For any property investor, administrative processes are a powerful indicator of a market’s maturity. The DEWA security deposit refund process is a case in point. A streamlined system means a faster turnaround of capital between tenancies—a critical detail that directly impacts portfolio performance and liquidity.

The DEWA Refund: A Key Metric For Asset Efficiency

From an asset manager's perspective, the objective is minimizing holding costs and maintaining cash flow. The speed at which a DEWA deposit is returned signals how quickly a property can be financially reset for the next tenant, directly affecting net returns. A delayed refund is simply dead capital, an inefficiency with no place in a well-managed portfolio.

This is why the overhaul of the DEWA refund system is a material development for investors. It is more than a convenience; it is a strategic upgrade to Dubai's investment climate. Late last year, Dubai Electricity and Water Authority revamped its refund process, cutting the processing time from four days to 30 minutes for amounts under AED 4,000.

This automation now covers approximately 90% of all refund requests, a substantial upgrade benefiting the vast majority of residential property investors. You can review the specifics of this update directly from DEWA's official news release.

To appreciate the operational impact of this change, a comparison to last year's benchmarks is necessary.

DEWA Refund Process At A Glance

| Metric | Previous Process (Pre-2026) | Current Process |

|---|---|---|

| Processing Time | Up to 4 business days | 30 minutes (for refunds < AED 4,000) |

| Initiation Method | Manual request | Automated upon final bill generation |

| Follow-Up | Often required | Minimal to none needed |

| Capital Access | Delayed | Near-instant, improving liquidity |

| Investor Burden | High administrative involvement | Low, "hands-off" experience |

The data is clear: what was once a minor but consistent administrative drag has been transformed into a hyper-efficient, almost invisible process.

Understanding the Strategic Impact

This shift toward hyper-efficiency offers tangible benefits for landlords and asset managers. It signals a mature market that values an investor's time and capital. The old multi-day waiting period was a low-level drag on asset turnover; now, those funds are released almost instantly, allowing for immediate reallocation.

As we analyse the Dubai property market forecast for 2026, it’s these micro-efficiencies that collectively build a compelling case for sustained investment. They reflect a government focused on creating a frictionless business environment, a powerful confidence booster for global capital.

This rapid refund capability translates into direct benefits for property investors:

- Improved Liquidity: Faster fund recovery between tenancies allows for immediate settlement of maintenance costs or other expenses.

- Reduced Administrative Burden: The automated process nearly eliminates the need for manual tracking, freeing up time for asset managers.

- Enhanced Tenant Relations: A smooth move-out, capped by a quick deposit refund, leaves a positive final impression on tenants.

Ultimately, the evolution of the DEWA security deposit refund process is a clear marker of Dubai's commitment to operational excellence, reinforcing its position as a top-tier destination for real estate investment.

Kicking Off The DEWA Deactivation And Refund Request

Obtaining a DEWA security deposit refund begins with the account deactivation request. For landlords, executing this correctly is the difference between an automated refund hitting an account in 30 minutes and a week of follow-up calls. The entire process is now online.

The process is initiated through the DEWA online portal or its Smart App, requiring the account holder's Emirates ID and the specific Contract Account Number. This links the request directly to the correct asset, preventing administrative errors that can halt the process.

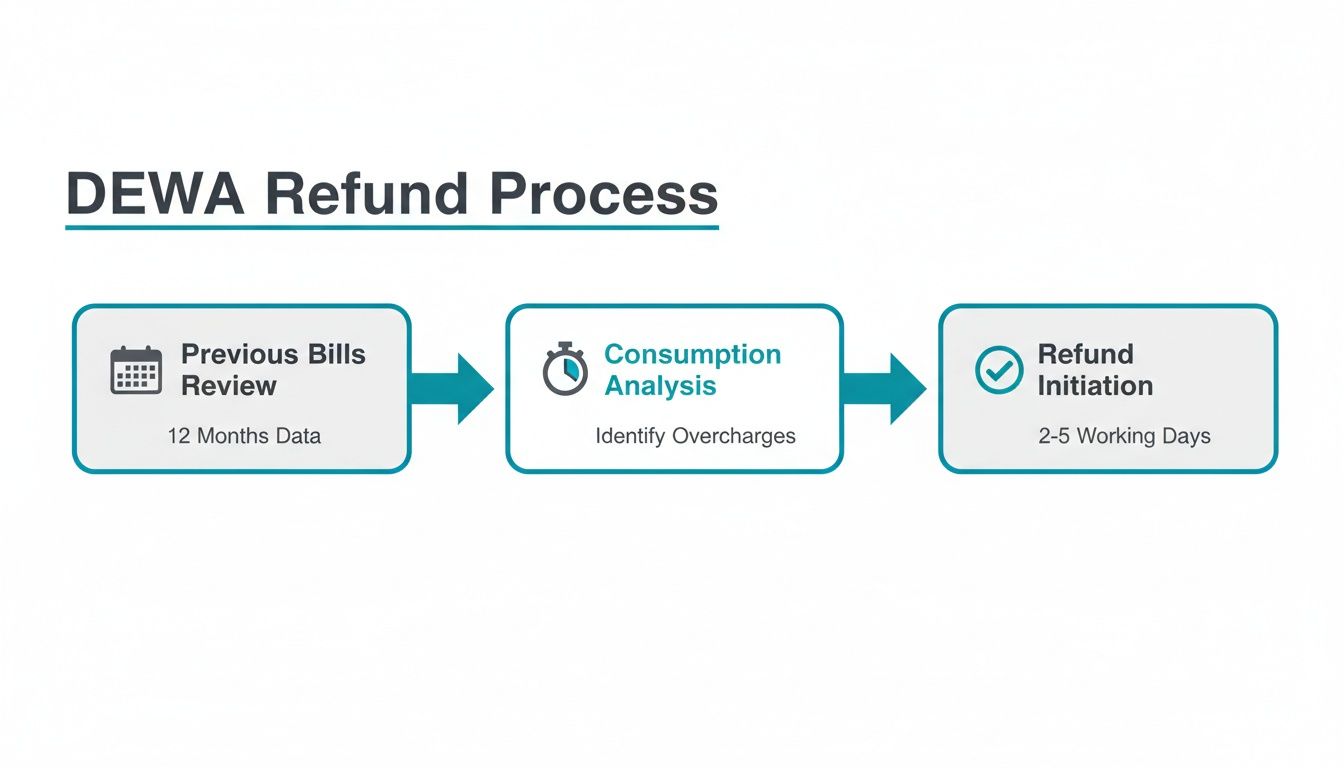

This flowchart provides a visual of the modern refund journey compared to the multi-step process from previous years.

The new system bundles the move-out request, final clearance, and the refund into a single, automated workflow. It is a major improvement that reduces administrative legwork.

Key Actions Within The Portal

Once logged in, the first action is to submit a ‘Move Out’ notification, which officially starts the deactivation. During this step, the system requires scheduling the final meter reading. Precision is key; select a date that aligns perfectly with the tenancy contract's end date to ensure final bill accuracy.

All outstanding bills must be cleared before the refund can be processed. The system will not proceed if any balance remains. This is the single most common reason for delays.

The portal's design is intuitive. The 'Move Out' and refund services are located on the main consumer dashboard, eliminating the need to search through menus.

Required Documentation And Information

While the process is digital, having the correct information ready is essential for a smooth transaction. Before logging in, ensure these details are on hand:

- Emirates ID: The number of the official DEWA account holder.

- Contract Account Number: The nine-digit number found on any DEWA bill.

- Final Move-Out Date: The official end date of the tenancy.

- Valid IBAN: The International Bank Account Number for the refund destination. This account must belong to the DEWA account holder.

- Updated Contact Details: A current mobile number and email are non-negotiable for receiving the verification code required for authorisation.

A critical detail: the name on the bank account linked to the IBAN must be an exact match for the name on the DEWA account. Any variation will trigger an automatic rejection of the transfer, forcing a restart of the process. For a broader context on these expenses, review our guide on the main housing charges including DEWA.

The system's efficiency is only as good as the input data. Double-checking every detail before submission is a non-negotiable step for any asset manager aiming for operational excellence.

Choosing The Right Refund Mechanism For Your Portfolio

For a property portfolio, retrieving a DEWA security deposit is a strategic decision. The chosen method directly impacts cash flow and the efficiency of turning over a property. The optimal path depends on asset type and deposit size.

For the vast majority of residential properties—apartments with an AED 2,000 deposit or villas with AED 4,000—the direct bank transfer via an International Bank Account Number (IBAN) is the superior choice. It is built for speed, often returning funds in under 30 minutes.

However, for high-value assets like a luxury penthouse or a large commercial unit, deposits often exceed the threshold for rapid electronic transfers. In these scenarios, other mechanisms must be considered.

Comparing Refund Options For Investors

The refund method should align with the financial strategy for that specific property. An IBAN transfer is ideal for the rapid turnover of residential units, while a cheque may be the only option when closing out a major corporate lease.

The choice is a trade-off between speed, convenience, and the deposit amount.

DEWA Refund Method Comparison

| Refund Method | Typical Processing Time | Best Suited For | Key Requirement |

|---|---|---|---|

| IBAN Transfer | 3 Working Days (often under 30 mins for < AED 4,000) | Standard residential units; investors prioritizing speed and liquidity. | Bank account holder's name must be an exact match to the DEWA account holder's name. |

| Cheque Issuance | 6 Working Days | High-value commercial property deposits exceeding AED 200,000. | Incurs a fee of AED 20 + VAT and requires courier coordination. |

| Account Balance Transfer | 3 Working Days | Portfolio investors managing multiple properties under the exact same legal name. | Offers zero liquidity; it reallocates capital within your DEWA portfolio. |

While the IBAN transfer is the go-to for efficiency, it is capped for deposits of AED 200,000. Beyond that figure, cheque issuance becomes mandatory—a critical detail for managers of mixed-use portfolios.

Strategic Use Of Account-To-Account Transfers

For investors managing a portfolio of properties, the option to transfer a security deposit between accounts is a useful, if niche, tool. This is not a "refund" in the traditional sense, as no cash enters a bank account.

Instead, it functions as an internal credit shuffle. This can be a smart move when preparing a new property, using the deposit from a recently vacated unit to cover the deposit for a new one. It reduces immediate cash outlay at the cost of liquidity.

Bank Guarantees For Major Commercial Leases

For substantial commercial leases, the security deposit is typically a bank guarantee, not a cash payment. The refund process here is entirely different.

Upon lease termination and settlement of final bills, the landlord formally releases the bank guarantee by sending an instruction to the bank. This action cancels the guarantee and frees up that line of credit for the corporate tenant. This process occurs outside the standard DEWA portal and is dictated by banking protocols and lease terms.

This distinction is crucial for commercial real estate investors. For businesses managing commercial portfolios, these requirements often intersect with corporate structuring. Our guide on LLC company formation in Dubai provides context on how these legal setups impact operational matters.

How To Avoid Common Refund Delays

A few simple mistakes are responsible for nearly every DEWA security deposit refund delay. These are not complex system glitches but basic administrative errors that can jam the process for days. Proactive management eliminates them.

The primary culprit is an incorrect IBAN. A single wrong digit will cause the bank transfer to fail, forcing a manual reset. What should be an automated refund becomes a multi-day issue.

The Final Bill Precision Check

Another common pitfall is leaving a small balance on the final bill. The automated refund system is absolute; it will not proceed if even AED 1 is outstanding. This could be a late fee or a minor charge from the final reading.

A thorough account check is non-negotiable before initiating the move-out. This simple step prevents the workflow from halting.

Mismatched Account and Contract Details

Discrepancies between DEWA account information and tenancy contract details are a red flag for the system. This almost always triggers a manual review, negating the possibility of a speedy, automated refund.

Common mismatches include:

- Name Variations: A slight difference between the name on the DEWA account (e.g., "Mohd" versus "Mohammed") and the official tenancy contract.

- Incorrect Premise Number: The DEWA premise number must exactly match the one listed in the Ejari-registered contract.

- Outdated Contact Information: An old mobile number will prevent receipt of the verification code needed to authorise the refund.

An asset manager’s job is to eliminate these variables. We maintain a master file for each property, ensuring every detail is verified and consistent across all official documents. This data hygiene is fundamental to seamless operations and begins with a properly structured tenancy contract in Dubai.

Actionable Troubleshooting Guide

This checklist should be standard procedure for every tenant move-out. This is the exact process we use for our clients' portfolios.

Pre-Refund Verification Checklist:

- IBAN Verification: Triple-check the provided IBAN. Critically, confirm the name associated with the bank account is an exact match to the name on the DEWA account. No abbreviations.

- Zero Balance Confirmation: Log into the DEWA portal and confirm a zero balance after the final bill has been generated and paid. Do not start the refund request until this is confirmed.

- Document Consistency Audit: Before submitting the move-out, compare the tenant's Emirates ID, the tenancy contract, and the DEWA account details side-by-side. All names and property identifiers must align perfectly.

- Contact Information Update: Ensure the mobile number and email registered with DEWA are current and accessible to the account holder for receiving the one-time password (OTP).

Methodically running through these steps transforms the refund from a potential bottleneck into a predictable part of the investment cycle.

Final Thoughts: Strategy Over Speculation

The operational efficiency of a city's administrative machinery is a powerful, yet often overlooked, indicator of its market health. For a global investor analysing Dubai, the DEWA refund system is not just a convenience—it is a clear signal of market maturity. It shows a deep commitment to removing friction for capital, a core principle driving the sustainable growth cycle we are witnessing in 2026.

This shift towards digitization and speed reflects a government focused on the ease of doing business. When capital can be unlocked from one asset and redeployed to another with minimal delay, it directly boosts the velocity of money within the real estate ecosystem. This is a critical factor supporting a stable investment environment, especially when measured against last year's benchmarks.

From an asset management viewpoint, these operational details have a cumulative, powerful impact on net yield. A process that returns capital in minutes rather than days shaves holding costs between tenancies and sharpens portfolio performance. It is a tangible metric of a system built for investors. The larger narrative is one of confidence. Efficient and transparent administrative processes are foundational to attracting and retaining global capital.

Success in 2026 requires looking beyond glossy brochures to analyse the real mechanics of the market. Understanding factors like the DEWA refund process is a vital piece of any serious portfolio strategy. If you are rebalancing your portfolio for 2026, let's run the numbers.

Frequently Asked Questions

As an asset manager, a few specific questions about the DEWA security deposit refund arise frequently, particularly from overseas investors. These are practical, on-the-ground scenarios that can make a transaction either seamless or problematic.

Getting these details right is key to smooth portfolio management.

Transferring Deposits During A Property Sale

What happens to the DEWA deposit if I sell my property with a tenant in place? The process is a clean break, not a direct transfer.

When ownership changes, the seller must initiate a 'Move Out' to close their DEWA account. The original deposit is then refunded directly to the seller.

Simultaneously, the new owner must apply for a 'Move In' using their new title deed and a fresh tenancy contract listing them as the landlord. They will pay a new security deposit to activate the account in their name. There is no direct "transfer" of the deposit from seller to buyer. Managing this transition is a key part of the handover we detail in our guide on selling property in Dubai.

Authorising A Property Manager For Refund Collection

Can my property management company handle the refund for me? Yes, and for any serious investor, this should be standard practice. A professional asset management firm can manage the entire DEWA deactivation and refund process.

To enable this, specific authorisation is required, typically through a clause in a Power of Attorney (POA) or a formal authorisation letter.

This document grants your manager the legal authority to deal with DEWA, provide the necessary IBAN for the refund, and handle any follow-up. For overseas clients, this service is fundamental, turning a hands-on task into a simple line item on their management report.

Original Payment Method Versus Refund Channel

Does it matter if I originally paid the deposit with a credit card instead of cash? The answer is simple: it does not matter.

The method used to pay the security deposit years ago has zero impact on the refund process today.

Whether it was paid by credit card, cash, or bank transfer is irrelevant to DEWA's modern system. The refund is processed based solely on the option you choose during the online deactivation request—either an IBAN transfer or a cheque. The system is built for present-day efficiency, not historical payment records.

At Proact Luxury Real Estate LLC, we manage these granular details to ensure our clients' portfolios operate with maximum efficiency, protecting their time and capital. Schedule a consultation with us to optimise your asset management strategy.