While many investors are still analyzing last year's benchmarks, the smart money has already moved on. The 1% monthly payment plan, standard in 2025, has been largely replaced by 60/40 structures from major developers. This shift signals a maturing market, raising the entry barrier and filtering out short-term speculators in favor of strategic asset managers.

For High-Net-Worth Individuals, success in 2026 requires a forward-looking strategy focused on high-growth corridors, emerging master communities, and a precise understanding of asset structures to lock in both yield and capital growth.

The Dubai Market: A 2026 Investor Briefing

Last year's surge in off-plan transactions was a clear indicator of changing market dynamics. We have transitioned from the post-Covid boom into a sustainable growth cycle, underpinned by tangible economic drivers rather than fleeting sentiment.

Corporate relocations and state-level investments, such as Microsoft's planned $7.9 billion commitment between 2026 and 2029, are creating sustained demand for executive housing. This demand is driven by genuine population growth, not just investor appetite, providing a stable foundation for the market.

Core Market Drivers in 2026

The market's current stability is attracting institutional capital and sophisticated family offices for several key reasons:

- Capital Appreciation Stability: Price growth has normalized from the steep climbs of 2023-2024. Astute investors are now targeting assets in communities with committed infrastructure spending, where appreciation is tied to real development.

- Rental Yield Resilience: While rapid rent increases have stabilized, yields remain globally competitive. Prime communities deliver net yields between 5% and 6.5%, offering a dependable income stream for portfolio diversification.

- Safe-Haven Status: Global economic turbulence continues to funnel capital into Dubai. The UAE's robust legal framework, governed by transparent uae property law, provides a secure harbor for wealth preservation.

The narrative has moved beyond simplistic growth stories. Success in 2026 demands a granular understanding of micro-market performance and developer pipelines.

This briefing establishes an actionable framework for navigating this mature market. For a deeper dive, our detailed Dubai property market forecast offers granular insights into the trends shaping investment decisions this year.

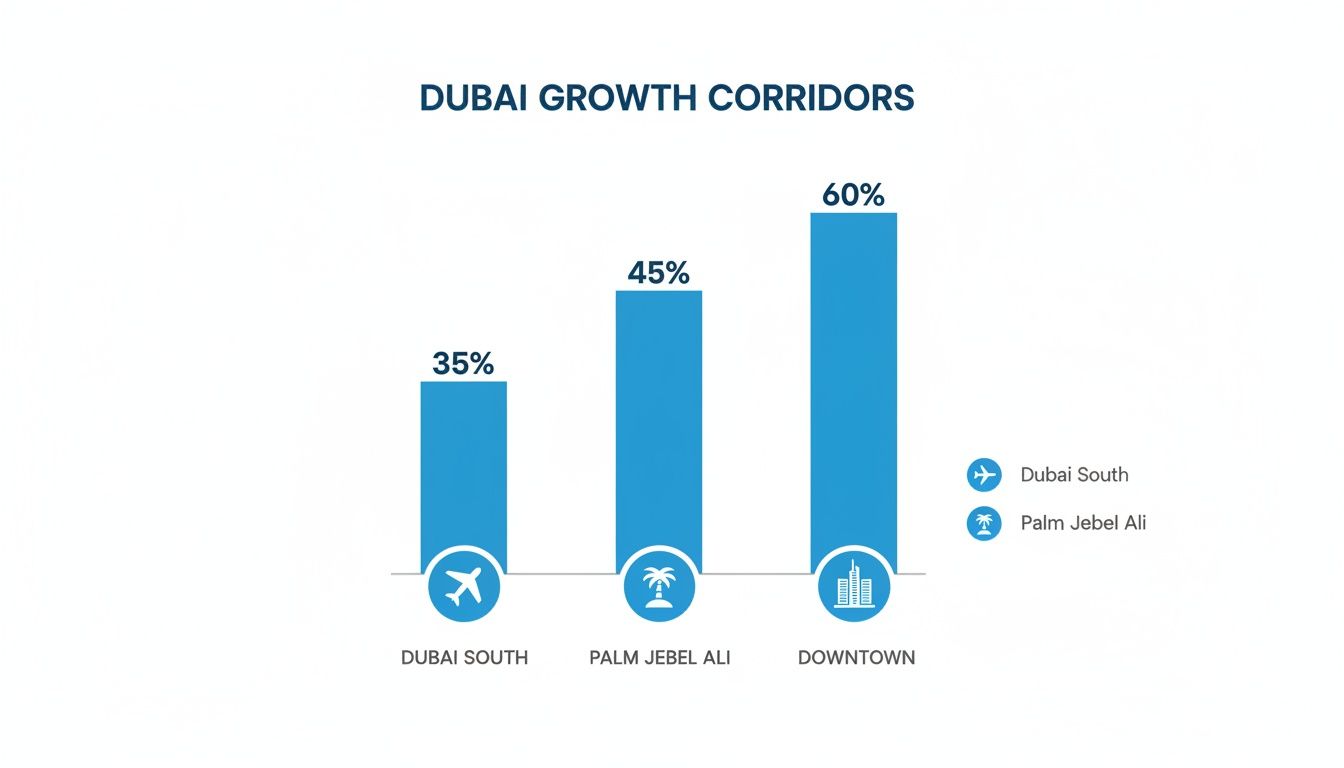

Identifying High-Growth Investment Corridors

The typical investor playbook points towards established areas like Downtown Dubai or Palm Jumeirah. However, astute capital in 2026 is flowing differently. The real opportunity lies in emerging master communities and infrastructure-led growth corridors where the appreciation curve is just beginning.

Last year's market performance was powerful; Dubai recorded Dh917 billion in total property transactions, a 20% increase from 2024. Understanding where this capital is now moving is the key to maximizing returns. Learn more about these record-breaking property deals.

The Dubai South Strategic Thesis

The most compelling growth story for the next decade is unfolding in Dubai South. The government’s confirmed expansion of Al Maktoum International Airport into a global mega-hub is a primary catalyst that will reshape the city's southern corridor. This state-level directive will drive a massive influx of jobs and residents, making any investment here a direct play on Dubai's long-term aviation and logistics strategy.

- Proximity to Expo City: The legacy infrastructure has created a self-sustaining economic ecosystem, attracting businesses and residents.

- Logistics and Aviation Hub: The airport expansion will generate tens of thousands of jobs, creating organic housing demand.

- Lower Entry Point: Off-plan projects here, such as new launches in Dubai South's master communities, offer a lower price per square foot compared to saturated central districts, presenting a clear path for capital appreciation.

[Map: Location relative to Al Maktoum Airport]

Palm Jebel Ali: The New Waterfront Frontier

While Palm Jumeirah is a mature, stable asset class, Palm Jebel Ali represents a pure growth opportunity. The initial launches saw unprecedented absorption rates, signaling powerful demand for ultra-luxury waterfront properties. Astute investors are buying into the scarcity of prime, government-backed waterfront land.

The plot sales from last year are a clear leading indicator of the future value of the villas and branded residences that will be built on the fronds.

Compared to older towers in areas like JBR, the new stock on Palm Jebel Ali will command premium valuations and higher yields upon completion. The investment thesis is straightforward: get in early on a mega-project with undeniable state backing.

High-Growth Corridor Analysis

An apartment in an early Dubai Marina tower might offer a stable 5.5% net yield, but its capital growth is capped by existing supply. In contrast, an off-plan townhouse in The Valley's second phase projects a capital appreciation of 25-30% by its handover. This is the trade-off savvy investors are making.

[Chart: 2026 Payment Plan Breakdown]

| Growth Corridor | Primary Driver | Projected 3-Year Capital Appreciation | Average Off-Plan Entry Price (AED/sq.ft.) | Key Infrastructure Links |

|---|---|---|---|---|

| Dubai South | Al Maktoum Airport Expansion | 20-25% | 1,100 - 1,400 | E311, E611, Metro Line Extension |

| Palm Jebel Ali | New Waterfront Mega-Project | 30-40% | 2,500 - 4,000+ | Sheikh Zayed Road (E11), Waterfront Marine Transport |

| The Valley | Mid-Market Luxury Demand | 18-22% | 1,000 - 1,300 | Dubai-Al Ain Road (E66) |

These figures illustrate a clear divergence in opportunity. For a more granular analysis of individual communities, our guide on the best areas to buy property in Dubai provides further detail.

Executing the Purchase: Off-Plan Versus Ready Property

The decision between an off-plan or a ready property is a critical fork in the road. As we move deeper into 2026, the choice is between future capital growth and immediate income generation. It's a strategic trade-off: leverage tomorrow's market by staging payments, or acquire an asset that generates cash flow from day one.

Last year’s residential sales hit a record AED 682.5 billion, a 30% jump in value from 2024, driven by overseas buyers. The absorption rate for off-plan units was unprecedented, especially in branded residences and new waterfront communities.

The Dynamics of Off-Plan Investment in 2026

The 1% monthly payment plans of 2025 are gone. Major developers now favor capital-heavy 60/40 or 70/30 structures, filtering out short-term flippers and attracting investors with substantial capital.

This shift signals developer confidence, but it requires recalibrating financial models. The core benefit remains: you lock in today’s price for an asset delivered in a more valuable future market. RERA regulations ensure all payments are held in project-specific Escrow accounts, released only upon hitting construction milestones. For a complete breakdown, our deep dive on buying off-plan property in Dubai is essential reading.

Investment Profile: Off-Plan

- Investment Pros:

- Capital Appreciation Potential: The primary driver is the value jump between launch price and handover value.

- Leveraged Payments: Payment plans allow you to control a high-value asset without deploying the full capital upfront.

- Newer Asset: A brand-new property commands higher rental premiums and has lower initial maintenance costs.

- Investment Cons:

- Revised Handover Timelines: Market conditions can shift handover dates, delaying the start of rental income.

- Market Risk: You are exposed to market fluctuations during the construction phase.

- No Immediate ROI: Capital is tied up without generating income until handover.

Analysing Ready Property Assets

For ready property in 2026, the strategy is identifying undervalued assets that deliver immediate, stable rental income. While capital growth may be lower compared to off-plan projects, the risk profile is reduced. You can physically inspect the asset, value it based on real-time data, and have a tenant in place within weeks.

A ruthless calculation of your net yield is critical. An analysis must account for annual service charges, maintenance, and property management fees to determine true earnings.

The data makes it clear: while Downtown remains a solid benchmark, strategic momentum is shifting toward future-focused mega-projects like Palm Jebel Ali and Dubai South.

Investment Profile: Ready Property

- Investment Pros:

- Immediate Rental Income: The asset generates cash flow from the moment of transfer.

- Tangible Asset: Physical inspection removes uncertainty about quality and finish.

- Proven Location: The community’s infrastructure and rental demand are established and verifiable.

- Investment Cons:

- Higher Initial Outlay: The full purchase price plus all fees are required at transfer.

- Lower Capital Growth: Appreciation is typically more modest compared to off-plan potential.

- Potential for Maintenance: Older properties may require upgrades or come with higher service charges.

Legal and Financial Structuring for Overseas Investors

How you structure ownership is what separates an amateur purchase from a professionally managed asset. For an HNWI, getting the structure right impacts wealth preservation, succession planning, and operational efficiency.

The most direct path is individual ownership, which is clean and simple for a single asset. Joint ownership with up to four partners is also an option. Once a portfolio scales, however, corporate structures become a necessity.

Strategic Ownership Through a Corporate Vehicle

For a portfolio of assets, holding them under a corporate entity like a Jebel Ali Free Zone (JAFZA) offshore company or a Dubai Development Authority (DDA) company is the smarter play. These structures create a protective firewall between personal wealth and the property portfolio. They also simplify succession planning, as ownership is transferred via company shares, sidestepping complex probate.

We are seeing a marked increase in HNWIs moving from individual ownership to corporate structures. The initial setup cost is offset by long-term asset protection and streamlined portfolio management.

For investors whose real estate is tied to a wider mainland business, a Dubai LLC company setup offers a clear operational framework.

Understanding the Transactional Costs

Closing costs in Dubai are fixed and transparent. Budgeting for these is a non-negotiable part of due diligence.

Here is a breakdown of what to account for:

- DLD Transfer Fee: 4% of the property’s final sale price.

- Registration Fees: AED 4,200 for properties valued above AED 500,000.

- Mortgage Registration Fee: 0.25% of the total loan amount if financing.

- No Objection Certificate (NOC) Fee: A developer fee (AED 500 - AED 5,000) to confirm service charges are paid.

Miscalculating these costs will affect your projected returns. The fee structure is part of a transparent system governing taxes on property in Dubai.

The Golden Visa as a Strategic Asset

A property investment of AED 2 million or more makes you eligible for the 10-year renewable UAE Golden Visa. This is not just a lifestyle perk; it is a powerful strategic tool for global mobility and wealth security.

Holding a Golden Visa simplifies banking, business setup, and long-term residency for you and your family without requiring full-time residence. In an uncertain world, it provides a secure base and a reliable safe harbor.

Maximizing Returns Through Post-Acquisition Asset Management

Acquiring the property is the start, not the end. The work of maximizing your ROI begins immediately, focusing on rental yield optimization and planning for capital growth.

For overseas landlords, professional property management is a prudent choice. While self-management saves the typical 5-8% annual fee, it requires significant on-the-ground market knowledge. A good manager handles tenant sourcing, maintenance, and RERA compliance.

Rental Yield Optimisation

Setting the right rent is a science. You must be competitive, basing your price on real-time data from the latest Dubai real estate market analysis, not historical figures. An overpriced property risks long vacancy periods that erode gains.

A dynamic approach is advised:

- Quarterly Rent Reviews: Analyze comparable listings and rental contracts in your community to stay ahead of the market.

- Justify the Premium: For furnished properties, ensure the quality justifies the higher rent. High-calibre tenants expect and will pay for quality.

- Lease Term Flexibility: Offering a slightly lower rate for a guaranteed two-year lease can provide greater financial stability than chasing the highest annual rent.

Capital Growth Realisation and Strategic Exits

For many investors, the ultimate prize is capital appreciation. Knowing when to sell is crucial. This requires constant monitoring of transaction data from the Dubai Land Department to identify peak selling windows and sidestep market corrections.

An asset that has been professionally managed and meticulously maintained will always command a higher valuation. For investors holding prime assets, monitoring listings for villas for rent in Palm Jumeirah helps in understanding tenant expectations and rental premiums in the ultra-luxury segment.

Treat your Dubai property as a dynamic component of your global portfolio. Its performance must be actively tracked and optimized like any other asset class.

Final Thoughts: Strategy Over Speculation

The window for 'easy flips' has narrowed. Success in 2026 requires targeting communities with genuine infrastructure growth—specifically those connected to the expanding metro lines and economic hubs.

The most durable returns will be captured by investors who align their capital with Dubai's long-term economic blueprint. At Proact Luxury Real Estate, we track these infrastructure corridors daily. If you are rebalancing your portfolio for 2026, let's run the numbers.

Frequently Asked Questions

Navigating high-value investments in Dubai raises key questions. Here are direct answers to common queries from experienced investors.

What Are the Primary Risks in the Dubai Property Market Today?

The biggest risk is not a market crash, but a price adjustment in over-saturated neighborhoods where supply has outpaced demand. The critical mistake in 2026 is overpaying for a property in a community with poor infrastructure growth.

Another factor is the shift in off-plan payment plans. Heavier upfront payments increase capital-at-risk during construction. Counter this with intense due diligence on the developer’s delivery history and by focusing on locations with proven end-user demand.

How Does the Golden Visa Through Property Investment Work?

An investment of AED 2 million or more in property qualifies you for a 10-year renewable Golden Visa. This can be a single property or a portfolio, off-plan or ready. If the property is mortgaged, you can qualify provided your paid-up equity is at least AED 2 million.

The process is managed through the Dubai Land Department. The visa extends to your spouse and children, offering a stable path to long-term residency. To understand its strategic value, learn more about what is golden visa uae.

Are There Hidden Costs When Buying Property in Dubai?

The costs are not hidden, but they must be budgeted for meticulously. Beyond the purchase price, the main cost is the 4% Dubai Land Department (DLD) transfer fee, plus administrative fees.

- For off-plan, you will have a registration fee (Oqood).

- For a ready property, expect fees for the Trustee Office and a potential agency fee of 2%.

It is prudent to review a detailed guide on the associated taxes on property in Dubai before committing.

What Is the Real Net Rental Yield I Can Expect?

Net yield is the only number that matters. Once you factor in annual service charges (AED 15-30 per sq. ft.), property management fees (5-8% of annual rent), and a maintenance buffer, the picture becomes clear.

A realistic net yield for a well-managed apartment in a prime community is between 5% and 6.5%. Villas may show slightly lower yields but often deliver superior long-term capital appreciation. The latest Dubai real estate market analysis indicates rental increases are stabilizing, so basing forecasts on current data is key.

At Proact Luxury Real Estate LLC, we provide the data-driven analysis required for strategic, high-performance investment decisions. If you are structuring your portfolio for long-term growth, let's connect.