Last year's benchmarks saw off-plan sales dominate Dubai's real estate transactions. Entering 2026, the market has matured. The focus for High-Net-Worth Individual (HNWI) portfolios is shifting from speculative gains to long-term asset performance and capital preservation, particularly for hyper-towers like the Burj Binghatti Jacob & Co Residences in Business Bay, now nearing completion.

Project Benchmark For 2026 Portfolios

The post-Covid boom cycle has transitioned into a sustainable growth phase. For investors evaluating assets in 2026, the critical metrics are no longer just entry price and potential appreciation, but confirmed rental yields and operational costs. The dialogue has moved beyond launch hype to a hard-nosed assessment for HNWI balance sheets.

This analysis deconstructs the project's current standing against other branded residences, examining its strategic value for both original off-plan investors and new buyers entering the secondary market. The goal is to frame this tower not as a residential novelty, but as a strategic real estate asset class within Dubai's evolving market. A comprehensive Dubai real estate market analysis confirms a flight to quality, where trophy assets are positioned to outperform.

Developer Scale And Market Impact

This collaboration is a cornerstone of Dubai's luxury real estate sector, backed by Binghatti's AED 80 billion portfolio, which covered over 38 projects as of 2025. This scale amplifies the impact of the 557-metre tower, set to displace New York's Central Park Tower as the tallest residential skyscraper globally.

The project’s launch in mid-2023 occurred during a period of intense investor demand. As it approaches its 2026 handover, the asset is entering a new phase of its life cycle.

For HNWIs, the conversation is shifting from "what's the entry price?" to "what's the long-term holding strategy and net yield?" This is the sign of a market that has moved from speculative fever to sustainable asset management.

Strategic Considerations For Investors

For investors rebalancing portfolios, the Binghatti Jacob & Co tower offers a unique proposition. It is less about chasing the rapid off-plan appreciation that defined last year's market and more about securing a stake in an iconic, income-generating asset.

- Investment Pros: Trophy asset status, potential for high rental yields from a UHNWI demographic, and a built-in brand premium that provides a buffer against market corrections.

- Investment Cons: Higher service charges associated with hyper-luxury amenities, and capital is tied up in a less liquid asset compared to flipping smaller units.

- Asset Performance: Post-handover, key metrics will be rental demand from the UHNWI segment and the stability of service charges.

How this property performs will be a critical bellwether for the entire ultra-luxury branded residence segment through 2026 and beyond.

Analysing The Jacob and Co Brand Premium

The partnership between Binghatti and Jacob & Co is a calculated financial move designed to engineer an asset with a built-in brand premium—a quantifiable market advantage. To understand this project's weight in an investment portfolio, one must deconstruct what that premium means in financial terms.

Based on last year’s transaction data in Business Bay, it is possible to isolate the percentage premium this hyper-tower commands over other non-branded luxury projects in the same location. Buyers are not just paying for square footage; they are acquiring an identity curated by a global luxury icon, which creates a perception of scarcity and superior quality that drives value.

Quantifying The Brand's Impact

For any asset manager, the critical question is whether this premium holds up post-handover. Historically, branded residences have shown stronger resilience during market adjustments and commanded higher rental rates. The Jacob & Co name is designed to attract a UHNWI demographic that demands this exclusivity.

This targeted appeal translates into tangible investor benefits:

- Enhanced Resale Value: The brand acts as a quality assurance mark, justifying a higher asking price on the secondary market compared to generic towers.

- Increased Asset Liquidity: A globally recognized brand widens the pool of potential international buyers, making the asset easier to sell.

- Higher Rental Demand: The tower will attract a caliber of tenant willing to pay a premium for prestige, supporting stronger rental yields.

This collaboration creates a distinct, non-replicable asset class, unlike more standardized offerings such as those in the Binghatti Aquarise Dubai portfolio.

For the HNWI investor, the Jacob & Co brand is a risk mitigation tool. It provides a layer of value insulation independent of general market fluctuations, tied instead to the enduring power of a luxury icon.

A Forward View On Branded Residences

Looking toward 2026 and beyond, such partnerships are creating a new tier of investment-grade property in Dubai. Sophisticated investors are hunting for assets with unique selling points that go beyond location and finishes. The Binghatti Jacob & Co project is a prime case study of where the smart money is heading.

[Map: Location relative to Al Maktoum Airport]

The partnership combines Binghatti’s execution track record with Jacob & Co’s marketing power and direct access to an elite global clientele. This synergy is engineered to deliver outperformance, not just in capital appreciation during construction, but in sustained rental income and value preservation long after handover. For a portfolio manager, the long-term sustainability of this brand premium is the core metric. Early data on rental inquiries is promising, indicating the strategy is performing as designed.

Dissecting Transaction Velocity And Price Performance

Hard data provides the clearest narrative. As we enter 2026, we can analyze the Binghatti Jacob & Co Residences' market performance using official records from the Dubai Land Department (DLD). Last year’s numbers paint a picture of sustained investor confidence.

The DLD data from 2025 offers a granular view. In Business Bay, this project has consistently demonstrated market strength. Over the last 12 months, the tower recorded 193 apartment sales, achieving an average price of AED 28,567 per square metre. That represents a 12-13% premium over comparable luxury properties in the district—a quantifiable outperformance.

For any HNWI considering a position in this asset, this data-driven approach is non-negotiable. It allows us to cut through promotional noise and focus on the numbers that define the project’s investment profile.

Correlating Activity With Market Trends

Investor activity aligns with key construction milestones. A breakdown of sales volume by quarter throughout 2025 reveals that transaction velocity increased after the superstructure's completion—a tangible signal to the market that the project was on track for its 2026 handover.

This pattern is typical for well-managed, high-profile developments and reflects a maturing investor base that reacts to concrete progress rather than initial launch excitement. This behavior is part of a broader market shift away from pure speculation toward acquisitions driven by fundamentals. For context on this trend, our guide to the best off-plan projects in Dubai offers further analysis.

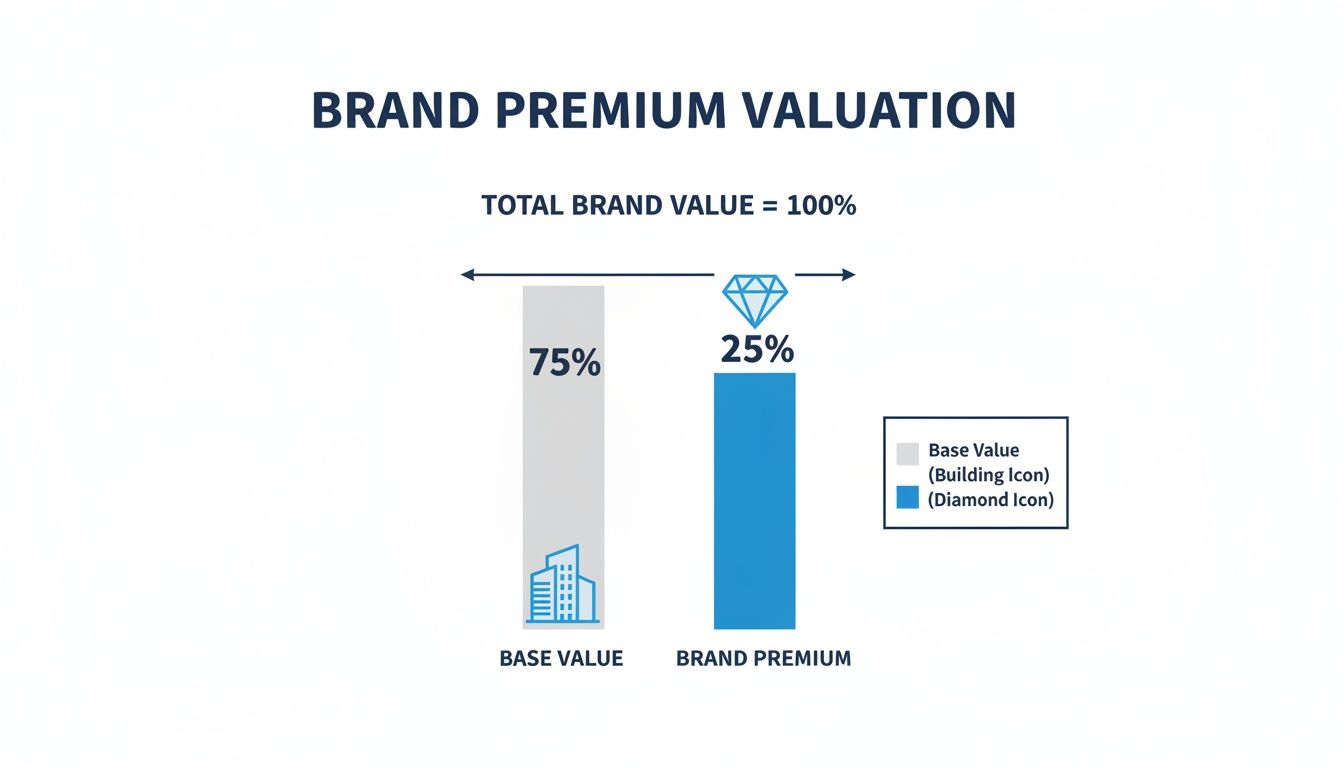

The chart below illustrates the value gap between a standard luxury asset and one enhanced by a brand collaboration like Jacob & Co.

A substantial portion of the asset's market value derives directly from this exclusive partnership.

Benchmarking Against The Business Bay Average

To grasp the tower's outperformance, a side-by-side comparison is necessary. The fact that the Binghatti Jacob & Co project has consistently held a double-digit premium over the average price per square metre for non-branded, new-build luxury properties in Business Bay confirms its trophy asset status.

This premium is not a launch-day phenomenon. The sustained price growth through Q4 2025 indicates the secondary market is already pricing in the tower's iconic status and future rental yield potential.

This historical performance is a critical indicator of future stability. It provides a solid foundation for projecting returns and gauging the asset's resilience against potential market adjustments.

Binghatti Jacob & Co vs. Business Bay Market: A 2025 Performance Snapshot

This table offers a direct comparison of key investment metrics between the Burj Binghatti Jacob & Co Residences and the broader Business Bay luxury property market, based on DLD data from last year.

| Metric | Burj Binghatti Jacob & Co Residences | Business Bay Average (Luxury Segment) |

|---|---|---|

| Average Price Per Square Metre | AED 28,567 | ~AED 25,300 |

| Premium Over Market Average | 12.9% | N/A |

| Total Sales Volume (Units) | 193 | Varies by project |

| Price Growth (Q1-Q4 2025) | Sustained positive trajectory | Moderate, project-dependent growth |

The data confirms this is a market-defining development that has consistently commanded a higher valuation. Understanding this context is essential before allocating capital in 2026.

Developer Reliability: An Assessment of Binghatti's Track Record

When evaluating an off-plan project of this ambition, the developer's reliability is the primary risk management factor. For our HNWI clients, a deep dive into the developer's history is a non-negotiable part of due diligence.

Since its inception in 2014, Binghatti Developers has become a major force in Dubai, having handed over more than 7,000 residential units with a reported 95% on-time completion rate. This figure provides a level of predictability in a market where revised handover timelines can be a challenge for investors.

RERA Protections and the Escrow Account Safety Net

Dubai's regulatory framework provides a powerful layer of security for investor capital. The Real Estate Regulatory Agency (RERA) mandates the use of escrow accounts for all off-plan developments. Every payment is held in a RERA-monitored account, with funds released to the developer only after specific construction milestones are verified.

This structure ensures capital is used for its intended purpose and reduces the risk of mismanagement. Any changes to UAE property law are designed to further strengthen these protections.

The combination of a developer with a proven on-time delivery rate and a robust regulatory system like RERA's escrow accounts creates a more secure investment environment. It shifts the primary risk from project failure to market performance—a variable a sophisticated investor is better equipped to manage.

Proof of Execution at Scale

Binghatti's portfolio was valued at over AED 20 billion last year, demonstrating its capacity to manage multiple large-scale projects simultaneously. This is a vital sign of both financial health and operational expertise.

- Financial Health: A large, active portfolio suggests stable cash flow and strong relationships with contractors, making funding-related delays less likely.

- Operational Depth: Managing numerous projects builds institutional know-how and efficient processes, helping to meet demanding timelines.

- Market Confidence: A history of delivery builds trust with buyers, suppliers, and secondary market agents.

To benchmark a developer's strength, a review of a comprehensive Dubai developers list is prudent. Binghatti's ability to deliver across a multi-billion dirham portfolio provides the confidence required for a capital-intensive asset like this.

Yield Projections And Exit Scenarios For 2026

As the Burj Binghatti Jacob & Co Residences approaches its 2026 handover, the investor dialogue must shift. The initial off-plan appreciation phase is concluding. The focus now turns to long-term rental performance and mapping clear exit strategies.

Modelling potential rental income requires a disciplined analysis of data from comparable branded residences in Business Bay and Downtown. The gross rental figure is only a headline; net return on investment requires a deeper examination of operational costs.

Projecting Net ROI For Key Unit Types

To create a realistic financial picture, one must analyze net returns after all expenses. In a hyper-tower with amenities like private chefs and an infinity pool, service charges will be higher than in standard luxury buildings. These costs are a critical component of the financial model.

While Dubai's tax environment is favorable, understanding all associated costs is crucial. Our guide on taxes on property details DLD fees and other potential liabilities that can impact the bottom line.

[Chart: 2026 Payment Plan Breakdown]

The table below provides a projection of potential ROI based on the performance of similar top-tier branded units, adjusted for 2026 market conditions.

Projected Annual ROI for Binghatti Jacob & Co Units (2026 Estimates)

This analysis of potential rental yields and net ROI for representative unit types is based on 2026 market comparables in Dubai's luxury branded residence sector.

| Unit Type | Estimated Annual Rent (AED) | Estimated Service Charges (AED) | Projected Net Yield |

|---|---|---|---|

| Sapphire Suite (2 Bed) | 950,000 | 120,000 | ~6.5% |

| Emerald Villa (3 Bed) | 1,400,000 | 180,000 | ~6.1% |

| Astronomia Penthouse | Price on Application | Price on Application | Varies |

Note: These are preliminary estimates and subject to final service charge confirmation and prevailing market rental rates upon handover.

These figures indicate that despite premium service charges, the potential for strong, stable yields is tangible.

Defining Strategic Exit Scenarios

For early investors, the approaching handover raises a key question: hold or sell? The optimal path depends on portfolio goals, risk tolerance, and cash flow needs. We model three core scenarios for our clients.

Scenario 1: The Post-Handover Flip

- Pros: Lock in capital gains quickly, freeing up cash to deploy into the next high-growth off-plan launch.

- Cons: Forfeit long-term rental income and potential future appreciation. Timing is critical.

Scenario 2: The Medium-Term Rental Hold

- Pros: Generate a stable income stream while the asset appreciates. The brand's prestige attracts top-tier tenants, reducing vacancy risk.

- Cons: Capital remains tied up. Exposure to property market cycles and ongoing service charges.

Scenario 3: The Long-Term Legacy Hold

- Pros: Secure a prime piece of Dubai real estate for generational wealth preservation. Serves as a prestigious global base.

- Cons: The least liquid option. The investment relies on the long-term stability of the Dubai market.

Each scenario demands a different strategy based on a clear-eyed analysis of the numbers and how this asset fits into a wider financial plan for 2026 and beyond.

Final Thoughts: Strategy Over Speculation

The Burj Binghatti Jacob & Co Residences signals the maturation of Dubai's ultra-luxury property sector. Success in 2026 with a tower of this caliber requires a disciplined strategy that balances rental yield generation with precise timing for future capital growth. The window for easy flips has narrowed.

The defensible value of this tower is locked in its unique brand collaboration, architectural significance, and the developer's delivery track record. These factors create a buffer against market adjustments. We are positioning assets like this within diversified global portfolios, using Dubai's stable environment as a strategic advantage. This is not a residential purchase; it is the acquisition of a unique, income-generating asset class.

Your Questions, Answered

As the 2026 handover for the Burj Binghatti Jacob & Co Residences approaches, investors are drilling down into the details. Here are answers to common questions from an asset management perspective.

Will Owning a Property Here Qualify Me for a UAE Golden Visa?

Yes. An investment of this magnitude comfortably exceeds the financial threshold for the 10-year renewable UAE Golden Visa. This is a direct route to securing long-term residency in Dubai. The final decision rests with the UAE government, based on the registered property value.

What Is the Ownership Structure for Foreign Investors in This Project?

The Burj Binghatti Jacob & Co Residences is in Business Bay, a designated freehold area. International buyers acquire full, outright ownership registered with the Dubai Land Department (DLD), receiving a legally recognized title deed. For asset protection or succession planning, a corporate holding structure is an effective strategy. We often assist clients with a Dubai LLC company setup for this purpose.

How Do the Projected Returns Stack Up Against Other Off-Plan Investments in Dubai?

This project operates in its own class, offering a different risk-return profile than an emerging community. While a new masterplan in Dubai South might promise higher initial appreciation from a lower entry point, this tower delivers the stability and prestige of a landmark asset in a prime location. The projected rental yields are supported by the Jacob & Co brand premium, attracting a tenant base less sensitive to minor market shifts. The strategy here is long-term capital preservation over short-term speculative gains.

What Are the Main Risks With Investing in a Supertall Branded Residence?

The two primary factors to monitor are market cycles and ongoing service charges. While the current Dubai real estate market analysis indicates sustainable growth, the ultra-luxury segment can be sensitive to shifts in the global economy. Secondly, service charges for amenities like a private chef and bodyguard services will be higher than standard. A rigorous analysis of these projected fees against potential rental income is a critical part of our due diligence to ensure net yields are realistic.

If you are rebalancing your portfolio for 2026 and require a data-driven strategy for acquiring assets like the Binghatti Jacob & Co Residences, let's run the numbers. At Proact Luxury Real Estate LLC, we provide the analytical rigour necessary for informed investment decisions.