Entering 2026, the Dubai property market shows clear signs of stabilization. The post-Covid boom has transitioned into a mature growth cycle, compelling investors to pivot from broad market bets to precise asset selection. While many focus on branded residences in Downtown, the smart money is analyzing boutique developments like Hyati Residence Dubai for superior, sustainable yields.

Analyzing Hyati Residence in the 2026 Market Cycle

The speculative frenzy of 2024 has passed. The new market dynamic for 2026 is driven by sustainable growth, fueled by genuine end-user demand and supported by mature infrastructure. It is within this framework that Hyati Residence, a project by Aurora Real Estate Development, warrants a detailed analysis.

Unlike the high-rise towers that saturated last year's benchmarks, Hyati Residence is a low-rise project comprising a single five-storey building and a collection of townhouses. This is not merely a design choice; it is a distinct investment proposition in a city where tenants and buyers are actively seeking community-focused environments over anonymous towers.

The Boutique Advantage in Jumeirah Village Circle

Jumeirah Village Circle (JVC) is no longer an "up-and-coming" area; it is a fully-established residential district. Transaction data from Q4 2025 shows a persistent demand for well-finished, low-density homes. While the supply of standard high-rise apartments continues to grow, the inventory of quality, boutique projects remains limited.

This supply-demand imbalance creates a specific market gap that Hyati Residence is positioned to fill. Its appeal is built on its differentiation from cookie-cutter high-rises.

For the astute investor, the focus shifts from chasing potential capital growth to securing tenant quality and retention. Boutique developments in established communities consistently attract a more stable, long-term tenant base, resulting in lower vacancy rates and a more predictable income stream.

Our in-depth Dubai real estate market analysis for 2026 indicates a clear "flight to quality." Investors are moving away from high-risk ventures toward assets offering a balanced, reliable return. The investment case for Hyati Residence is built on this principle.

Here is why this asset class is gaining traction:

- Reduced Competition: With fewer identical units in the immediate vicinity, there is less direct competition for tenants. This provides greater leverage on rental pricing.

- Community Feel: The low-rise design fosters a sense of community. This has become a key decision-making factor for expat families and professionals.

- Focus on Quality: Smaller developers like Aurora must concentrate on superior finishes and build quality to compete. This directly supports better long-term asset value and tenant satisfaction.

This analysis will dissect Hyati Residence not as just another property, but as a strategic asset class. We will evaluate its potential against the backdrop of a maturing Dubai market, providing the hard data required for an informed portfolio decision.

Getting a Read on the Developer and the Project

When evaluating an investment like Hyati Residence Dubai, the critical first step is to analyze the developer. For a serious investor, a professional assessment of Aurora Real Estate Development is where risk mitigation begins. It requires an understanding of their history, financial model, and delivery track record.

Aurora is a boutique developer, not one of the master developers shaping entire districts. Their business model is built on a lower volume of projects, which allows for a greater focus on construction quality and finishing details that tenants value. Last year's data indicates that projects from similar-sized developers often achieve higher tenant satisfaction and retention rates due to superior build quality.

This smaller scale, however, presents a different risk profile. While larger firms have balance sheets to absorb market shocks, boutique developers operate on tighter margins. Therefore, their history of on-time delivery is a crucial metric.

Track Record and RERA Compliance

Aurora Real Estate Development has concentrated its operations primarily within Jumeirah Village Circle with projects like Hyati Avenue. This focus simplifies performance analysis. A review of their past projects reveals a consistent pattern of meeting handover deadlines—a critical indicator in a market where revised handover timelines are not uncommon.

The non-negotiable component of this due diligence is confirming strict compliance with RERA (Real Estate Regulatory Agency) protocols.

For any off-plan investment in 2026, the developer's use of a RERA-compliant escrow account is the paramount safeguard. This mechanism ensures capital is allocated directly to construction progress, with each stage verified by authorities. Aurora's consistent use of this system is a fundamental green light.

A Tale of Two Models

Choosing between a boutique developer and a master developer is a strategic decision based on trade-offs.

Boutique Developer (Aurora) vs. Master Developer

| Attribute | Aurora Real Estate (Boutique) | Major Master Developer |

|---|---|---|

| Focus | Project-specific, high attention to detail. | Master community scale, often standardised. |

| Financial Scale | Leaner operations, more sensitive to market shifts. | Large capital reserves, greater resilience. |

| Flexibility | Potentially more agile in design and execution. | Standardised processes, less room for deviation. |

| Investor Risk | Execution risk tied to a smaller team. | Market risk tied to large-scale supply delivery. |

The core argument for investing with a developer like Aurora is that their specialized focus creates a superior end product—one that will outperform mass-market options in both rental yield and long-term value. This is a vital point when buying off-plan property in Dubai, as asset quality ultimately attracts premium tenants in a competitive rental market.

Ultimately, a developer’s integrity is built into the final structure. Our analysis of Aurora’s track record points to a reliable, quality-focused operator, providing the confidence to proceed to the next stage: an evaluation of the project's location and connectivity.

A Strategic Overview of Location and Connectivity

The conversation around Jumeirah Village Circle has matured. Today, informed investors understand that the specific district and street can determine an asset's performance. Hyati Residence Dubai is located in District 14, a calculated position offering a blend of quiet community life with efficient access to Dubai's main economic arteries.

From an asset management perspective, commute time is a critical factor for rental appeal. The target tenant for this project—mid-to-senior level professionals and their families—values time highly. Hyati Residence is situated strategically close to the main access points for Al Khail Road and Sheikh Mohammed Bin Zayed Road.

This is not merely about convenience; it is a fundamental pillar of the property's long-term rental strength and a key reason JVC is one of the best areas to invest in Dubai.

Infrastructure and Economic Corridors

Looking toward 2026, an investor's focus must be on the maturity of surrounding infrastructure. Hyati Residence benefits from JVC's established ecosystem of schools, supermarkets, and clinics. The presence of institutions like JSS International School and the convenience of a nearby Spinneys create a stable, family-focused tenant pool.

[Map: Location relative to Al Maktoum Airport]

A forward-looking analysis highlights its connectivity to the Al Maktoum International Airport and Jebel Ali corridor. As Dubai’s center of gravity continues its southern expansion, easy access to this economic engine becomes a powerful driver for future capital growth.

The value proposition is clear: Hyati Residence offers the established community feel of JVC while acting as a residential feeder for Dubai’s next major growth zone. This dual appeal separates a standard rental property from a strategic portfolio asset.

This positioning diversifies the tenant base, tapping into professionals working in traditional hubs like Downtown and Dubai Marina, as well as the growing workforce in the south.

Commute Times to Key Business Hubs

Corporate tenants analyze commute times when selecting a residence. This data directly impacts occupancy rates and rental yield.

| Destination | Average Travel Time (Minutes) | Strategic Importance |

|---|---|---|

| Dubai Marina / JLT | 15 - 20 | Hub for multinational corporations, leisure |

| Downtown Dubai | 20 - 25 | Financial centre, professional services |

| Jebel Ali Free Zone | 20 - 25 | Major industrial and logistics hub |

| Al Maktoum Int'l Airport | 25 - 30 | Future global aviation centre |

These metrics confirm the property is placed to serve a diverse professional demographic. The road network's efficiency provides a durable competitive edge. With ongoing infrastructure enhancements around JVC, this position is set to strengthen through 2026 and beyond, underpinning potential for both steady rental income and capital appreciation.

Cracking the Numbers: Unit Economics and Payment Structures

Before committing capital, a dissection of the unit economics is necessary. For an asset like Hyati Residence, this involves an analysis of the price per square foot, ongoing costs, and the initial cash outlay.

Based on transaction data from late last year, the price per square foot for high-quality, new apartments in Jumeirah Village Circle has stabilized. Hyati Residence is competitively priced within this bracket, reflecting its boutique quality without an unreasonable premium. The key is to weigh the price against the deliverable: superior finishes and a low-density living experience.

How It Stacks Up Against the 2026 Market

To determine its market value, Hyati Residence must be benchmarked against new launches and established properties in JVC. Last year’s data reveals a price split between mass-market high-rises and specialized low-rise projects. Large towers often compete on price, while smaller buildings command higher rates due to scarcity and tenant preference.

Below is a breakdown of the numbers for each unit type, providing a framework for financial modeling. This is a critical step when evaluating assets within the broader category of Dubai freehold properties.

Hyati Residence Unit Configuration and Price Analysis

This table provides the essential data points to build investment scenarios.

| Unit Type | Average Size (sq. ft.) | Estimated Price/sq. ft. (AED) | Projected Annual Service Charge (AED/sq. ft.) |

|---|---|---|---|

| Studio | 450 - 600 | 1,300 - 1,450 | 14 - 16 |

| 1-Bedroom | 924 - 980 | 1,250 - 1,350 | 14 - 16 |

| 2-Bedroom | 1,300 - 2,500 | 1,200 - 1,300 | 14 - 16 |

| 4-Bed Townhouse | 3,383 | 1,100 - 1,200 | 12 - 14 |

Note: Prices and service charges are estimates based on Q4 2025 data and developer guidance for 2026.

Projected service charges are in line with, and in some cases lower than, high-rise towers with more extensive amenities. This efficiency is a direct benefit of the low-rise model and positively impacts net yield calculations.

Breaking Down the Financial Commitment

Beyond the purchase price, two figures are crucial for determining your initial cash outlay: the Dubai Land Department (DLD) fee and the payment plan structure.

- DLD Fee: This is a standard 4% of the property's purchase price, a mandatory government fee due upon registration of the Sales and Purchase Agreement (SPA). For details on all associated purchase costs, see this guide to taxes on property.

- Payment Plan: The aggressive 1% monthly plans common in 2024 are gone. In 2026, developers have reverted to more traditional, construction-linked structures, signaling a healthier, less speculative market.

A typical payment plan for a project like Hyati Residence is a 40/60 or 50/50 structure. This requires 40-50% payment in instalments during construction, with the remaining 50-60% due at handover. This structure requires more upfront capital but also demonstrates the developer's financial confidence in project completion.

[Chart: 2026 Payment Plan Breakdown]

This shift in payment plans filters out short-term flippers, attracting genuine end-users and long-term investors. This contributes to the price stability of the community. A clear understanding of these numbers is the foundational step in building a solid investment case.

Projecting Your ROI: Rental Yield and Capital Growth

An asset's worth is measured by the return it generates. For a 2026 portfolio, we must analyze the financial performance of Hyati Residence, projecting its rental yield and capital appreciation based on market dynamics in Jumeirah Village Circle.

Based on Q4 2025 rental data, a well-finished one-bedroom in a quality JVC low-rise achieved between AED 85,000 and AED 95,000 annually. For 2026, we anticipate market stabilization. While the explosive rental growth of recent years is moderating, demand for premium, community-focused living remains strong.

This demand is driven by a specific tenant profile: young professionals and small expat families. This demographic values quality finishes and a close-knit community feel. They form the bedrock of a stable, long-term tenant base, ensuring a consistent rental income stream.

Calculating Net Rental Yield

Gross yield is a starting point, but net yield reflects an asset's true performance by accounting for real-world costs.

To project accurately, we must factor in:

- Annual Service Charges: Estimated at a competitive AED 14-16 per sq. ft. for apartments, lower than many surrounding towers due to the efficient low-rise design.

- Property Management Fees: A standard 5-7% of the annual rent should be budgeted for professional tenancy management, particularly for overseas investors.

- Maintenance & Void Periods: Prudent investors set aside at least one month's rent per year to cover potential vacancies or minor upkeep.

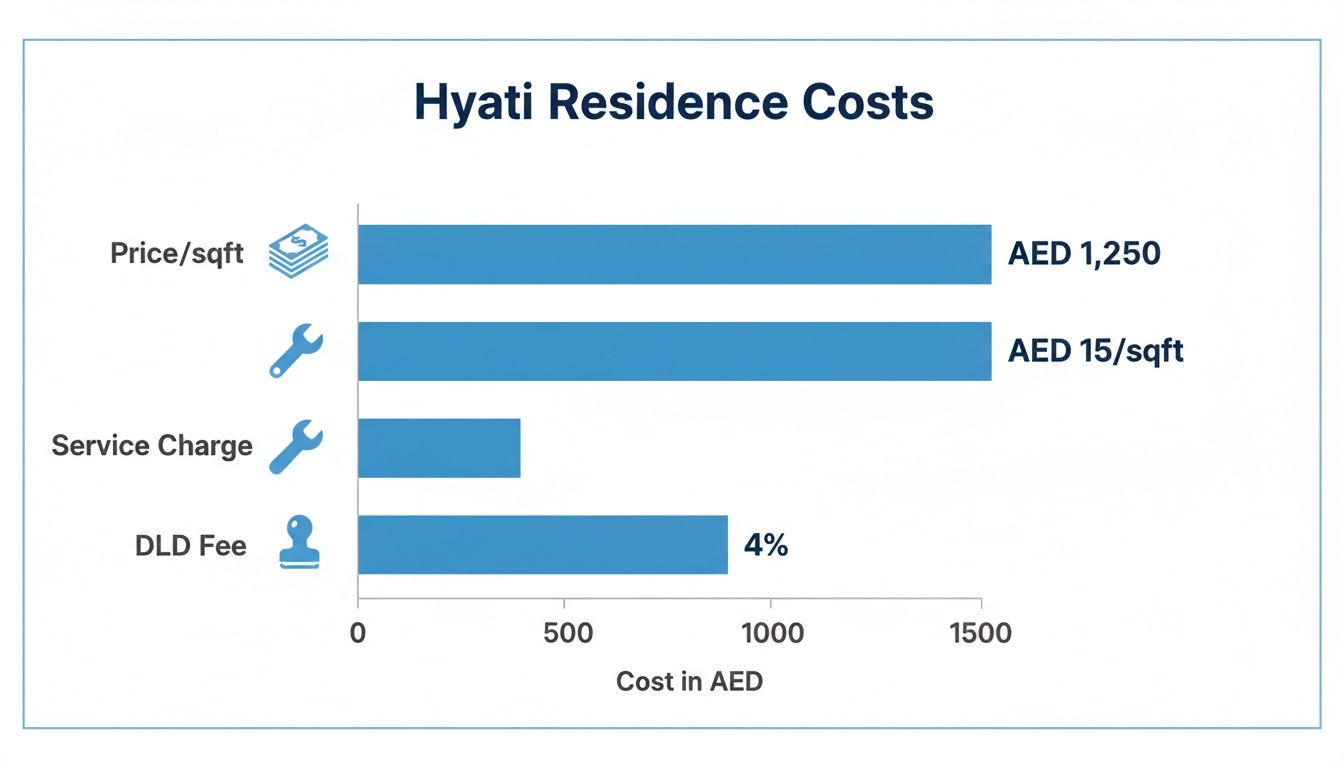

The chart below provides a snapshot of the primary costs associated with acquiring an asset like Hyati Residence.

This visual underscores the need to look beyond price per square foot to understand the full financial picture.

After accounting for these costs, our projections indicate a potential net rental yield for Hyati Residence in the 5.5% to 6.5% range. In a maturing market, this is a strong, sustainable return. For a detailed breakdown of financial modeling, refer to our guide on how to maximise ROI on property investments in Dubai.

Capital Appreciation Drivers

Capital growth is governed by supply and demand. For Hyati Residence, the primary growth driver is scarcity. There is a documented shortage of high-quality, low-density residential buildings in JVC. As the community matures, this scarcity will exert upward pressure on the prices of well-built properties.

The investment thesis is straightforward: in a market of homogenous high-rise towers, a superior, differentiated product will command a premium. The capital growth of Hyati Residence is tied directly to its boutique nature and the enduring demand for community-centric living.

The table below offers a comparison of its projected performance against market alternatives.

Comparative Investment Analysis: Hyati Residence vs Market Alternatives

| Asset | Projected Gross Rental Yield (%) | Projected 3-Year Capital Appreciation (%) | Key Risk Factor |

|---|---|---|---|

| Hyati Residence, JVC | 7.0% - 8.0% | 15% - 20% | Niche resale market liquidity |

| High-Rise, JVC | 6.5% - 7.5% | 10% - 15% | High competition, potential oversupply |

| Townsquare Apartment | 7.0% - 8.0% | 12% - 18% | Distance from central business hubs |

| Arjan Mid-Rise | 6.0% - 7.0% | 10% - 14% | Developing infrastructure |

This data-led comparison shows Hyati Residence holds a competitive edge, offering a balanced profile of strong rental yield and solid capital growth potential. Its value proposition is built on tangible demand for quality in a key Dubai sub-market, not on speculation.

Final Thoughts: A Niche Asset for a Mature Portfolio

The period of speculative, rapid-fire flips is over. Success in the 2026 Dubai real estate market requires a tactical pivot to precise asset selection where fundamentals trump market hype.

In this stabilized environment, Hyati Residence Dubai is suited for a discerning portfolio manager prioritizing stable, long-term rental income and steady capital growth from a well-built, community-focused project. This represents a deliberate move away from headline-chasing and toward acquiring fundamentally sound real estate.

Strategy Over Speculation

The window for momentum-driven gains has narrowed. The value of Hyati Residence Dubai is in its boutique nature, proven construction quality, and strategic position within a mature JVC. This asset is designed for consistent, reliable performance, not a quick turnaround.

The investment thesis is built on differentiation in a crowded market. As tenant demand shifts towards quality of life and community feel, assets like this are positioned to command premium rents and maintain higher occupancy rates compared to standard high-rise inventory.

An asset's true strength is revealed not during a market boom, but during a cycle of stabilisation. Projects with superior build quality and a clear target demographic, like Hyati Residence, demonstrate resilience and provide a defensive hedge against market fluctuations, ensuring a more predictable cash flow.

A Fit for the Right Portfolio

This asset class is best suited for an investor with a three-to-five-year horizon or longer. It appeals to those who understand that in a mature market, wealth is built through consistent rental yields and organic capital appreciation, not speculative gambles.

Acquiring a unit here should be viewed as a strategic allocation to the mid-market luxury segment. For investors seeking passive income to support a Golden Visa UAE application through property ownership, this asset class provides a solid foundation.

If you are rebalancing your portfolio for 2026 and this asset profile aligns with your objectives, the next step is a detailed financial deep-dive.

Investor FAQs

Direct answers to common questions from investors analyzing Hyati Residence and the JVC sub-market for their 2026 portfolios.

What Are the Primary Risks with a Boutique Development?

With boutique projects, risks center on developer execution and resale liquidity. Smaller firms lack the deep financial reserves of master developers to absorb unexpected delays. This risk is mitigated by RERA’s escrow account rules, which link payments to verified construction milestones, protecting investor capital as per current UAE property law.

On the resale side, the buyer pool for a niche building may be smaller than for a well-known tower. The counter-strategy is the asset's quality. A premium build attracts discerning end-users and tenants willing to pay for quality, justifying its market position.

How Do Service Charges Compare to Other JVC Properties?

Service charges in low-rise buildings like Hyati Residence Dubai are typically competitive, often lower than in high-rise towers with extensive amenities. The lower operational cost of maintaining fewer, focused facilities translates directly into smaller annual fees for owners.

For an investor, this is a critical metric. Lower recurring costs directly boost net rental yield. Before any client proceeds, we conduct a detailed comparative analysis of projected service charges against established benchmarks for similar-grade buildings.

Is Jumeirah Village Circle Oversupplied with Apartments?

While the total number of apartments in JVC is high, the market is segmented. The area has a surplus of average-quality units in high-density towers. There is a deficit in the supply of high-quality, low-rise residential buildings with superior finishes and practical layouts.

Projects like Hyati Residence do not compete with the mass market. They target a specific gap for tenants and buyers seeking a more private, community-focused lifestyle. The investment thesis is based on this quality differential, which allows such assets to command premium rents and maintain high occupancy, even during a market price adjustment. The strategy is not merely to own property in JVC, but to own a superior asset in a specific, in-demand niche.

At Proact Luxury Real Estate LLC, we provide the data-driven analysis required to make strategic, high-performance acquisitions in Dubai's maturing market. If you are rebalancing your portfolio for 2026, let's run the numbers.