Last year's benchmarks revealed a notable shift in investor capital allocation. While branded residences captured headlines, analysis shows that astute capital gravitated towards high-yield, well-located off-plan assets in Dubai's core commercial hubs. Binghatti Aquarise in Business Bay is a prime case study of this strategic pivot. This analysis moves past generic descriptions to focus on the financial metrics defining this project as a strategic holding.

Binghatti Aquarise: A Strategic Asset For 2026 Portfolios

Entering 2026, the market's post-Covid expansionary phase has transitioned into a sustainable growth cycle, demanding more rigorous asset selection. Binghatti's launch of Aquarise during last year's market peak was not speculative; it was a calculated response based on deep confidence in Business Bay's long-term economic fundamentals. This project is engineered to meet tangible market demand, not to chase transient market sentiment.

The investment thesis for Aquarise rests on two pillars: its strategic location and a unit mix engineered for high rental velocity. Business Bay is a mature economic engine with established infrastructure and direct connectivity to Dubai's primary financial districts. This ensures a consistent tenant pool of corporate professionals seeking proximity to their workplace.

Unit Mix and Target Demographics

The project's composition is its core strength. By concentrating on studios, one-bedroom, and two-bedroom apartments, Binghatti has aligned Aquarise with the most liquid rental categories in the central Dubai market.

- Studios & 1-Bedrooms: These units directly target the large demographic of single professionals and couples employed in Business Bay and the adjacent Downtown/DIFC corridor.

- 2-Bedrooms: This configuration serves the growing segment of small families and professional co-habitants in central Dubai.

- Larger Residences: The intentional scarcity of 3 and 4-bedroom units is a strategic decision. It caters to senior executives who require prime urban living without the maintenance overhead of a villa.

This targeted strategy contrasts sharply with projects over-supplied with larger, harder-to-lease units. For an asset manager, this translates to lower vacancy risk and more predictable income streams—a critical factor confirmed by our latest Dubai real estate market analysis.

Forward-Looking Value Proposition

A rigorous asset assessment must project performance beyond current market conditions. Moving towards 2027, Binghatti Aquarise is positioned to benefit from several key growth drivers. The continued development of the Dubai Canal district and planned infrastructure upgrades will support capital appreciation in Business Bay.

For investors rebalancing portfolios away from pure speculation towards income-generating assets, Aquarise presents a compelling blend of potential capital growth and durable rental income. It represents a mature approach to real estate as a core financial asset.

Developer Analysis: Is Binghatti a Tier-1 Operator?

In off-plan acquisition, an investor is underwriting the developer's execution capability. A forensic analysis of the developer's track record and balance sheet is as critical as the asset's floor plan. Binghatti Developers, formerly a mid-tier operator, has executed an aggressive growth strategy over the past two years, fundamentally altering its market position.

Last year's benchmarks tell the story. Binghatti consistently outpaced competitors in sales volume, an indicator of marketing strength and an ability to launch projects that meet market demand. This performance is the result of a calculated strategy: acquire prime land in high-growth corridors and achieve rapid market delivery. This operational velocity is a key variable when assessing delivery risk for an asset like Binghatti Aquarise Dubai.

From Volume To Velocity

Binghatti's strategy has been to dominate specific, high-demand market segments. By focusing on mid-market luxury, they achieve economies of scale in construction and marketing that few private developers can match. This speed—from land acquisition to sales launch—reduces holding costs and improves capital efficiency.

The pace of their portfolio expansion demonstrates a capacity to manage multiple large-scale projects concurrently. While such velocity can raise concerns about quality control, their consistent handover record, coupled with strict adherence to RERA's mandatory escrow account regulations, provides a material risk mitigant. Investor funds are tied to construction milestones, a vital safeguard under current UAE property law.

The developer's transition from a known operator to a market leader is substantiated by performance data. For investors, this trajectory signals stability and a proven capacity to deliver—a primary concern in the off-plan sector.

A Growth Story Backed By Numbers

To assess Binghatti's current standing, one must review their financial performance from last year. The launch of Binghatti Aquarise in April 2025 was indicative of their growth, adding 1,562 units to their development pipeline. This single project contributed to their sale of nearly 12,000 units in the first nine months of 2025, positioning Binghatti as Dubai’s top-selling developer by volume. This was underpinned by a net profit increase of 145% to AED 2.66 billion, demonstrating strong execution.

This financial stability is paramount. It signals the developer possesses the cash flow to maintain construction momentum without delays or capital calls, directly de-risking the investment. For broader market context, our analysis of the top 10 real estate companies in Dubai provides an essential comparison.

Market Share And Mitigating Risk

Binghatti has strategically secured a commanding market share in key districts like Business Bay and JVC. Their projects frequently set new benchmarks for pricing and amenities in these areas. This market dominance acts as a competitive buffer, supporting rental demand and future capital appreciation.

Ultimately, an investment in Binghatti Aquarise is an investment in the developer's operational model. Their delivery track record, robust financials, and the oversight from RERA present a compelling case for investors seeking a quality asset in a central Dubai location. Execution is the final determinant, and Binghatti's performance metrics justify their Tier-1 status.

Location Analysis: Business Bay as a Core Economic Hub

An asset’s value is fundamentally tethered to its geographic coordinates. For Binghatti Aquarise, its position in Business Bay is not merely a feature; it is the core investment thesis. This district has matured beyond a secondary business hub into a critical artery of Dubai's economy.

Proximity here is measured in minutes, reflecting operational efficiency for its target demographic of corporate professionals.

From an analytical perspective, the time-and-distance metrics are compelling. A commute of approximately 11 minutes to Dubai Mall places the project within the premium rental bracket. Equally important, the Dubai International Financial Centre (DIFC) is similarly accessible, directly linking the property to the region's primary financial hub. This logistical efficiency underpins long-term rental demand from high-income tenants.

Strategic Positioning For Future Growth

Looking beyond last year's benchmarks, future value will be unlocked by planned infrastructure projects. The expansion of the Dubai Canal promenade and scheduled upgrades to Al Khail Road interchanges are set to improve traffic flow—a key determinant of capital appreciation.

As Dubai’s economic center of gravity continues to consolidate around the Downtown-Business Bay axis, properties with prime access like Aquarise are positioned to outperform the broader market.

[Map: Aquarise Location relative to Dubai Canal and Downtown]

This is an integrated economic zone. A quantitative analysis reveals a high density of corporate headquarters, five-star hotels, and retail outlets within a 5-kilometre radius. This ecosystem provides the amenities corporate tenants require, which in turn reduces vacancy rates and supports premium rental pricing.

Connectivity Metrics: A Quantitative Look

To quantify the project's logistical strength, we must analyze real-world travel times, which heavily influence tenant decision-making.

| Destination | Off-Peak Travel Time | Peak Hour Travel Time | Strategic Importance |

|---|---|---|---|

| Downtown Dubai / Burj Khalifa | 11-13 Minutes | 18-22 Minutes | Epicentre for leisure and retail |

| DIFC | 12-15 Minutes | 20-25 Minutes | Core financial and legal hub |

| Dubai International Airport (DXB) | 18-20 Minutes | 25-35 Minutes | Critical for frequent business travellers |

| Al Maktoum International Airport (DWC) | 35-40 Minutes | 45-55 Minutes | Future aviation and logistics hub |

This data shows that while peak hours impact transit, the travel times remain within acceptable parameters for the senior management demographic.

The investment case for location is therefore twofold: immediate access to Dubai's established economic centers and strategic positioning to capitalize on the next phase of infrastructure enhancements.

This data-driven approach moves beyond subjective lifestyle commentary to focus on tangible connectivity factors that drive rental yields and long-term asset value.

Modelling The Financials: Payment Plans, ROI, And Growth

An asset's value is revealed in its financial model. For HNWIs, quantitative analysis is not optional; it is foundational. This section dissects the financial structure of Binghatti Aquarise, focusing on payment plans, projected income, and realistic capital growth scenarios.

Last year’s market saw the 70/30 payment plan become the standard for quality off-plan projects. Binghatti Aquarise aligns with this market-accepted structure, offering a plan that balances developer cash flow with investor feasibility. This is a shift from the more speculative payment plans of the post-Covid boom, signaling a market maturing towards long-term asset holding. The structure is designed to be manageable for portfolio investors while ensuring project funding is secured via RERA-protected escrow accounts.

Standard Payment Structure Breakdown

The payment structure for Binghatti Aquarise is linked directly to construction progress, a standard practice that mitigates investor risk.

- Booking Fee: An initial 20% down payment secures the unit, a standard commitment level in the 2026 market.

- During Construction: 50% of the property value is paid in instalments tied to verifiable construction milestones. This ensures capital is deployed against tangible progress.

- On Handover: The final 30% is due upon project completion, scheduled for Q1 2027.

This 70/30 model is critical for liquidity management over the construction period. Our guide on buying off-plan property in Dubai provides a deeper analysis of these mechanics.

Projecting Rental Yields And ROI

The core of an income-generating asset is its rental yield. Based on the performance of comparable new-build units in Business Bay last year, we project a gross rental yield for Binghatti Aquarise to stabilize between 6.5% and 8.0%. This is a conservative estimate, accounting for expected new supply in the area.

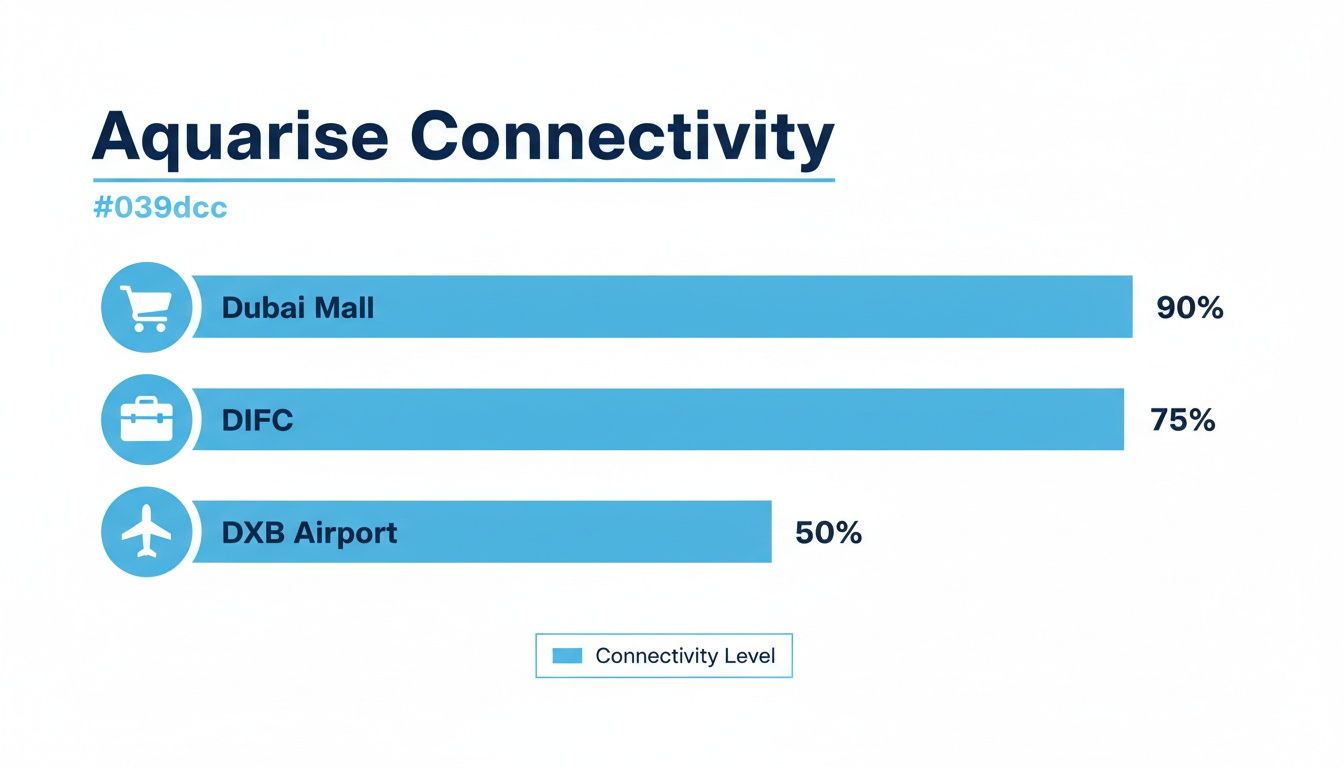

This chart highlights the strategic connectivity of Binghatti Aquarise to key economic and lifestyle hubs across Dubai.

The data illustrates the project's prime location, a fundamental driver of rental demand from corporate tenants.

A key factor supporting these yield projections is the unit mix. The high concentration of studios and one-bedroom apartments directly targets the most liquid segment of the rental market.

Below is a comparative analysis modeling the potential returns against established Business Bay benchmarks from last year.

Binghatti Aquarise Projected ROI vs. Business Bay Benchmark Forecast

This table provides a comparison of projected returns for Aquarise against the actual performance of similar properties in Business Bay last year. This grounds our forecasts in historical data, offering a clearer picture of potential investment performance.

[Chart: 2026 Payment Plan Breakdown]

| Unit Type | Aquarise Projected Gross Yield | Business Bay Avg. Gross Yield (Last Year) | Projected 3-Year Capital Appreciation (Low Scenario) | Projected 3-Year Capital Appreciation (High Scenario) |

|---|---|---|---|---|

| Studio | 7.5% - 8.0% | 7.2% | 18% | 25% |

| 1-Bedroom | 7.0% - 7.5% | 6.8% | 20% | 28% |

| 2-Bedroom | 6.5% - 7.0% | 6.3% | 22% | 30% |

Aquarise is projected to slightly outperform the area's recent averages, driven by its new-build quality and strategic location. The capital appreciation forecasts also point to robust potential over the medium term.

Capital Appreciation Scenarios

While rental income provides cash flow, capital appreciation builds wealth. Our model for Binghatti Aquarise considers two primary scenarios, both predicated on Dubai’s continued economic stability and the delivery of planned infrastructure in the Business Bay area.

The low scenario assumes market stabilization with moderate growth, projecting an 18-22% increase in value over the first three years post-handover.

The high scenario, contingent on stronger economic tailwinds and successful supply absorption, projects a more robust 25-30% appreciation.

These figures are grounded in the developer's track record and the asset’s intrinsic locational advantage. The total acquisition cost, including DLD fees, which are part of the overall taxes on property, must be factored into these calculations for an accurate net return forecast.

Competitive Analysis: Aquarise vs. Market Alternatives

An asset must be evaluated relative to its direct competitors. This is a direct comparison of Binghatti Aquarise against other off-plan launches in Business Bay and adjacent districts from last year.

The analysis focuses on quantitative metrics: price per square foot, unit efficiency, amenity quality, and the developer's delivery track record. This is where Aquarise’s value proposition becomes clear.

Price Per Square Foot Analysis

In the Business Bay corridor, price per square foot (PSF) is the primary comparative metric. Last year, similar private developers launched projects in the AED 2,100 to AED 2,400 PSF range. Binghatti Aquarise entered the market at a strategic price point to capture attention from both end-users and portfolio investors.

This pricing strategy is designed for sales velocity, which builds market confidence in the project. While ultra-luxury branded residences nearby command a higher PSF, they target a different buyer profile with a different risk tolerance. For an income-focused asset, Aquarise’s pricing is calibrated for optimal rental yields post-handover.

Competitor Comparison Table: Business Bay Launches (2025)

| Feature | Binghatti Aquarise | Competitor A (Unnamed) | Competitor B (Unnamed) |

|---|---|---|---|

| Average PSF | AED 2,050 - AED 2,250 | AED 2,300 - AED 2,500 | AED 2,100 - AED 2,300 |

| Amenity Focus | Resort-style living, large pool | Standard luxury, smaller pool | Business-focused amenities |

| Handover Date | Q1 2027 | Q4 2027 | Q2 2028 |

| Developer Tier | Tier 1 (Volume Leader) | Tier 2 (Boutique) | Tier 1 (Established) |

The data indicates that Aquarise is not only competitively priced but also has a shorter projected delivery timeline. For an investor, this means capital is deployed for a shorter period before income generation begins.

Design and Finishing as a Differentiator

Beyond quantitative metrics, material selection and architectural style are key differentiators. Many new towers in Business Bay feature a generic design. Binghatti Aquarise breaks from this with a more premium finish, using materials like travertine panels and polished marble.

These are not merely aesthetic choices; they signal a quality level that can command a rental premium upon completion. Tenants in this market segment are discerning and will pay for superior finishes and thoughtful design. This is a critical factor for long-term asset performance.

Nestled in Business Bay, Binghatti Aquarise is part of Binghatti's AED 80 billion portfolio. Last year's data confirmed their market dominance; the developer completed seven projects, accounting for over 20% of all new completions in Dubai. This delivery record, combined with Aquarise’s 1,626 units and luxury finishes, makes it a prime vehicle for investors, as detailed in recent performance reports on Gulf News.

Due Diligence Checklist For Risk Mitigation

Effective investment is not about risk avoidance but precise risk management. Last year's market activity showed that investors who performed meticulous due diligence were the ones who generated superior returns.

This checklist provides a practical framework to neutralize the primary risks associated with acquiring an off-plan asset like Binghatti Aquarise.

Verifying Project Legitimacy and Financial Security

This initial step is non-negotiable: confirm the project's legal standing with the Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA).

RERA Registration: Every legitimate Dubai project has a unique RERA registration number. This number allows you to verify the project's official status, approved plans, and developer credentials on the DLD's REST app.

Escrow Account Verification: RERA mandates that all off-plan payments be deposited into a project-specific escrow account. You must obtain the escrow account number for Binghatti Aquarise and confirm every payment is directed there—never to the developer's general corporate account. This is your most critical financial safeguard.

Title Deed and Affection Plan: Request a copy of the plot's title deed to confirm Binghatti's ownership of the land. The affection plan verifies the land is approved for this type of development.

Scrutinising The Sale and Purchase Agreement (SPA)

The SPA is the legally binding contract defining the investment. It requires a forensic-level review.

The SPA dictates every critical detail: unit specifications, completion date, delay penalties, and the payment schedule. Any ambiguity in this document typically benefits the developer.

Pay close attention to clauses regarding the handover date and finishing specifications. Reviewing the developer's history of adhering to SPAs on past projects is also prudent. Our in-depth guide covering the full Dubai developers list is a useful resource for this research.

Assessing Market and Timeline Risks

Even with a Tier-1 developer, external factors must be considered. The potential for a market-wide price adjustment always exists. The best hedge is ensuring your entry price is at or below the market average for comparable new builds, creating a buffer against future market stabilization.

While Binghatti has a strong delivery record, construction delays can occur. Prudent financial planning includes stress-testing the investment for a potential 6-9 month revised handover timeline. An investor must ensure a potential delay does not compromise their financial position.

For international buyers, confirming if the investment in Binghatti Aquarise qualifies for residency, such as the Golden Visa UAE, is crucial. This can transform the property from a financial asset into a tool for global mobility.

Final Thoughts: Strategy Over Speculation

The 2026 Dubai property market requires a strategic, data-driven mindset. The window for speculative, short-term flips has narrowed. Success now depends on a methodical approach, and Binghatti Aquarise is the type of asset suited for this mature market phase: prime location, backed by a well-capitalized developer, and priced for sustainable rental income.

The key takeaway is to focus on fundamentals: developer execution capability, surrounding infrastructure, and proven rental demand. When Binghatti launched Aquarise in April 2025, it was part of a major residential launch cycle that confirmed the market's depth. Their expansion to over 20,000 units with an AED 44 billion GDV is a signal of institutional confidence. You can review the specifics of that market activity on REIDIN.

In this environment, value is built through diligent asset management. Long-term gains will be captured by those who prioritize quality, location, and developer reliability. If you are rebalancing your portfolio for 2026 and this fundamentals-first approach aligns with your strategy, let's run the numbers.

Common Questions from Investors

It is prudent to address practical questions when evaluating an asset of this nature. The following addresses payment structures, operational costs, and visa eligibility.

What is the payment structure for Binghatti Aquarise?

Binghatti is utilizing the market-standard 70/30 payment plan, which became the benchmark for prime off-plan assets last year.

The structure is: a 20% down payment to secure the unit, followed by 50% paid in instalments tied to construction progress. The final 30% is due upon handover, scheduled for Q1 2027. All funds are protected in a RERA-monitored escrow account.

What are the projected service charges?

While final RERA-approved charges will be confirmed closer to completion, our analysis based on comparable new towers in Business Bay projects service charges between AED 18 to AED 22 per square foot annually.

This estimate accounts for the high-end amenities, including the artificial beach and large fitness center, which require higher upkeep than standard facilities. It is a realistic figure for the asset class.

Does purchasing a unit qualify for a residency visa?

Yes, an investment in Binghatti Aquarise can qualify an investor for a renewable residency visa.

Eligibility for a specific visa, such as the 10-year what is golden visa uae, depends on the final property value meeting the government's minimum investment threshold, currently AED 2 million. Verifying eligibility against the latest regulations is a standard part of our due diligence for international clients.