Last year's benchmarks showed a market dominated by 1% monthly payment plans. Entering 2026, major developers are pivoting to 60/40 structures, a shift that signals a maturing market but also changes the entry barrier for new investors. This recalibration makes the foundational choice between freehold and leasehold ownership more critical than ever, directly impacting capital security, exit liquidity, and intergenerational wealth transfer.

Defining Freehold and Leasehold Structures in Dubai

For High-Net-Worth Individuals (HNWIs), the freehold vs leasehold debate is a core portfolio decision. The market structure was defined by Dubai Law No. 7 of 2006, which designated specific zones where foreign nationals could acquire absolute ownership rights. This was a critical pivot that reshaped Dubai's appeal to international capital.

This move created two distinct asset classes. With freehold, an investor receives an absolute title deed registered with the Dubai Land Department, establishing perpetual ownership. Leasehold is a usufruct right—a long-term right to use and benefit from a property, which reverts to the landlord when the term expires. This structure introduces a 'ground lease' and its associated fees, impacting long-term holding costs. Understanding the wider context of a Free Zone vs Mainland Dubai business setup is also useful, as these corporate structures often align with property ownership rules.

Core Legal and Financial Distinctions

The differences between these models have a direct, measurable impact on an investor's control, costs, and legacy planning capabilities. A clear assessment of these factors is essential before committing capital.

The table below outlines how the two structures compare on the factors that matter most to an investor.

Freehold vs Leasehold Core Legal and Financial Distinctions

| Attribute | Freehold Ownership | Leasehold Ownership (99-Year Term) |

|---|---|---|

| Ownership Title | Absolute ownership of property and land, registered in perpetuity. | Right-to-use (usufruct) for a fixed term; land owned by the landlord. |

| Duration of Rights | Indefinite; can be held forever and passed to heirs. | Fixed term (e.g., 99 years), with diminishing value over time. |

| Investor Control | Full control over alterations and sale, subject to community rules. | Requires landlord's permission for major alterations or sale. |

| Ongoing Costs | Annual service charges set by the Owners' Association. | Annual service charges plus potential ground rent payable to the landlord. |

| Legacy Planning | Simple intergenerational wealth transfer of a perpetual asset. | Inheritance of a depreciating asset (the remaining lease term). |

The market's direction is unambiguous.

Dubai has systematically expanded its designated freehold zones, signaling a clear policy preference for models that attract and secure long-term foreign capital. Explore our detailed guide to the best Dubai freehold properties for current opportunities.

This evolution has shaped where capital flows. Last year, freehold transactions accounted for roughly 70% of all residential sales, with foreign buyers driving 58% of these deals in prime communities. Last year's benchmarks show average rental yields in these zones holding at 6–8% for apartments, proving sustained demand. This trend favors freehold for any long-horizon wealth strategy.

Analysing Capital Appreciation and Exit Strategies

For any investor, the end game is the total return on capital. The perpetual ownership that comes with a freehold asset—where you own both the building and the land—is the structural reason it almost always delivers superior capital appreciation.

This is a world away from the economic reality of a leasehold property, which is chained to a principle called lease decay. As the fixed term on a lease shortens, its value diminishes. This has a direct impact on resale value and a new buyer's ability to secure a mortgage. Once a lease term dips below 70 years, banks become reluctant to lend, severely shrinking your pool of potential buyers.

Unpacking the Performance Gap

The market benchmarks from last year show where the smart money is moving. The market for freehold assets is broader and more liquid, attracting a far larger portion of international capital, which fuels stronger price growth. Leasehold properties tend to serve a niche, more cost-sensitive buyer, limiting your options at exit.

Performance data from 2023 to 2025 shows a clear return premium for freehold over leasehold, especially in the villa and luxury segments. Last year's benchmarks showed freehold assets made up around 70% of residential sales. Villa prices in prime communities like Emirates Hills increased by up to 15% year-on-year, easily outpacing the 9% average growth across the wider residential market. Understanding broader smart Dubai property investment strategies is critical to maximizing these returns.

Liquidity and Exit Strategy Implications

The exit strategy for a freehold property is straightforward. You can sell it on the open market to any buyer, local or international (within designated zones). This creates a deep, competitive pool of buyers, ensuring you can achieve fair market value efficiently.

Leasehold properties present a more complex exit. Any potential buyer will focus on:

- Remaining Lease Term: An asset with 85 years remaining is entirely different from one with 65. The shorter the term, the smaller the buyer pool.

- Financing Hurdles: Banks are reluctant to lend against properties with shorter leases, eliminating a large number of potential buyers.

- Landlord Consent: Selling a leasehold property often requires consent from the ground landlord, adding delays and complexity to the transaction.

For family offices and HNWIs focused on intergenerational wealth, the distinction is fundamental. A freehold asset can be passed down through generations as a perpetual, value-accruing holding. A leasehold asset is, by definition, a depreciating right that will eventually expire.

The current market cycle reflects this reality. Investors are prioritizing asset quality and long-term security, which is why freehold communities continue to absorb the majority of inbound capital. A comprehensive Dubai property market forecast shows this trend will continue as the city further cements its status as a global hub for private wealth.

Securing Financing and Understanding Lender Appetite

Access to leverage can transform an investment's return. In Dubai's real estate market, a property's ownership structure directly influences a lender's willingness to finance it. This is a critical factor that can define your entire acquisition strategy.

Financial institutions across the UAE have a clear preference for freehold assets. The perpetual ownership provides stronger, more secure collateral, which translates into tangible benefits for the borrower. This means higher loan-to-value (LTV) ratios, more competitive interest rates, and mortgage tenures up to 25 years. Understanding this superior access to leverage is a core part of learning how to invest in Dubai real estate effectively.

The Underwriting Hurdle for Leasehold Assets

Financing a leasehold property is a different exercise, filled with underwriting challenges. Lenders are acutely aware of "lease decay"—the fact that the asset's value diminishes as its term shortens. This introduces a risk they must account for.

Banks impose stringent requirements that can make many leasehold properties unmortgageable for new buyers. The most common stipulation is a minimum remaining lease term. Lenders typically require the lease to extend 30 to 40 years beyond the full mortgage term. For a 25-year mortgage, this means the property must have at least 55-65 years left on its lease at the time of purchase, instantly disqualifying a large portion of older leasehold stock.

A lender's primary concern is what the asset will be worth when the loan is paid off. With a freehold property, the asset is perpetual. With a leasehold, the asset's value is guaranteed to decline, making it inferior collateral.

Modelling the Financial Impact

To see how this plays out, let's model the acquisition of an AED 5 million property. The financing terms a bank will offer vary based on the title, directly impacting your initial capital outlay and total cost of borrowing.

Financing Scenario: Freehold vs. Leasehold (AED 5M Property)

| Metric | Freehold Financing | Leasehold Financing |

|---|---|---|

| Typical LTV Ratio | 80% for residents | 60% (if eligible) |

| Loan Amount | AED 4,000,000 | AED 3,000,000 |

| Investor Equity (Down Payment) | AED 1,000,000 | AED 2,000,000 |

| Mortgage Tenure | Up to 25 years | Typically capped at 15-20 years |

| Interest Rate | More competitive rates | Higher rates due to perceived risk |

The initial capital needed for the leasehold property is double that of the freehold equivalent. This severely impacts cash flow and the ability to deploy capital across other opportunities. The robust protections under the current UAE property law and RERA's escrow account system give lenders the confidence to extend more aggressive terms on freehold titles.

Comparing Governance, Service Charges, and Owner Control

An investor's control over an asset extends beyond the title deed. The ongoing governance structure—who controls service charges and manages the community—directly impacts operational costs and the long-term health of your investment. Here, the difference between freehold and leasehold is a fundamental gap in control.

In a freehold master community, governance is handled through an Owners' Association (OA), regulated by RERA. This is a body made up of property owners. They hold the power to approve annual budgets, hire or fire building management, and make collective decisions. This structure gives you a direct line of sight into where your money is going.

Dissecting Service Charge Structures

Leasehold arrangements usually keep control with the master developer or ground landlord. They typically set service charge calculations and manage the building’s operations. This can be efficient but often comes at the cost of transparency, leaving owners with little power to challenge rising fees.

For HNWIs who treat real estate as a managed asset, this distinction is critical. When buying off-plan property in Dubai, a deep dive into projected service charges and the governance model is a crucial step in forecasting net returns.

In a freehold tower, a well-run Owners' Association acts like a disciplined board of directors for the asset. In many leasehold scenarios, owners are stakeholders with limited voting rights, subject to the unilateral decisions of the landlord.

A Comparative Cost Analysis

To understand the financial impact, let's look at typical ongoing costs. The governance model dictates how fees are structured, justified, and controlled. The following table breaks down what these charges usually cover and highlights the difference in owner oversight.

Comparative Analysis of Investor Control and Ongoing Costs

| Factor | Freehold Property | Leasehold Property |

|---|---|---|

| Service Charge Control | Budget approved annually by a vote of the Owners' Association. | Set by the master developer or landlord, with limited owner input. |

| Management Oversight | Owners can vote to appoint or replace the building management company. | Management is typically appointed and controlled by the landlord. |

| Transparency | RERA mandates audited financial statements be shared with all owners. | Transparency levels can vary; less stringent reporting requirements. |

| Typical Covered Costs | Common area maintenance, security, landscaping, pool, gym, insurance. | Similar costs, but may also include a management fee for the landlord. |

| Potential for Disputes | Disputes are handled through RERA and the OA's internal governance. | Disputes are resolved directly with the landlord, potentially favoring them. |

For an investor calculating net yield, the predictability and control over these recurring expenses are key. The freehold model, with its mandated transparency and owner-led governance, offers a structurally sounder framework for long-term asset management.

When Does a Leasehold Property Make Sense?

While a freehold-first strategy is the bedrock of long-term wealth creation, writing off leasehold entirely would be an analytical mistake. There are niche scenarios where a leasehold property serves a specific, tactical goal—as long as you accept its limitations.

One of the clearest use cases is securing a foothold in a location where freehold is unavailable. Think of prime, geographically locked areas near Dubai Creek or certain heritage commercial zones. In these spots, leasehold isn't a choice—it's the only access to a high-demand micro-market.

Commercial and Yield-Focused Scenarios

The math looks different for commercial assets. A business with a 15-year operational plan might find a 20-year lease on a retail unit logical. Here, the lower cost of entry aligns with a business plan where the asset's job is utility, not capital growth.

Similarly, some investors use leasehold properties for targeted, short-to-medium-term rental yield plays. They knowingly trade long-term appreciation for a lower initial investment, aiming to maximize cash flow over a 5-to-10-year horizon before exiting. This demands sharp financial modeling to ensure the yield justifies the predictable decay in the lease's value.

A leasehold asset is an instrument with a fixed maturity date. Success requires treating it as such—calculating returns against a known timeline and accepting that its terminal value is effectively zero. It is a cash flow tool, not a legacy asset.

Analysing the Trade-Offs

The decision to buy a leasehold property comes down to a disciplined assessment of how it fits within your wider portfolio. They are not comparable on a like-for-like basis.

Instead, ask these questions:

- Objective Alignment: Does this property serve a temporary business need or a specific cash flow target that is more important than long-term capital growth?

- Entry Cost Advantage: Is the upfront capital saving significant enough to be deployed in higher-growth assets elsewhere, balancing out the portfolio?

- Exit Clarity: Do you have a clear, realistic exit plan that acknowledges the shrinking lease term and the smaller buyer pool?

This balanced perspective is crucial. For investors structuring a diverse portfolio, understanding the tactical applications of leasehold can be an advantage. For those exploring specific high-yield strategies, our guide to Dubai off-plan property investment offers deeper analysis.

Final Thoughts: Strategy Over Speculation

The window for 'easy flips' has narrowed. Success in 2026 requires targeting communities with genuine infrastructure growth—specifically those connected to the expanding metro lines and new economic corridors like Dubai South. At Proact Luxury Real Estate, we track these infrastructure corridors daily.

A thorough Dubai real estate market analysis confirms that smart capital continues to pour into well-governed, prime freehold communities as the market matures beyond last year's benchmarks. The freehold structure, with its perpetual ownership and greater control, aligns with the certainty required for intergenerational wealth planning.

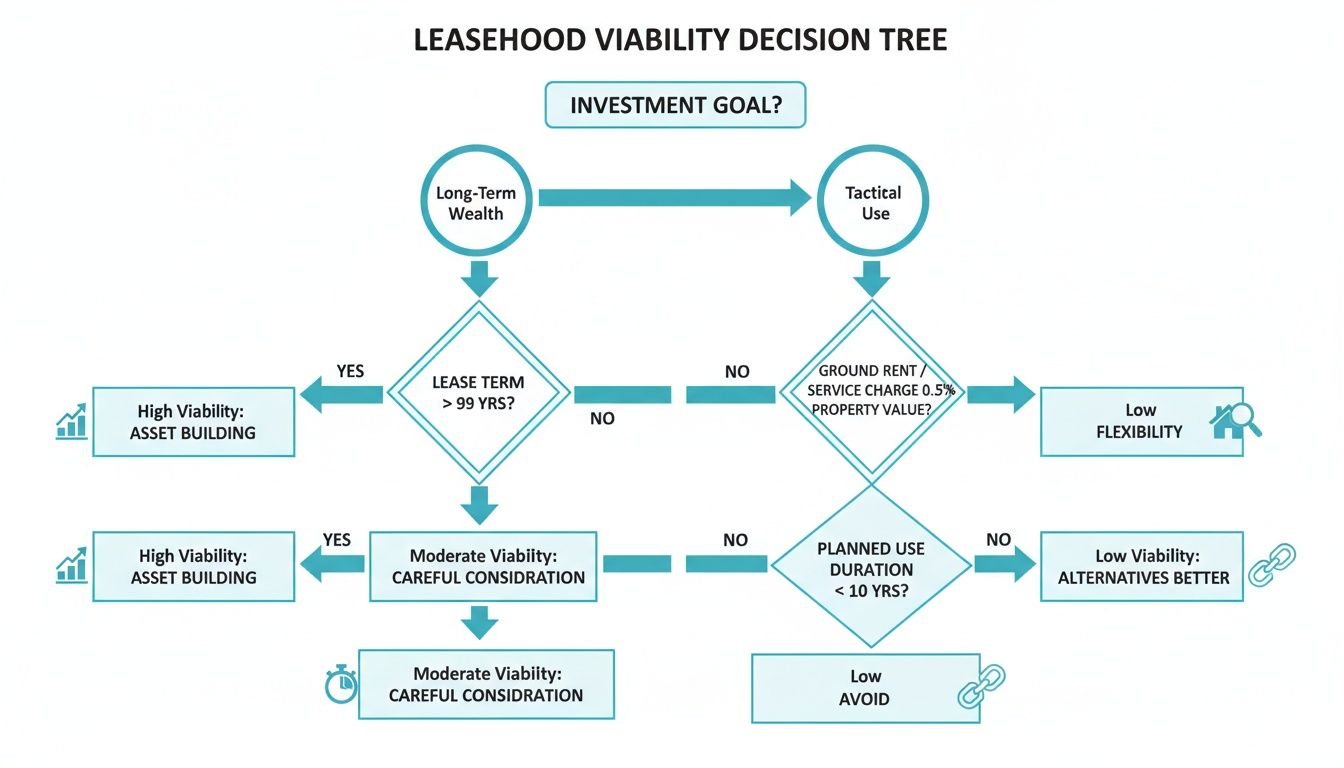

The visual makes it clear: if long-term wealth creation is the goal, freehold is the logical path. We model outcomes based on forward-looking infrastructure development and how new UAE property law regulations or changes to taxes on property might impact net returns.

If you are rebalancing your portfolio for 2026, let's run the numbers.

Frequently Asked Questions

When navigating Dubai's property market, a few critical questions always arise. Getting straight answers is essential for protecting the long-term value of your investment. Here are the most common queries we tackle for clients, framed for the 2026 market.

Can a Leasehold Property in Dubai Be Converted to Freehold?

In almost every case, the answer is no. The ownership structure is determined by the official designation of the land, a classification set by the Dubai government and the master developer.

For a property to switch from leasehold to freehold would require a top-down re-zoning of an entire district by the authorities, an exceptionally rare event. An investor must assume that the ownership type purchased is the one they will hold for the life of the asset.

How Does Golden Visa Eligibility Differ for Property Owners?

The main requirement for a property-linked Golden Visa is an investment of AED 2 million or more. While a freehold property offers a clean path to eligibility, the rules for leasehold assets are tighter.

A leasehold property only qualifies if the original lease was for at least 99 years. The critical detail is that there must be a minimum of 10 years left on the lease when you apply for or renew your visa. This makes freehold a far more reliable anchor for long-term residency plans tied to a what-is-golden-visa-uae strategy.

What Are the Key Differences in Inheritance Laws?

Inheritance is where the fundamental gap between these ownership models becomes clear, particularly for expatriate investors.

With a freehold property, UAE law allows non-Muslim expats to register a will with the Dubai Courts or DIFC Wills Service Centre. This lets you apply your home country's inheritance laws, providing certainty for intergenerational wealth transfer.

With a leasehold, what your heirs inherit is not the property itself, but the remaining years on the lease agreement. As this term shrinks with each passing generation, the value of the inherited asset systematically declines. This makes leasehold a poor choice for building a family legacy.

Are Service Charges Higher in Freehold or Leasehold Buildings?

There is no universal rule, but the governance structure creates different financial realities. Generally, the freehold structure offers better cost control and transparency.

In freehold communities, the Owners' Association (OA)—a body of property owners—votes on and approves the annual service charge budget. This process, overseen by RERA, promotes accountability.

In many leasehold buildings, the ground landlord or master developer sets service charges unilaterally. These fees often include their own management charges, which can lead to higher, less transparent costs. The freehold model fundamentally gives you more control over your long-term operational costs.

At Proact Luxury Real Estate, our advice goes beyond the transaction. We focus on strategic asset management and portfolio optimization for 2026 and beyond. If you're weighing opportunities in Dubai's prime real estate market, let's set up a detailed consultation.