While many investors focus on last year's benchmarks in established areas, the smart money has moved. Q4 2025 data confirms a pivot towards master communities with phased handovers and integrated infrastructure, particularly those aligning with Dubai's southern expansion corridor. This analysis moves beyond lifestyle descriptions to provide a quantitative framework for identifying the best villa communities in Dubai, focusing on capital growth potential, rental yield stabilisation, and the structural advantages of new off-plan releases over ageing secondary stock.

The market has matured from the "post-Covid boom" into a sustainable growth cycle, demanding a more analytical approach to asset selection. Our objective is to equip you with the data needed to make informed portfolio decisions for 2026 and beyond. We will examine the metrics that matter: price-per-square-foot evolution, upcoming supply pipelines, and the revised payment plan structures that now define market entry. This guide dissects each prime community, offering a clear-eyed view on its investment thesis, target demographic fit, and potential ROI.

This is not about finding a residence; it is about allocating capital effectively within a dynamic asset class. We will address the practicalities of acquisition, including the RERA protections afforded by escrow accounts and the nuances of current UAE property law that impact overseas investors. Each community profile is designed to provide actionable intelligence, helping you differentiate between short-term market noise and long-term value corridors.

1. Dubai Hills Estate: The Benchmark for Integrated Community ROI

Dubai Hills Estate is no longer an emerging community; it is the established benchmark against which new master-planned developments in Dubai are measured. Its performance through 2025 solidified its status as a mature, fully integrated ecosystem, offering a clear model for sustainable investor returns. The community's primary advantage is its completed, high-quality infrastructure, which underpins its consistent rental demand and robust capital appreciation.

For investors analysing the market in 2026, Dubai Hills Estate presents a dual opportunity. The focus has shifted from initial launch prices to the premium secondary market and the final, highly anticipated off-plan releases. Here, ROI is driven not by speculative uplift but by scarcity and sustained end-user demand from families and executives. This community serves as a powerful case study in how phased, RERA-regulated development translates into long-term, defensible asset value, making it one of the best villa communities in Dubai for portfolio stability.

Investment Profile & 2026 Outlook

Dubai Hills Estate provides a diversified asset mix, from ultra-luxury mansions in Hills Grove to more accessible townhouses in Maple and Sidra. This tiered offering attracts a broad spectrum of tenants and buyers, insulating it from volatility in any single market segment.

- Investment Pros: Completed infrastructure (schools, hospital, mall) reduces development risk. Strong, consistent rental demand from executive-level tenants ensures low vacancy rates.

- Investment Cons: Initial high-growth phase has passed; returns are now steadier, not exponential. Entry prices on the secondary market reflect its mature status.

- Portfolio Fit: A core holding. It offers a balance of reliable rental income and steady capital growth, contrasting with higher-risk, purely speculative off-plan plays in less developed areas.

Analyst Insight: While the initial high-growth phase has matured, the rental market in Dubai Hills remains exceptionally strong. The completion of surrounding business hubs has created a direct tenant pipeline of senior management, ensuring low vacancy rates and strong yields. This is a key metric for anyone assessing the UAE's taxes on property, as consistent rental income is crucial for optimising net returns.

Financial Metrics & Buyer Suitability

The entry point and potential returns in Dubai Hills Estate vary by sub-community, but the overall performance remains a market leader.

| Metric | 2025-2026 Data & Projections | Investor Suitability |

|---|---|---|

| Price Range (Villas) | AED 4.5M – AED 100M+ | Broad spectrum from HNWIs to family investors. |

| Average Rental Yield | 4.5% - 5.5% (Varies by sub-community) | Investors seeking stable, long-term income streams. |

| Capital Appreciation (2025) | 12% - 18% (Secondary Market) | Buyers with a medium to long-term hold strategy. |

| Key Attraction | Established infrastructure, schools, and healthcare. | End-users, expatriate families, and portfolio investors. |

For those exploring residency options, a qualifying investment here can be a strategic pathway toward securing the Golden Visa in the UAE, linking a tangible asset to long-term residency benefits.

2. Bayut: The Primary Research Tool for Market Data

For any serious investor entering the Dubai market, Bayut has become the indispensable starting point for data aggregation and initial due diligence. It functions less as a simple listings portal and more as a comprehensive market intelligence tool. Its primary value lies in translating vast amounts of raw listings data into actionable insights, allowing investors to benchmark communities, track price fluctuations, and validate yield projections before ever engaging with an agent.

The platform's editorial arm, 'MyBayut', provides macro-level area guides that are crucial for shortlisting potential investment zones. While agents provide on-the-ground specifics, Bayut offers the high-level data needed to frame your acquisition strategy. This is where you conduct your first-pass analysis, identifying which of the best villa communities in Dubai align with your capital allocation and return objectives. It is the research engine that powers informed decision-making in a fast-moving market.

Investment Profile & 2026 Outlook

Bayut’s utility for an investor in 2026 is its ability to filter signal from noise. It provides a transparent view of both asking prices and historical trends, which is critical for verifying the valuations presented in an increasingly competitive landscape.

- Investment Pros: Extensive database provides strong initial market orientation. 'TruCheck™' feature helps filter for authentic, available listings. Historical data allows for quick ROI comparisons between communities.

- Investment Cons: Data is based on asking prices, not final transacted prices. Non-exclusive listings can lead to contacts from multiple agents for the same unit.

- Portfolio Fit: A mandatory due diligence tool. Use it to create a preliminary list of 3-5 target communities, ensuring subsequent consultations are focused on deep-dive analysis.

Analyst Insight: Bayut’s greatest asset is its aggregated data. When evaluating an off-plan opportunity, cross-reference the developer's projections with Bayut’s performance data for ready properties in the same master community. This provides a crucial reality check against marketing materials. Such data is foundational to any robust Dubai real estate market analysis, allowing for a more accurate forecast of long-term asset performance.

Financial Metrics & Buyer Suitability

While not a direct investment, using the platform effectively has a clear impact on financial outcomes.

| Metric | Bayut Feature & Application | Investor Suitability |

|---|---|---|

| Price Validation | View current asking prices and historical price index charts. | All buyers, to establish a baseline before making an offer. |

| Yield Calculation | Use listed rental prices against for-sale prices for an initial ROI estimate. | Investors focused on long-term rental income. |

| Market Comparison | Compare price-per-square-foot and community amenities across Dubai. | Buyers looking to identify undervalued assets or high-growth areas. |

| Key Attraction | Direct link between research content and live, filterable listings. | Proactive investors and end-users in the initial research phase. |

The platform, located at https://www.bayut.com/, is a powerful tool for initial exploration. However, be aware that submitting an enquiry on a non-exclusive listing can result in contacts from multiple agencies representing the same property.

3. Dubizzle (Property): For Price Discovery and Direct Listings

Dubizzle is a foundational tool in the Dubai real estate ecosystem, functioning less as a curated developer portal and more as the market's raw, unfiltered classifieds hub. Its primary value for investors in 2026 is twofold: granular price discovery and the potential to uncover off-market or direct-from-owner listings that bypass traditional agency channels. While mainstream portals aggregate official feeds, Dubizzle's classified nature often surfaces properties with unique circumstances, such as motivated sellers or legacy units not actively marketed elsewhere.

For the serious analyst, monitoring Dubizzle provides a real-time pulse on asking prices versus transacted prices recorded on the DLD. This platform is not for passive browsing; it is a tactical instrument for identifying pricing anomalies and connecting directly with listing agents or, occasionally, owners. Understanding its nuances is crucial for any investor looking to gain an edge, making it a key resource alongside official portals when scouting for the best villa communities in Dubai.

Investment Profile & 2026 Outlook

Dubizzle's utility spans the entire investment spectrum, from scouting entry-level townhouses to finding unlisted mansions. Its strength lies in its sheer volume and the diversity of its listings, though this necessitates a higher degree of due diligence from the buyer.

- Investment Pros: Sheer volume of listings provides a comprehensive view of market supply. Potential for direct-from-owner listings, avoiding agency fees. Useful for real-time monitoring of price reductions.

- Investment Cons: Listing quality is inconsistent; duplicate and outdated ads are common. Requires rigorous independent verification of property details and agent credentials.

- Portfolio Fit: A tactical lead-generation tool. Use it to identify targets, then engage professional verification and due diligence before proceeding.

Analyst Insight: The primary risk on Dubizzle is listing quality and authenticity. RERA regulations have improved standards, but duplicate listings and outdated ads persist. A savvy investor uses the platform to identify a target property, then immediately cross-references its Title Deed and agent credentials via the DLD's REST app. Treat it as a lead generation tool, not a source of verified truth.

Financial Metrics & Buyer Suitability

Dubizzle is not a community with defined metrics, but a marketplace reflecting the entire city's financial landscape. Its suitability depends on the investor's willingness to perform rigorous verification.

| Metric | 2025-2026 Data & Projections | Investor Suitability |

|---|---|---|

| Price Range (Villas) | AED 1.5M – AED 200M+ | Covers the entire market, from affordable to ultra-luxury. |

| Average Rental Yield | N/A (Market-wide reflection) | Varies by community; useful for comparing advertised yields. |

| Capital Appreciation (2025) | N/A (Market-wide reflection) | Best used to track asking price trends in specific sub-communities. |

| Key Attraction | Breadth of listings and potential for owner-direct deals. | Hands-on investors, researchers, and professional agents. |

Using this platform effectively is a skill. For those exploring investment pathways, identifying a potential asset on Dubizzle and then having it professionally vetted can be a strategic route, especially when the property qualifies for benefits like the Golden Visa in the UAE.

4. Emaar Properties: Direct Access to Primary Market Villa Inventory

For investors aiming to bypass the secondary market and secure assets directly from the source, Emaar Properties' official platform is the definitive portal. As the master developer behind Dubai's most liquid and established villa communities, this site is not just a listings portal; it is the primary gateway to off-plan launches in flagship developments like Arabian Ranches, Dubai Hills Estate, and The Valley Phase 2. It offers unfiltered access to official master plans, unit specifications, and developer-backed payment schedules.

Engaging directly with Emaar is a strategic move for securing assets at launch prices, before secondary market premiums are applied. The platform allows for pre-registration for highly anticipated villa releases, a critical step for gaining allocation priority. For investors evaluating the best villa communities in Dubai, this direct-from-developer channel provides a transparent baseline for pricing and a clear view of the upcoming supply pipeline, which is essential for making informed portfolio decisions in 2026.

Investment Profile & 2026 Outlook

Emaar's platform caters primarily to investors focused on the primary (off-plan) market, offering a direct line to some of the most sought-after family-oriented villa assets in the emirate. The value proposition is early access and transparent, developer-guaranteed terms.

- Investment Pros: Access to launch prices avoids secondary market premiums. RERA-compliant contracts and escrow accounts offer security. Proven track record of delivering high-quality, liquid assets.

- Investment Cons: Popular launches are oversubscribed, requiring speed and preparedness. Payment plans are less flexible than secondary market negotiations.

- Portfolio Fit: A growth-focused asset. An off-plan Emaar villa complements holdings in mature, income-generating communities by offering potential for capital appreciation upon handover, a key consideration for those reviewing the best areas to buy property in Dubai.

Analyst Insight: While the allure of launch-day pricing is strong, success requires speed and preparedness. Allocations for Emaar's prime villa launches are often granted to those who have pre-registered and have their financing in order. The platform’s post-purchase tools are also a key benefit, providing official updates on construction progress and payment milestones directly from the source.

Financial Metrics & Buyer Suitability

Using the Emaar platform means engaging with developer pricing, which can be less flexible than the secondary market but offers the security of a direct, RERA-compliant contract.

| Metric | 2026 Payment Plan Breakdown | Investor Suitability |

|---|---|---|

| Price Range (Villas) | Varies by launch (e.g., AED 3M+ Townhouses to AED 20M+ Villas) | Off-plan investors and end-users seeking new builds. |

| Payment Plans | Typically 60/40, 80/20, or 90/10 structures. | Buyers who can manage phased construction-linked payments. |

| Capital Appreciation | Highest potential between launch and handover. | Investors with a medium-term (2-4 year) hold strategy. |

| Key Attraction | First access to inventory in A-grade communities. | Priority clients, HNWIs, and registered agency partners. |

The platform is an indispensable tool for any serious investor targeting Dubai's primary villa market. It provides the foundational data needed to analyse new projects and secure allocations in communities poised for long-term growth and stability.

5. Nakheel: The Gatekeeper to Dubai's Iconic Waterfront Living

For investors targeting Dubai’s most globally recognised addresses, the Nakheel official website is not just a resource; it is the primary and most critical entry point. This is the master developer behind the projects that define Dubai's coastline, including the original Palm Jumeirah, Jumeirah Islands, and the highly anticipated Palm Jebel Ali. Accessing this portal is fundamental for securing allocations in new, marquee coastal villa releases and is the source-of-truth for project specifications and handover protocols.

In 2026, the focus for HNWIs is squarely on Nakheel's pipeline, particularly the phased releases at Palm Jebel Ali, which are set to redefine luxury waterfront standards. Navigating their official site is a non-negotiable step for serious buyers. It allows for direct registration for launches, bypassing the noise of unofficial third-party sites and ensuring access to accurate information on payment plans and unit specifications. Using the portal correctly is the difference between securing a prime plot and missing an allocation. [Map: Palm Jebel Ali location relative to Al Maktoum Airport]

Investment Profile & 2026 Outlook

Nakheel's portfolio represents the pinnacle of Dubai's luxury real estate, commanding premium pricing and attracting a global elite clientele. The investment strategy here is one of capital preservation and legacy asset acquisition rather than high-yield rental returns.

- Investment Pros: Ownership of a globally recognized trophy asset. Limited supply underpins long-term capital preservation. Strong branding and unique waterfront locations.

- Investment Cons: High capital entry point. Lower rental yields compared to inland communities due to high asset values.

- Portfolio Fit: A legacy asset. These properties are less about yield and more about securing a position in one of the world's most exclusive communities, suitable for UHNWIs and family offices.

Analyst Insight: The official Nakheel website is the only channel for authenticating information. Numerous third-party microsites attempt to replicate official data but often contain outdated or inaccurate details. For any serious transaction, particularly resale, the Nakheel portal is also essential for managing Service/NOC applications and understanding community service charges, which are critical for calculating net ROI.

Financial Metrics & Buyer Suitability

Entry into a Nakheel waterfront community is a significant capital commitment, positioning it for a specific investor class focused on asset quality over speculative gains.

| Metric | 2025-2026 Data & Projections | Investor Suitability |

|---|---|---|

| Price Range (Villas) | AED 8M – AED 300M+ | UHNWIs, family offices, and legacy asset buyers. |

| Average Rental Yield | 2.5% - 4.5% (Asset value skews yield) | Investors focused on capital preservation and prestige. |

| Capital Appreciation (2025) | 10% - 22% (Prime Waterfront) | Buyers with a very long-term hold strategy (10+ years). |

| Key Attraction | Iconic branding, exclusive waterfront access. | Global elite and investors seeking trophy real estate. |

Engaging directly with Nakheel is a critical first step. An in-depth understanding of this key player is invaluable, and you can review a comprehensive list of Dubai's top developers here to compare their market positions.

6. DAMAC Properties: The Hub for Off-Plan Villa Inventory

DAMAC Properties' official portal has become a primary destination for investors seeking direct access to a high volume of new and upcoming villa communities. Moving into 2026, the developer's strategy of launching entire townships like DAMAC Hills 2 and the expansive DAMAC Lagoons provides a clear pipeline of off-plan inventory. The website acts as a direct-from-source hub, bypassing third-party aggregators and offering clarity on project timelines and payment structures.

For investors, the portal’s value lies in its organised presentation of themed villa clusters. It allows for a systematic comparison of different architectural styles, price points, and community concepts-from the sports-centric vibe of DAMAC Hills to the Mediterranean-inspired enclaves of Lagoons. This platform is a crucial due diligence tool, especially for those considering the nuances of buying off-plan property in Dubai, as it provides the developer's official data on which to base an investment thesis, making it a gateway to some of the best villa communities in Dubai for portfolio diversification.

Investment Profile & 2026 Outlook

DAMAC’s offerings cater to a wide investor base, from those seeking entry-level townhouses to ultra-high-net-worth individuals targeting branded mansions. The portal effectively segments these opportunities, allowing users to drill down into specific clusters that match their capital outlay and ROI objectives.

- Investment Pros: Wide range of price points and themes. Aggressive payment plans often appeal to new investors. High potential for capital appreciation on off-plan units as infrastructure develops.

- Investment Cons: Timelines for infrastructure delivery in newer mega-projects are a key risk factor. Secondary market liquidity can be lower in the initial years post-handover.

- Portfolio Fit: Suitable for investors seeking higher growth potential with a corresponding risk appetite. The branded residences offer a unique ultra-luxury proposition.

Analyst Insight: The key to leveraging the DAMAC portal in 2026 is speed and verification. High-demand clusters are released and sold quickly. Serious investors should pre-register interest directly on the official site to gain priority access. Crucially, always verify you are on the

damacproperties.comdomain, as sophisticated phishing sites often mimic the developer’s branding to capture leads.

Financial Metrics & Buyer Suitability

The DAMAC portfolio is defined by its scale and diversity, with financial metrics varying significantly between its different master communities. [Chart: 2026 Payment Plan Breakdown]

| Metric | 2025-2026 Data & Projections | Investor Suitability |

|---|---|---|

| Price Range (Villas) | AED 1.8M – AED 50M+ | Broad appeal from first-time investors to UHNWIs. |

| Average Rental Yield | 4.0% - 6.5% (Projected, upon handover) | Investors targeting new-build rental assets. |

| Capital Appreciation (Off-Plan) | Varies by launch and payment plan structure. | Buyers with a medium-term (3-5 year) hold strategy. |

| Key Attraction | Themed communities, attractive payment plans. | Off-plan specialists and end-users seeking new properties. |

For overseas buyers, particularly from markets like India, the clear payment schedules and RERA-protected escrow accounts detailed on the site provide a secure framework for investing in Dubai’s property market.

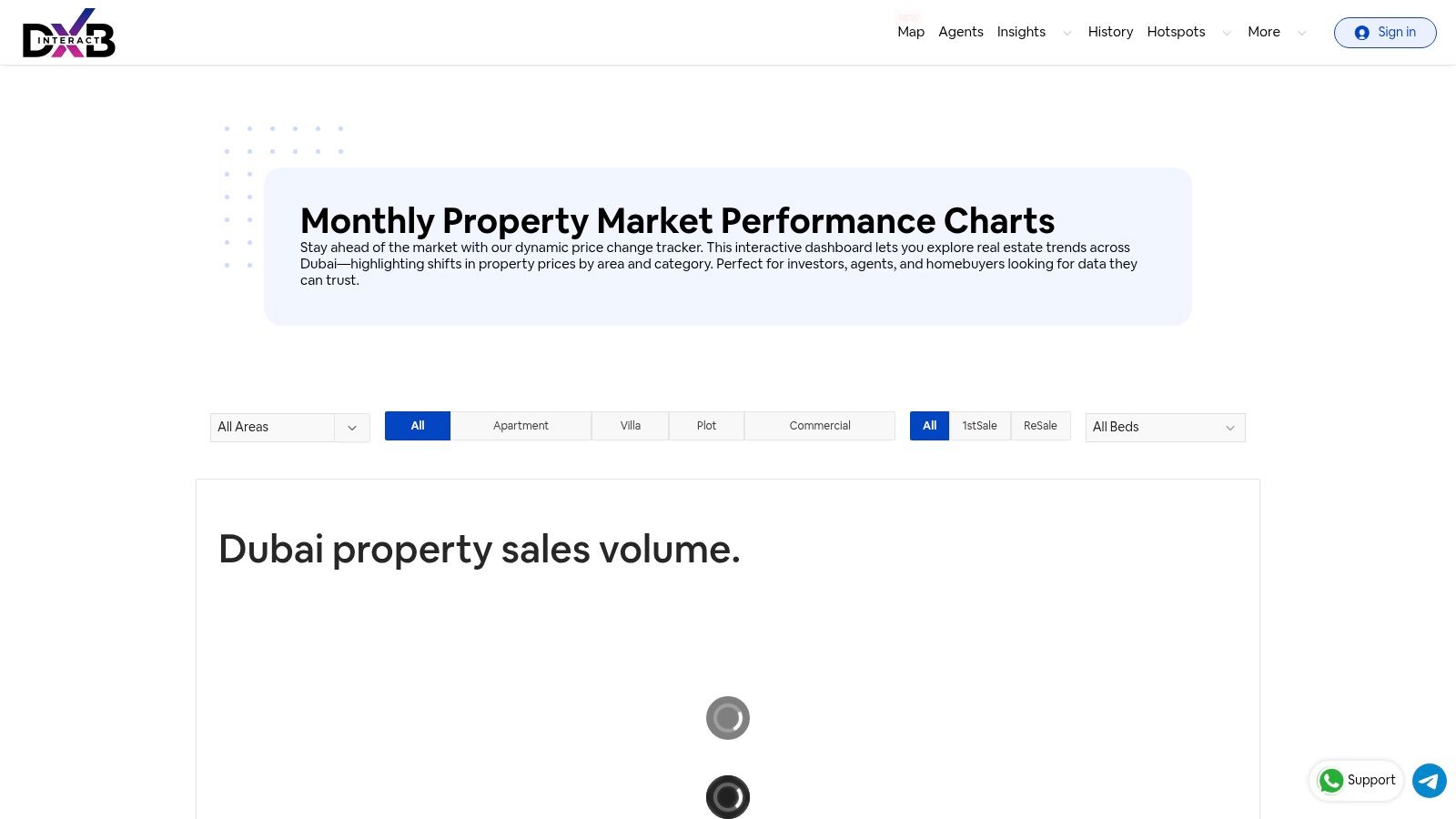

7. DXBinteract: The Data Terminal for Strategic Villa Acquisition

In a market driven by narrative, raw data provides the only verifiable truth. DXBinteract is not a villa community but an essential data terminal for anyone serious about acquiring assets within one. It aggregates and visualises official Dubai Land Department (DLD) transaction data, allowing investors to cut through marketing noise and analyse performance based on actual sales and rental figures. Its utility in 2026 is non-negotiable for due diligence.

Before making an offer in any community, this platform allows you to validate price points, track historical capital appreciation, and model potential rental yields with precision. For an investor, it transforms the search for the best villa communities in Dubai from a qualitative exercise into a quantitative one. It is the tool used to verify agent claims and identify sub-communities that are outperforming the broader market, making it indispensable for data-driven portfolio management.

Investment Profile & 2026 Outlook

DXBinteract is a strategic resource, not a direct investment. Its value lies in empowering buyers to make informed decisions across all villa segments, from emerging off-plan projects to established luxury enclaves. The platform is crucial for validating the investment theses presented in this listicle.

- Investment Pros: Provides access to actual DLD transaction data, not just asking prices. Enables precise negotiation based on real-time comps. Identifies trends at a sub-community level.

- Investment Cons: Requires a degree of data literacy to interpret charts and metrics correctly. Subscription may be required for full feature access.

- Portfolio Fit: An essential risk-management tool for all investors. It empowers data-driven decision-making, from individual buyers to institutional portfolio managers.

Analyst Insight: The most powerful feature for 2026 is its ability to track the performance of newly handed-over communities. As projects from the 2023-2024 off-plan cycle enter the secondary market, DXBinteract provides the first real performance data, separating developer promises from market reality.

Financial Metrics & Buyer Suitability

The platform is a tool, so its metrics are about the value it provides to the user's decision-making process. Access is typically subscription-based.

| Metric | 2025-2026 Data & Projections | User Suitability |

|---|---|---|

| Subscription Cost | Varies (Free basic access to paid premium tiers) | All serious investors, from individuals to institutions. |

| Key Benefit | DLD-sourced data for negotiation and due diligence. | Buyers seeking to avoid overpaying and validate ROI claims. |

| Learning Curve | Moderate; requires understanding of property metrics. | Users comfortable with data analysis and charting tools. |

| Unique Selling Point | Direct visualisation of official DLD data, not listings. | Anyone prioritising transparent, unbiased market intelligence. |

Leveraging this platform provides the analytical backing needed for significant capital deployment. For international investors, such data-backed investments are often a prerequisite for confidently proceeding with a Golden Visa in the UAE application tied to a property asset.

7-Point Comparison of Dubai Villa Communities

| Item | Implementation complexity 🔄 | Resource requirements ⚡ | Expected outcomes 📊 | Ideal use cases 💡 | Key advantages ⭐ |

|---|---|---|---|---|---|

| Property Finder | Medium — intuitive UI; some premium features require login | Low — web access; account improves data access ⚡ | Broad, current shortlist + price/yield snapshots for communities | Shortlisting villas and comparing off‑plan vs ready stock | High inventory coverage and DataGuru pricing/yield guidance ⭐⭐⭐⭐ |

| Bayut | Medium — combines listings with editorial content | Low — web access; use guides for faster selection ⚡ | Research-driven shortlists with rental vs buy context | Research-first buyers selecting by lifestyle or budget | Editorial area guides linked to live listings; clear community ROI snippets ⭐⭐⭐⭐ |

| Dubizzle (Property) | Low — simple classifieds but variable listing quality | Low — browsing easy; verification may be needed ⚡ | Price discovery and occasional owner/off‑market finds | Finding owner-listed or unusual listings and testing price ranges | Surfaces unique owner-stock and quick new-listing visibility ⭐⭐⭐ |

| Emaar Properties | Low–Medium — browsing easy; launch registration required | Medium — registration/deposit processes for launches ⚡ | Direct access to primary launches, official specs and payment plans | Securing off‑plan villas in flagship communities (Dubai Hills, Arabian Ranches) | Official source with transparent specs, plans and strong liquidity ⭐⭐⭐⭐ |

| Nakheel | Low–Medium — standard developer workflows | Medium — limited supply; allocation procedures apply ⚡ | Access to marquee waterfront launches and official documentation | Purchasing waterfront or landmark community villas (Palm, Jumeirah Islands) | Source‑of‑truth for waterfront projects and future pipeline ⭐⭐⭐⭐ |

| DAMAC Properties | Low–Medium — browse and register for clusters | Medium — registration and staged payments common ⚡ | Access to themed villa clusters across price tiers | Buyers seeking themed or varied villa styles from value to luxury | Wide range of villa styles and clear handover/payment info ⭐⭐⭐ |

| DXBinteract | Medium–High — requires data interpretation skills 🔄 | Low — web dashboards; time to analyze required ⚡ | DLD‑sourced transaction validation and trend rankings | Investors and negotiators validating comps, yields and liquidity | Authoritative DLD transaction data for pricing and negotiation support ⭐⭐⭐⭐ |

Final Thoughts: Strategy Over Speculation

The era of uniform, market-wide price lifts has passed. Success in the 2026 Dubai villa market requires a granular, sub-market-specific strategy. As we have seen through the analysis of communities from the established luxury of Dubai Hills Estate to the ambitious new blueprints for Palm Jebel Ali, the key divergence for investors is now clear: acquiring assets in mature, infrastructure-rich communities versus targeting new master plans for long-term capital appreciation.

The decision-making process for identifying the best villa communities in Dubai has evolved from simple location scouting to complex asset allocation. The former strategy, focusing on prime, ready communities, offers security, proven rental yields, and liquidity. These are a portfolio's anchor assets. The latter strategy, involving new phases in communities like The Valley or DAMAC Lagoons, presents higher growth potential intrinsically tied to development timelines and the delivery of promised infrastructure. This is where capital is allocated for growth.

Navigating the Data-Driven Decision Matrix

The tools we have profiled—Bayut, Dubizzle, and especially DXBinteract—are no longer just for browsing. They are essential for validating the micro-trends that define opportunity in 2026.

- For Yield-Focused Investors: Use DXBinteract's transaction history to benchmark rental yields in mature communities like Arabian Ranches against last year's figures. This data provides a realistic forecast, stripping away the speculative noise that characterized the post-2022 boom.

- For Capital Growth Investors: Monitor developer-specific portals like Emaar's and Nakheel's for new phase launches. Cross-reference these with master plans to understand how a new villa cluster fits into the broader infrastructure rollout, a key driver of future value. Unlike the speculative frenzy of 2024, the current dubai-real-estate-market-analysis suggests a stabilization in price per square foot.

- For NRI and Overseas Buyers: The legal framework is now a critical part of your due diligence. Understanding the nuances of financing and the protections offered by a robust uae-property-law system is vital. Your investment is not just in a physical asset but in a regulated and increasingly transparent market.

The window for 'easy flips' has narrowed. Success in 2026 requires targeting communities with genuine infrastructure growth—specifically those connected to the expanding metro lines and the economic hub around Al Maktoum International Airport. Your portfolio's composition must reflect your specific risk tolerance and investment horizon. The question is no longer "should I invest in a Dubai villa?" but rather, "which villa community aligns with my asset growth strategy for the next five years?" This requires a shift from a transactional mindset to an asset management perspective.

If you are rebalancing your portfolio for 2026 and need to run the numbers on specific off-plan launches versus secondary market opportunities, let's schedule a strategic consultation. At Proact Luxury Real Estate LLC, we manage assets, not just transactions, providing data-driven advisory to ensure your capital is deployed with precision.