In Q4 2025, off-plan transactions outpaced ready units by a margin of 12%, a key indicator that sophisticated capital is targeting Dubai's future growth corridors over its saturated prime districts. A Damac Lagoon Villa is a direct play on this forward-looking strategy. This is not a trophy asset; it is a calculated entry into the mid-market luxury villa segment, a category that demonstrated considerable resilience based on last year's benchmarks. The investment case is not about lifestyle—it's about aligning a portfolio with Dubai's audited, long-term infrastructure expansion.

The Damac Lagoon Villa Investment Thesis

While many portfolios remain over-weighted in established areas like Downtown or Dubai Marina, the forward-looking money has shifted to the city's growth corridors. The Damac Lagoons master plan is a direct bet on Dubai's southern expansion, requiring a different analytical framework than one based on historical performance in mature, built-out districts.

The market has moved from the post-Covid boom into a sustainable growth cycle. The days of indiscriminate, market-wide appreciation are behind us. The core question for any investor entering 2026 is no longer if they should deploy capital into Dubai, but precisely where and what asset class will outperform the market baseline.

Strategic Location and Infrastructure Alignment

The primary value driver for this community is its location. It is strategically positioned adjacent to the expanding Al Maktoum International Airport and the former Expo 2020 site, which is being repurposed into the major commercial and residential hub, Expo City. This is a long-term anchor for sustained demand and capital growth.

[Map: Location relative to Al Maktoum Airport]

The investment case for Damac Lagoons is fundamentally tied to the government's multi-billion dollar investment in Dubai South. As this economic zone matures, the demand for quality residential communities in the vicinity is projected to outpace supply.

This is a different proposition from coastal projects catering to an ultra-luxury demographic. A more detailed analysis of DAMAC Islands is available for comparison. The Lagoons project is aimed squarely at the executive and upper-middle-class family demographic—the backbone of Dubai's long-term rental market.

Asset Class and Target Demographic

The property types available in Damac Lagoons—primarily townhouses and standalone villas—are designed to meet a large, underserved market segment. Data from last year showed a clear trend of families migrating from apartments into larger homes with private outdoor space.

Key metrics for analysis include:

- Projected Rental Yields: Based on 2025 benchmarks, villas in this corridor achieved gross rental yields that outperformed many established luxury areas.

- Capital Appreciation Forecasts: Growth is directly linked to the phased handovers of the community and the completion of surrounding public infrastructure like roads and retail centres.

- Property Typologies: The difference between a three-bedroom townhouse and a larger five- or six-bedroom villa creates distinct risk-return profiles within the same community.

This is not a short-term "flip" opportunity. A Damac Lagoon Villa should be viewed as a mid-to-long-term asset, engineered to generate consistent rental income and benefit from organic, infrastructure-led capital growth.

Market Performance and Capital Growth Analysis

To assess a Damac Lagoon Villa's potential for capital growth, we must analyze the market's current state. The speculative rush of the post-Covid era has transitioned into a more mature, sustainable growth cycle where value is tied to economic fundamentals, not market hype. Last year's data indicates a market that is not just expanding—it's stabilizing.

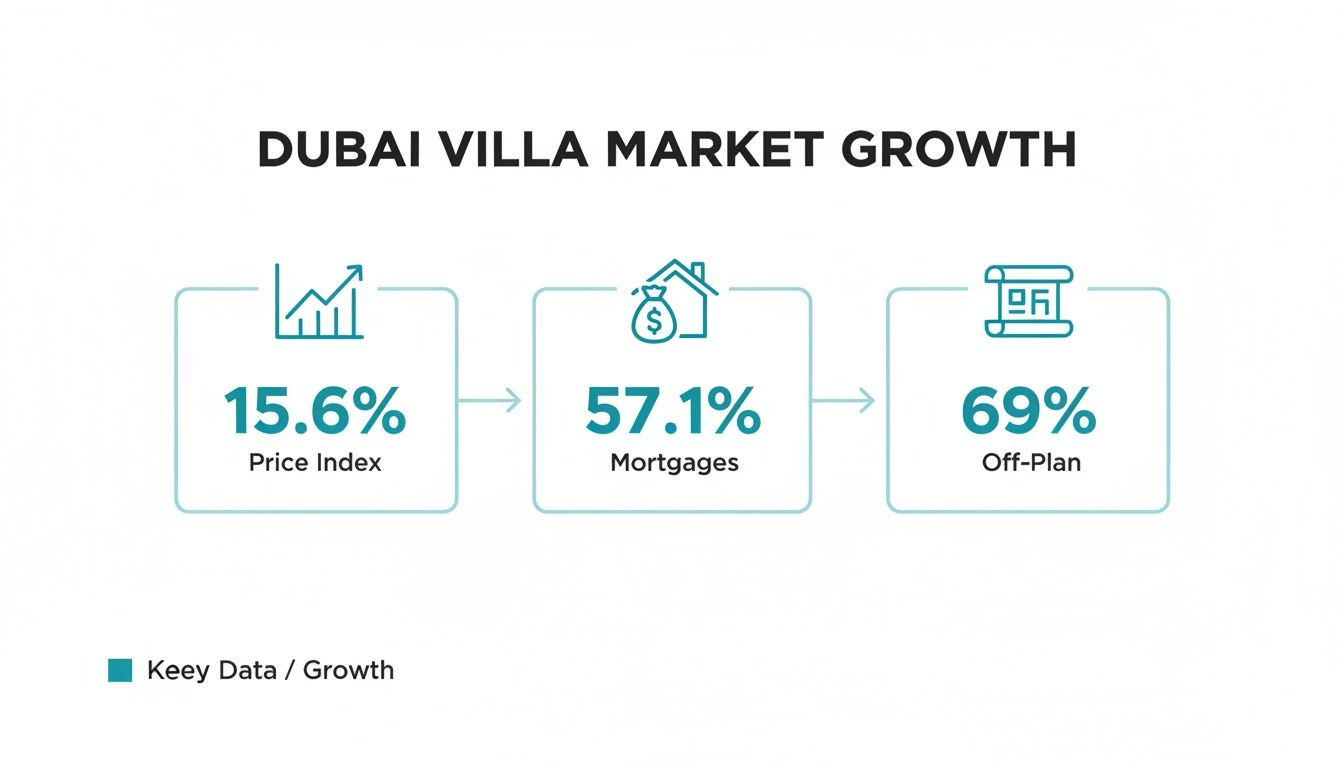

Dubai's overall residential price appreciation provides the macro context. The Residential Market Sales Price Index rose by 15.60% annually in 2025, a strong indicator of sustained buyer interest. More telling, however, is the composition of that growth. The value of mortgage transactions for villas and townhouses increased by 57.1%, reaching AED 20.4 billion in Q1 2025 alone. This data points to a clear trend: a shift from speculative flips toward long-term, end-user driven investments.

This structural change in the market, favoring spacious, family-focused communities, is not a temporary trend. The use of long-term financing indicates real confidence in future value.

The Villa Segment's Outperformance

Within this market-wide upswing, villas have been the leading performers. The demand for larger, self-contained homes is now a permanent feature of buyer preference. A key statistic from last year illustrates this: 69% of all luxury villa sales were off-plan, a powerful signal of investor confidence in new communities like Damac Lagoons.

This is driven by economics. Investors recognize that new master communities offer a lower price per square foot compared to older, established villa neighborhoods. This creates a clearer runway for capital appreciation as the community matures and planned infrastructure is delivered.

The current market cycle rewards investors who can identify where value is being created, not just where it already exists. The increase in mortgage-backed villa deals confirms that the market is underpinned by end-users and long-term investors, creating a stable demand floor.

Supply, Demand, and Pricing Power

Future prices are a function of future supply. Over 10,700 villa and townhouse units are scheduled for delivery across Dubai by 2028. However, developers are staggering handovers strategically. This is a controlled release designed to prevent market saturation and support price stability.

This phased delivery schedule within a large community like Damac Lagoons is a central part of the investment case.

- First-Mover Advantage: Investors in the initial phases almost always secure the lowest price points. As later phases launch at higher prices, it creates an upward valuation pull on earlier-sold properties.

- Community Maturation: With each completed phase, the community's value proposition strengthens. New amenities, retail, and improved road networks add tangible value, making the area more attractive for rentals and supporting price growth.

- Controlled Inventory: The staggered approach allows demand to absorb new supply in a measured way, unlike markets where thousands of units are handed over simultaneously.

This managed release of new stock is a major factor supporting a positive outlook for capital growth, mitigating the risk of price adjustments often seen in communities with massive, simultaneous handovers. For a deeper dive, our comprehensive Dubai property market analysis provides more context. A Damac Lagoon Villa's value is directly linked to the developer’s delivery strategy and Dubai's ability to absorb new supply.

Forecasting Rental Yields and Cash Flow Potential

For any serious investor, cash flow is as critical as capital growth. Relying purely on appreciation exposes a portfolio to market volatility. A hard analysis of a Damac Lagoon Villa's rental potential is therefore non-negotiable, using last year's market data as our baseline.

The community's rental performance last year was notable. DAMAC Lagoons established itself as a top-tier villa investment, with rental yields reaching 10.46% for certain villa types in 2025. That figure surpasses many established luxury communities where yields often compress to around 6%.

The project's signature waterfront villas are expected to stabilize at a healthy 7% rental return, while the more common townhouses should consistently deliver 6% annually.

The infographic below shows the drivers of Dubai's villa market. It highlights key metrics like the price index, mortgage uptake, and off-plan sales volume, all of which create a robust environment for strong rental returns.

This data shows a market driven by both end-user families (mortgage activity) and forward-looking investors (off-plan sales). This is the ideal composition for a healthy rental market.

Yields in a Competitive Context

To appreciate these figures, they must be benchmarked against other options. The projected 6-7% gross yields for Damac Lagoons villas give them a quantitative edge in Dubai's property market.

These figures compare favorably against established, mid-tier villa communities where yields are typically in the 5-7% range. They also outperform prime but yield-compressed areas like MBR City, where returns often fall below 6% due to high entry prices. Even premium waterfront locations require careful analysis; our guide on villas for rent in Palm Jumeirah shows how high capital values can squeeze yield percentages.

The table below benchmarks Damac Lagoons' rental performance against other luxury communities in Dubai.

Rental Yield Comparison: Dubai Luxury Villa Communities

| Community | Average Gross Rental Yield (Villas) | Commentary |

|---|---|---|

| DAMAC Lagoons | 6.0% - 7.0% (Projected) | High yields driven by lower entry price and unique amenities commanding rental premiums. |

| Dubai Hills Estate | 5.5% - 6.5% | Mature community; higher acquisition costs slightly compress gross yield compared to new projects. |

| Arabian Ranches 3 | 5.0% - 6.0% | Strong family-oriented demand; yields are in a traditional range for established suburban communities. |

| Palm Jumeirah | 3.5% - 4.5% | Prime global address where capital appreciation is the primary driver; yields secondary to high property values. |

| MBR City | 4.0% - 5.5% | High demand and luxury appeal offset by high capital investment, leading to moderate rental returns. |

The data shows the balance between purchase price and achievable rent gives Damac Lagoons a distinct quantitative advantage. This positions it as a compelling option for investors focused on generating strong, consistent cash flow.

Drivers of Sustained Rental Demand

High yields are only sustainable if tenant demand is consistent. The rental strength of a Damac Lagoon Villa is the direct result of a value proposition that attracts a reliable tenant profile.

- Amenity-Driven Premium: The resort-style lagoon and themed clusters are a massive differentiator, allowing landlords to command a premium over standard villa communities.

- Targeting the Executive Expatriate Demographic: The community is designed for expatriate executive families seeking 3-5 bedroom homes, security, and community features, often with corporate housing allowances.

- Proximity to New Economic Hubs: Its location near Dubai South and the Al Maktoum International Airport corridor makes it a logical choice for professionals in Dubai's logistics, aviation, and exhibition sectors, creating a built-in tenant pool.

The cash flow potential here aligns with the needs of Dubai’s core economic engine. It offers the desired lifestyle at a competitive rental price, ensuring high occupancy and a predictable income stream.

Villa Pricing And Payment Plan Breakdown

For any investor, the entry price and payment structure are the most critical data points. Analyzing a Damac Lagoon villa requires a granular look at these numbers to calculate the true cost of entry, model cash flow, and define a financing strategy. The pricing is tiered to appeal to different capital sizes.

The price range at Damac Lagoons is broad, reflecting the diversity of available properties. This allows an investor to target specific segments of the villa market.

Three-bedroom townhouses establish the entry point around AED 1.3 million, while large eight-plus-bedroom mansions can exceed AED 12 million. This tiered approach is characteristic of current Dubai real estate market trends, where demand is strong across multiple price bands.

The table below provides a snapshot of the typical pricing for different unit types.

Damac Lagoon Villa Unit Typology and Price Bands (AED)

| Villa Type | Bedrooms | Starting Price (AED) | High-End Price (AED) |

|---|---|---|---|

| Townhouse | 3 | 1,300,000 | 2,500,000 |

| Townhouse | 4 | 1,400,000 | 3,200,000 |

| Villa | 5 | 1,700,000 | 6,600,000 |

| Villa | 6 | 4,500,000 | 9,800,000 |

| Mansion | 8+ | 8,200,000 | 12,000,000+ |

Mid-range four-bedroom villas sit between AED 1.4 million and AED 3.2 million, with five-bedroom properties falling between AED 1.7 million and AED 6.6 million. For context, comparable communities like Murooj Al Furjan and Arabian Ranches 3 saw price growth between 17-28% last year. This data positions Damac Lagoons in an established growth corridor.

Decoding 2026 Off-Plan Payment Plans

The developer’s payment plan is a crucial lever for cash management. The hyper-aggressive 1% monthly schemes of a few years ago are gone. The market in 2026 has matured, shifting towards more balanced, construction-linked plans.

A typical Damac Lagoon Villa now follows an 80/20 or 70/30 model. This means 70-80% of the property's value is paid in instalments tied to construction milestones, with the final 20-30% due at handover.

This structure requires more upfront capital but signals a more stable, less speculative market.

- Impact on Cash Flow: It filters for serious investors with solid financial standing.

- RERA Protections: All payments go into a RERA-governed escrow account, a critical security measure ensuring funds are used for construction, as mandated by uae-property-law.

- Financing Implications: This structure provides ample time to arrange financing, aligning mortgage pre-approvals with the final handover payment.

The move away from ultra-flexible plans is a clear signal of market normalization.

Calculating Total Acquisition Cost

The sticker price is just the starting point. An accurate financial model must account for all associated acquisition costs to determine the true capital outlay. These are mandatory, government-regulated charges.

An accurate ROI calculation must factor in total acquisition costs, which typically add 6-7% to the purchase price. Overlooking these will distort yield and capital appreciation forecasts.

The main costs to budget for are:

- Dubai Land Department (DLD) Fee: A standard 4% of the property purchase price.

- DLD Registration Fees: Administrative fees for title registration, usually around AED 4,200.

- Developer Fees: A No Objection Certificate (NOC) fee may apply for resales, but is less common on initial off-plan purchases.

- Agency Fees: Standard real estate brokerage fees are 2% of the purchase price.

These funds must be liquid at the time of signing the deal. Building these costs into your initial budget provides a clear picture of your total financial commitment.

The Acquisition Process for a Damac Lagoon Villa

Acquiring an off-plan Damac Lagoon villa is a financial transaction requiring a focus on risk mitigation and transparency. The process hinges on meticulous due diligence, correct legal structuring, and disciplined financial planning.

The entire transaction is governed by the Sales and Purchase Agreement (SPA). This legal document is the core of the investment and must be reviewed carefully. It details villa specifications, construction milestones, the payment plan, and the handover process.

Foundational Due Diligence

Before transferring any funds, several non-negotiable checks are required. This is the foundation of investor protection in Dubai's off-plan market, designed to verify the project's legitimacy and financial security through official channels.

The verification checklist must include:

- RERA Project Registration: Confirm the Damac Lagoons project is officially registered with the Real Estate Regulatory Agency (RERA). This is mandatory before a developer can market or sell off-plan units.

- Escrow Account Verification: Every off-plan project must have a RERA-approved escrow account. Verify the account details and ensure all payments are made directly to this specific account. This is a critical safeguard.

These are not formalities; they are fundamental risk-management steps that protect the investment.

Structuring the Acquisition

For overseas investors, the ownership structure is a strategic decision. While personal ownership is straightforward, structuring the purchase through a corporate entity often provides superior asset protection and simplifies succession planning. An entity like a JAFZA offshore company or a mainland dubai-llc-company-setup can offer these advantages.

The decision to buy as an individual versus through a company should be driven by portfolio structure and long-term goals. A corporate structure can shield from liability and simplify asset transfers, a key concern for HNWIs managing cross-border assets.

The Payment and Handover Protocol

Payments for a Damac Lagoon villa are tied directly to construction progress. This construction-linked plan ensures payments are made against tangible development milestones. The process is clear and tightly regulated.

- Reservation and SPA: The process begins with a reservation fee, followed by signing the SPA and making the initial down payment, which includes the 4% DLD fee.

- Milestone Payments: Subsequent instalments are due only when the developer achieves specific, pre-agreed, and independently verified construction stages.

- Pre-Handover: Nearing completion, you will be invited for a final inspection to identify any defects (snagging).

- Final Payment and Handover: Upon making the final payment, the title deed is issued, and you take official possession of the property.

Successfully navigating these steps can also be a pathway to long-term residency. An investment of this scale often meets the threshold for a golden-visa-uae, adding another layer of value. Our detailed guide on buying off-plan property in Dubai provides an in-depth checklist.

Final Thoughts: Strategy Over Speculation

The market has changed. Investing in a Damac Lagoon villa in 2026 is a different proposition than it was during the post-pandemic boom. The across-the-board price inflation has settled into a mature market where strategic asset selection—not just momentum—drives returns. The window for easy flips has narrowed.

This is no longer about speculation. Success is about aligning with Dubai's long-term infrastructure plans and the real demand from its growing population. The value of Lagoons is anchored in its unique design and its strategic position in the path of Dubai's future economic growth, particularly the Dubai South corridor.

The New Investment Calculus

In this market, success hinges on a more detailed approach, focused on specific factors that determine an investment's long-term health.

- Unit Selection: Not all villas are equal. A corner plot, a premium layout, or proximity to a cluster's main lagoon will always command higher rent and resale value.

- Entry Price: Securing the best possible price during the off-plan stage is more critical than ever. It is the foundation of the entire ROI calculation.

- Clear Exit Strategy: A plan must be defined from day one. Is this a long-term rental asset for income, or a capital growth play held for five to seven years?

Performance data from last year provides a baseline, but what worked then will not automatically work now. The market no longer rewards participation alone; it rewards meticulous planning and strategic positioning.

A Damac Lagoon villa remains a strong asset, but only for the investor with a clear, well-researched strategy. This is an investment in the tangible growth of Dubai’s new economic heartland.

If you are rebalancing your portfolio for 2026, let's run the numbers.

Frequently Asked Questions

As an asset manager for high-net-worth individuals, I field specific, data-driven questions daily. Below are direct answers to common queries about a Damac Lagoon Villa investment in the current 2026 market. These are strategic assessments.

What Are the Primary Risks with an Off-Plan Damac Lagoon Villa?

The primary risks have shifted from broad market price corrections to project-specific execution and absorption rates. A granular risk assessment is essential.

Key considerations for financial modeling:

- Revised Handover Timelines: Damac is a tier-one developer, but any master community of this scale can face adjustments to its delivery schedule. These potential shifts must be factored into cash flow and rental income projections.

- Interest Rate Sensitivity: While cash deals are common, the secondary market relies heavily on mortgage financing. Any adjustments to central bank interest rate policies could impact secondary market liquidity and exit valuations.

- Supply Concentration: Damac Lagoons is a large project. Upon handover, a high volume of similar units will enter the rental market. Your strategy must involve analyzing the specific cluster and unit type to differentiate your asset and avoid competing with identical inventory.

RERA's mandatory escrow account requirements provide a robust layer of financial protection against developer default. This specific risk is substantially mitigated under the current framework of UAE property law.

How Does a Damac Lagoon Villa Compare to an Investment in Dubai Hills Estate?

This comparison is about growth potential versus established maturity. Each asset serves a different purpose within a diversified real estate portfolio.

Dubai Hills Estate is a mature, fully-realized community commanding a price premium for its proven infrastructure and stable rental market. Based on last year's benchmarks, its rental yields have settled in the 5-6% range. The investment thesis for Dubai Hills is capital preservation with moderate, predictable growth.

In contrast, a Damac Lagoon Villa is a growth-phase asset. Its main quantitative advantages are a lower entry price per square foot and higher projected rental yields, which trended between 7-10% based on early handovers and 2025 market data. The investment thesis here is higher potential for both capital appreciation and rental income, balanced by the risks of a community still in its development phases.

The choice is strategic. Dubai Hills is the blue-chip stock; Damac Lagoons is the high-growth equity. The decision should align with your portfolio’s objectives for cash flow generation versus long-term, stable value accretion.

What Is a Viable Exit Strategy for a Damac Lagoon Villa?

A clear exit strategy must be defined at acquisition. For a Damac Lagoon Villa, three primary paths exist, each suited to different market conditions.

- Post-Handover Rental Asset: The most prudent strategy in the current market. Take possession of the completed unit and lease it to generate immediate cash flow, leveraging the community's high rental yield potential.

- Secondary Market Sale Upon Handover: This strategy aims to capture the capital appreciation between the off-plan purchase price and the ready property value at completion. Success depends on timing the market and ensuring the final valuation exceeds total acquisition cost, including all fees related to taxes on property.

- Pre-Handover Assignment (Flipping): Selling the Sales and Purchase Agreement (SPA) before project completion. While profitable in 2023-2024, it is a more speculative play in today's mature market and is generally viable only after a significant portion of the purchase price (typically 40-50%) has been paid.

The window for easy, pre-handover flips has narrowed. The most robust strategies for 2026 and beyond are focused on the asset's tangible value as a rental income generator or a long-term family home.

At Proact Luxury Real Estate LLC, we focus on the numbers that drive portfolio growth. If you are rebalancing your assets for the current market cycle, let's conduct a detailed analysis of where a Damac Lagoon Villa fits into your strategy.

https://ritukant.com