While many investors focus on Downtown, the smart money has moved to established master communities where proven infrastructure underpins value. As we enter 2026, Damac Hills villas exemplify this shift. The community has transitioned from its high-growth launch phase into a sustainable cycle, buoyed by real end-user demand and predictable returns.

Why Damac Hills Warrants a Deeper Asset Analysis

The speculative frenzy of the post-Covid boom has given way to a more calculated investment environment. Last year's benchmarks from the Dubai Land Department confirm that communities with established schools, retail, and world-class amenities are consistently outperforming purely speculative zones. Damac Hills, anchored by the Trump International Golf Club, fits this profile.

This is not a lifestyle overview; it is a quantitative breakdown of a specific asset class. The focus is on performance, comparing the entry points and ROI trajectories of the distinct villa typologies within the community.

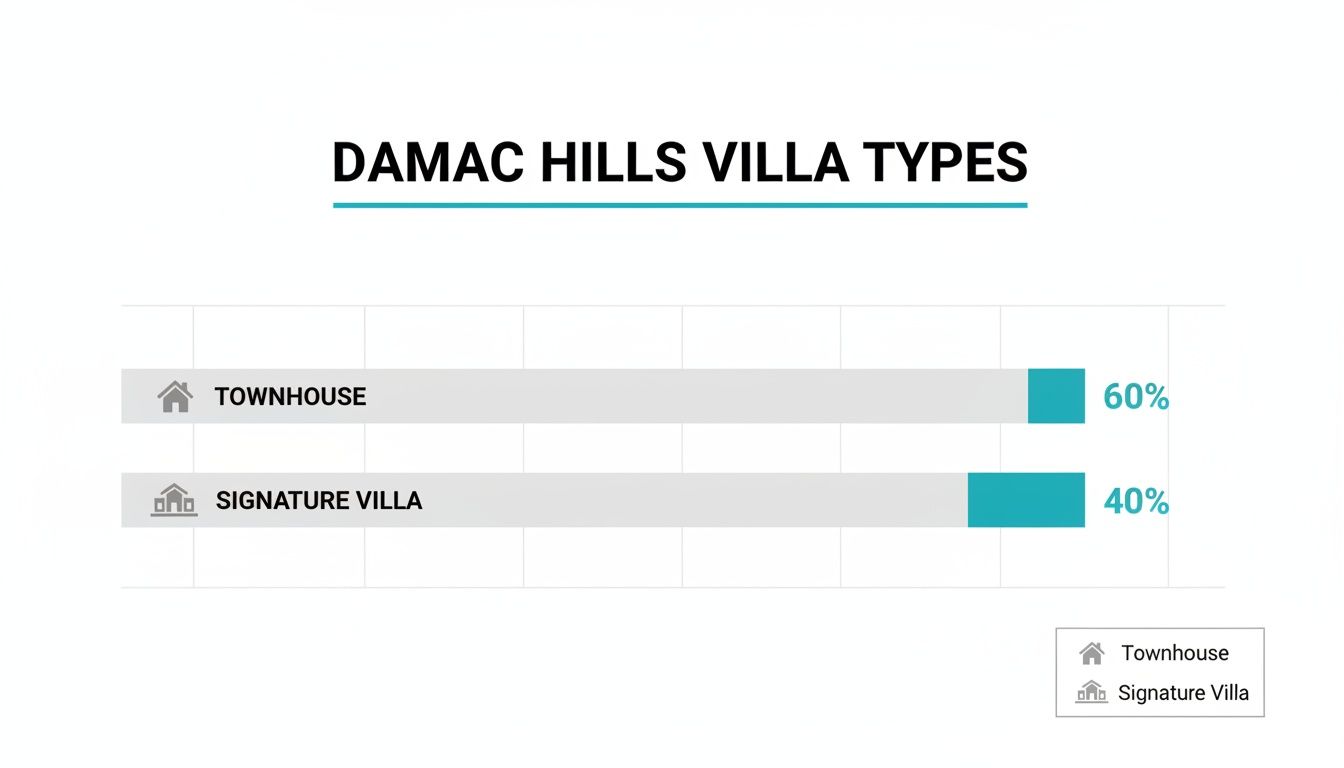

Dissecting the Product Mix: Townhouse vs. Signature Villa

The term "villa" in Damac Hills covers two distinct asset classes appealing to different investor profiles. Understanding this distinction is fundamental to a successful acquisition.

Investment Pros/Cons: Townhouses (Attached Villas)

- Pros: These three- to five-bedroom units are the workhorses of the community's rental market, attracting executive end-users. Their smaller plots mean lower service charges, which directly boosts net rental yields.

- Cons: Capital appreciation is typically slower compared to standalone units, and they offer less privacy.

Investment Pros/Cons: Signature Villas (Standalone)

- Pros: These are larger, independent properties, often on the golf course. Targeted by HNWIs as primary residences, their value is a capital appreciation play driven by scarcity and location.

- Cons: Lower rental yields due to higher acquisition cost. The pool of potential tenants is smaller, potentially leading to longer vacancy periods.

A Data-Driven Perspective

Using 2025 transaction data as our baseline, this analysis builds a case for Damac Hills villas as a strategic portfolio component for 2026. This is about identifying an asset that aligns with financial objectives, whether that is steady income or capital growth.

The core difference is land ownership and privacy. A villa sits on its own plot, offering greater exclusivity. A townhouse shares common walls and often falls under a Strata title for communal areas. This legal distinction directly impacts entry price and long-term maintenance costs.

By breaking down the product mix, we can model future performance with greater accuracy. For a yield-focused investor, the townhouse sub-market offers a compelling, lower-risk entry. For those with a longer time horizon, signature villas provide an excellent hedge against inflation. You can explore similar asset distinctions in our guide to Damac Lagoons villas.

Gauging Real Returns: Capital Appreciation & Investment Metrics

Hard numbers define an asset's value. For any HNWI evaluating Damac Hills villas, the two metrics that matter are capital appreciation and rental yield. These determine the total return and define the asset's performance within a portfolio.

Last year's performance benchmarks indicate where the community is headed. While the post-Covid boom has settled into a sustainable growth rhythm, certain pockets within Damac Hills show robust performance. The strategy is to look past community-wide averages and analyze performance on a cluster-by-cluster basis.

Data from early 2025 showed a notable surge, with villa prices jumping 20.7% in Q1 alone—a growth rate that outstripped many of Dubai’s prime districts. This pushed the average transaction value to AED 4.4 million. Coupled with average rental yields holding at a solid 6.5%, Damac Hills cemented its place among Dubai's top five districts for villa investment.

The View Premium: A Quantifiable Advantage

Not all properties are created equal, and the price per square foot (PSF) makes this difference financially tangible. In Damac Hills, units with unobstructed views of the Trump International Golf Club command a significant premium. Last year's transaction data consistently shows these signature golf-facing villas commanding a 15-20% PSF premium over identical units facing internal roads.

This is an investment moat. During a market correction, these prime-location assets are more resilient and hold their value better. For an investor focused on long-term capital preservation, securing a golf course view is a strategic advantage.

The high number of townhouses underscores the community's strong foundation in the end-user rental market, providing a stable floor for demand.

Rental Yield Analysis

For any buy-to-let investor, gross rental yield is the most immediate measure of performance. In Damac Hills, yields vary based on the villa's size and layout.

- Three-Bedroom Townhouses: These are the rental market workhorses, delivering the highest yields, often in the 6.5% to 7.0% range. Their accessible price point creates a healthier net return.

- Four & Five-Bedroom Townhouses: The pool of potential tenants shrinks with size, leading to a slight yield compression. These units typically generate yields between 6.0% and 6.5%.

- Signature Villas (5+ Bedrooms): These are primarily a capital appreciation play. Their high purchase price pushes the gross yield down to the 4.5% to 5.5% range. Investors acquire these assets for wealth preservation, not immediate cash flow.

A key takeaway from last year’s data is the inverse relationship between property size and rental yield. The smaller, more accessible units consistently outperform larger villas on this metric. To see how these figures stack up against the wider market, you can review our detailed Dubai property market forecast.

Damac Hills Villa Investment Snapshot (Based on 2025 Benchmarks)

This table provides a comparative analysis of key investment metrics for different villa configurations within Damac Hills for portfolio planning.

[Table: 2025 Investment Metrics for Damac Hills Villas]

| Villa Type | Average Sale Price (2025) | Average Annual Rent (2025) | Gross Rental Yield (%) | Q1 2025 Price Appreciation (%) |

|---|---|---|---|---|

| 3-Bed Townhouse | AED 2.8M | AED 190,000 | 6.8% | 22.1% |

| 4-Bed Townhouse | AED 3.5M | AED 220,000 | 6.3% | 21.5% |

| 5-Bed Townhouse | AED 4.2M | AED 260,000 | 6.2% | 20.8% |

| 5-Bed Signature Villa | AED 7.5M | AED 375,000 | 5.0% | 19.5% |

| 6-Bed Signature Villa | AED 11.0M | AED 550,000 | 5.0% | 19.9% |

While all segments performed well, smaller townhouse units offered a superior blend of high rental yield and strong capital appreciation, making them a compelling option for investors focused on total return.

Benchmarking Damac Hills Against Rival Communities

An asset's value is relative. For any investor evaluating Dubai in 2026, understanding where Damac Hills sits on the risk-reward spectrum requires a direct comparison with its main competitors. A close look at last year's data reveals a distinct value proposition against Arabian Ranches and Dubai Hills Estate.

Arabian Ranches is the established, mature neighborhood with premium price tags and tighter rental yields. Dubai Hills Estate is the modern giant that commands a high price from the outset. Damac Hills occupies a unique space in the middle, offering established infrastructure with tangible growth potential at a more attractive entry point.

Price Per Square Foot Analysis

PSF data from 2025 shows villas in Dubai Hills Estate consistently sold for a 15-20% premium over similar properties in Damac Hills, driven by its more central location.

Arabian Ranches presents a more complex picture. While its PSF is high, much of the older stock requires significant capital upgrades—a hidden cost not reflected in the sale price. Damac Hills offers newer construction at a lower PSF, providing a cleaner path to immediate rental income without renovation expenses.

Capital Growth Velocity and Yield Compression

Last year, both Dubai Hills Estate and Arabian Ranches saw steady but slowing growth as their markets matured. Their rental yields have been compressed, now hovering in the 4-5% range.

Damac Hills, in contrast, showed stronger growth momentum. Data from early 2025 shows villa prices rose 20.7% in Q1, with the average deal size hitting AED 4.4 million. All the while, its rental yields remained healthy, averaging a robust 6.5%. This offers a superior blend of capital appreciation and steady income. For more context, our guide to the best villa communities in Dubai provides further comparisons.

The Damac Hills 2 Benchmark

Damac Hills 2 serves as a vital benchmark. It acts as a feeder community, offering a more accessible price point that attracts a broader range of homebuyers and tenants.

This accessibility creates a unique value proposition. A three-bedroom villa in Damac Hills 2 averages around AED 1,100,000, a major discount compared to the wider Dubailand average. This pricing creates a solid foundation for the rental market.

From a portfolio management perspective, the relationship between Damac Hills and Damac Hills 2 is symbiotic. The premium status of the original community pulls up values in the new one, while the accessibility of Damac Hills 2 creates a stable rental demand floor for the entire ecosystem.

This dynamic makes Damac Hills villas a strategic selection. Investors can acquire assets in a premium, established community at a valuation with clear growth potential, amplified by surrounding infrastructure projects like the Al Maktoum International Airport expansion.

[Map: Location relative to Al Maktoum Airport]

Off-Plan vs. Resale Villas: A 2026 Strategic Choice

The choice between an off-plan villa and a ready property on the resale market is a critical financial calculation. As of early 2026, the dynamics for both have shifted, demanding closer analysis.

Last year saw a rush for ready properties from investors seeking immediate rental income. However, a forward-looking strategy involves a careful analysis of new off-plan launches in and around Damac Hills. These offer a different value proposition centered on capital growth during the construction phase.

The Off-Plan Proposition: Capital Leverage

The primary advantage of buying off-plan is financial leverage. In 2026, developers are moving from 1%-per-month plans to more structured 60/40 or 70/30 payment schedules. This shift weeds out short-term speculators and leads to more stable communities post-handover.

For an investor, this means controlling a high-value asset for a fraction of its total cost during the 2-3 year construction period. This is the window for capital appreciation driven by construction milestones and market uplift. Our guide on buying off-plan property in Dubai breaks down this mechanism.

This strategy has risks; revised handover timelines are a commercial reality and must be factored into financial models.

All off-plan investments in Dubai are protected by the Real Estate Regulatory Agency (RERA). Payments are held in a secure, government-managed escrow account and are only released to the developer as construction progresses. This is a critical pillar of current uae-property-law.

The Resale Market: Immediate Cash Flow

Buying a resale villa offers the certainty of a physical asset. For an investor whose primary goal is immediate cash flow, a ready villa in Damac Hills is a turnkey solution.

The main benefit is generating rental income from day one. With gross yields for three-bedroom townhouses averaging 6.5% to 7.0% based on last year's data, a ready unit provides an instant, predictable return. This is particularly appealing for mortgage-financed purchases.

A Comparative Financial Model

This hypothetical five-year ROI model compares the two strategies for a three-bedroom townhouse valued at AED 3 million.

[Chart: 2026 Payment Plan Breakdown]

| Metric | Off-Plan Villa (3-Year Construction) | Resale (Ready) Villa |

|---|---|---|

| Initial Outlay (Year 1) | AED 900,000 (30% during construction) | AED 3,120,000 (Full price + 4% DLD fee) |

| Rental Income (Years 1-3) | AED 0 | AED 570,000 (Assuming AED 190k/year) |

| Capital Appreciation (Est.) | 15% pre-handover (AED 450,000) | 5% annually (AED 472,880 over 3 years) |

| Total Position (End Year 3) | Asset value: AED 3.45M | Asset value: AED 3.47M + Rental Income |

The model shows that while the resale option provides immediate cash flow, the off-plan route allows for capital growth on a much smaller initial investment. The choice depends on an investor's financial position, risk tolerance, and whether the priority is cash flow or capital appreciation.

Transaction Execution: A Guide for International Investors

Acquiring a high-value asset like a Damac Hills villa requires precision to ensure transparency and legal compliance. The process in Dubai is straightforward but demands attention to detail.

The first step is signing the Memorandum of Understanding (MOU), which outlines the terms of the sale. This is backed by a 10% security deposit held by a RERA-registered agency. The MOU takes the property off the market while final checks are completed.

The Transaction Flow: From MOU to Title Deed

Following the MOU, a No Objection Certificate (NOC) is required from the developer, Damac Properties. The NOC confirms all service charges are paid and there are no outstanding issues. The final transfer cannot proceed without this.

The final step is the title deed transfer at the Dubai Land Department (DLD). Once the agreed price and all official fees, including any applicable taxes-on-property, are paid, the DLD issues a new title deed in the buyer's name.

Financial and Ownership Structuring

A clear understanding of costs is essential. Beyond the purchase price, budget for these non-negotiable fees:

- DLD Transfer Fee: 4% of the property's sale price.

- Agency Commission: Typically 2% of the sale price.

- Trustee Fees: Administrative fees around AED 4,200.

Ownership structuring is a strategic decision. While buying in a personal name is common, establishing a corporate entity can offer liability protection and succession planning benefits. Our guide on buying property in Dubai for foreigners details this process.

A key driver for property acquisition is the residency-by-investment program. An investment in a property valued at AED 2 million or more makes you eligible to apply for a 10-year renewable Golden Visa. This residency permit is a major value-add, providing a long-term UAE base. For more information, read our article on what-is-golden-visa-uae.

Navigating this process requires expert guidance. At Proact, we manage every step to ensure your acquisition is executed flawlessly and aligns with your investment strategy.

Final Thoughts: Strategy Over Speculation

The window for 'easy flips' has narrowed. Success in the 2026 market is not about speculation; it is about targeting communities with genuine infrastructure growth and proven end-user demand.

Based on last year's hard data, Damac Hills villas offer a compelling balance of steady rental income and solid capital growth. The community has reached a level of maturity that inspires confidence, yet a pipeline of new premium launches provides multiple entry points for different investment objectives.

Unlocking value requires granular analysis. Success lies in dissecting the performance of specific clusters and villa types to align with your financial goals, whether that is maximizing yield or preserving capital.

This is where sharp asset management becomes critical. My role at Proact Luxury Real Estate is to provide that deep analysis, managing your property from acquisition through to a profitable exit. Our focus is on strategy, ensuring every decision is backed by data. If you are rebalancing your portfolio for 2026, let's run the numbers.

Frequently Asked Questions

What Is The Primary Difference Between A Townhouse And A Villa In Damac Hills?

From an investment perspective, the difference is stark. A villa is a standalone property on its own plot, offering maximum privacy. A townhouse is attached, sharing at least one wall with a neighbor. This impacts the bottom line: villas command a higher price due to land value, positioning them as a capital appreciation play. Townhouses are rental portfolio workhorses—more affordable, generating stronger yields, and appealing directly to the end-user family market.

Are The Service Charges In Damac Hills Competitive?

Service charges can erode net rental yield. In Damac Hills, fees are calculated per square foot and regulated by the DLD's service charge index. Last year's data shows the charges are in line with other premium communities like Arabian Ranches. Before signing any resale agreement, an investor should insist on seeing the complete service charge history.

What Is The Outlook For Capital Appreciation In 2026?

The market is in a more mature, sustainable cycle. For 2026, capital appreciation in Damac Hills will be driven by local factors, not general market hype. Key drivers include the expansion of Al Maktoum International Airport, the scarcity of prime units with golf course views, and the halo effect from new high-end cluster handovers like Cavalli and Gems Estates. We forecast stable, single-digit growth for Damac Hills, with prime assets outperforming the average. This aligns with the broader dubai-real-estate-market-analysis which suggests a stabilization in price per square foot.

How Does The Golden Visa Program Apply To Damac Hills Villas?

The golden-visa-uae residency program is a major incentive. Purchasing a property valued at AED 2 million or more makes you eligible for a 10-year renewable residency visa. Nearly all Damac Hills villas and most townhouses meet this threshold. The purchase becomes a strategic move to secure a long-term foothold in the UAE.

Can I Purchase A Villa Through A Company Structure?

Yes, and for many HNWIs, it is the optimal approach. Using a corporate structure like a JAFZA offshore company or a mainland dubai-llc-company-setup offers liability protection, privacy, and more efficient succession planning. The appropriate structure depends on an investor's long-term objectives.

What Are The Typical Rental Yields For Damac Hills Villas?

Rental performance is a core strength. Last year's benchmarks show yields at 6.5%, placing Damac Hills in the UAE's top five locations for villa investments. This is supported by a diverse range of properties and continued infrastructure investment, signaling sustained rental demand and asset value potential.

At Proact Luxury Real Estate LLC, our advisory service is built on granular data and an understanding of market cycles. We assist clients in managing assets, not just acquiring them. If you are rebalancing your portfolio for 2026 and require a data-driven strategy, let's connect. Find out more at https://ritukant.com.