While many investors view the UAE through a single lens, the fundamental difference between its two primary real estate markets is stark. Dubai offers velocity and high-yield opportunities, while Abu Dhabi provides stability and long-term capital preservation. The choice is not about which is 'better', but which aligns with your portfolio's objectives for 2026.

Last year’s benchmarks, where Dubai's transaction volumes captured headlines, must now be weighed against Abu Dhabi's strategic, state-backed projects altering capital flows. Are you underwriting for tactical cash flow generation, or is your strategy focused on steady, strategic asset growth?

An Investor Briefing for the UAE Real Estate Market

As we enter 2026, the conversation among HNWIs has matured beyond the post-Covid boom. The focus has pivoted from chasing short-term gains to securing long-term asset stability and targeting sustainable growth corridors.

Viewing Dubai and Abu Dhabi as interchangeable luxury hubs is a surface-level analysis. Their underlying economic structures present two distinct investment theses for a discerning asset manager. This analysis provides a quantitative framework for allocating capital, dissecting capital appreciation forecasts, rental yield sustainability, and the critical differences in their off-plan market maturity.

Last year's data, which showed a market in transition, sets the stage for the strategic shifts we are now witnessing. A thorough Dubai real estate market analysis from 2025 confirms this pivot. The real question for 2026 is no longer 'which city is better?' but 'which city's economic trajectory aligns with my capital objectives?'

| Metric | Dubai | Abu Dhabi |

|---|---|---|

| Primary Driver | Global tourism, trade, finance | State-led non-oil diversification |

| Market Velocity | High-volume, fast-paced transactions | Measured, controlled supply |

| Investor Thesis | High rental yields, tactical gains | Capital preservation, appreciation |

| Typical Tenant | Expatriate professionals, tourists | High-income, long-term residents |

This briefing provides a data-driven comparison to guide your allocation strategy. It focuses on the forward-looking indicators that will shape returns through 2026, examining how foundational differences impact everything from off-plan payment structures to the viability of specific growth corridors.

Analyzing Two Divergent Economic Growth Models

To understand the Dubai versus Abu Dhabi property markets, one must analyze the economic engines driving them. These fundamentals dictate long-term asset performance far more than short-term market hype. An investor needs to know where tenant demand and capital originate.

Abu Dhabi’s strategy is deliberate, state-led diversification away from oil, creating a stable, high-income employment base that supports premium property values. Dubai is a high-velocity ecosystem fueled by global tourism, trade, and finance, which creates a more dynamic but also more cyclical rental market.

State-Led Stability Versus Private Sector Velocity

Abu Dhabi's focus on foundational sectors like advanced manufacturing and renewable energy cultivates long-term residential demand. Employees in these fields seek stable family homes, which translates into consistent, predictable rental income for investors. This model prioritizes economic resilience over volume-driven growth.

Dubai thrives on its connectivity to the global economy. Its reliance on hospitality, logistics, and a transient professional population creates a deep and liquid rental market, particularly for short-term lets. This can generate higher gross yields but also exposes the market to greater volatility tied to international business cycles.

The investor question in 2026 is direct: are you underwriting your asset against the stability of a sovereign-backed economic plan or the high-yield potential of a global commercial hub? One model offers lower volatility and steady appreciation; the other offers superior cash flow with higher cyclical risk.

This difference is clear in the macroeconomic data. Abu Dhabi's non-oil economy has become a dominant force. In the first half of 2025, its non-oil sectors expanded by 6.37% year-on-year, comprising 56.8% of the emirate's total GDP in Q2 2025. The real estate sector alone grew by 10% in H1 2025, pushed by population growth and sustained foreign investor interest. The official SCAD report on Abu Dhabi's accelerating non-oil GDP growth provides further detail.

Impact on Real Estate Sub-Sectors

These two models create different types of opportunities. Abu Dhabi’s economic gravity pulls in talent for major projects, fueling demand in master-planned communities like Saadiyat and Yas Islands. The development of new entertainment districts on Yas Island exemplifies this strategy, creating an ecosystem that supports residential property values. Our analysis of how Disneyland Abu Dhabi could be a real estate game-changer details this potential.

In Dubai, growth is more geographically dispersed and tied to logistical infrastructure. The expansion of Al Maktoum International Airport is the primary catalyst for value appreciation in Dubai South. This is an investment in global connectivity, not domestic industry.

The choice in the dubai v abu dhabi comparison is an allocation decision. An asset in Abu Dhabi is a long-term hold, tethered to the emirate's sovereign wealth. An asset in Dubai is a play on global economic currents, offering higher liquidity and cash-flow potential.

Comparing Capital Appreciation Against Rental Yields

For any serious investor, the conversation boils down to one fundamental choice: are you hunting for capital growth or immediate cash flow? The data from Q4 2025 shows a clear divergence. Abu Dhabi is cementing its reputation as the market for long-term value, while Dubai continues to dominate as the engine for generating rental income.

Your decision is not about which emirate is "better"—it is about which return profile fits your strategic goals for 2026. This split comes directly from their different economic models and how they manage real estate supply.

Abu Dhabi: Capital Growth Driven by Controlled Supply

Abu Dhabi's methodical release of new property, mostly through state-backed master developers, creates a supply-and-demand tension that naturally supports prices. This is evident in prime areas like Saadiyat Island and Yas Island, where new launches are timed with major government projects designed to attract a high-income resident base.

Looking at last year's benchmarks, while Abu Dhabi had fewer transactions than Dubai, the price per square foot in these premium communities showed a steadier climb. The strategy is about building entire ecosystems, creating a solid foundation for long-term asset value. For an investor whose priority is wealth preservation, Abu Dhabi's market structure is inherently more defensive.

Dubai: Rental Yields Fuelled by Market Velocity

Dubai’s mature, high-volume market is a machine for delivering superior net rental yields. This is powered by a massive short-term rental market fed by global tourism and a constant stream of expats needing long-term leases. While high tenant turnover requires more hands-on management, it allows for more frequent rent recalibration to market rates.

Last year's economic data confirms this. Dubai’s tourism sector is a powerhouse, welcoming 9.9 million international overnight visitors in H1 2025 alone. For investors chasing high-yield opportunities, Dubai’s rental machine feeds directly off this demand.

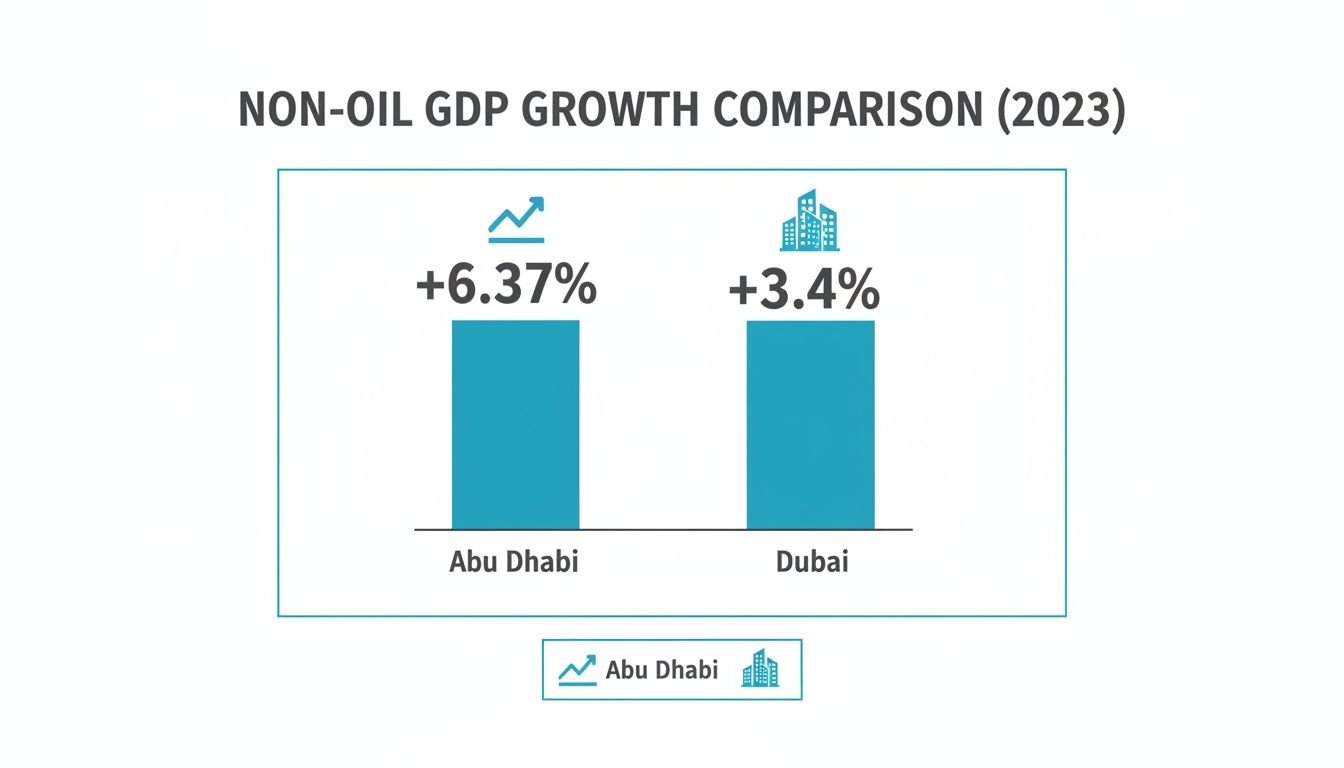

This chart of non-oil GDP growth highlights the different economic engines at play.

Abu Dhabi's accelerated diversification creates a high-income job market that supports property price growth, while Dubai's tourism-fueled economy keeps its high-velocity rental market churning.

For the asset manager, the choice is clear: Do you allocate capital for the steady, infrastructure-led appreciation in Abu Dhabi, or deploy it for the higher-velocity, tourism-driven cash flow in Dubai? The optimal strategy may involve a calculated blend of both.

The table below benchmarks key investor metrics from the end of 2025, providing a clear quantitative snapshot.

Investor Metrics Benchmark: Dubai vs Abu Dhabi

This table offers a comparative analysis of key performance indicators for prime residential real estate, based on end-of-year 2025 data.

| Metric | Dubai (Prime Zones) | Abu Dhabi (Prime Zones) | Dominant Investor Thesis |

|---|---|---|---|

| Average Capital Appreciation (2025) | +8-12% | +10-15% | Abu Dhabi's controlled supply supports stronger price growth. |

| Average Gross Rental Yield (2025) | 6.5-8.0% | 5.5-6.5% | Dubai's high rental demand delivers superior cash flow. |

| Transaction Volume Growth (YoY 2025) | +18% | +12% | Dubai remains the more liquid and high-velocity market. |

| Primary Demand Driver | International Investors & Expats | Domestic & Institutional Capital | Reflects differing economic foundations and risk profiles. |

As we move through 2026, these trends are set to continue. New projects in emerging Dubai communities like Dubai South will cater to the mid-market luxury rental segment, while new branded residences in Abu Dhabi target the capital appreciation segment. A detailed Dubai property market forecast can provide deeper context on these developing sub-markets. Your investment in the dubai vs abu dhabi landscape must be a conscious decision between asset value growth and immediate income generation.

Deconstructing Off-Plan Investment Structures and Risks

The off-plan market is where the strategic chasm between Dubai and Abu Dhabi becomes most visible. An investor's approach to this segment must be different in each emirate, as the risk profiles, payment structures, and secondary market liquidity are worlds apart.

Last year’s benchmarks confirmed this divergence. Dubai’s off-plan sector was a high-volume machine driven by aggressive payment plans, while Abu Dhabi’s was a measured release of assets tied to long-term economic goals.

The Great Payment Plan Divide

In Dubai, the prevailing model from last year was often a 60/40 or 70/30 payment plan, where the bulk of capital is due during construction. This structure offers high leverage and appeals to investors seeking to time the market for a flip before handover. However, it introduces market timing risk; a price adjustment during construction can erode equity before the asset is completed.

Abu Dhabi typically favors a more conservative 40/60 or 30/70 structure. Here, a smaller capital portion is committed during construction, with the majority due upon completion. This model is designed to attract end-users and long-term buy-to-let investors, fostering stability over speculative velocity.

Comparing Payment Liabilities and Investor Protections

Structural differences extend to regulatory oversight. Both emirates have robust systems tailored to their market dynamics. Understanding these nuances is critical when assessing risk.

- Dubai's RERA Framework: The Real Estate Regulatory Agency (RERA) mandates escrow accounts (Oqood) for all off-plan sales. This ensures developer funds are ring-fenced for project construction, a strong protection against project failure, especially in a market with numerous private developers.

- Abu Dhabi's DMT Regulations: The Department of Municipalities and Transport (DMT) oversees a similar escrow system. With fewer, larger, often state-backed developers, the counterparty risk is perceived as inherently lower. The focus is on ensuring the phased delivery of master communities aligns with broader economic initiatives.

The following table breaks down a typical liability schedule for a hypothetical AED 3 million property in each emirate, illustrating the difference in capital exposure.

| Payment Milestone | Dubai (60/40 Plan) | Abu Dhabi (40/60 Plan) | Capital Exposure Analysis |

|---|---|---|---|

| Down Payment (Booking) | AED 600,000 (20%) | AED 300,000 (10%) | Dubai requires a higher initial commitment, reflecting market confidence. |

| During Construction | AED 1,200,000 (40%) | AED 900,000 (30%) | Dubai's structure front-loads payments, increasing risk during the build phase. |

| On Handover | AED 1,200,000 (40%) | AED 1,800,000 (60%) | Abu Dhabi's back-loaded plan aligns better with end-user financing. |

| Total Paid Pre-Handover | AED 1,800,000 | AED 1,200,000 | A 33% lower capital outlay in Abu Dhabi before project completion. |

Secondary Market Liquidity: Flipping vs. Holding

The secondary off-plan market—where investors sell purchase agreements before handover—is another critical differentiator. Dubai’s market is exceptionally liquid, with high transaction volumes. This provides an exit route for speculators but also contributes to price volatility.

Abu Dhabi's secondary off-plan market is thinner. The investor base is more focused on long-term holds, and the transaction process is more deliberative. While this means less opportunity for rapid speculative gains, it insulates the market from sentiment-driven swings. For more detail, our guide on buying off-plan property in Dubai offers an operational breakdown.

Spotting Prime Communities and Future Growth Corridors

Investment success in 2026 is not about buying into saturated prime districts. The strategic play is identifying the next nexus of infrastructure and population growth, where government spending is laying the groundwork for future value. Capital is rotating from established areas into these new corridors.

The core difference in growth zones between Dubai and Abu Dhabi is the economic catalyst. Dubai's growth is logistical and demographic; Abu Dhabi’s is strategic and cultural, linked to its sovereign wealth agenda.

Dubai: The Aerotropolis and Mid-Market Demand

While Downtown and the Marina remain prominent, smart money now tracks major infrastructure projects. The expansion of Al Maktoum International Airport is the single most powerful catalyst for Dubai's southern corridor. [Map: Location relative to Al Maktoum Airport]

- Investment Pros:

- Dubai South: This is a calculated investment in a future aerotropolis. Off-plan launches here last year saw absorption rates hit over 85% within weeks, a demand surge driven by proximity to the airport and the Expo City ecosystem. This area represents the future of Dubai's mid-market luxury rental engine.

- The Valley Phase 2: Master communities like Emaar's The Valley are engineered for the growing upper-middle-class family demographic. They offer a price point and lifestyle increasingly rare in central Dubai, creating a powerful pull factor for long-term residents.

- Investment Cons:

- Construction timelines are long-term, requiring capital patience.

- Higher competition among developers could put pressure on rental rates initially.

For portfolio managers, Dubai's growth corridors offer volume and demographic depth. The investment thesis is direct: acquire assets in the path of logistical and population expansion before the infrastructure is fully priced in.

A granular understanding of which districts offer the best entry points is necessary. Our guide on the best areas to buy property in Dubai provides this deep-dive analysis.

Abu Dhabi: The Cultural and Capital Hub

Abu Dhabi's growth is more concentrated and capital-intensive. The emirate curates zones of excellence to attract and retain global wealth. The strategy is focused on creating an unassailable premium brand.

- Investment Pros:

- Saadiyat Island: The emirate's crown jewel. With the Guggenheim nearing completion, Saadiyat is transforming into a global cultural destination. New branded residences command premium prices justified by the island's unique positioning.

- Yas Island: The focus is on entertainment-driven real estate. Projects are linked to theme parks and the F1 circuit, creating a self-contained ecosystem that supports both short-term and long-term rentals.

- Investment Cons:

- Higher entry price points compared to Dubai's growth corridors.

- Less liquid secondary market for off-plan assets.

The table below breaks down the core value drivers for the primary growth zones in each emirate. [Chart: 2026 Payment Plan Breakdown]

| Growth Corridor | Primary Catalyst | Target Investor Profile | 2026 Outlook |

|---|---|---|---|

| Dubai South | Al Maktoum Airport Expansion | Yield-focused, portfolio diversification | Strong rental demand, steady capital appreciation. |

| The Valley (Dubai) | Mid-Market Luxury Demand | Long-term hold, end-users | High occupancy, community-driven value growth. |

| Saadiyat Island (AD) | Cultural Infrastructure | Capital preservation, trophy asset | Price premium, strong global demand. |

| Yas Island (AD) | Tourism & Entertainment | High-yield short-term rentals | Consistent occupancy tied to island's event calendar. |

Choosing between these corridors depends on your objective. Dubai offers scalable opportunities tied to demographic expansion. Abu Dhabi provides access to curated, high-barrier-to-entry assets backed by direct sovereign investment.

Final Thoughts: Strategy Over Speculation

The window for 'easy flips' has narrowed. Success in 2026 requires targeting communities with genuine infrastructure growth. The old "Dubai vs. Abu Dhabi" debate is obsolete; a bifurcated strategy is now the most sophisticated play, allocating capital to each emirate for different, complementary reasons.

Dubai remains the engine for high rental yields, its liquid market offering tactical opportunities for cash flow generation. Abu Dhabi makes a compelling case for long-term capital preservation and deliberate growth, serving as the perfect anchor for a conservative portfolio.

The optimal allocation is a strategic weighting based on your financial architecture. An investor chasing aggressive cash flow might put 70% into Dubai's high-yield assets. One prioritizing wealth preservation could reverse that, favoring Abu Dhabi's stable communities. The critical exercise is to weigh your risk tolerance against these two distinct market trajectories. If you are rebalancing your portfolio for 2026, let's run the numbers.

Investor FAQs: Your High-Stakes Questions Answered

These are direct answers to common queries from HNWIs weighing the Dubai vs Abu Dhabi investment landscape for 2026.

Which City Offers a More Secure Path to the Golden Visa?

Both emirates provide a clear, federally governed path to a Golden Visa UAE through real estate, anchored by a minimum property value of AED 2 million. The security of the visa itself is identical. The difference is in the variety of qualifying assets.

Dubai presents a wide spectrum of qualifying properties from numerous private developers, allowing you to tailor asset selection. Abu Dhabi's qualifying assets are more concentrated within state-backed master developments, an advantage for investors who value alignment with sovereign-backed initiatives.

How Do Property Taxes and Fees Compare?

Both emirates benefit from zero income tax on rental earnings and no capital gains tax. The key upfront cost is the transaction fee.

- Dubai: The Dubai Land Department (DLD) charges a 4% transfer fee.

- Abu Dhabi: The Abu Dhabi Municipality (ADM) transfer fee is 2%.

This difference can be negligible in the off-plan market, as Dubai developers frequently run promotions covering the 4% DLD fee, effectively leveling the playing field. A review of all associated taxes on property is essential to forecast net returns.

What is the Outlook on Dispute Resolution?

The legal framework is now clearer. The Dubai International Arbitration Centre (DIAC) is the primary institution for dispute resolution, streamlining the process. For real estate contracts, this standardization provides greater certainty about the legal forum for handling potential disputes—a crucial factor in risk assessment. It is always wise to review the current UAE property law before signing new contracts.

Is a Market Correction More Likely in Dubai or Abu Dhabi?

We analyze the probability of a "price adjustment." Dubai's market, with its high volume of international capital and active secondary market, is historically more susceptible to cyclical swings. Its velocity is both a strength and a source of risk.

Abu Dhabi’s market is structurally less cyclical. Supply is more tightly controlled, and demand is more closely tied to the stable growth of its domestic, high-income employment base. While Dubai's market may offer higher peaks, Abu Dhabi’s architecture is engineered for greater price stability, making it a more defensive component within a diversified UAE portfolio.

At Proact Luxury Real Estate, we provide the data-driven analysis HNWIs need to make strategic allocation decisions. If you are structuring your UAE portfolio for stability and growth, let's schedule a confidential consultation.