For any serious investor with a high-value property portfolio in Dubai, a Limited Liability Company (LLC) has shifted from an optional extra to a non-negotiable component of asset management. An LLC company formation in Dubai is the primary firewall that separates personal wealth from the financial and operational risks tied to real estate. This structure is what elevates a simple acquisition into a professionally managed, protected investment.

The Strategic Shift to Asset Protection

Last year's benchmarks showed a market dominated by acquisition and capital growth. As we enter 2026, the market has matured into a sustainable growth cycle. The conversation among sophisticated investors has made a decisive turn towards risk management and long-term wealth preservation.

Owning a multi-million dirham property directly in your personal name is now seen as a dated, high-risk move, especially for international clients.

A properly structured LLC draws a clear legal line. This distinction is critical not just for shielding you from financial fallout but for creating a clean, efficient framework to manage your portfolio.

Key Reasons This Is Now Mandatory for Investors

- Liability Shielding: The core function of an LLC is to exist as a separate legal entity. This means any claims, debts, or legal disputes related to your property are aimed at the company, not your personal bank accounts or other global assets.

- Succession and Inheritance Planning: For foreign nationals, navigating inheritance under UAE law can be complex. Holding properties within an LLC allows for a straightforward succession plan. You're passing on company shares, not real estate, which sidesteps potential probate issues and ensures a smooth transfer of assets. A well-structured company can also be a key component for securing a golden-visa-uae.

- Operational Efficiency: An LLC professionalises the management of your portfolio. It allows you to open a corporate bank account, making it simpler to track rental income, pay service charges, and handle expenses. This creates the clean financial records needed for tax compliance and any future sale.

For an international investor, an LLC transforms a foreign property into a manageable, compliant, and protected asset. It removes grey areas and replaces them with a clear corporate structure recognised worldwide.

Making Future Transactions Smoother

Beyond protection, the LLC structure brings powerful transactional benefits. When it is time to sell an asset held within an LLC, you have the choice to sell the company shares instead of the property itself. This can lead to a more efficient and faster transaction.

Developers and banks also prefer dealing with corporate entities for large-scale transactions; it signals a structured and professional approach. As you rebalance your portfolio for 2026, don't just review your properties—review the legal structures holding them. For another vital layer of protection, explore comprehensive property insurance in Dubai. This isn't just about buying buildings; it's about building a resilient financial legacy.

Choosing Your Jurisdiction: Mainland vs. Free Zone vs. Offshore

The most critical decision in your LLC company formation in Dubai isn't the company name—it's the jurisdiction. This choice dictates operational scope, annual costs, and the effectiveness of your asset protection. An incorrect choice locks you into operational friction and unnecessary expenses.

For property investors, the choice boils down to three paths: Dubai Mainland, a specialised financial Free Zone, or an Offshore entity. Each serves a different strategic purpose.

A Mainland LLC, registered with the Department of Economy and Tourism (DET), gives you the broadest freedom to operate. It is the only structure that lets you trade directly within the UAE domestic market without restriction—a key factor if your entity will also be managing properties or involved in other local business.

This flexibility comes at a price, both in higher setup fees and the mandatory requirement for a physical office. For a pure asset-holding strategy, where the LLC's only job is to own property, a Mainland setup is often an over-engineered and needlessly expensive solution.

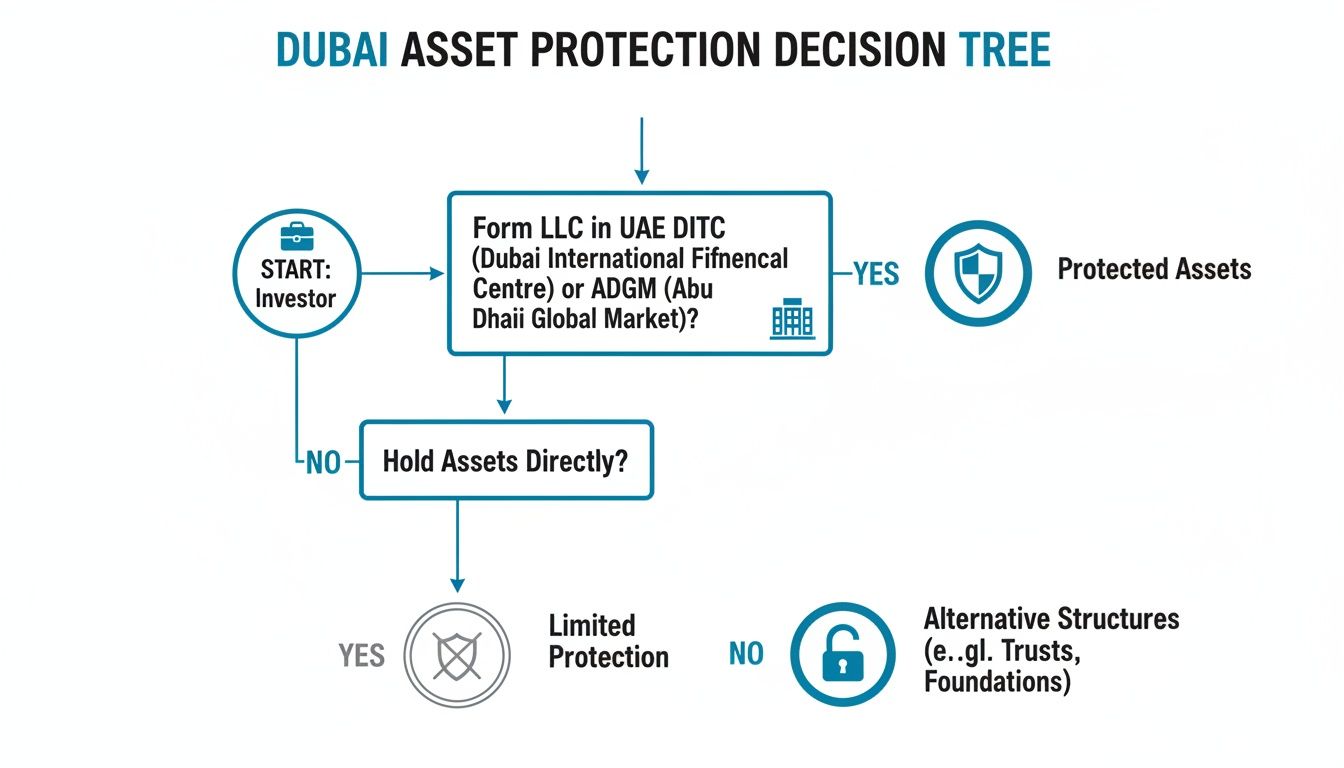

This decision tree simplifies the initial choice for asset protection.

As the visual shows, your investment intent creates a clear fork in the road, guiding you toward the most efficient structure for your specific goals.

The Power of Financial Free Zones for Asset Holding

For sophisticated property investors, a specialised Free Zone entity is often the smarter play. These zones operate under an independent regulatory framework and common law, offering 100% foreign ownership, zero currency restrictions, and a tax-efficient environment.

Dubai’s Free Zones have become immense economic drivers. The DMCC, for instance, houses over 25,000 member companies and attracted nearly 12% of Dubai’s total FDI last year. This robust growth attracts top-tier financial and legal talent.

A prime example is the Dubai International Financial Centre (DIFC). While known for housing major international banks and law firms, it also offers a highly efficient, low-cost vehicle designed specifically for holding assets: the Prescribed Company, or Special Purpose Vehicle (SPV).

A DIFC SPV is a lightweight corporate structure built for a single purpose: to hold assets. It has lower registration fees, minimal substance requirements, and reduced annual compliance costs compared to a full-fledged operating company. This makes it the superior choice for passive real estate investment.

Analysing the DIFC Prescribed Company (SPV)

For HNWIs, the DIFC Prescribed Company offers a compelling alternative to a cumbersome Mainland LLC. Its main advantage is cost-efficiency and streamlined administration. Unlike a Mainland entity that demands a physical office lease (Ejari), a DIFC SPV can operate through a registered agent with a registered office address, drastically cutting overheads.

This structure is purpose-built for HNWIs and family offices looking to segregate assets within a portfolio. You can set up separate SPVs for different properties or classes of assets, creating clean, ring-fenced structures that simplify accounting, risk management, and future divestment. This level of organisation is invaluable for complex portfolios. For a deeper look at ownership models, our comparison of freehold vs leasehold in Dubai is useful.

The operational scope of an SPV is intentionally limited—it cannot trade with the public or provide services. For the singular goal of owning real estate, it is the most precise and financially prudent tool available. It gives you the legal separation needed for asset protection without the financial and administrative burden of a full commercial licence.

Jurisdiction Comparison: Mainland vs DIFC SPV for Real Estate Investors

| Metric | Dubai Mainland LLC | DIFC Prescribed Company (SPV) |

|---|---|---|

| Primary Use Case | Active trading, local business, property holding | Purely passive asset holding (real estate, shares) |

| Annual Licence Fees | AED 10,000 - 15,000+ | USD 1,000 (approx. AED 3,670) |

| Office Requirement | Mandatory physical office (Ejari registration required) | Registered office address via an agent is sufficient |

| Ownership | 100% foreign ownership now standard for most activities | 100% foreign ownership by default |

| Legal Framework | UAE Federal Law (Civil Law) | Independent Common Law framework |

| Best For | Investors who need to manage properties or conduct other business in the UAE. | HNWIs and family offices seeking a low-cost, low-admin structure for passive holding. |

The choice isn't about which one is "better," but which one is precisely right for your investment strategy. If you need operational flexibility to trade within the UAE, the Mainland LLC is the only option. However, if your goal is purely to hold assets in a secure, tax-efficient, and low-cost structure, the DIFC SPV is the more intelligent choice.

Navigating the LLC Incorporation Process

Finalising your LLC company formation in Dubai is a methodical process where success hinges on precision and anticipating potential delays. Think of it less as paperwork and more as a series of legal milestones that legitimise your investment vehicle. A single misstep can create hold-ups that directly impact your ability to transact.

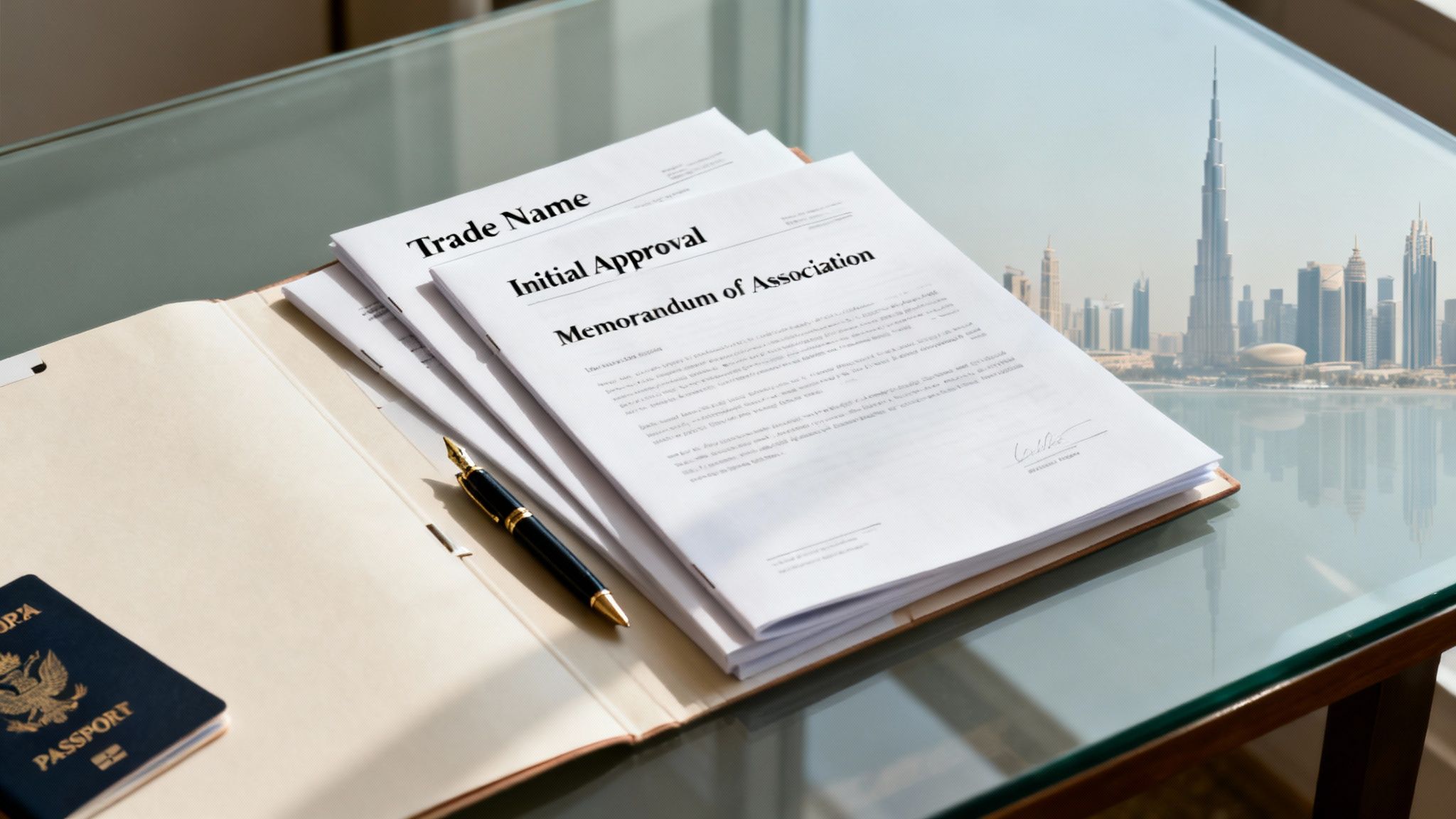

The journey starts with two key approvals: reserving your trade name and getting initial approval from the correct authority—the Department of Economy and Tourism (DET) for mainland, or the specific registrar for a free zone. This initial green light confirms your proposed business activity is permitted and your chosen name is available. Only then can you move on to the core legal work.

This foundational step is drafting and notarising your Memorandum of Association (MoA). The MoA is the constitution of your LLC. It lays out the shareholding structure, management, and the company's purpose. It must be drafted with absolute precision before being legally attested.

Critical Documentation Checklist

My primary advice: sort your documents proactively. It is the single most effective way to sidestep delays. The required paperwork isn't flexible, and one missing attested document can halt the entire process.

Your core submission file will need to include:

- High-Resolution Passport Copies: For every shareholder and the appointed manager.

- Proof of Entry or Residency: A clear copy of the UAE entry stamp or current residence visa.

- Parent Company Documents (if applicable): If a corporation is a shareholder, its legal papers must be attested first in its home country, and then by the UAE Embassy.

- No Objection Certificate (NOC): Only needed if a shareholder is already employed in the UAE on a residence visa.

This file is more than just copies. Documents from outside the UAE require a multi-stage attestation that can take weeks. You must factor this into your timeline from day one.

Mainland vs Free Zone Timelines

Incorporation time varies dramatically by jurisdiction. A DIFC Prescribed Company (SPV) is designed for asset holding, so the process is much faster. Once a complete application is submitted, expect licence issuance within 5-10 business days. This speed is a huge advantage for investors who need to place a property under a corporate structure quickly.

A mainland LLC is a more involved affair. The main extra step is securing a physical office lease and registering it with Ejari, which is mandatory before the final licence is issued. Because of this, a realistic timeline for a mainland company—from initial approval to having the trade licence in hand—is typically 2-4 weeks. Understanding these procedural differences is a core part of figuring out how to invest in Dubai real estate effectively with a corporate structure.

The process wraps up with the final submission of all documents and payment of government fees. Once processed, the authorities issue your digital trade licence. This is your official permit to operate, sign contracts, open a corporate bank account, and sponsor visas. It is the final piece that turns your strategic plan into a legally recognised, operational entity.

Budgeting for Your Dubai LLC Formation

Setting up a real estate LLC is a capital investment. To plan effectively and avoid cash flow surprises, you need a complete financial picture from the start. Too many investors fixate on the trade licence fee and underestimate the total capital required to become fully operational.

The costs of an LLC company formation in Dubai are layered. You have direct government fees, essential third-party service costs, and—for mainland entities—the substantial overhead of a physical office. Getting this calculation wrong is a classic pitfall that can stall both your company setup and your ability to close on a property deal.

Deconstructing the Core Costs

A realistic budget requires breaking down every expense. Each jurisdiction, whether mainland or a free zone, comes with a different cost structure that must be weighed against your specific investment goals.

- Government and Licensing Fees: This is the main charge from the relevant authority—the Department of Economy and Tourism (DET) for a mainland company, or the specific free zone registrar.

- Third-Party and Administrative Costs: These are smaller but necessary fees for notarising your Memorandum of Association (MoA), legal translations, and reserving your trade name.

- Physical Office Requirement (Mainland): For a mainland LLC, this is the biggest variable cost. A registered lease (Ejari) is a non-negotiable legal requirement, representing a serious upfront and recurring financial commitment.

- Visa and Establishment Card Fees: If you or your team need residency visas, each has its own processing cost, on top of the fee for your company's establishment card.

The critical takeaway is that a lean free zone structure like a DIFC SPV is built for low overheads and is perfect for passively holding assets. A mainland LLC is designed for active operations, and its cost structure reflects that, demanding a much higher initial investment.

A Comparative Cost Analysis

Understanding the financial gap between jurisdictions is key. A mainland LLC gives you unparalleled freedom to operate, but you pay a premium for that access. Setting up a mainland LLC in Dubai can easily see Year 1 costs hitting AED 35,000 or more. This typically includes AED 10,000-20,000 for the DED licence, AED 600-3,000 for the trade name, around AED 1,500 for the MoA, a mandatory AED 15,000-50,000 for office space, and an extra AED 5,500-9,200 for every visa.

This is a world away from the lean setup of a DIFC SPV, which can be established for as little as USD 100 with a USD 1,000 annual renewal. However, for a client-facing firm like Proact Luxury Real Estate LLC that advises on major developments, the mainland structure is indispensable. You can discover more insights about these holding company structures at Kayrouz and Associates.

For a clearer picture, here is a typical budget for a mainland LLC:

| Cost Component | Estimated Range (AED) | Notes |

|---|---|---|

| Trade Licence & Approvals | 12,000 - 20,000 | Dependent on the specific business activity chosen. |

| Office Lease (Annual Rent) | 15,000 - 50,000+ | The largest variable; depends on location and size. |

| Visa per Person | 5,500 - 9,200 | Includes medical tests and Emirates ID fees. |

| MOA Notarisation & Admin | 2,000 - 4,000 | Covers legal attestation and other minor fees. |

| Total Estimated First Year | 34,500 - 83,200+ | Excludes professional service fees. |

This table makes it clear why setting up a mainland LLC must be a strategic decision tied to operational needs, not just a default choice. These figures do not include ongoing liabilities like corporate tax. Investors must be familiar with the full picture of taxes on property and corporate entities.

The Final Hurdle: Corporate Bank Account Opening

Receiving your trade licence is a milestone, but not the end of the road. Your LLC is not truly operational until it has a corporate bank account, a step often underestimated. Banks in the UAE are serious about due diligence and conduct rigorous compliance checks.

The process typically takes 2 to 6 weeks after you get your licence. Banks will demand a complete file, including the new trade licence, MoA, shareholder passports and visas, and often a business plan. Any inconsistencies will halt the process. To navigate this final step efficiently, be proactive and engage with the bank from day one.

Managing Ongoing Tax and Corporate Compliance

Your trade licence is the beginning, not the finish line. For HNWIs, the real work starts post-incorporation. You must manage the ongoing compliance framework that protects your LLC’s legal standing and your assets.

These are not administrative afterthoughts. They are core functions of asset management, essential for steering clear of financial penalties and preserving the integrity of your investment structure.

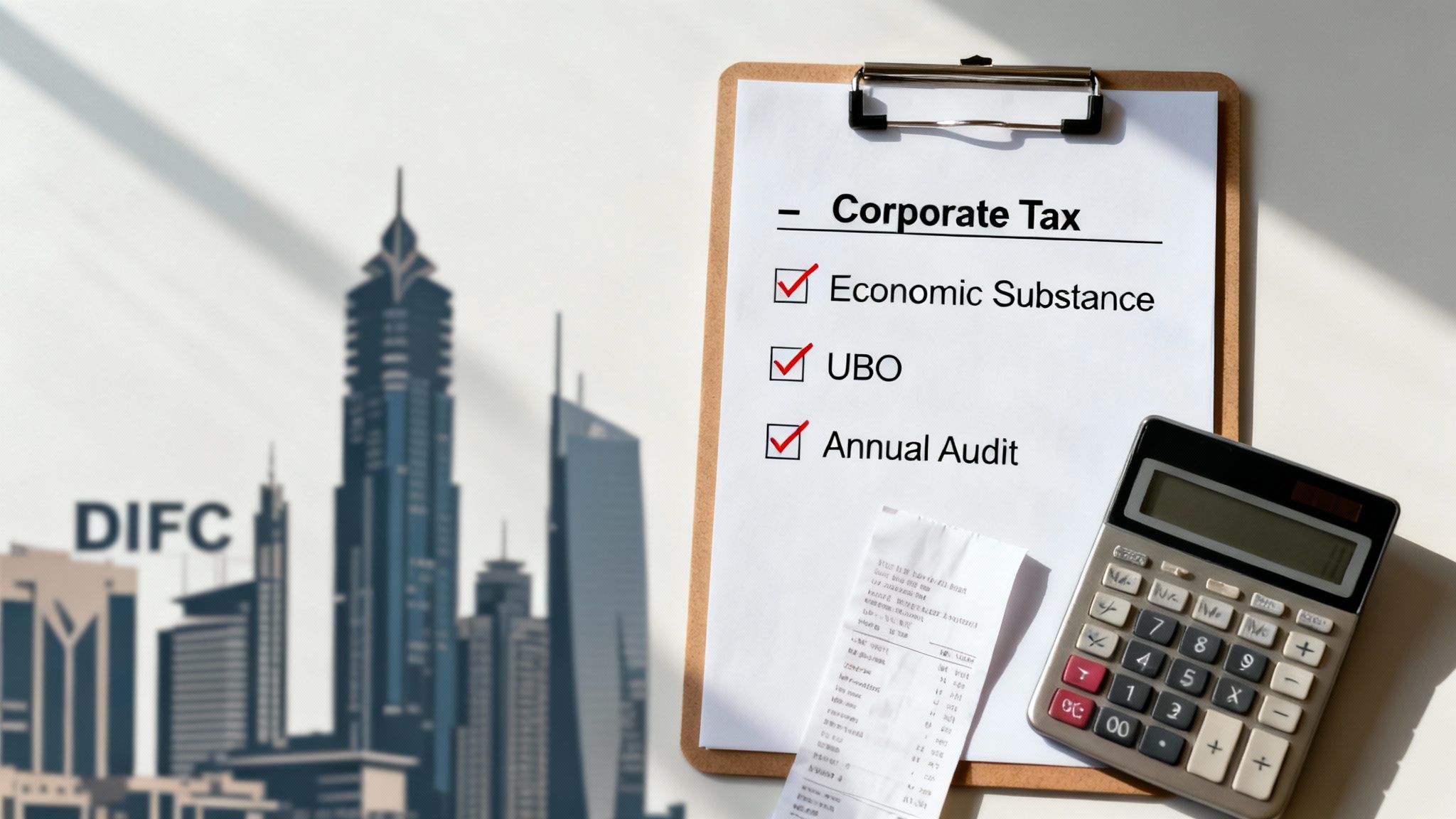

The introduction of the UAE's Federal Corporate Tax regime has fundamentally changed operations for every LLC owner. The law is straightforward: a 9% corporate tax now applies to any taxable income that crosses the AED 375,000 threshold. While this rate is globally competitive, it mandates meticulous bookkeeping and annual tax filings.

This new tax environment has sharpened the focus on corporate governance, pushing Dubai's business environment towards greater transparency and alignment with international standards.

The Nuances of Free Zone Taxation

If your LLC is in a Free Zone, the tax situation is more complex. A 0% corporate tax rate might apply to 'qualifying income', but only if your company is a 'Qualifying Free Zone Person' (QFZP).

This benefit is tied to strict criteria, including meeting specific 'de minimis' requirements. These rules test whether your company's non-qualifying revenue—income from outside the Free Zone, for instance—stays below a certain minimal threshold.

An error here has severe consequences. Misclassifying income or failing substance rules can strip you of your 0% tax benefit, leading to the standard 9% rate being applied retroactively. This is a major financial risk for investors who mistakenly believe a Free Zone status is a blanket tax exemption.

Beyond Corporate Tax: Three Core Compliance Mandates

Your duties as a director extend beyond a tax return. The UAE has rolled out regulations to align with global standards on transparency and anti-money laundering, and failure to comply comes with substantial fines.

There are three non-negotiable annual requirements your LLC must meet:

- Economic Substance Regulations (ESR): Your LLC must prove it has genuine economic activity in the UAE relevant to its licence. This means filing an annual ESR notification and, in some cases, a detailed report demonstrating adequate operational substance.

- Ultimate Beneficial Ownership (UBO): You are legally required to keep an accurate, updated register of the ultimate beneficial owners of your company. This information must be submitted to the authorities to ensure transparency of who controls the entity.

- Annual Audits: Most LLCs, particularly on the mainland, must have their financial statements audited each year by a licensed UAE-based auditor. These audited financials are needed for licence renewals and are mandatory for corporate tax filing.

These regulations are not paperwork. They are designed to ensure every LLC is a legitimate, transparent entity with real substance, reinforcing the UAE's position as a credible global business hub. Proactive management of these duties is fundamental.

The momentum behind forming these entities continues. In 2020, the UAE recorded 19,050 new business registrations, dominated by LLCs. This trend has accelerated; the Dubai International Financial Centre (DIFC) alone reported a 32% jump in new company registrations in the first half of last year, largely driven by asset managers and family offices. This surge underscores how critical a robust compliance framework is. You can read more about the UAE's business registration trends at Trading Economics.

Ultimately, managing compliance is risk mitigation. By maintaining immaculate records and adhering to regulatory deadlines, you shield your asset-holding vehicle from legal challenges and financial penalties, ensuring it remains a durable part of your wealth strategy.

Final Thoughts: Strategy Over Speculation

An LLC company formation in Dubai is more than a compliance task; it is the foundational move in a sophisticated real estate investment strategy. It marks the shift from merely buying property to actively managing a portfolio of assets—a crucial step for navigating Dubai's maturing market. Your choice of jurisdiction and corporate structure will define your risk exposure, operational efficiency, and long-term returns.

As we move deeper into 2026, the market no longer rewards passive or unstructured investing. Success now demands a deliberate approach, where the legal vehicle holding your assets is planned as meticulously as the properties themselves. The era of easy speculative gains seen in the post-pandemic boom has given way to a cycle that favours sustainable, well-managed growth. This shift is a key part of our latest Dubai property market forecast.

At Proact Luxury Real Estate, our role goes beyond identifying high-yield properties. We focus on building the optimal corporate framework needed to protect and amplify asset value. This means aligning your LLC structure with your specific investment goals, whether you’re targeting long-term rental yields or strategic capital appreciation. If you are rebalancing your portfolio for 2026, let's run the numbers.

Your Questions Answered: LLC Formation in Dubai

Even with a clear strategy, forming an LLC in Dubai for the first time brings up questions. For investors, these queries usually circle back to ownership rules, capital requirements, and timelines. Let's get them answered.

Can Foreigners Own 100% of a Real Estate LLC?

Yes. As of early 2026, the reforms to the UAE Commercial Companies Law are firmly in place. For nearly all activities tied to real estate investment and holding, you, as a foreign national, can retain 100% ownership of a mainland LLC. There is no longer a need for an Emirati partner. This was a major shift that dismantled a historical hurdle for international investors, as detailed in recent updates to the uae-property-law. Free Zone companies have always offered 100% foreign ownership by design.

What is the Minimum Capital for a Property LLC?

This is a common point of confusion. While the law technically requires "sufficient" share capital, in practice, there is no mandatory minimum capital you have to pay up or lock away in a bank for a standard LLC formation. The amount you state in your Memorandum of Association (MoA) is more of a formality. Authorities are more interested in your ability to cover operational costs than a fixed deposit. This lowers the initial financial barrier, letting you put capital to work acquiring assets.

How Long Does the LLC Setup Process Take?

The timeline depends on the jurisdiction. If speed is the priority, a DIFC Prescribed Company (SPV), built for lean asset holding, is your fastest route. You can have everything wrapped up in 5 to 10 business days once all documents are submitted correctly. A mainland LLC has more steps, mainly securing a physical office lease (Ejari). A realistic timeline, from reserving your company name to holding the final trade licence, is between 2 to 4 weeks. In my experience, delays are almost always down to incomplete or improperly attested shareholder documents.

Is an Annual Audit Mandatory for My LLC?

Yes, for most structures, an annual audit is a non-negotiable compliance requirement. Since the UAE Corporate Tax regime came into effect, all mainland LLCs and most Free Zone companies are required to have their financial statements audited by a UAE-licenced firm. These audited financials are not just for your records. They are a prerequisite for filing your annual corporate tax return with the Federal Tax Authority (FTA). This rule reinforces financial transparency and is essential for keeping your company in good standing.

At Proact Luxury Real Estate LLC, we structure investment vehicles that are as resilient and high-performing as the properties they hold. If you are assessing the optimal corporate framework for your Dubai real estate assets in 2026, let's schedule a strategic consultation.

Explore your investment strategy with us at https://ritukant.com.