To buy a property in Dubai Marina is to invest in one of the most liquid real estate markets in the region. It is the "Blue Chip" stock of Dubai real estate—offering a proven track record of high rental demand, resilient capital values, and a global brand that requires no introduction.

For the sophisticated investor, the Marina represents a strategic entry point. It is an economic powerhouse driven by tangible fundamentals: a scarcity of waterfront plots, consistent demand from high-earning expatriates, and a lifestyle infrastructure that is virtually impossible to replicate elsewhere.

Whether you are looking for a high-yield studio or a capital-appreciation penthouse, this guide moves beyond the marketing hype to provide a structural analysis of how to acquire and manage a performing asset in Dubai’s most iconic district.

Why Dubai Marina Captivates Investors

Dubai Marina is more than just a prestigious address; it's an economic powerhouse driven by tangible factors that appeal to discerning investors. Its allure is rooted in the unique combination of a high-energy urban environment with the tranquillity of waterfront living, creating a lifestyle that is in constant demand.

The area consistently attracts a steady stream of high-earning expatriates, young professionals, and tourists. This diverse demographic fuels robust rental demand for both long-term and short-term lets, ensuring property owners can achieve strong occupancy rates and attractive rental yields.

The Anatomy of Its Appeal

The investment appeal of Dubai Marina is multifaceted. It's not just about the stunning views but also the practical, everyday conveniences that make it a premier residential choice. The infrastructure here is second to none, offering residents seamless connectivity and access to a vibrant community.

Key drivers behind its sustained popularity include:

- Unmatched Lifestyle Amenities: From the bustling Dubai Marina Mall and the scenic Marina Walk to countless fine-dining restaurants and cafes, residents have everything at their doorstep.

- Strategic Location: Its proximity to major business hubs like Dubai Media City and Jebel Ali, along with easy access to Sheikh Zayed Road and the Dubai Metro, makes commuting simple.

- Strong Rental Market: The area's global recognition ensures a continuous flow of rental inquiries, translating into reliable income streams for property owners. You can explore a deeper Dubai real estate market analysis to understand the broader trends supporting this demand.

Market Performance and Investor Confidence

The numbers confirm Dubai Marina's status as a top-tier investment destination. It consistently ranks among the most transacted communities in Dubai. Throughout 2025 H1 2025 Dubai Marina remained a preferred community for apartment buyers, reflecting its sustained appeal.

During this period, apartment prices ranged from AED 1,800 to AED 2,500 per square foot, with premium waterfront units commanding prices upwards of AED 3,000. This resilience and growth potential are why so many choose to buy a property in Dubai Marina as a cornerstone of their portfolio. Discover more insights about the Dubai Marina property investment landscape on entralon.com.

Finding the Right Dubai Marina Property for You

Deciding to buy a property in Dubai Marina is the easy part. The real work—and where your strategy comes into play—is picking the right asset. This isn't just about finding a flat with a nice view; it's about drilling down on your financial goals and finding the specific property that will get you there.

The first major crossroads you'll hit is the choice between an off-plan property (buying from a developer before it's built) and a ready one (an existing unit on the secondary market). Each path has its own set of pros and cons, and the right choice for you depends entirely on what you're trying to achieve.

An off-plan deal might come with an attractive payment schedule and the promise of a big payday when the project is finished. A ready property, on the other hand, puts rental income in your pocket from day one and lets you see, touch, and feel exactly what you're buying, taking construction risks completely off the table.

Off-Plan Versus Ready: A Strategic Choice

Think of this as the first critical fork in the road. An investor laser-focused on capital growth might jump on an off-plan unit in a hyped-up new tower, banking on the value popping once the keys are handed over. This is a game of patience, and you'll need the stomach for market swings during the build.

On the flip side, if your priority is immediate, predictable cash flow, a ready one-bedroom apartment in a well-established tower with a solid rental track record is your move. This isn't a speculative play; it's about getting your asset to work for you right now, generating a steady income stream from the moment you close the deal. It's the lower-risk option for a reason.

Matching Apartment Types to Your Investment Goals

Once you've decided between off-plan and ready, the next layer is the apartment type. Dubai Marina has it all, from compact studios to massive penthouses, and each carries its own investment personality. Don't get fixated on just the bedroom count—the layout, the view, and the quality of the building itself are just as important.

Here’s a quick rundown of how different properties usually stack up against investor goals:

- Studios and One-Bedroom Apartments: These are the rental workhorses of the Marina. They appeal to the broadest tenant base—think young professionals and business travellers—which means high occupancy rates and consistent rental yields.

- Two-Bedroom Apartments: Perfect for couples and small families, these units hit a sweet spot. They offer a great balance between strong rental demand and the potential for solid capital appreciation over the medium to long term.

- Three+ Bedroom Apartments and Penthouses: These larger homes are often bought by families looking for a place to live. While their rental yield as a percentage might be lower than smaller units, they often pack the biggest punch for long-term capital growth, especially if they have those killer full sea or marina views.

Investor Insight: It’s a classic mistake to assume the priciest property will deliver the best return. I've often seen a perfectly located one-bedroom apartment outperform a luxury penthouse on net rental yield, simply because its entry price is lower and its appeal to tenants is much wider.

Understanding these details is what separates a good investment from a great one. And for my international clients, it's also vital to understand the ownership structure. Investing in Dubai freehold properties gives you full, outright ownership, which is a massive advantage.

Dubai Marina Property Types Investor Snapshot

To make it even clearer, here’s a table breaking down the typical investor profiles for different apartment types in the Marina.

| Property Type | Best For | Average Price Range (AED) | Typical Gross Rental Yield |

|---|---|---|---|

| Studio Apartment | Maximising Rental Yield | 1M - 1.5M | 7% - 9% |

| One-Bedroom Apt | Consistent Yield & Occupancy | 1.4M - 2.5M | 6.5% - 8% |

| Two-Bedroom Apt | Balanced Yield & Capital Growth | 2.2M - 4.5M | 6% - 7.5% |

| Three-Bedroom Apt | Long-Term Capital Growth | 3.5M - 7M+ | 5% - 6.5% |

| Penthouse / Duplex | Trophy Asset & Capital Growth | 8M - 25M+ | 4% - 6% |

This snapshot gives you a solid starting point for aligning your budget with your primary investment goal, whether that’s immediate cash flow or long-term appreciation.

Yield Powerhouses Versus Capital Growth Champions

Ultimately, your choice boils down to this: are you hunting for rental yield or capital growth? While some properties deliver a bit of both, most are stronger in one area.

A one-bedroom flat with a partial marina view in a mid-tier tower? That’s your classic yield powerhouse. The purchase price is manageable, service charges won’t break the bank, and you'll almost never have to worry about it sitting empty. It’s a cash-flow machine.

Now, consider a three-bedroom corner unit with a sweeping sea view in a high-end, branded residence. That’s a capital growth champion. Its rental yield might look modest at first, but its rarity and desirability mean its value could soar over time, setting you up for a significant profit when you decide to sell.

The latest market data for 2024–2025 continues to highlight Dubai Marina's muscle in the rental market, with gross yields frequently hitting the 6%–8% sweet spot. We've even seen one-bedroom units deliver yields up to 7.7% on a purchase price of around AED 1.5 million, renting out for about AED 115,000 per year. For a deeper dive, you can explore rental yield comparisons on cordovaproperty.com. This is the kind of hard data that keeps investors coming back, and it’s what will empower you to buy a property in Dubai Marina that’s perfectly tuned to your financial ambitions.

A Step-by-Step Guide to the Purchase Process

So you've found a property in Dubai Marina that ticks all your boxes. What now? Navigating the purchase process might seem daunting from the outside, but it’s actually a very clear, well-trodden path designed to protect everyone involved.

Think of it less as a series of hurdles and more as a structured journey. From the moment you say "yes," a sequence of legal and financial checks kicks in, all under the watchful eye of Dubai's robust regulatory system. Let's break it down.

Before a single dirham is exchanged, your absolute priority is due diligence. This isn't just a quick look at the apartment; it’s a deep dive into the legal and financial health of the property you're about to acquire.

The Foundation of a Secure Purchase: Due Diligence

Due diligence is your safety net. It's the investigative work that you and your RERA-certified agent do to verify every claim and uncover any hidden issues before they become your problem. Getting this right prevents very expensive headaches later on.

Your checklist needs to be thorough. Here’s what to focus on:

- Title Deed Verification: First things first—is the seller the legal owner? Your agent must verify the Title Deed's authenticity with the Dubai Land Department (DLD), ensuring there are no ownership disputes or nasty surprises.

- Service Charge History: Ask for at least two years of service charge statements. Sky-high or rapidly climbing charges can seriously dent your net rental yield. You're looking for consistency; any sudden spikes are a red flag that needs questioning.

- Building Status: Dig a little deeper. Are there any outstanding disputes with the developer or the owners' association? You also need to ask about any planned major works or special assessments on the horizon that could land you with an unexpected bill.

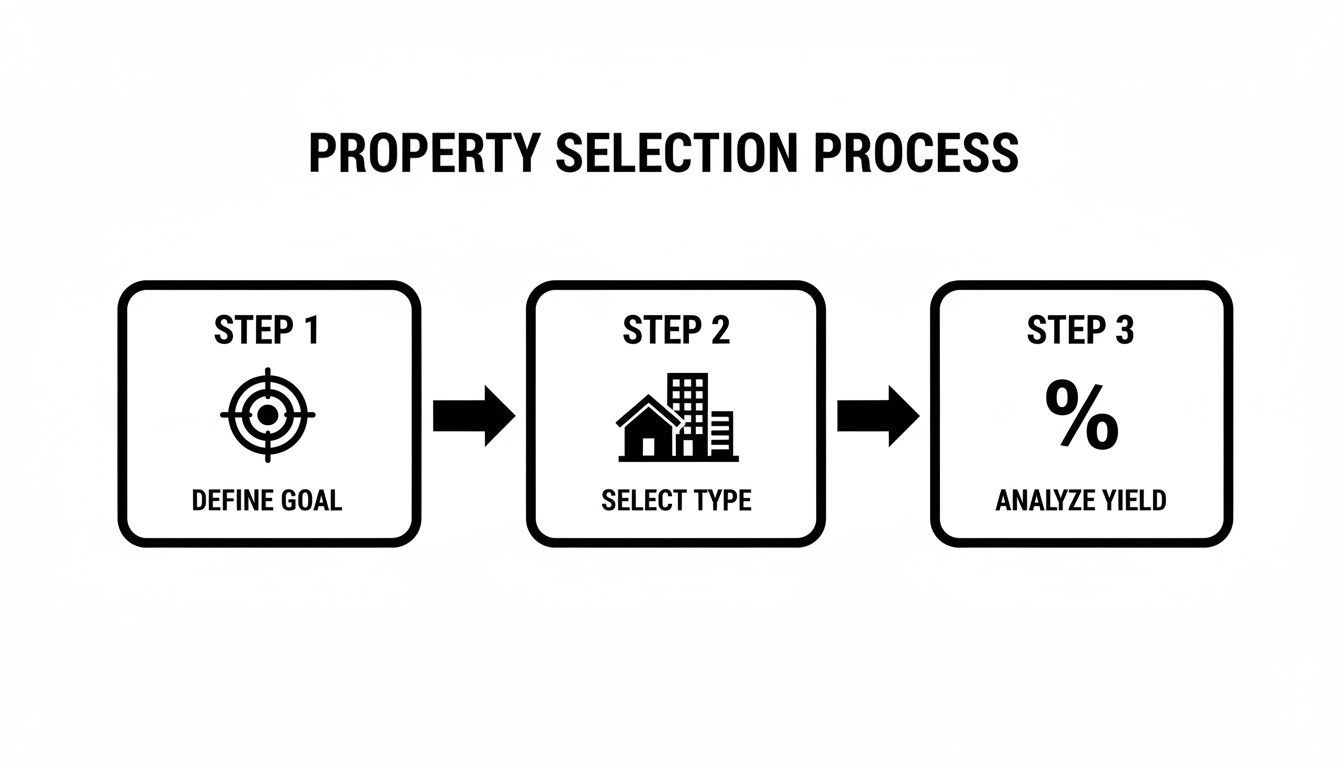

This initial selection phase—from clarifying your goal to running the numbers on potential yield—is the bedrock of a successful purchase. It happens long before any contracts are signed.

As you can see, a solid investment starts with a clear strategy. That strategy dictates the type of property you look for and how you analyse its financial viability.

Securing the Deal: The MOU and NOC

Once your due diligence gives you the green light and you’ve shaken hands on a price, it's time to make it official. This happens with a key document called the Memorandum of Understanding (MOU), known officially in the DLD system as 'Form F'.

The MOU is a formal sales agreement that locks in all the terms—price, payment schedule, handover date, and so on. It legally binds both you and the seller to see the deal through. When you sign, you’ll typically hand over a security deposit cheque, usually for 10% of the purchase price. This cheque is held in trust by the real estate agency.

Expert Tip: Never, ever make the deposit cheque payable directly to the seller. It must always be held by a neutral, RERA-registered third party like the brokerage until the property transfer is complete. This is non-negotiable protection for your funds if the seller backs out.

With the MOU signed, the next critical piece of paper is the No Objection Certificate (NOC) from the property's developer. The NOC is the developer’s official stamp of approval, confirming the seller has cleared all their dues, like service charges, and has no other outstanding financial obligations.

The DLD will not allow the transfer to happen without an NOC. The seller is responsible for getting this document and covering any associated fees, which can run anywhere from AED 500 to AED 5,000, depending on the developer. It's a mandatory step ensuring you inherit a property with a clean slate.

Finalising the Transfer at the DLD

With the MOU and NOC sorted, the final step is the ownership transfer at a Dubai Land Department trustee office. You (or your legally appointed representative) and the seller both need to be present to close the deal.

This is when all the final payments happen. You'll give the seller the remaining balance for the property, usually as a manager's cheque. At the same time, you'll need to pay the DLD transfer fees and the agency commission.

Key Transfer Day Payments:

- Final Payment to Seller: The rest of the purchase price after your deposit.

- DLD Transfer Fee: This is 4% of the property’s purchase price, plus a small admin fee. While it's technically split between buyer and seller, it’s standard market practice for the buyer to cover the full amount.

- Real Estate Agency Commission: This is typically 2% of the purchase price plus VAT, paid to your brokerage for their services.

- Mortgage Registration Fee: If you’re using a mortgage, there's a 0.25% fee on the loan amount payable to the DLD.

Once all payments are confirmed and the documents are signed, the DLD issues a new Title Deed in your name. That's it—you're officially a property owner in Dubai. The entire process, from signing the MOU to holding your new title deed, can be done in just a few days if all the paperwork is ready, but it more commonly takes a few weeks to allow for bank financing and NOC processing.

Understanding Legal Ownership and Residency Visas

For most of my international clients, buying a property in Dubai Marina is much more than just acquiring a physical asset. It's a strategic play to plant a flag in the UAE for the long term. This means getting to grips with two things: your ownership rights and the powerful residency benefits that come attached to your investment.

The bedrock of foreign investment in prime areas like Dubai Marina is freehold ownership. This isn't just jargon; it’s the most important concept to understand. It means when you buy, you own the property outright, forever. You have the absolute right to sell it, rent it out, or pass it down to your family, just as you would in your home country.

This system, enshrined in Dubai law, gives global investors the confidence and legal protection they need. It’s the key that unlocks the full potential of Dubai's real estate market for everyone.

The Power of Freehold Ownership

Unlike leasehold systems, where you’re essentially just a long-term renter for a set period (often 99 years), freehold gives you the absolute title. This is a game-changer for anyone thinking about long-term wealth creation or planning a future for their family in the UAE.

Your ownership is officially registered with the Dubai Land Department (DLD), and you'll receive a Title Deed. Think of this as a legally binding document that is irrefutable proof of your ownership. This kind of transparency and robust legal framework is a huge part of Dubai's appeal.

Connecting Your Property to UAE Residency

Here’s where it gets really interesting. One of the biggest draws of buying property in Dubai is the direct path it creates to securing UAE residency. Your real estate investment isn't just a number on a balance sheet; it's your ticket to living and working in one of the world's most exciting hubs. The main route to this is the UAE Golden Visa programme.

The government specifically designed this programme to attract investors and top talent by offering long-term residency in return for significant contributions to the economy—and real estate is a primary qualifier.

Key Takeaway: A property purchase in Dubai Marina isn't just a transaction. It's a qualifying investment for one of the world's most desirable residency programmes, giving you and your family stability for up to 10 years at a time, with the option to renew.

Unlocking the Golden Visa Through Real Estate

The UAE has made the Golden Visa programme accessible by creating clear tiers for property investors. Knowing these thresholds is crucial as you map out your purchase strategy.

Here are the main visa options linked to property:

Two-Year Property Investor Visa: This is a very popular starting point. If you invest AED 750,000 (roughly USD 204,000) in a single property, you qualify for a two-year renewable residency visa. The key condition here is that the property must be completed and handed over, not off-plan.

Ten-Year Golden Visa: This is the premier option for those making a more substantial, long-term commitment. An investment of AED 2 million (around USD 545,000) in real estate gets you a 10-year, self-sponsored, renewable Golden Visa. A major advantage here is that your investment can be spread across one or more properties, and it can include off-plan projects from approved developers.

The Golden Visa comes with some serious perks beyond just the long-term residency. It allows you to sponsor your spouse and children (with no age limit for unmarried kids), and even domestic staff. It also gives you the flexibility to stay outside the UAE for more than six months without your visa being cancelled, which is a massive benefit for global citizens.

If you want to dive deeper into the specifics, our detailed guide explains what is Golden Visa UAE and all its benefits.

Managing Your Investment After The Purchase

Holding the title deed to your new Dubai Marina property is a huge moment. But in many ways, this is where the journey as a savvy investor truly begins. The decisions you make from this point forward are what separate a good buy from a great, profitable asset.

Right out of the gate, you face a critical choice: manage the property yourself or bring in a professional agency? This isn't just about saving a fee; it's a strategic decision that hinges on your location, your familiarity with the Dubai market, and how much of your own time you're willing to commit.

If you're an investor living in Dubai with one or two properties, you might feel comfortable going it alone to maximise your net income. But for an overseas buyer, trying to handle tenant calls, unexpected maintenance, and local paperwork from another country can quickly turn into a stressful, full-time job.

Self-Management vs. Hiring an Agency

For many investors, especially those based abroad, a reliable management company isn't just a convenience—it's an essential part of the investment. They become your on-the-ground team, handling everything from marketing and vetting tenants to rent collection and making sure you're compliant with all RERA regulations.

To make the right call, you need a clear-eyed view of what each path entails.

Property Management Decision Matrix Self-Managed vs. Agency

| Factor | Self-Management | Hiring an Agency |

|---|---|---|

| Cost | You keep all the rental income, but bear all operational costs directly. | Management fees typically range from 5% to 8% of the annual rental income. |

| Time Commitment | High. You are the point of contact for every viewing, call, and issue. | Minimal. The agency handles everything, offering a truly passive experience. |

| Local Expertise | Requires a solid grasp of RERA laws, tenancy contracts, and the Marina's rental dynamics. | Professional expertise in pricing, marketing, and navigating legal requirements. |

| Convenience | Low, particularly if you are overseas or have a demanding schedule. | High. Your investment works for you without demanding your constant attention. |

| Maintenance | You are responsible for finding, vetting, and managing all contractors for repairs. | They use a pre-approved network of trusted and reliable maintenance professionals. |

For most of our overseas clients, the peace of mind and optimised returns provided by a professional agency easily justify the fee. It transforms the property from a potential headache into a hands-off asset.

Optimising Your Rental Income

With your management strategy sorted, the next focus is maximising your returns. This goes beyond just putting up a listing; it's about positioning your property to attract the best tenants at the best possible price, ensuring minimal downtime between leases.

Your approach will change dramatically depending on whether you're playing the long-term or short-term rental game.

- Long-Term Leases (Annual Contracts): This is the traditional path to stable, predictable income. The goal here is to attract high-quality, reliable tenants who will treat your property with respect. Furnishings should be stylish but durable, and your asking price needs to be competitive for similar units in your tower and the wider Marina area.

- Short-Term Lets (Holiday Homes): As a global tourism magnet, Dubai Marina is prime territory for lucrative short-term rentals. This market, however, is far more demanding. Your property needs to be fully furnished to a very high standard, stocked with amenities, and flawlessly managed to earn those crucial five-star reviews. The potential income is significantly higher, but so are the operational costs and management intensity.

Investor Insight: A mistake I see new landlords make all the time is skimping on photography. Whether you're targeting long or short-term tenants, investing in a professional photoshoot is non-negotiable. It's the first impression you make and can be the single factor that makes a tenant choose your apartment over a dozen others, often allowing you to ask for a higher rent.

Understanding Service Charges and Maintenance

A key part of managing your investment is staying on top of the recurring costs, primarily the annual service charges. These fees are paid to the building’s Owners Association to cover the maintenance of all common areas—think lobbies, swimming pools, gyms, security, and landscaping.

In Dubai Marina, service charges generally fall between AED 15 to AED 30 per square foot annually. You should have already reviewed the building's service charge history during your due diligence. As an owner, it's crucial to pay these on time and, if possible, get involved in the Owners Association meetings. This is your money being spent, and these fees directly impact your net yield, so keeping an eye on them is just smart business.

Got Questions About Buying in Dubai Marina? We've Got Answers.

Even the sharpest investors have questions when they first look at Dubai Marina. It's a market with its own unique rhythm and rules. Let's tackle some of the most common queries we hear day in and day out, giving you the straightforward answers you need to invest with confidence.

These aren't just hypotheticals; they're the practical, on-the-ground concerns that can genuinely make or break your investment. Getting clear on them from the start is absolutely crucial for a smooth and profitable purchase.

What Are the Annual Service Charges Really Like in Marina Towers?

This is always one of the first questions, and for good reason. Service charges directly eat into your net yield, so you have to know what you're getting into.

In Dubai Marina, the fees vary quite a bit. It all comes down to the building's age, the quality of its amenities, and the overall level of luxury. As a general rule, expect to pay anywhere from AED 15 to AED 30 per square foot annually. A brand-new tower with multiple pools, a private cinema, and a state-of-the-art gym will naturally sit at the higher end. An older, more established building will be on the lower side.

Insider Tip: Before you even think about putting an offer down, insist on seeing at least two years of service charge history for the specific unit. This gives you a clear baseline of the costs and, more importantly, helps you spot any sudden, eyebrow-raising hikes that could signal a problem.

Can I Get a Mortgage as a Non-Resident?

Yes, you absolutely can. UAE banks are more than willing to lend to non-residents for a property purchase. However, and this is a big "however," the lending criteria are noticeably stricter than they are for residents. From the bank's perspective, it's a higher risk, so they tighten the terms.

Here’s what you should be prepared for as a non-resident:

- A larger down payment is standard, typically in the ballpark of 40-50% of the property's value.

- The paperwork is more extensive. You'll need to provide detailed proof of income and a solid credit history from back home.

Our strongest advice? Get mortgage pre-approval from a UAE-based bank before you even start looking at apartments. It gives you a rock-solid budget to work with and instantly makes you a more serious, credible buyer when it's time to negotiate.

Which is Better: A Sea View or a Marina View?

Ah, the classic Dubai Marina debate. The honest answer is that there’s no single winner—both are premium, high-demand options that drive serious value.

A full, unobstructed sea view is often seen as the pinnacle of luxury. It can command the absolute highest prices, especially for high-floor penthouses, offering a sense of calm and undeniable prestige.

A marina view, on the other hand, gives you that iconic, dynamic cityscape. It’s a vibrant spectacle of dazzling lights, the bustling promenade, and a parade of superyachts. It is the Dubai Marina experience. Both views are incredibly attractive to tenants and future buyers. Your final choice should really come down to personal preference and the specific layout of the unit you're considering. Either way, you're making a solid bet for long-term value.

What's the Real Difference Between an MOU and an SPA?

Getting these two documents straight is key to navigating the legal side of the deal.

The Memorandum of Understanding (MOU), also known as Form F in Dubai's system, is the initial agreement you sign. It locks down the price and the main terms of the deal. This is the point where you'll pay the standard 10% security deposit.

The Sales and Purchase Agreement (SPA) is the final, far more detailed contract. It’s especially critical for off-plan properties. This document legally binds you and the seller to every single specific of the transaction right through to handover.

Think of it this way: the MOU is the formal handshake, and the SPA is the comprehensive, legally-binding rulebook that governs the entire sale.

Navigating the nuances of the Dubai real estate market requires expert guidance. At Proact Luxury Real Estate LLC, we provide the data-driven insights and strategic advice you need to make confident investment decisions. Book a complimentary consultation with our team today.