While many investors focus on the off-plan launches dominating last year's headlines, the smart money in 2026 has shifted to stabilised, income-generating assets. We have exited the post-Covid speculative boom and entered a sustainable growth cycle, where asset performance—not just potential—is the primary metric for portfolio inclusion.

Bella Vista: A Strategic Asset in the 2026 Dubai Market

New off-plan communities come with inherent execution risks, including revised handover timelines and uncertain future infrastructure. This is where a development like Damac Hills Bella Vista presents a compelling case. It is an established, ready-to-move cluster within one of Dubai’s most successful master communities.

Investing here is not about purchasing potential; it is about acquiring a performing asset from the moment of transfer.

The Value of an Established Community

Bella Vista's core strength is its location within a fully realised, low-density green community. This aligns with the strong tenant demand for family-friendly neighbourhoods with established amenities, a trend that defined the 2025 rental market. The investment case is direct:

- Immediate Rental Income: There is no construction period. An investor can place a tenant and generate cash flow immediately, servicing financing or enhancing portfolio returns.

- Proven Capital Appreciation: Bella Vista has a clear transaction history. Performance analysis is based on actual Dubai Land Department data, not developer forecasts.

- Reduced Volatility: As a tangible asset in a developed neighbourhood, it has lower exposure to the price fluctuations common in newer, off-plan areas.

This stability is a key differentiator in the current market. Damac Hills consistently ranks among the top five most sought-after districts for villa and townhouse transactions, driven by demand for ready communities valued for their immediate availability and premium infrastructure.

Strategic Portfolio Placement

For an investor rebalancing their portfolio in 2026, Bella Vista acts as a solid anchor. It provides a strategic hedge against the construction risks tied to new projects while offering exposure to one of Dubai's prime freehold areas in Dubai.

The community's unit mix of townhouses and villas is tailored to the expat family and senior professional demographic. These tenants prioritise proximity to top-tier international schools, green parks, and established retail—all foundational elements of the Damac Hills master plan. This strong tenant profile directly translates into lower vacancy rates and sustained rental demand.

Analyzing Bella Vista’s Performance: A Look Back and Projections for 2026

Financial metrics, not marketing brochures, dictate sound investment decisions. To evaluate Damac Hills Bella Vista for a 2026 portfolio, we must analyse its performance using last year's benchmarks. From a data-driven perspective, ready villas inside established master communities have consistently outperformed the wider market.

Bella Vista exemplifies Dubai’s shift towards low-density, green communities experiencing premium price growth. Property Monitor's reports from last year placed Dubai's average prices at levels reflecting strong year-on-year growth, a tailwind for established clusters like Bella Vista. This is the asset class that has consistently delivered for investors focusing on fundamentals over speculation.

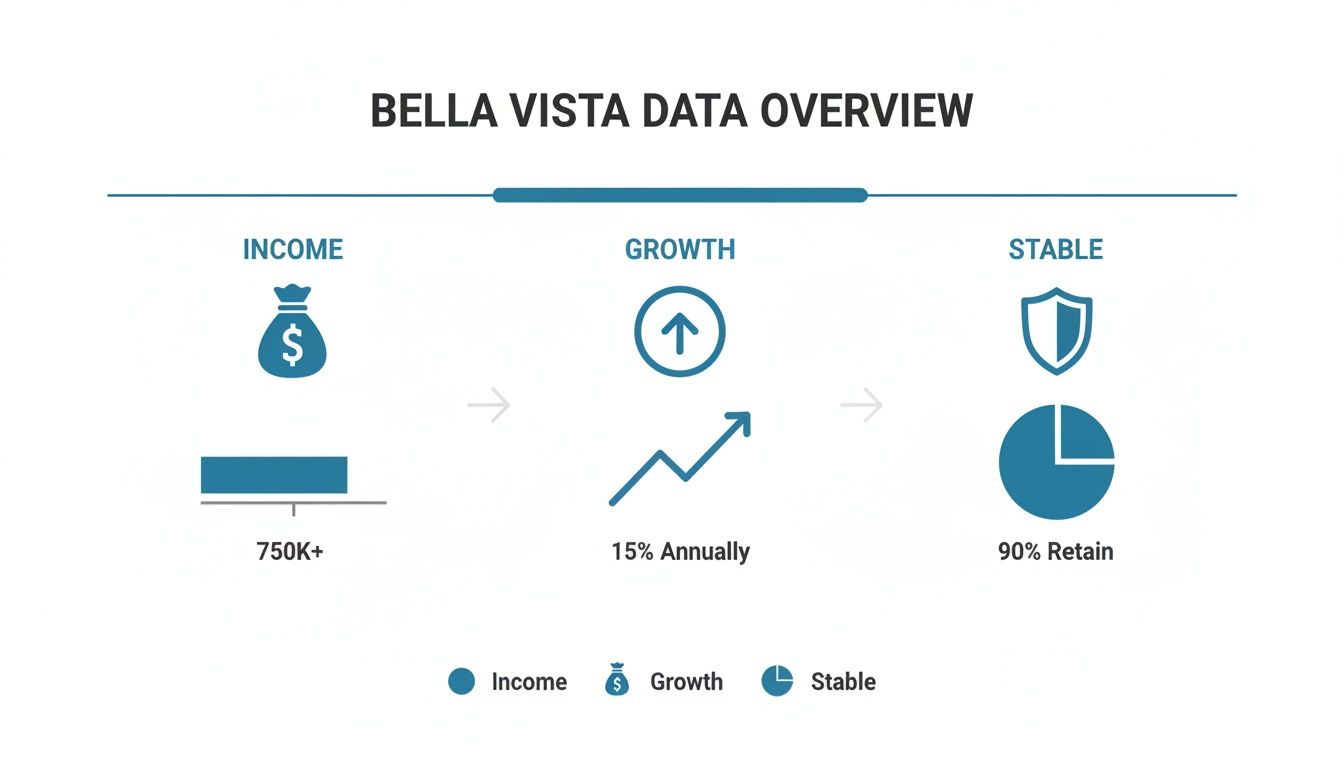

This visual distills the core investment metrics for a typical Bella Vista property—income, growth potential, and stability.

The data confirms this is a strong asset class combining healthy income generation with solid capital appreciation and high tenant retention rates.

Capital Appreciation Analysis: 2025 vs. 2026

Last year, the price per square foot for ready villas in Damac Hills saw a notable climb, aligning with city-wide demand for spacious, family-oriented homes. As a mature cluster, Bella Vista tracked this trend, delivering solid capital gains for investors.

Looking ahead, our internal models project a continuation of this upward trend, but at a more sustainable pace. The speculative energy of 2023-2024 has been replaced by growth supported by genuine economic expansion and a steady influx of new residents. We forecast a conservative 6-8% capital appreciation for well-maintained Bella Vista units throughout 2026, factoring in new supply from off-plan handovers in adjacent communities.

The era of double-digit annual flips in ready communities has narrowed. The 2026 strategy is about acquiring assets with strong fundamentals for steady, long-term growth, not short-term speculation.

Rental Yield and Income Stability

From an asset management perspective, the most compelling metric for Bella Vista is its rental yield. Unlike off-plan properties that offer zero immediate income, these villas generate cash flow from day one.

In Q4 2025, gross rental yields for Bella Vista villas were strong, supported by high demand from the expatriate family demographic. This tenant profile values the community's proximity to top international schools, green spaces, and the Trump International Golf Club, which translates to low vacancy rates and stable rental income. You can find more detail in our in-depth guide to Damac Hills villas.

The table below breaks down last year's performance against our projections for 2026, providing a quantitative basis for any investment decision.

Bella Vista Performance Metrics: Q4 2025 vs. 2026 Projections

This table provides a comparative analysis of key financial indicators for Bella Vista villas, contrasting last year's benchmarks with forward-looking estimates. [Chart: Bella Vista Performance Metrics 2025 vs 2026]

| Metric | Q4 2025 Benchmark | Q1-Q4 2026 Projection | Commentary |

|---|---|---|---|

| Average Price/Sq. Ft. | AED 1,150 | AED 1,220 - 1,250 | Growth is moderating to a sustainable level, driven by organic demand. |

| Gross Rental Yield (3-BR) | 5.8% | 5.5% - 5.7% | A slight compression is expected as capital values rise faster than rents. |

| Gross Rental Yield (4-BR) | 5.5% | 5.2% - 5.4% | Larger units show marginally lower yields but attract longer-term tenants. |

| Average Occupancy Rate | 94% | 92% - 95% | Remains exceptionally high due to the community's established appeal. |

| Projected Capital Growth | N/A | 6% - 8% | Reflects a mature market cycle focused on asset quality over speculation. |

These figures confirm Bella Vista's standing as a reliable, income-generating asset. The stability of its rental yields provides a defensive cushion against potential market adjustments, making it a prudent choice for investors seeking to de-risk their portfolios.

Deconstructing The Asset: Unit Mix And Renter Profile

From an investment perspective, it is necessary to analyze the asset's components. To build a solid financial model for Damac Hills Bella Vista, we must evaluate the unit types, their layouts, and the specific end-user they attract. When product and market are aligned, the result is strong rental demand and high occupancy.

Bella Vista's design is focused on one of the most stable segments of Dubai's population: the mid-to-large expatriate family. The community is dominated by spacious townhouses and independent villas, intentionally avoiding smaller apartments that often attract a more transient tenant base. This was a strategic decision by the developer to ensure a reliable, long-term rental market.

What’s On Offer: Popular Layouts and Liquidity

The property mix in Bella Vista aligns with the layouts that proved most popular throughout 2025. These are the assets that perform best on the rental market and are most liquid on the secondary market.

3-Bedroom Townhouses: These are the workhorses of the community. With a built-up area (BUA) of around 2,000 to 2,400 sq. ft., they are the top choice for young professional families. Their practical size and competitive rental price point result in the lowest vacancy rates.

4-Bedroom Villas: These homes are sized for established families, often with live-in help. A BUA ranging from 2,500 to 3,000 sq. ft. provides the additional living space and larger private gardens this demographic demands.

5-Bedroom Villas: These are the premium offerings. Aimed at senior managers and business owners, these villas often exceed 3,200 sq. ft. While the tenant pool is smaller, they command the highest rents and are often secured through long-term corporate leases.

Across all unit types, the design philosophy emphasizes practical, usable living space. Features like a maid's room, a closed kitchen, and private outdoor areas are standard, directly meeting the expectations of the ideal tenant.

For a more detailed breakdown, our guide on buying a villa in Dubai details these essential attributes.

Pinpointing The Primary Renter

Understanding the target tenant is the core of successful property investment. The primary renter for Damac Hills Bella Vista is specific and consistent.

The ideal Bella Vista tenant is a Western or senior-level expatriate family with one to three children attending a nearby international school. Their decision is driven less by proximity to urban hubs and more by access to green spaces, top-tier education, and community safety.

This profile is why certain community features directly boost rental yields. The proximity to Jebel Ali School and other British-curriculum schools is a major attraction. Access to the Trump International Golf Club and the expansive parks are not just lifestyle perks; they are tangible assets that reduce tenant turnover. This tenant type is less price-sensitive and more focused on quality, willing to pay a premium for a well-maintained property in a secure, established community.

Comparative Market Analysis Against Key Villa Communities

An asset's performance must be benchmarked against its competition. To understand Bella Vista's position in a 2026 portfolio, it must be compared to its main rivals. The analysis focuses on three key market segments: Jumeirah Village Circle (JVC), Town Square, and the original benchmark, Arabian Ranches.

Investment Pros & Cons

Pros

- Established Infrastructure: Unlike emerging off-plan communities, all amenities, roads, and landscaping are complete and mature.

- Immediate Income Generation: The asset produces rental income from day one, with no construction-related delays impacting cash flow.

- Premium Tenant Profile: The community attracts high-income, long-term expatriate families, leading to lower vacancy rates and stable returns.

- Proven Track Record: Capital appreciation and rental yields are based on historical data, reducing forecasting risk.

Cons

- Higher Entry Cost: The acquisition price is higher than off-plan alternatives, reflecting the lower risk and immediate utility.

- Moderating Capital Growth: The rapid appreciation phase typical of new launches has passed; future growth will be more sustainable and aligned with the broader market.

- Service Charge Obligations: As a mature community, ongoing service charges are a factor in calculating net yield and must be professionally managed.

Town Square: A Direct Competitor

Town Square offers a more direct comparison. It is a well-regarded, family-friendly master community with excellent amenities and a competitive price point, attracting a similar demographic. The key difference lies in brand equity and market positioning. Damac Hills, with the Trump International Golf Club as its centerpiece, operates in a higher tier. This translates into stronger price resilience during market adjustments and greater appeal for senior executive tenants.

While both communities are excellent family options, Damac Hills has a premium status that Town Square does not. This positioning acts as a valuable buffer for capital preservation.

Arabian Ranches: The Established Benchmark

Arabian Ranches is the original benchmark for premium villa living. Its mature greenery and established community feel make it a perennially sought-after address. However, its maturity presents a challenge for new investors. The explosive capital growth phase occurred years ago. What remains is stability, but at a much higher entry cost, which compresses gross rental yields, often below 5%.

For a deeper analysis of top-tier communities, our guide on the best villa communities in Dubai breaks down the data.

2026 Investment Snapshot: Bella Vista vs. Key Competitors

This table provides a direct comparison of investment metrics across popular Dubai villa communities to inform asset allocation. [Map: Location of Bella Vista relative to Arabian Ranches and Town Square]

| Community | Average Price/Sq. Ft. (2026 Est.) | Projected Gross Rental Yield | Key Differentiator |

|---|---|---|---|

| Damac Hills Bella Vista | AED 1,220 - 1,250 | 5.2% - 5.7% | Premium brand equity; golf course community; balanced growth & yield. |

| JVC (Villa Clusters) | AED 850 - 950 | 6.0% - 6.5% | Lower entry price; higher density; potential for higher vacancy. |

| Town Square | AED 1,050 - 1,150 | 5.5% - 6.0% | Strong family amenities; competitive pricing; lacks premium positioning. |

| Arabian Ranches | AED 1,300 - 1,500 | 4.5% - 5.0% | Mature and stable; limited capital growth potential; high entry cost. |

This analysis makes it clear that Bella Vista is a calculated investment. It offers an optimal blend of immediate rental income, solid community infrastructure, and real potential for capital growth, positioning it as a core asset for any 2026 property portfolio.

Investment Risks and Mitigation Strategies

A professional investor must analyze potential risks. Every investment has them; the key is to identify and mitigate them with a clear strategy. For Bella Vista, risks fall into two categories: market-wide factors and project-specific variables.

Market-Wide Risk Factors

The Dubai real estate market is in a sustainable growth phase but is not insulated from global economic shifts.

Supply Dynamics from New Launches: The constant launch of new off-plan villa communities, particularly in areas like Dubai South and The Valley Phase 2, could dilute demand for existing properties.

Mitigation Strategy: The primary defense is a "flight to quality." Bella Vista's advantage is its established nature. It has mature landscaping and proven infrastructure, available now—a tangible asset that tenants and buyers already trust.

Interest Rate Fluctuations: Global monetary policy directly impacts mortgage affordability in the UAE. A sharp rise in interest rates could cool buyer demand.

Mitigation Strategy: Focus on the asset's defensive cash flow. Bella Vista's gross rental yields of 5.2% - 5.7% act as a buffer. Even if capital growth flattens, the property remains a strong income-generating asset.

Project-Specific Risk Management

On-the-ground realities of asset ownership must also be managed.

An asset's long-term value lies not just in its location but in its upkeep. Proactive management of operational costs is as critical as the acquisition strategy, a core principle of current UAE property law.

Service Charge Escalation: Community service charges are a necessary operational cost, but rapid increases can erode net yields. These fees require RERA approval but can rise over time.

Mitigation Strategy: Active ownership is essential. Involvement in the owners' association and professional property management are critical to scrutinizing budgets and ensuring value.

Long-Term Maintenance and Asset Depreciation: A physical asset requires maintenance. Neglecting upkeep will accelerate depreciation and reduce its appeal to high-quality tenants.

Mitigation Strategy: A proactive maintenance schedule and proper insurance are non-negotiable. Our guide on securing home insurance in the UAE outlines the necessary coverage to protect your investment.

Final Thoughts: Strategy Over Speculation

Success in Dubai's 2026 property market requires precise, strategic asset selection. Damac Hills Bella Vista is not just another property; it is a core holding for a diversified real estate portfolio. Its value proposition is clear: a blend of immediate rental income and sustainable long-term growth, anchored in a premium, established community.

This type of asset delivers stability and predictable cash flow, acting as a hedge against the execution risks of new off-plan launches that dominated last year's market. For any investor building a resilient portfolio, this balance is fundamental. The next step moves from this overview to granular financial modeling based on a specific unit, factoring in its layout, condition, and position. An asset is only as strong as the strategy behind its acquisition.

If you are rebalancing your portfolio for 2026, let's run the numbers. At Proact Luxury Real Estate, our entire focus is on data-driven asset management.

Frequently Asked Questions

What are the typical annual service charges?

For 2026, service charges in Damac Hills are stable, typically between AED 3 to AED 5 per square foot of the property's built-up area annually. For a standard three-bedroom villa, budget approximately AED 8,000 to AED 12,000 per year. These RERA-regulated fees cover landscaping, 24/7 security, and maintenance of all common area amenities.

Is financing available for non-resident investors?

Yes. UAE banks actively offer mortgage products to non-resident investors for ready properties like those in Bella Vista. A non-resident can typically secure a loan for up to 50-60% of the property's appraised value, subject to meeting the bank's lending criteria, which includes verified proof of income and a detailed credit history.

Does a Bella Vista property purchase qualify for a UAE Golden Visa?

Yes, this is a significant value-add. A property purchase in Damac Hills Bella Vista can facilitate long-term residency. The current framework for the Golden Visa UAE requires a property investment of at least AED 2 million, with the property being free of any mortgage. Most villas in Bella Vista exceed this price point, allowing an investor to initiate the application process upon completion of the property transfer.