Dubai's real estate market is a landscape of constant innovation, with new off-plan projects promising lucrative returns for savvy investors. But with countless launches from world-renowned developers, identifying genuine opportunities requires more than just browsing portals; it demands strategic insight and meticulous research. The challenge isn't a lack of options, but a surplus of noise. How do you cut through the marketing hype to find projects with genuine capital growth potential and strong rental yields?

This guide is your starting point. It's designed for high-net-worth individuals, overseas buyers, and seasoned investors who need to make informed decisions. We will explore the key platforms and direct developer channels that are essential for sourcing and vetting the best off-plan projects in Dubai. Each section will provide actionable insights, screenshots, and direct links to simplify your search.

We will move beyond simple listings to provide a framework for due diligence, helping you differentiate between fleeting trends and solid, long-term investments. You will learn not just what is available, but how to evaluate each opportunity based on critical factors like developer reputation, payment plans, projected yields, and location-specific growth drivers. For those seeking a deeper, more personalised strategy, expert advisory services can provide curated access to exclusive deals, ensuring your capital is deployed with precision and confidence. Let's delve into the essential resources you need to navigate this dynamic market.

1. How to Find the Best Off-Plan Deals in Dubai

For investors seeking a strategic, data-driven entry into Dubai’s competitive property market, Proact Luxury Real Estate's advisory service, led by seasoned financial expert Ritu Kant Ojha, offers a distinct advantage. Rather than presenting a generic portal of listings, this platform functions as a high-touch consultancy, curating access to the best off-plan projects in Dubai based on proprietary research and deep developer relationships. It is designed for discerning global investors who prioritise ROI and require an end-to-end support system to navigate the complexities of off-plan acquisitions.

This service stands out by transforming the search for off-plan deals from a passive browsing experience into an active, intelligence-led investment strategy. The team leverages its network to secure privileged access to under-the-radar launches, exclusive developer incentives, and optimal price corridors often unavailable to the general public. This curated approach ensures that clients are presented only with opportunities that align with specific financial goals, whether that is maximising long-term capital appreciation or securing high rental yields.

Core Advisory Features & Investor Benefits

The advisory is structured around several key pillars that provide tangible value to investors. Its research-driven methodology goes beyond surface-level metrics, incorporating comparative analytics and market timing models to identify projects with the highest growth potential.

- Curated Inventory Access: Members gain entry to a handpicked portfolio of off-plan opportunities from Dubai's most reputable developers. This includes early access to launches, pre-sales, and special payment plans that are not advertised on mainstream property portals.

- ROI-Focused Analytics: Each recommended project is backed by in-depth analysis of its potential for rental yield and capital growth. The advisory team evaluates factors like location dynamics, infrastructure development, and historical performance to project future returns with greater accuracy.

- Comprehensive Due Diligence Support: The service integrates critical legal and financial guidance into its offering. This includes meticulous contract reviews, verification of developer credentials via RERA, and strategic advice on financing options to structure the investment optimally. Understanding the intricacies of buying off-plan property in Dubai is crucial, and this advisory simplifies the entire process.

- Forward-Looking Market Intelligence: Proact provides clients with insights into emerging trends that will shape the future value of their assets. This includes analysis of tokenization, blockchain-enabled ownership models, and the growing importance of ESG (Environmental, Social, and Governance) factors in property valuation and resale.

Who is This Advisory Best For?

This service is ideally suited for mid-to-high net-worth individuals, family offices, and international investors who lack the time or on-the-ground expertise to source and vet high-calibre deals themselves. It is particularly valuable for those who appreciate a data-backed, personalised approach and seek a long-term partnership rather than a one-time transaction. While off-plan investments always carry inherent risks like potential delays, this advisory model is designed to mitigate them through rigorous pre-selection and continuous project monitoring.

| Feature Analysis | Proact Advisory vs. Public Portals |

|---|---|

| Deal Sourcing | Curated, early-access opportunities based on proprietary research and developer relationships. |

| Advisory Scope | End-to-end support: selection, legal, financing, exit strategy, and market intelligence. |

| Focus | Maximising investor ROI through a data-driven, strategic approach. |

| Exclusivity | Access to pre-market launches and exclusive developer incentives. |

Practical Tip: To make the most of this service, investors should prepare a clear brief of their financial goals, risk appetite, and preferred property types before their initial one-on-one consultation. This allows the advisory team to tailor their recommendations and provide a highly relevant shortlist of investment opportunities from the outset.

- Pros: Curated access to premium off-plan deals, expert ROI-focused analysis, comprehensive advisory from selection to exit, and forward-looking market insights.

- Cons: Advisory is likely fee-based and tailored for premium investors; inherent market risks of off-plan investments still apply.

- Website: Proact Luxury Real Estate - Best Off-Plan Deals

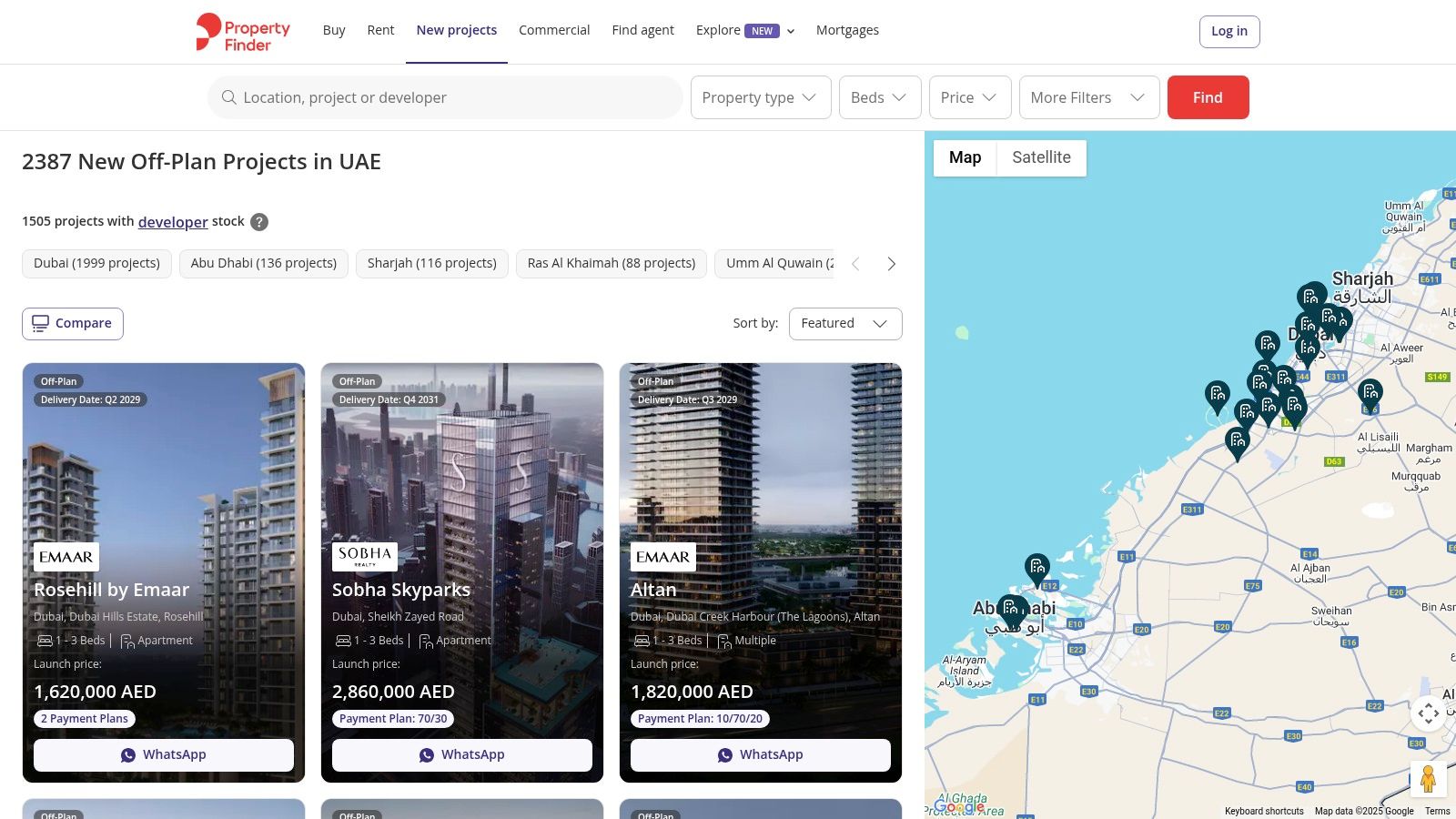

2. Property Finder

Property Finder is the UAE’s definitive real estate marketplace and an essential starting point for any investor looking to scan the broad inventory of the best off-plan projects in Dubai. Its dedicated "New Projects" hub functions as a comprehensive, real-time catalogue of developer launches, offering a panoramic view of what’s available across the emirate. This platform is less about direct developer sales and more about market discovery and comparison.

Think of Property Finder as your digital reconnaissance tool. It aggregates listings from developers and hundreds of brokerage firms, giving you an unparalleled scope of the market in one place. Its strength lies in its powerful and granular filtering capabilities, allowing you to slice and dice the entire off-plan market by specific criteria that matter most to your investment strategy. This is crucial for initial shortlisting before you commit to deeper due diligence.

Why It Stands Out

What makes Property Finder indispensable is its sheer volume and the organisation of its data. While a developer's own site will only showcase its portfolio, Property Finder allows you to compare a new Emaar launch in Downtown Dubai directly against a similar offering from DAMAC in Business Bay. The platform centralises vital information like launch prices, detailed payment plans, estimated handover dates, and unit configurations.

Furthermore, its integration with Mortgage Finder provides a practical next step, allowing you to get a mortgage pre-approval directly through the portal. This is a significant advantage for investors planning to finance their purchase, as it provides clarity on borrowing capacity early in the process.

Practical Tips for Maximising the Platform

To use Property Finder effectively, treat it like an analyst's dashboard.

- Filter with Precision: Don’t just browse. Use the filters for “Handover Date” to find projects completing within your investment timeframe. Filter by “Payment Plan” to identify post-handover options or developer-financed schemes that align with your cash flow.

- Analyse Developer Pages: Click through to the dedicated developer pages. This provides a focused view of a single developer's entire off-plan portfolio, helping you assess their scale, focus areas, and project diversity.

- Cross-Reference Listings: Since multiple agents can list the same project, you may find variations in the information presented. Use this to your advantage by contacting a few different agents to gauge their responsiveness and knowledge.

- Use the 'New Projects' Map View: Switch to the map view within the off-plan section. This gives you a geographical perspective, helping you understand a project's proximity to key landmarks, transport links, and community amenities.

Platform Breakdown

| Feature | Details |

|---|---|

| Primary Use Case | Market scanning, project discovery, and initial shortlisting. |

| Access | Free to browse and contact agents/developers. |

| Key Advantage | Unmatched inventory depth from virtually all major Dubai developers. |

| Potential Drawback | Listing quality can be inconsistent as it's submitted by third parties. |

Website: https://www.propertyfinder.ae/en/new-projects

3. Bayut

Bayut is another powerhouse in the UAE’s real estate portal landscape and a critical resource for anyone searching for the best off-plan projects in Dubai. It distinguishes itself through a user-friendly interface that seamlessly integrates market data with editorial content, making project discovery both intuitive and informative. Its dedicated "New Projects" section acts as a curated directory of the latest developer launches, complemented by a powerful off-plan search function.

Functioning as a comprehensive research hub, Bayut aggregates off-plan listings from a vast network of developers and real estate agencies. Its primary strength lies in presenting complex project information in a digestible format. For investors, this means quick access to essential data points like starting prices, high-level payment plan structures, and estimated completion dates, all designed to facilitate rapid initial comparisons between different investment opportunities.

Why It Stands Out

Bayut’s unique value proposition is its blend of structured listings with high-quality editorial content. The platform frequently publishes round-ups and guides on trending launches, categorising them by themes like "waterfront," "luxury," or "affordable." This content-driven approach helps investors quickly identify projects that align with their specific strategy without having to manually sift through hundreds of listings.

Project pages on Bayut are often very clear, providing "from AED" pricing to give an immediate sense of the entry point. The platform's powerful filtering tools are also a major asset, allowing users to narrow their search by developer, community, unit type, and, crucially, the project's handover timeline. This makes it particularly effective for identifying projects that fit a precise investment horizon.

Practical Tips for Maximising the Platform

To get the most out of Bayut, combine its search and content features strategically.

- Leverage the 'New Projects' Section: Start in the dedicated "New Projects" directory. It provides a clean overview of recent launches with key vitals, acting as your high-level market briefing.

- Use the 'Off-Plan' Search Toggle: When using the main property search, activate the "Off-Plan" filter. This switches the entire search engine to focus solely on unbuilt properties, giving you a live look at what agents are actively marketing.

- Read the Editorial Guides: Pay attention to Bayut’s blog and market reports. They often highlight new launches and provide context on specific communities or developers, offering insights you won't find in a standard listing.

- Focus on Handover Timelines: Use the "Completion Status" or similar filters to isolate projects nearing completion or those with longer-term delivery dates, depending on whether your goal is near-term rental income or long-term capital appreciation.

Platform Breakdown

| Feature | Details |

|---|---|

| Primary Use Case | Project discovery, market trend analysis, and developer comparisons. |

| Access | Free to browse projects and contact listed agents. |

| Key Advantage | Excellent blend of searchable listings and editorial content for guided discovery. |

| Potential Drawback | Specific unit availability and detailed payment breakdowns often require direct contact. |

Website: https://www.bayut.com/new-projects/dubai/

4. Emaar Properties (official)

For investors who want to go straight to the source, the official Emaar Properties website is the ultimate hub for its world-renowned projects. As Dubai’s largest developer, Emaar is the name behind iconic communities like Downtown Dubai, Dubai Marina, and Dubai Hills Estate. This platform provides direct, unfiltered access to their current and upcoming launches, making it a critical resource for anyone seeking to invest in some of the best off-plan projects in Dubai.

Going directly to Emaar’s site removes intermediaries, allowing you to engage with the developer's official sales team. It serves as a definitive source of truth for project details, offering official inventories, downloadable brochures, and precise information on unit types, locations, and handover windows. This is where you get the information straight from the master developer responsible for shaping much of Dubai's skyline.

Why It Stands Out

The key advantage of using Emaar’s official platform is authenticity and priority access. While aggregators are great for comparison, the developer's site is where new projects are often announced first. This gives diligent investors a potential head start, which is crucial as highly anticipated Emaar launches can sell out within hours of release.

The website also provides clear, authoritative guidance on the buying process, including eligibility criteria for foreign buyers and the standard timelines involved in an off-plan purchase. The payment plan structures are consistent and transparent, giving you confidence that the terms you see are official and non-negotiable. This direct-from-developer approach simplifies due diligence and ensures you are working with verified information. For more information on this, explore our guide on how to maximise ROI on property investments in Dubai.

Practical Tips for Maximising the Platform

To leverage the Emaar website effectively, a proactive approach is necessary.

- Pre-Register Your Interest: For upcoming launches, the site allows you to register your interest well in advance. Do this to get on the priority list for communication and potential early access during a launch event.

- Study the Masterplans: Don’t just look at individual project brochures. Explore the master community pages (e.g., Dubai Creek Harbour, The Oasis) to understand the long-term vision, planned amenities, and infrastructure that will drive future value.

- Download and Compare Brochures: Systematically download the brochures for projects that fit your criteria. These documents contain detailed floor plans, specifications, and renderings that are essential for your analysis.

- Engage with the Sales Team: Use the "Enquire" or "Register" buttons to connect directly with an Emaar sales advisor. They can provide specific unit availability and answer detailed questions that aren't on the website.

Platform Breakdown

| Feature | Details |

|---|---|

| Primary Use Case | Direct-from-developer purchase, priority access to new launches, and official project information. |

| Access | Free to browse and register interest. |

| Key Advantage | Authenticity of information and direct line to the developer, avoiding third-party commissions. |

| Potential Drawback | The catalogue is limited to Emaar's portfolio only, preventing cross-developer comparison. |

Website: https://properties.emaar.com/en/off-plan-projects/

5. Nakheel (official)

For investors targeting Dubai’s most iconic and ambitious waterfront communities, going directly to the source is paramount. The official Nakheel website is the definitive portal for those interested in the master developer's portfolio, which includes world-renowned projects like Palm Jumeirah, the revitalised Palm Jebel Ali, and the expansive Dubai Islands. This platform serves as the primary, authoritative source for official launches, project details, and direct contact with the developer’s sales team.

Think of Nakheel's website as your direct line to the creator of some of Dubai's most transformative real estate. Unlike aggregator sites, this platform provides unfiltered information straight from the developer’s desk. It is the go-to resource for securing an allocation in highly anticipated launches, tracking construction milestones, and understanding the long-term vision for their master-planned communities, making it an indispensable tool for serious investors.

Why It Stands Out

What makes the Nakheel website essential is its role as the single source of truth for its projects. While marketplaces list available units, Nakheel.com provides the foundational context: master plans, infrastructure updates, and official press releases. You can find detailed information on some of Dubai's most ambitious property projects of 2025 and beyond directly on the site. This is where new phases are announced first, offering a crucial head-start for investors looking to secure units at launch prices.

Furthermore, the website often provides tangible progress updates, sometimes including percentage of construction completion, which is vital for off-plan due diligence. This transparency offers a layer of confidence that is often missing on third-party platforms. The ability to register interest directly ensures you are in the official queue for information and sales events.

Practical Tips for Maximising the Platform

To leverage Nakheel’s website effectively, approach it as an intelligence-gathering hub.

- Register Interest Early: For upcoming mega-projects like Palm Jebel Ali, use the "Register Interest" forms as soon as they are available. This places you on the official communication list for pre-launch information and priority access.

- Monitor the Media Centre: Regularly check the "Media Centre" or "Press Releases" section. This is where Nakheel announces new contractor awards, infrastructure progress, and phase launches before they are widely publicised.

- Study the Master Plans: Go beyond individual project pages. Explore the interactive master plans for communities like Dubai Islands to understand the long-term vision, including planned amenities, transport links, and commercial hubs that will drive future value.

- Use the Direct Contact Number: Don't hesitate to use the 800-NAKHEEL number for specific queries. Direct contact can often yield more detailed information on payment plans and availability than what is published online.

Platform Breakdown

| Feature | Details |

|---|---|

| Primary Use Case | Direct-from-developer information, early launch registration, and due diligence. |

| Access | Free to browse and register interest. |

| Key Advantage | Authoritative source for iconic waterfront projects and official progress updates. |

| Potential Drawback | Limited to Nakheel’s portfolio only; pricing is often only available upon enquiry. |

Website: https://www.nakheel.com/

6. Sobha Realty (official)

For investors specifically interested in master-planned communities with a reputation for meticulous quality and design, the official Sobha Realty website is an essential resource. It offers a direct, unfiltered channel to explore some of the best off-plan projects in Dubai, such as the expansive Sobha Hartland and the luxurious Sobha SeaHaven. The platform serves as a digital headquarters for all things Sobha, providing a deep dive into their signature "Backward Integration" model, which ensures quality control from design to delivery.

This website acts as a developer-specific portal rather than an open marketplace. It is designed to immerse potential buyers in the Sobha brand ethos and provide detailed, first-party information straight from the source. Its strength lies in the depth and accuracy of the project information, offering dedicated microsites for each launch that are rich with architectural renders, floor plans, and construction updates, giving investors a clear and transparent view of their potential asset.

Why It Stands Out

Sobha Realty’s official platform stands out by offering unparalleled detail on its own portfolio. Unlike multi-developer portals, every piece of content, from payment plan structures to handover timelines, is official and definitive. This eliminates the risk of encountering outdated or inaccurate information from third-party agents. The site effectively showcases Sobha’s commitment to quality with high-resolution imagery, virtual tours, and detailed specifications for its design-led waterfront and city-centric projects.

A key advantage is the direct line of communication it provides. The website features prominent callback forms, dedicated sales contacts, and details for their global offices, ensuring that serious investors can connect directly with the developer’s sales team. This direct access is crucial for clarifying nuances in payment plans and securing priority access to new unit releases, bypassing intermediary layers.

Practical Tips for Maximising the Platform

To get the most value from the Sobha Realty website, use it as a focused due diligence tool.

- Explore Project Microsites: Don’t just browse the main portfolio. Click into the dedicated microsites for projects like Sobha Hartland II or The S Tower. These often contain detailed brochures, master plans, and amenity lists that are not available elsewhere.

- Register Your Interest Early: For upcoming launches, use the "Register Your Interest" forms. This puts you on the developer's radar, often granting you pre-launch information and priority booking opportunities before the general public.

- Utilise the ONE Sobha App: The website promotes the ONE Sobha app. Download it for real-time inventory checks, exclusive offers, and a more streamlined communication channel with the sales team, especially for existing buyers tracking their property's progress.

- Analyse Payment Structures: Pay close attention to the payment plans detailed on the site. Sobha often offers standardised plans (e.g., 60/40, 80/20), and understanding these directly from the source helps in financial planning without agent interpretation.

Platform Breakdown

| Feature | Details |

|---|---|

| Primary Use Case | Deep-dive research and direct purchase of Sobha’s portfolio. |

| Access | Free to browse and contact the developer's sales team directly. |

| Key Advantage | Authoritative, first-party information on design and build quality. |

| Potential Drawback | Inventory is limited exclusively to Sobha Realty's own projects. |

Website: https://sobharealty.com/

7. Meraas (official)

Meraas is a master developer synonymous with creating some of Dubai's most iconic lifestyle destinations, and its official website is the direct gateway for investors targeting its exclusive portfolio. Unlike aggregators, the Meraas site provides a focused, branded experience, showcasing its renowned urban and waterfront communities like City Walk, Bluewaters, and Madinat Jumeirah Living. It serves as an authoritative source for anyone looking for the best off-plan projects in Dubai with a strong emphasis on design and community-centric living.

This platform is your primary touchpoint for direct developer engagement. It is designed not just to display properties but to educate potential buyers on the entire off-plan purchase journey. Through detailed project pages, official FAQs, and direct sales inquiry forms, Meraas guides investors from initial interest to understanding critical processes like DLD registration (Oqood) and obtaining a No Objection Certificate (NOC) for future resales.

Why It Stands Out

Meraas distinguishes itself by offering more than just property listings; it offers a brand promise. The developer, now part of Dubai Holding Real Estate, has a proven track record of delivering high-quality, integrated communities that command premium valuations and strong rental demand. The website reflects this by providing rich, immersive content that communicates the lifestyle and vision behind each project, something often lost on third-party portals.

The platform's strength lies in its transparency and authority. By engaging directly with Meraas, you get first-hand, accurate information on availability, official payment plans, and construction updates. The site’s clear guidance on the necessary documentation and legal steps provides a level of assurance that is invaluable for both first-time and experienced off-plan investors.

Practical Tips for Maximising the Platform

To make the most of the Meraas website, use it as a primary due diligence resource.

- Register Your Interest Early: For upcoming launches, the official site is the best place to register your interest. This ensures you are among the first to receive project details, floor plans, and pricing information, giving you a competitive advantage.

- Study the FAQs: The FAQ section is a goldmine of information, explaining complex off-plan mechanics in simple terms. Review it to understand buyer eligibility, the Oqood process, and the requirements for reselling your unit before handover.

- Explore the Masterplan: Don’t just look at individual buildings. Use the site to explore the entire community masterplan. Understand the planned retail, F&B, and amenities, as this is what drives long-term value and tenant appeal.

- Initiate Direct Contact: Use the sales inquiry forms to start a conversation. This connects you with the official sales team, who can provide the most accurate and up-to-date information, bypassing potential misinformation from the secondary market.

Platform Breakdown

| Feature | Details |

|---|---|

| Primary Use Case | Direct developer purchases, project information, and buyer education. |

| Access | Free to browse and register interest. |

| Key Advantage | Authoritative, first-hand information and direct access to a portfolio of premium, lifestyle-focused projects. |

| Potential Drawback | Portfolio is limited to Meraas projects; some pricing details require direct contact with the sales team. |

Website: https://www.meraas.com/

Top 7 Off-Plan Projects in Dubai — Comparison

| Source | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes ⭐ / 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| How to Find the Best Off-Plan Deals in Dubai (Proact Luxury Real Estate) | 🔄 High — bespoke research, legal & advisory workflows | ⚡ Medium–High — fee-based, one-on-one time, access to networks | ⭐⭐⭐⭐ / 📊 High potential ROI and early-access inventory (mitigates but doesn’t remove market/developer risk) | Global mid‑to‑high net‑worth investors seeking curated, high‑yield off‑plan opportunities | Curated early access; end‑to‑end advisory; market‑timing & tokenization/ESG insights |

| Property Finder | 🔄 Low — marketplace search and lead capture | ⚡ Low — web access, filters, mortgage pre‑approval tools | ⭐⭐ / 📊 Broad market visibility and quick shortlisting | Buyers scanning large inventory and comparing many projects quickly | Deep, frequently refreshed inventory; robust filters; built‑in contact/mortgage tools |

| Bayut | 🔄 Low — portal with editorial + listings | ⚡ Low — easy search with editorial guidance | ⭐⭐ / 📊 Good discovery of trending launches and starting prices | Users wanting trend context and quick discovery of new launches | Editorial round‑ups + clear “from” pricing; solid filtering by area/developer |

| Emaar Properties (official) | 🔄 Low — direct developer purchase process | ⚡ Medium — deposit/payment plan; direct sales channel | ⭐⭐⭐ / 📊 Secure, official project info and consistent payment structures | Buyers who prefer to buy direct from a major flagship developer | Direct-from-developer inventories; clear eligibility and official brochures |

| Nakheel (official) | 🔄 Low–Medium — developer processes with phased releases | ⚡ Medium — registration/allocation windows, direct sales | ⭐⭐ / 📊 Official progress updates and launch diligence (allocation risk in phases) | Investors targeting iconic waterfront/master‑developer projects | Transparent construction progress; timely press/launch updates; direct sales |

| Sobha Realty (official) | 🔄 Low — developer microsites and sales process | ⚡ Medium — consistent payment plans, sales support & app | ⭐⭐ / 📊 Detailed project info for design-led, premium offerings | Buyers seeking design‑forward or branded residential projects | Detailed microsites; direct sales channels; app support (ONE Sobha) |

| Meraas (official) | 🔄 Low — direct sales with formal documentation guidance | ⚡ Medium — registration and documentation (DLD/Oqood) | ⭐⭐ / 📊 Branded urban/waterfront projects with clear buyer process guidance | Buyers needing clarity on documentation, resale NOC and Dubai Holding projects | Clear FAQs on Oqood/NOC; direct customer support; branded project pipeline |

From Shortlist to Signature: Your Next Steps in Off-Plan Investing

Navigating the dynamic landscape of Dubai's off-plan real estate market is both an exciting and intricate endeavour. We have journeyed through the essential tools, from comprehensive portals like Property Finder and Bayut to the direct source of innovation from developers such as Emaar, Nakheel, Sobha, and Meraas. Each platform offers a unique window into the market, providing the foundational data needed to build a strong investment shortlist.

However, a successful investment is built on more than just data; it is refined by strategy, insight, and expert guidance. The tools we’ve discussed are your starting point, your digital reconnaissance, but the journey from a promising online listing to a signed contract requires a deeper level of analysis. The critical next steps involve translating raw information, such as unit types and payment plans, into a coherent financial strategy that aligns with your specific goals, whether that's high rental yields or long-term capital appreciation.

Synthesising Data into a Coherent Strategy

The true challenge lies not in finding projects, but in identifying the best off-plan projects in Dubai for you. This requires a multifaceted approach that goes beyond the glossy brochures and marketing materials. Key considerations must be meticulously evaluated:

- Developer Diligence: Look beyond the developer’s name. Analyse their complete delivery history, track record for quality, and commitment to post-handover community management. A developer's reputation for on-time delivery is paramount.

- Payment Plan Analysis: A 60/40 plan might look appealing, but how does it stack up against a 70/30 plan when you factor in your own cash flow, financing options, and the project's anticipated completion date? The most favourable plan is the one that best suits your financial structure.

- Location Deep Dive: Proximity to a metro station is a clear benefit, but what about future infrastructure? Consider the Dubai 2040 Urban Master Plan. Is the community part of a designated growth corridor? Future developments can significantly impact your property’s value.

- Comparative Market Analysis (CMA): How does the price per square foot of your chosen off-plan unit compare to similar, ready properties in the immediate vicinity? This analysis provides a crucial benchmark for assessing potential capital growth upon completion.

The Human Element: Beyond the Digital Tools

While technology empowers us with unprecedented access to information, it cannot replicate the nuanced understanding of a seasoned market expert. An experienced real estate advisor acts as your strategic partner, bridging the gap between the data you have collected and the actionable insights you need. They provide context that algorithms cannot, such as insider knowledge on upcoming project launches, negotiating leverage with developers, or identifying undervalued micro-markets poised for growth.

Choosing the right off-plan project is one of the most significant financial decisions you will make. It requires a blend of rigorous research, strategic foresight, and professional guidance. By combining the powerful tools we've outlined with a robust due diligence framework, you can move forward with confidence, transforming your shortlist into a cornerstone of your investment portfolio. The best off-plan projects in Dubai are waiting, and with the right approach, you are now equipped to find them.

Are you ready to translate your research into a secure and profitable investment? Proact Luxury Real Estate LLC, led by Ritu Kant Ojha, offers bespoke advisory services to navigate the complexities of off-plan purchases, ensuring your choice is backed by comprehensive data and expert strategy. Book a personalised, one-on-one consultation at Proact Luxury Real Estate LLC to build a tailored investment plan that aligns perfectly with your financial ambitions.

Article created using Outrank