While many investors focus on Downtown, the smart money is shifting towards new master communities with tangible infrastructure catalysts. Last year, the market absorbed an unprecedented volume of off-plan launches, but entering 2026, the key metric is no longer absorption rate—it is the quality of the payment plan and the developer's commitment to delivery.

The post-Covid boom cycle has matured into a sustainable growth phase. This requires a shift in investor strategy from speculative flips to long-term asset management, focusing on freehold areas positioned for the next wave of economic expansion.

The Legal Bedrock: Why Freehold Remains the Superior Asset Class

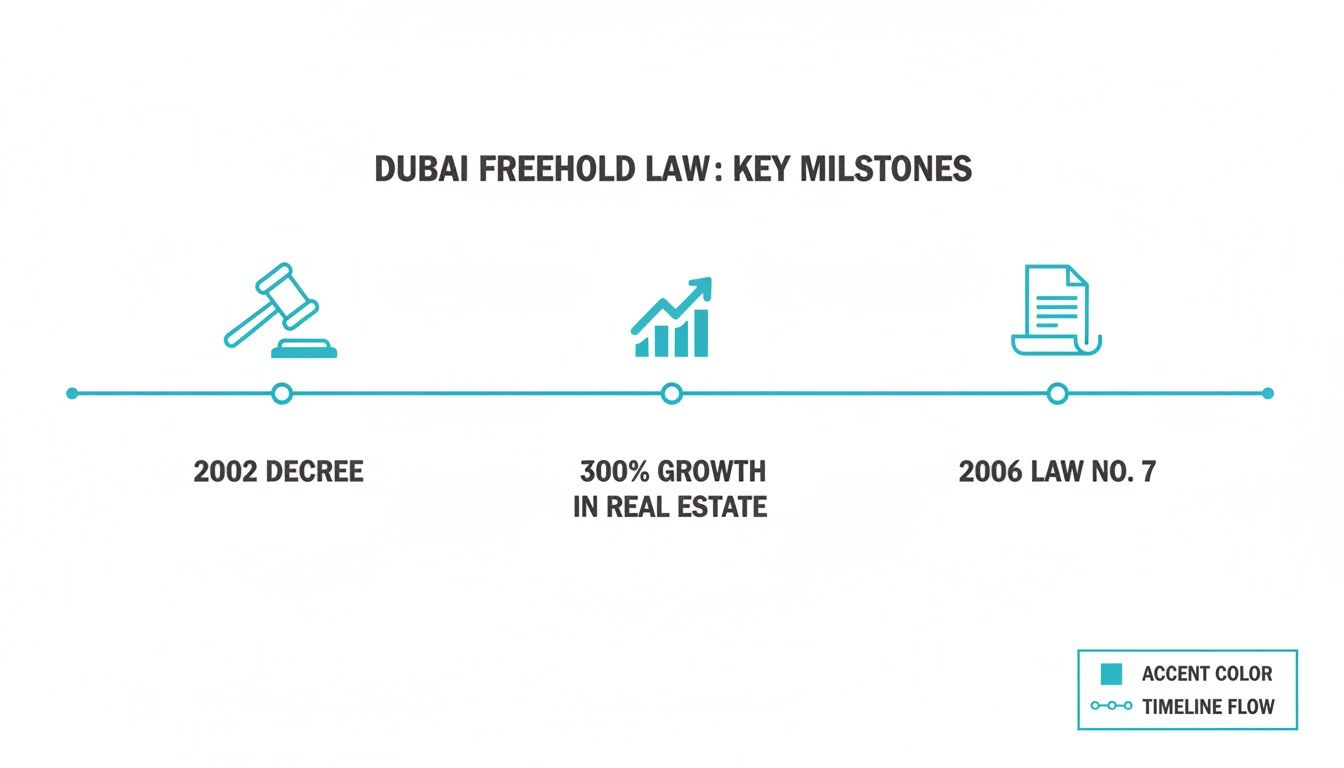

To understand the 2026 market, one must first appreciate its foundation. Dubai's framework for foreign ownership was built on decisive legal maneuvers that transformed the city into a global capital magnet. This history explains the stability and growth trajectory we see today, which is critical for portfolio-level decision-making.

From Decree to Global Standard

The pivotal moment was in 2002, when H.H. Sheikh Mohammed bin Rashid Al Maktoum issued a decree permitting foreign nationals to own property in designated areas. This unlocked a torrent of international capital, fueling a construction cycle that saw asset prices climb by 300-400%. Early projects like Emirates Living and Dubai Marina were the first to capitalize.

This momentum was codified with Law No. 7 in 2006. This legislation created a robust legal framework that gave institutional investors and HNWIs the certainty needed to commit serious capital, clearly defining the freehold areas in Dubai. Adherence to this UAE property law remains a cornerstone of market stability.

Lasting Impact on the 2026 Market

The legal structures established nearly two decades ago directly influence today's market dynamics. They are the reason RERA protections, such as mandatory escrow accounts for off-plan investments, exist.

This context is crucial. It explains why freehold remains the superior asset class for building a diversified portfolio. The principles laid down then are directly responsible for the market’s resilience and its ability to support sustainable growth, moving beyond the speculative volatility of its early years.

Analyzing the Data: The Widening Freehold Performance Gap

Capital is allocated based on data, not anecdotes. A quantitative analysis reveals a clear and widening performance gap between freehold and non-freehold properties in Dubai. Understanding this is essential for calculating an asset's real long-term value.

Historical data shows land prices in freehold zones have surged an incredible 495.8%, dwarfing the 240.7% growth in non-freehold areas—a 255-percentage point premium. More recently, last year's benchmarks from the Dubai Land Department confirm that prime freehold properties consistently outperformed leasehold counterparts by 12-18%.

The infographic below traces the legal milestones that built this powerful investment environment, from the initial decree to the formal laws that provide market stability today.

There is a clear cause-and-effect relationship. Foundational legal changes paved the way for periods of growth, creating the secure framework global investors now depend on.

The Mechanics of Resale Value and Asset Liquidity

The performance premium is driven by the mechanics of asset erosion inherent in any leasehold structure. A leasehold is a depreciating asset; as the term shortens, its underlying value erodes, impacting both resale potential and its utility as loan collateral.

Freehold ownership grants perpetual title, insulating the asset from this time-based decay. This has two powerful consequences for an overseas landlord:

- Investment Pros: Freehold properties attract a larger, global buyer pool, creating greater liquidity and enabling faster portfolio rebalancing.

- Investment Cons: The initial acquisition cost is higher, reflecting the intrinsic value of perpetual ownership.

A Comparative Analysis of Investment Metrics

To put this into perspective, let's analyze the assets based on last year's market benchmarks. The data clearly shows that freehold properties don't just appreciate faster; they offer superior exit liquidity—a critical metric for any HNWI portfolio manager. The current dubai-real-estate-market-analysis suggests this trend will continue.

The most critical metric is not entry price but exit value. The freehold premium is a hedge against the liquidity risk and value erosion intrinsic to leasehold agreements.

The table below provides a top-level comparison of key performance indicators, breaking down the tangible financial advantages of owning freehold property in Dubai.

Freehold vs. Leasehold Investment Metrics (Based on 2025 Data)

Here is a comparative look at key performance indicators for freehold and leasehold properties. The numbers illustrate the superior blend of capital growth and liquidity offered by freehold assets.

| Metric | Freehold (e.g., Downtown Dubai) | Leasehold (e.g., Deira) |

|---|---|---|

| 5-Year Capital Appreciation | 35-40% | 20-25% |

| Average Rental Yield | 5.5% - 7% | 6.5% - 8% (with higher risk) |

| Asset Liquidity (Avg. Days on Market) | 45-60 Days | 90-120+ Days |

| Financing Eligibility (LTV Ratio) | Up to 80% for Residents | Often lower; lender dependent |

The data confirms a key strategic point: while some leasehold areas might show slightly higher initial rental yields to compensate for risk, freehold properties deliver a superior combination of capital growth, security, and ease of transaction.

New Freehold Zones: Strategic Expansion Corridors for 2026

While new master communities capture headlines, a more strategic move is reshaping Dubai's urban core. In a landmark policy shift during Q3 2025, the Dubai Land Department unlocked hundreds of previously restricted plots for freehold conversion, signaling a new phase of strategic densification. This is a fundamental recalibration of land value along the city's established economic arteries.

The policy opened 457 plots for conversion—128 along the critical Sheikh Zayed Road corridor and 329 in the waterfront district of Al Jaddaf. These areas, once off-limits to foreign ownership, can now be converted by paying a 30% fee based on the property's gross floor area valuation.

This move supports Dubai’s Real Estate Strategy 2033, which targets a 70% increase in market transactions. For institutional investors and family offices, this presents two distinct, high-yield opportunities requiring different strategic approaches.

Sheikh Zayed Road: The Redevelopment Play

Plots along Sheikh Zayed Road (SZR), from the Trade Centre Roundabout to the Dubai Canal, are a classic redevelopment opportunity. Many of these parcels are occupied by older buildings that no longer represent the land's highest and best use.

The conversion fee should be analyzed as a capital expenditure that unlocks immense redevelopment potential. For SZR assets, the play is not the existing structure but the plot ratio and the potential for new, premium mixed-use or branded residential towers.

The investment thesis is straightforward: acquire, convert, demolish, and rebuild. Proximity to DIFC and Downtown Dubai ensures demand for premium commercial and residential space.

- Investment Pros: High potential for land value uplift and premium gross development value (GDV).

- Investment Cons: Requires substantial capital for conversion fees and construction, with longer holding periods.

Al Jaddaf: The Waterfront Growth Corridor

Al Jaddaf presents a different scenario. This is about completing a high-potential master plan along the Dubai Creek. It offers waterfront views and direct access to major transport links, positioning it as a future luxury residential hub.

Unlike SZR, Al Jaddaf offers ground-up development of entire community concepts. Turning these plots freehold de-risks the proposition for developers, who can now launch large-scale projects for a global buyer base. Early movers are positioning themselves ahead of inevitable infrastructure and amenity upgrades.

[Map: New freehold conversion zones relative to Dubai Canal and Downtown]

The investment focus here is future capital appreciation driven by placemaking. This is a rare opportunity to acquire freehold waterfront plots in the heart of "Old Dubai."

Calculating the Break-Even Point

The viability of these conversions depends on the break-even point. The 30% fee must be offset by the projected increase in the asset's final value. The formula is: (Projected Freehold Value - Current Leasehold Value) > Conversion Fee.

A sophisticated analysis must factor in construction costs, holding periods, and projected rental and sales values. This expansion of freehold areas in Dubai demands active asset management, not passive investment. For more on upcoming projects, see our guide on the best areas to buy property in Dubai.

Profiling Premier Off-Plan Freehold Communities for 2026

The speculative market of last year has cooled, replaced by a calculated investment cycle. For 2026, the focus for HNWIs is shifting from quick flips to assets within master-planned freehold areas with strong, long-term fundamentals. This requires a forensic look at upcoming off-plan launches.

Success now means targeting specific projects from proven developers in corridors of future growth. Three areas warrant close attention: The Valley Phase 2, the next stages of Dubai South, and the expanding pipeline of branded residences.

The Valley: Phase 2 Maturation

Emaar’s build-out of The Valley is a calculated bet on the mid-market luxury villa and townhouse segment. Last year's data for this community showed robust demand from end-users, particularly young families. The upcoming second phase builds on this momentum.

- Investment Pros: Capital appreciation is tied to community maturation (schools, retail). Emaar's track record provides a high degree of confidence.

- Investment Cons: Located further from the city center, making it a longer-term play dependent on surrounding infrastructure development.

The key shift is in payment structures. The 1% monthly plans of 2025 are being replaced by more conservative 60/40 and 70/30 models. This filters out speculators and attracts committed investors, stabilizing prices.

Dubai South: The Aerotropolis Effect

Dubai's economic center of gravity is moving south. The expansion of Al Maktoum International Airport is the region's largest infrastructure project, and Dubai South's residential communities are positioned to benefit.

The next development phases here are foundational pieces of a new city. An investment in this freehold area is a direct play on Dubai's long-term aviation and logistics strategy. Proximity to the airport and Expo City creates a powerful economic ecosystem, making it one of the most compelling best off-plan projects in Dubai for any portfolio.

For an asset manager, Dubai South is a logistics-driven economic zone that will generate tens of thousands of professional jobs, creating sustained demand for quality housing.

The investment case is clear: aligning capital with government-backed infrastructure and a future tenant pool. However, timelines are longer, requiring a patient capital approach. [Map: Location relative to Al Maktoum Airport]

Branded Residences: The Flight to Quality

The branded residence segment continues to outperform the general market, a trend driven by a global flight to quality. Last year's transaction data showed a clear price premium for these properties. In 2026, this trend is expanding beyond Palm Jumeirah and Downtown.

New projects are being announced in emerging luxury corridors. They offer HNWIs the service standards of a top-tier hotel with the security of a freehold title. For international investors, such an asset is a straightforward path to residency, aligning with criteria for the Golden Visa UAE.

Off-Plan Community Investment Profile

The table below provides a data-driven overview of these key off-plan communities, comparing payment plans and projected returns. This analysis is critical for aligning acquisitions with portfolio goals.

[Chart: 2026 Payment Plan Breakdown]

| Community | Lead Developer | Typical Payment Plan (2026) | Projected 3-Year Capital Growth | Target Rental Yield |

|---|---|---|---|---|

| The Valley (Phase 2) | Emaar | 70/30 or 60/40 | 18-22% | 5.5% - 6.5% |

| Dubai South (Residential) | Dubai South Properties | 60/40 | 25-30% (longer-term) | 6.0% - 7.0% |

| Branded Residences | Various Tier-1 | 50/50 or 40/60 | 20-25% | 4.5% - 5.5% |

This data shows the market's growing maturity. Developers are demanding higher upfront commitments—a sign of confidence. For investors, this requires more initial capital but provides a more stable foundation for growth. For a look at what is available, check out this new development in Dubai.

The Legal and Financial Framework

Acquiring freehold property in Dubai is a disciplined and transparent process guided by a mature regulatory system. Understanding this framework is your most important risk management tool.

The transaction begins with a Memorandum of Understanding (MOU), a binding contract outlining the terms. Next is securing a No Objection Certificate (NOC) from the developer, confirming no outstanding debts. These steps lead to the official transfer at the Dubai Land Department (DLD).

The Power of RERA and Escrow Accounts

For off-plan purchases, the Real Estate Regulatory Agency (RERA) provides serious investor protections, headlined by the mandatory use of escrow accounts (Law No. 8 of 2007).

This law is simple: all buyer payments go directly into a RERA-approved bank account, not to the developer. Withdrawals are only permitted after hitting verified construction milestones. This mechanism ensures your money is used for construction and reduces financial mismanagement risk.

Budgeting for Closing Costs

To accurately calculate ROI, you must know the true acquisition cost. Budget for closing costs that total around 7% of the property's value. Understanding these taxes on property is essential.

- DLD Transfer Fee: 4% of the property’s value.

- Agency Commission: 2% of the purchase price.

- Trustee Fees: Administrative charges, around AED 4,200.

- NOC Fee: A developer fee ranging from AED 500 to AED 5,000.

Factoring these figures in from the start is essential for accurate financial planning.

Structuring Your Investment

While personal ownership is common, investors often use corporate structures for better portfolio management. A structure such as a dubai-llc-company-setup can offer liability protection and succession planning advantages.

Local banks are open to financing for international buyers, though loan-to-value (LTV) ratios may be more conservative. A well-prepared application is key. For more detail, our guide on freehold versus leasehold properties in Dubai offers a deeper dive.

Final Thoughts: Strategy Over Speculation

The window for 'easy flips' has narrowed. Success in 2026 requires targeting communities with genuine infrastructure growth—specifically those connected to expanding metro lines and the aerotropolis in Dubai South.

The metrics that now matter are specific: infrastructure completion timelines, integration of new transport links, and the quality of community management. The era of buying anywhere and expecting appreciation is finished. Today, location, connectivity, and fundamentals are everything, a shift our Dubai property market analysis confirms.

The most resilient portfolios will be built on properties within master communities possessing their own economic gravity. These self-sustaining ecosystems attract long-term residents, creating sustainable rental yields and real capital growth. Success from this point is about anticipating where the economic and demographic center of gravity is moving.

If you are rebalancing your portfolio for 2026, let's run the numbers. At Proact Luxury Real Estate, we track these infrastructure corridors daily.

Key Investor Questions Answered

Navigating Dubai's property market from overseas raises valid questions. Here are direct answers for HNWIs and international investors.

What is the practical difference between Freehold and Leasehold?

Freehold is absolute ownership. You own the property and the land it sits on, in perpetuity. Your name is on the title deed at the Dubai Land Department (DLD), and you can sell, lease, or bequeath the asset.

Leasehold is a long-term rental, typically for up to 99 years. You have the right to use the property, but you never own the land. As the lease term shortens, the property's value can decrease, impacting capital appreciation.

Can foreign nationals buy freehold property without restriction?

Yes. Any foreign national can purchase freehold property within government-approved zones. The process is regulated by the Real Estate Regulatory Agency (RERA), making it one of the most secure systems for international investors.

A property investment of AED 2 million or more makes you eligible to apply for the what-is-golden-visa-uae. This is a long-term residency visa designed to attract global investors and talent.

What are the actual closing costs I should budget for?

Budget approximately 7% of the property's purchase price for closing costs. This provides a realistic picture of your total cash outlay.

- DLD Transfer Fee: 4% of the property value.

- Agency Commission: 2% of the purchase price, plus VAT.

- Registration Trustee Fees: Around AED 4,200.

- Developer NOC Fee: Between AED 500 and AED 5,000.

How does RERA protect my funds in an off-plan project?

RERA's system revolves around mandatory Escrow accounts, established under Law No. 8 of 2007.

The Escrow Law is the single most important regulation protecting off-plan buyers. It ties developer financing to construction progress, not sales velocity, fundamentally de-risking the investment.

All payments go into a RERA-approved escrow account. The developer can only withdraw funds after hitting specific, independently verified construction milestones. This system prevents the misuse of your funds. Additionally, all off-plan projects must be registered with RERA, confirming the developer legally owns the land and has all necessary permits.