Luxury Apt) |

|---|---|---|---|---|

| Gross Rental Yield | 6-8% | 2-3% | 2.5-3.5% | 2-3% |

| Net Rental Yield | 4-6% | 1.5-2% | 2-2.5% | 1.5-2.5% |

| Capital Gains Tax | 0% | Up to 28% | Up to 12% | Up to 20% |

| Transaction Costs | ~4.5% (DLD + Fees) | ~5-15% (Stamp Duty) | ~3-18% (Stamp Duty) | ~6-7% (Stamp Duty) |

The numbers are clear. The combination of higher yields with a 0% tax on capital gains and rental income creates a superior total return profile for investors in Dubai.

The Indian HNWI Perspective

For High-Net-Worth Individuals from India, the comparison is even more striking. A per-square-foot analysis of property values and rental income potential between a prime Dubai apartment and a similar asset in Mumbai reveals a massive ROI gap.

While property values in top Indian metros have grown, rental yields remain low, often below 3%. In Dubai, yields are higher, and the world-class infrastructure, quality of life, and stable, dollar-pegged currency offer a powerful hedge against regional economic shifts. Our detailed guide offers a direct look at how Dubai property prices compare to key Indian cities.

For an Indian investor, a Dubai property is not just an asset; it is a strategic diversification into a high-growth, tax-efficient, and globally connected market.

This combination of fundamentals solidifies Dubai’s position not just as a hub for middle east real estate dubai, but as a premier global destination for real estate capital.

Final Thoughts: Strategy Over Speculation

The window for easy flips has narrowed. Success in 2026 requires targeting communities with genuine infrastructure growth—specifically those connected to the expanding metro lines and Al Maktoum International Airport. It is about acquiring assets that are directly plugged into tangible economic growth, not just chasing headlines.

The focus for any serious investor must be on master communities directly supported by the D33 Agenda. These are the areas where government-led projects are creating real, sustainable demand.

“The smartest capital now targets strategic growth corridors rather than headline-driven plays.”

Key Criteria For Asset Selection

Here are the essential factors to look for:

- Economic Anchors: Is the area anchored by real economic drivers, like logistics hubs or tech parks?

- Infrastructure Links: How well is it connected to metro expansions and major transport hubs?

- Escrow Protections: Are your off-plan payments secured in RERA-backed escrow accounts? This non-negotiable layer of security dramatically reduces counterparty risk.

Building a Defensive Portfolio

In a maturing market, branded residences will continue to outperform. The built-in quality assurance and premium service create a defensive buffer against market corrections, attracting higher-quality tenants and commanding better rental yields.

A well-balanced portfolio might include:

- Off-plan units in key master communities with structured payment plans.

- Ready, income-generating units in established neighborhoods for immediate yield.

- A mix of branded and non-branded assets to spread risk.

Monitoring and Reporting

A resilient portfolio is actively managed. Use data dashboards to track key metrics like rental yields, occupancy rates, and capital appreciation against initial projections. A quarterly review process should compare performance against last year’s benchmarks. For investors seeking residency, aligning acquisitions above the AED 2 million threshold to qualify for the Golden-Visa-UAE adds another powerful layer of benefit.

If you are rebalancing your portfolio for 2026, let's run the numbers. At Proact Luxury Real Estate, we track these infrastructure corridors daily.