For global investors, the term Dubai freehold properties isn't just jargon; it means you own the property outright. We're talking about complete ownership of not just the building, but the very land it stands on—forever. It is, without a doubt, the most secure and comprehensive form of property possession available to foreigners in designated zones across the emirate.

What Does Freehold Ownership in Dubai Actually Mean?

Think about owning your home in the most traditional sense—where your name is on the title deed with no strings attached and no expiration date. That's the essence of freehold ownership in Dubai. It gives you absolute, perpetual rights over your property, a simple but powerful concept that completely redefined the city's real estate market.

This is a world away from leasehold ownership. The best way to think of a leasehold is as a very long-term rental. While these leases can run for up to 99 years, giving you the right to use the property, the land beneath it always belongs to someone else. When the lease is up, ownership goes back to the freeholder.

The Landmark Shift to Freehold

The entire landscape for international investment in Dubai was turned on its head in 2002. That year, a landmark decree from Sheikh Mohammed bin Rashid Al Maktoum kicked off Dubai's freehold property revolution, allowing non-UAE nationals to own property outright for the very first time. This was formalised with 2006 Law No. 7, which expanded the designated freehold zones to over 20 areas.

This wasn't just a minor legal tweak; it was a strategic masterstroke that threw open the doors of Dubai's property market to the world. It sent a clear signal: Dubai was serious about becoming a global hub for business, tourism, and long-term residency. Today, more than 60% of Dubai's residential units are in freehold areas, cementing its status as a top destination where foreigners own about 43% of residential real estate value. You can find more details on this legal framework at Rubert & Partners.

Your Rights as a Freehold Owner

When you buy a freehold property, you receive a title deed directly from the Dubai Land Department (DLD). This document officially registers you as the owner in perpetuity. It's not just a piece of paper; it's a legal status that hands you a full suite of rights, giving you the control and security that global investors crave.

As a freehold owner, you have the full authority to:

- Sell the Property: You can put your asset on the open market and sell it at any time, capitalising on its appreciation.

- Lease or Rent It Out: Generate rental income by leasing your property to tenants, with you setting the terms.

- Inherit and Bequeath: The property becomes a permanent part of your estate, something you can pass down to your heirs.

- Modify or Renovate: You have the freedom to make changes and improvements to your property, as long as you follow community and municipal guidelines.

In essence, freehold ownership gives you a permanent, tangible stake in one of the world's most dynamic cities. It’s not just an investment in a building; it's an investment in a legacy that you fully control.

Understanding The Freehold Versus Leasehold Difference

When you're looking at property in Dubai, one of the first and most critical decisions you'll face is choosing between freehold and leasehold. This isn't just about legal jargon; it's a choice that directly shapes your financial returns, future flexibility, and the kind of legacy you can build with your asset.

Think of it this way: freehold is the difference between owning a piece of Dubai forever and simply having the long-term right to use it.

When you buy a freehold property, you own it all—the building and the land it stands on. It's yours outright, with no expiration date. This is the very model that blew the doors open for global investors, giving them a secure, tangible stake in the city's future.

A leasehold property, on the other hand, is closer to a very long-term rental agreement. You get the right to use the property for a fixed period, typically up to 99 years, but the land itself still belongs to the freeholder. Once that lease runs out, ownership of the property goes back to them. This single difference creates a ripple effect across every key investment metric.

Financial Implications and Asset Value

The biggest distinction between the two lies in how they perform as investments over time. A freehold property is an appreciating asset that you have complete control over. As the market climbs, so does its value, and that growth is entirely yours. You can sell it, renovate it, or pass it down through your family, making it a powerful tool for building generational wealth.

A leasehold property, however, is what we call a diminishing asset. Its value is directly tied to how many years are left on the lease. As the term gets shorter—especially once it drops below the 70 or 80-year mark—the property becomes a tougher sell for both buyers and mortgage lenders. This can seriously limit its capital appreciation compared to a freehold equivalent.

The core financial logic is simple: Freehold ownership is about building permanent equity. Leasehold ownership is about securing the right to use a property for a fixed duration, which naturally impacts its long-term value and marketability.

This isn't just theory; the market data backs it up loud and clear. Freehold properties in Dubai consistently outperform leaseholds in both value growth and how quickly they sell. Data from the Dubai Land Department shows that freehold properties in prime areas gained 12-18% more value than similar leaseholds over the last five years.

The resale speed tells another part of the story, with freeholds selling 30-40% faster. Just look at a recent real-world comparison in Jumeirah Beach Residence: a freehold apartment sold in just two weeks at 97% of its asking price. A nearly identical leasehold unit, with 65 years left on the lease, took three months to sell and only fetched 91% of its list price. For a deeper dive into market performance, check out these insights on Dubai freehold property from Anika Property.

Freehold vs Leasehold Ownership At a Glance

To make the choice even clearer, let's break down the practical differences that matter most to an investor. Getting these straight will help you match your property purchase to your financial goals, whether you're after quick capital growth or building a stable, long-term portfolio.

| Feature | Freehold Property | Leasehold Property |

|---|---|---|

| Ownership Tenure | Perpetual and indefinite ownership of the property and the land. | Right to use the property for a fixed term, typically up to 99 years. |

| Asset Nature | An appreciating asset that builds permanent equity. | A diminishing asset whose value can decline as the lease shortens. |

| Resale Value | Generally higher and more stable, with strong market demand. | Can be harder to sell, especially with a shorter remaining lease term. |

| Owner's Rights | Full rights to sell, lease, inherit, and modify the property. | Rights are limited by the lease agreement; modifications often need approval. |

| Financing | Banks are more willing to offer mortgages with favourable terms. | Mortgage eligibility can become difficult as the lease term reduces. |

| Best For | Long-term investors, legacy builders, and those seeking maximum control. | Buyers with short-to-medium-term plans or lower initial budgets. |

Ultimately, the right choice comes down to your personal investment strategy. But for global investors targeting Dubai freehold properties, the advantages in security, growth potential, and legacy-building are undeniable. It's why freehold remains the top choice for the vast majority of non-resident buyers flocking to the city.

Discovering Top Freehold Communities for Investors

Choosing where to invest in Dubai freehold properties isn’t just about picking an attractive building. It's about finding a lifestyle and a community that fits your financial goals. Each designated freehold area has its own unique character, catering to completely different investor profiles—from those chasing the high-octane energy of the city to families looking for quiet, suburban comfort.

Getting these nuances right is the key to unlocking the real value in your investment. Someone focused on high rental yields from tourism will find their perfect asset in a very different place than an investor looking for long-term capital growth in a family-friendly neighbourhood.

Let's dive into some of the most sought-after communities for global investors.

Dubai Marina: The Vibrant Waterfront Hub

Dubai Marina is the picture-perfect Dubai experience. Think of a stunning man-made canal framed by futuristic skyscrapers, luxury yachts gliding by, and a buzzing promenade packed with cafes and boutiques. This area is an absolute magnet for young professionals, tourists, and expats drawn to its energetic, cosmopolitan vibe.

The property scene here is all about high-rise apartment towers. You’ll find everything from sleek studios to massive penthouses with jaw-dropping water views. The constant demand from renters, both long-term and short-stay, makes it a true powerhouse for generating rental income.

- Property Types: Mostly apartments (studios to 4-bedroom), penthouses, and a few podium villas.

- Average Rental Yield: Typically ranges from a very healthy 6% to 8%, among the highest in Dubai for apartments.

- Investor Profile: Ideal for those who want strong, consistent rental returns, backed by endless tourist and resident demand.

Downtown Dubai: The Heart of the City

Home to the iconic Burj Khalifa, The Dubai Mall, and the world-famous Dubai Fountain, Downtown Dubai is the city's prestigious cultural and entertainment core. An address here represents the very peak of luxury urban living and carries serious global weight.

Properties here are at the premium end of the spectrum, including high-end apartments in globally recognised towers and exclusive penthouses. An investment in Downtown Dubai is as much about capital preservation and appreciation as it is about lifestyle. Its proximity to the Dubai International Financial Centre (DIFC) also makes it a top choice for high-level executives.

An address in Downtown Dubai is more than just a property; it's a blue-chip asset. The global recognition of its landmarks provides a unique layer of investment security and long-term value growth that few other locations can match.

For a comprehensive analysis of different investment locations, you can explore our detailed guide on the best areas to invest in Dubai.

Palm Jumeirah: Iconic Beachfront Luxury

Synonymous with exclusivity and opulence, Palm Jumeirah is a true marvel of modern engineering. This man-made archipelago offers a one-of-a-kind island lifestyle with private beaches, five-star hotels, and world-class restaurants. It’s a haven for high-net-worth individuals and families seeking privacy and unparalleled sea views.

The property options are diverse, from signature villas on the "fronds" with their own beach access to luxury shoreline apartments and branded residences. Palm Jumeirah is a mature, stable market known for holding its value and delivering solid capital gains over the long run.

- Property Types: Signature and garden villas, townhouses, luxury apartments, and branded residences.

- Average Rental Yield: Generally 3% to 5% for villas and a bit higher for apartments, with appreciation being a key driver of returns.

- Investor Profile: Perfect for HNW investors focused on legacy assets, capital appreciation, and owning a world-class lifestyle property.

Arabian Ranches: A Serene Family Haven

In a complete contrast to the city's vertical living, Arabian Ranches offers a peaceful, suburban oasis. This established, gated community is famous for its lush green spaces, championship golf course, and family-first amenities like schools, parks, and community centres.

The community is almost entirely made up of spacious villas and townhouses, making it a top choice for families wanting a secure and quiet environment away from the city buzz. The strong community feel and high-quality infrastructure ensure consistent demand from both buyers and long-term tenants, making it a stable and reliable investment.

- Property Types: Independent villas and townhouses, ranging from two to six bedrooms.

- Average Rental Yield: Consistently strong yields for villas, often sitting between 5% and 6.5%.

- Investor Profile: A great fit for investors looking for stable, long-term rental income from family tenants and steady capital growth in a mature community.

Navigating the Buying Process as a Foreign Investor

For anyone outside the UAE, the thought of buying property in Dubai can seem daunting, wrapped in unfamiliar rules and procedures. But the reality on the ground is quite different. Dubai has gone to great lengths to create a remarkably straightforward, secure, and transparent process, specifically designed to welcome global investors. The entire system is built on clarity and is efficiently managed by government bodies like the Dubai Land Department (DLD).

This guide is your roadmap. We’ll break down each stage of acquiring Dubai freehold properties, step-by-step. Whether you're eyeing a ready-to-move-in apartment or an off-plan villa, understanding this process will clear up any confusion and give you the confidence to move forward.

The Initial Steps: Finding Your Property and Agent

Your journey starts with zeroing in on the right property—one that perfectly aligns with your investment goals. Once you have a shortlist, the next critical move is to partner with a RERA-certified real estate agent. The Real Estate Regulatory Agency (RERA) is the governing body that holds all agents to strict professional standards, giving you an immediate layer of protection.

Think of your agent as your guide on the ground. They’ll set up viewings, offer priceless market insights, and handle the initial back-and-forth of negotiations. Their expertise is essential for navigating the local market and ensuring all the paperwork is spot-on from day one.

Securing the Deal: The MOU and Initial Deposit

Once your offer is accepted, things get official. The next step is signing a Memorandum of Understanding (MOU), also known as Form F. This isn't just a handshake agreement; it's a legally binding contract that lays out all the terms of the sale—the price, payment schedule, and handover date. Your agent prepares it, and both you and the seller sign it.

At this point, you'll need to pay a security deposit, which is typically 10% of the property's value. This money isn't handed directly to the seller. Instead, it's held by a trusted third party, like a registration trustee's office, until the property transfer is officially complete. This system guarantees your funds are safe and are only released once the deal is successfully done.

The Path for Ready Properties: The NOC and Transfer

If you're buying a property that’s already built (a "ready" property), the process includes a crucial document called a No Objection Certificate (NOC). The property's developer issues this certificate to confirm that there are no outstanding service charges or other debts tied to the unit.

Think of the NOC as a 'clearance certificate'. It's the developer's official stamp of approval, confirming the seller has settled all their dues. This gives you, the new buyer, a clean slate and total peace of mind before the final ownership transfer.

With the NOC in hand, you and the seller will meet at a Dubai Land Department (DLD) trustee’s office to make the transfer official. Here, you'll pay the remaining balance of the purchase price and the required DLD fees (usually 4% of the property value). The DLD then issues the new title deed in your name, making you the undisputed freehold owner.

The Off-Plan Property Route

The journey for off-plan properties—those you buy directly from a developer before they’re finished—follows a slightly different path.

- Booking Form and SPA: You'll start by signing a booking form and paying an initial booking fee to reserve your unit.

- Sale and Purchase Agreement (SPA): Next, you'll sign a detailed Sale and Purchase Agreement (SPA) with the developer. This document outlines everything: project specifics, the payment plan, and the completion timeline.

- Oqood Registration: The developer then registers this SPA with the DLD through a system called Oqood. This officially records your ownership stake in the off-plan property, protecting your interest long before the keys are in your hand.

This highly structured process, protected by RERA regulations and mandatory escrow accounts for developers' funds, makes buying off-plan Dubai freehold properties a secure and very popular investment strategy. For a more detailed breakdown, you can review our complete guide on the process of buying property in Dubai for foreigners.

Managing Your Investment Finances: Fees and Taxes

Getting into Dubai freehold properties is exciting, but a successful investment hinges on understanding the full financial picture, which goes far beyond just the sticker price. To avoid any unwelcome surprises, you need to budget with precision, accounting for everything from mandatory government fees to the ongoing costs of ownership.

The biggest one-time cost you'll face is the Dubai Land Department (DLD) transfer fee, a standard 4% of the property's purchase price. While it's officially split between buyer and seller, it's common practice in the market for the buyer to cover the entire amount. On top of that, you’ll need to budget for real estate agent commissions, which typically hover around 2% of the sale value.

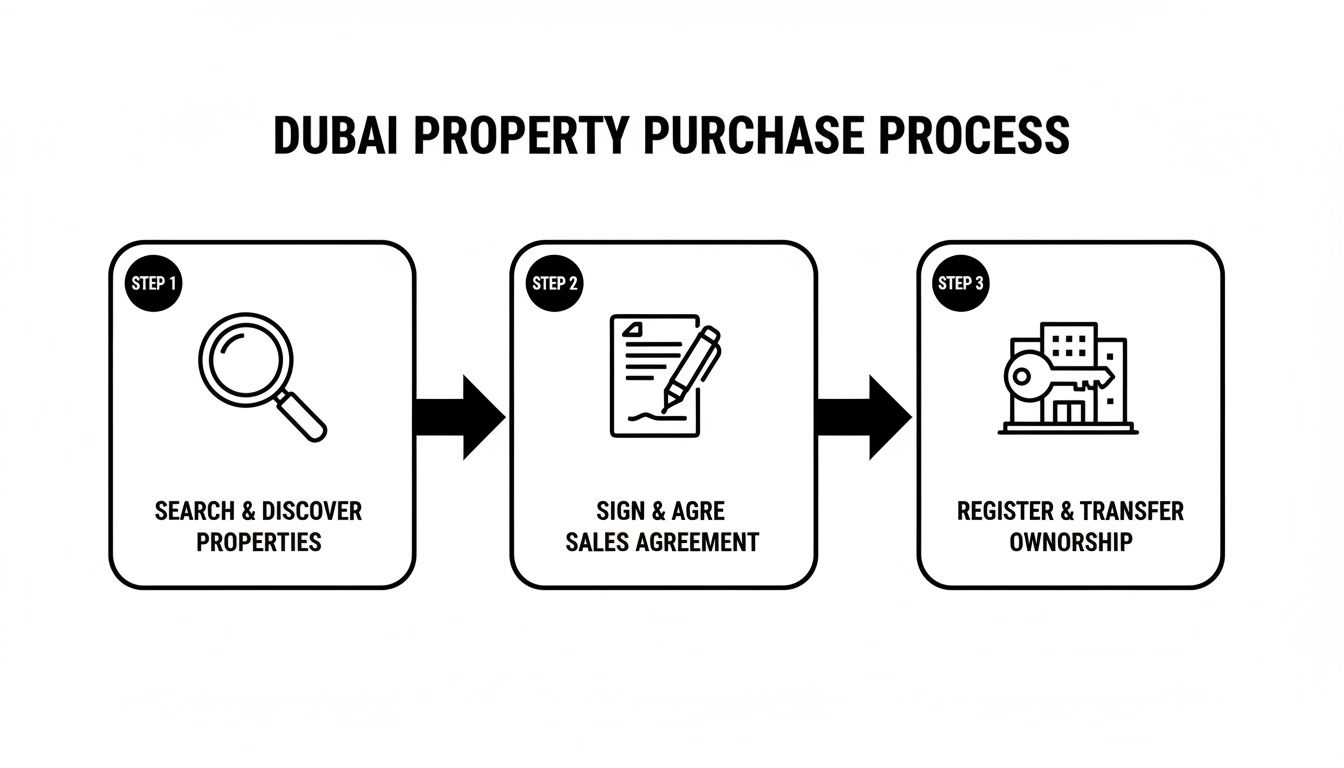

This diagram breaks down the straightforward, three-step process for buying property in Dubai, from finding your ideal asset to the final ownership transfer.

It’s a clear path that shows just how well Dubai has structured the process, making it secure and efficient for investors to acquire freehold assets.

Unpacking Dubai's Tax-Friendly Advantage

One of the most powerful draws for global investors is Dubai's incredibly attractive tax environment. This isn't just a minor perk; it’s a game-changer that directly boosts your net returns and makes financial management a breeze.

For property owners, the benefits are clear and substantial:

- No Annual Property Tax: Unlike major property hubs around the world, you won’t be hit with an annual tax based on your property's value.

- No Income Tax on Rental Earnings: Every dirham you earn from rent is yours to keep. There are zero income tax deductions.

- No Capital Gains Tax: When you decide to sell and make a profit, that gain is entirely tax-free.

This tax-free framework is a cornerstone of Dubai’s investment appeal. It ensures that the returns generated from your asset are truly maximised, making the financial case for investing here far stronger than in many other international markets.

Foreign ownership is the backbone of Dubai's freehold residential market. In fact, it accounts for about 43% of the total value, which had already soared to $121 billion by early 2022. The city’s tax advantages have proven especially attractive amid recent geopolitical shifts, which saw Russian-linked off-plan sales jump by an incredible 940%. Dubai's no-personal-income-tax policy transforms real estate into a major economic pillar where expats can genuinely build wealth.

Securing a Mortgage as a Non-Resident

Think you need to be a resident to get a mortgage? Think again. Financing a property purchase is a very real option for non-residents, as many UAE banks offer products specifically tailored to international buyers.

The catch is that the eligibility criteria are a bit different. Lenders will usually require a larger down payment, with the minimum for non-residents set at 25% of the property's value—though some banks might ask for more.

To apply, you'll need to pull together a comprehensive set of documents. This typically includes your passport, proof of income from your home country (like salary certificates and bank statements), and the details of the property you’re looking to buy. Each bank has slightly different requirements, so it pays to shop around.

Getting a handle on these financing routes is key, and you can get a clearer picture by reading our comprehensive Dubai real estate market analysis. Successfully navigating the mortgage process allows you to manage your capital effectively while locking down your dream freehold property.

Finding Your Partner in Dubai Real Estate

Buying Dubai freehold property is a significant financial step, and frankly, choosing the right advisor is just as critical as picking the right asset. As we've seen, the upside is huge—we're talking long-term security, impressive capital growth, and a lifestyle that's hard to beat. But this market moves fast and has its own set of rules. To really get the most out of it, you need someone on the ground who lives and breathes Dubai real estate.

Navigating this landscape isn't about scrolling through online listings. It's about having access to deep market intelligence, knowing about exclusive off-market deals, and having a sharp eye for which communities will deliver on your specific goals—whether that's pulling in high rental yields or securing long-term appreciation.

Your End-to-End Advisory

At Proact Luxury Real Estate, we're not just agents; we're your guides. Our job is to handle the entire journey, turning what can be a complicated process into a smooth, straightforward experience. We take care of everything, from pinpointing the best properties in Dubai's most desirable freehold areas to managing tough negotiations and making sure every piece of legal paperwork is perfect.

We don't guess. Our approach is driven by hard data, so every recommendation we make is backed by solid market analysis. Our commitment is simple: transparency, integrity, and a relentless focus on hitting your financial targets.

Your investment goals are unique. A one-size-fits-all strategy just won’t cut it in a market as nuanced as Dubai's. We build personalised strategies that match your vision, turning your aspirations into a real, high-performing property portfolio.

The opportunities in Dubai’s freehold market are immense, but the best ones don't wait around. They're usually snapped up through expert insight and decisive action. Let us help you unlock them.

Connect with our team for a personalised consultation. We’re ready to help turn your investment ambitions into a successful reality in Dubai's thriving property market.

Have Questions? Let's Get Them Answered.

Diving into the Dubai property market, especially from overseas, naturally brings up a few questions. It’s a unique landscape, and it pays to have clear, straightforward answers before you make a move. Let's tackle some of the most common queries we hear from investors just like you.

Our goal here is simple: to clear up any lingering doubts so you can proceed with total confidence.

Can Foreigners Actually Own Property in Dubai?

Yes, 100%. This is probably the most common question we get, and the answer is a resounding yes. Back in 2002, a landmark decision changed the game, and Law No. 7 of 2006 solidified it. This law allows non-UAE nationals to buy and own property outright in specially designated "freehold" areas.

Think of iconic communities like Dubai Marina, Downtown Dubai, or the Palm Jumeirah—these are all freehold zones created specifically to welcome global investors. When you buy here, you get a title deed registered in your name with the Dubai Land Department (DLD). It’s your property, plain and simple.

Does Buying a Property Get Me a Residency Visa?

It certainly can. In fact, investing in real estate is one of the most direct routes to securing residency in the UAE. The government has put visa programmes in place specifically tied to property investment.

- The 2-Year Investor Visa: If you invest AED 750,000 (roughly $204,000 USD) or more in a property, you become eligible to apply for a two-year residency visa, which is renewable.

- The 10-Year Golden Visa: For a more permanent footing, an investment of AED 2 million (around $545,000 USD) or more in property makes you eligible for the highly sought-after 10-year Golden Visa.

These visas aren't just for you; they can typically be extended to your family, making a move to Dubai a seamless reality for your loved ones as well.

What About Property Taxes? Am I Missing Something?

You're not missing anything—this is one of Dubai's biggest draws for investors. The financial environment here is designed to help your investment grow, not shrink.

In Dubai, there are no annual property taxes. There’s no income tax on the rent you earn. And when you decide to sell, there’s no capital gains tax. This means the returns you make are truly yours, without the hefty tax deductions common in most other major property markets.

The primary government charge you’ll encounter is a one-time Dubai Land Department (DLD) transfer fee of 4% of the property value, paid when you make the purchase. After that, your ongoing costs are mainly community service charges for upkeep, not government taxes.

What Happens to My Property if I Pass Away?

As the outright owner of a freehold property, your asset is fully inheritable. It becomes a part of your estate and can be passed on to your heirs exactly as you intend.

To ensure everything goes smoothly, we strongly advise expatriate owners to register a will with a recognised body like the Dubai International Financial Centre (DIFC) Courts or the Abu Dhabi Judicial Department. This simple legal step removes any ambiguity, provides clear instructions for distributing your assets, and protects your legacy for the next generation. It's all about securing your investment and gaining complete peace of mind.

Your investment goals are unique, and navigating the market requires expert guidance. Proact Luxury Real Estate provides data-driven advice to help you secure high-performing assets in Dubai's most sought-after communities. Book a personalised consultation with us today to turn your investment vision into a reality.