While many investors continue to focus on Downtown Dubai, analysis of last year's benchmarks shows the strategic capital has shifted. The market has matured from the post-Covid boom into a sustainable growth cycle, demanding a focus on assets that deliver stable yields over speculative gains.

This is where apartments for rent in al furjan now warrant serious consideration. This community's balanced supply of new properties has moderated the aggressive rent escalations seen elsewhere, creating an optimal environment for long-term tenancy and, consequently, predictable investor returns entering 2026.

A Data-Driven Overview of the Al Furjan Rental Landscape

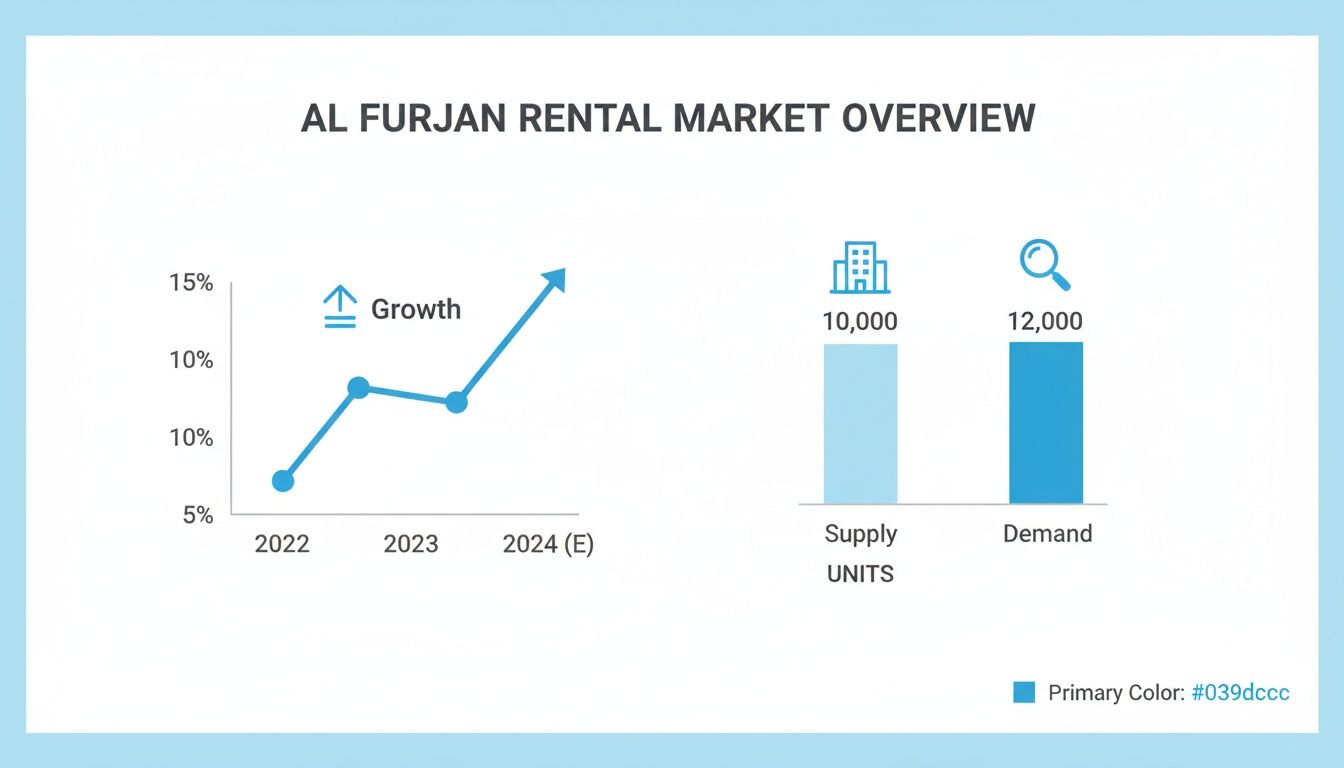

Last year's transaction data tells a clear story. While prime districts dealt with rental volatility, Al Furjan demonstrated a measured and sustainable growth pattern. This was not a sign of weakness but of a maturing market—precisely the characteristic required for stable portfolio construction in 2026. The cycle of easy, market-wide gains is over; consistent cash flow is now the primary metric.

The supply and demand dynamics in Al Furjan are a core component of our comprehensive Dubai real estate market analysis. The community has effectively absorbed new unit handovers from 2025, which has cooled the rapid price increases seen in prior years. This equilibrium is what attracts a reliable, long-term tenant base.

Shifting Demand Drivers

Al Furjan's appeal is no longer a simple matter of affordability. Its strategic value has increased, driven by two non-negotiable economic factors:

- Proximity to Economic Hubs: Its location near major employment centers like Expo City and the Jebel Ali Free Zone makes it the logical choice for thousands of professionals. This creates a resilient floor for rental demand, insulating investor income from the volatility common in tourist-centric areas.

- Established Infrastructure: Unlike emerging master communities, Al Furjan offers a complete ecosystem. It provides direct access to the Route 2020 Metro line, retail pavilions, and international schools—critical decision factors for the expatriate families who form the community's core demographic.

For the asset manager in 2026, Al Furjan represents a pivot from high-risk speculation to calculated performance. The objective is no longer to simply ride an appreciation wave but to secure an asset generating predictable, long-term revenue streams.

This tenant profile, favoring long-term leases, is the key to maintaining low vacancy rates and high net operating income. The demographic is less transient, reducing turnover costs and providing landlords with a more predictable financial outlook. As we analyze opportunities for 2026, Al Furjan stands out not for explosive growth, but for its robust and defensible market fundamentals—a crucial distinction for any serious portfolio.

Projecting Rental Yields and Capital Appreciation

An asset's value is defined by its performance. As we assess the market in 2026, evaluating apartments for rent in Al Furjan requires moving beyond last year's simple rental figures. Sound asset management demands a deeper analysis of projected yields and long-term capital appreciation.

The data below provides a comparative view of Al Furjan's rental yield projections, supply dynamics, and tenant demand, illustrating the market's trajectory.

This data confirms our on-the-ground observations: while the extreme growth of the last cycle is leveling off, the balance between new supply and consistent demand creates a stable investment environment. This equilibrium is what astute portfolio managers should target in the current market cycle.

Al Furjan vs. JVC Projected Gross Rental Yield Comparison

To contextualize Al Furjan's performance, let's compare it against another popular mid-market community, Jumeirah Village Circle (JVC). While both attract similar tenant profiles, their metrics reveal key differences that should inform an investment strategy.

| Unit Type | Al Furjan Projected Gross Yield | JVC Projected Gross Yield | Key Demand Driver |

|---|---|---|---|

| Studio Apartment | 7.0% - 7.5% | 7.2% - 7.8% | JVC's higher density attracts a more transient, younger demographic. |

| 1-Bedroom Apartment | 6.8% - 7.2% | 6.5% - 7.0% | Al Furjan's metro access provides a premium for commuting professionals. |

| 2-Bedroom Apartment | 6.5% - 7.0% | 6.0% - 6.5% | Al Furjan's family-oriented infrastructure and larger layouts attract long-term tenants. |

The takeaway is direct. While JVC may offer slightly higher yields on studio units, Al Furjan delivers more consistent returns on larger, family-sized apartments. This stability is a direct result of superior infrastructure and a tenant base seeking long-term residency.

Capital Appreciation Outlook and Infrastructure Impact

Capital appreciation in Al Furjan is no longer tied to market-wide speculation. It is now anchored to tangible infrastructure development. The expansion of Al Maktoum International Airport is the primary engine, transforming the Dubai South corridor into a global logistics and aviation hub. This development will create sustained, high-quality housing demand for years. [Map: Location relative to Al Maktoum Airport]

Strategic asset selection in 2026 is less about timing the market and more about acquiring proximity to future economic hubs. Properties within a 10-minute walk of the Al Furjan metro station are positioned to outperform the community average in both rental income and value growth.

In a family-focused community like Al Furjan, investors are now prioritizing long-term leases to lock in stability, especially with a forecasted 12% average annual vacancy rate across Dubai in 2026. Last year's data shows that Ejari-registered long-term contracts in communities like Al Furjan consistently outperform mid-term rentals, offering reliable cash flow.

For HNWIs comparing Dubai to markets like Mumbai or Bengaluru, Al Furjan’s balanced price-to-rent ratios—yielding a solid 6-7% annually—make it a prime choice for portfolio diversification. You can find more analysis on these market shifts in this expert forecast on Dubai rental prices.

Maximizing net return requires careful accounting for operational costs. Landlords must accurately factor in annual service fees and utility bills. Our detailed guide on housing charges and DEWA fees outlines the liabilities every investor must calculate.

Final Thoughts

The performance of an asset in Al Furjan now hinges on its specific quality and location within the master community. The days of uniform appreciation are over. Success in 2026 demands a focused strategy: acquire units that appeal to the stable, long-term expatriate demographic and benefit directly from major infrastructure projects.

Decoding Tenant Demographics and Demand Drivers

To accurately forecast rental income and minimize vacancy, an asset manager must first understand the end-user. The profile of a tenant seeking apartments for rent in Al Furjan is different from those in transient, tourist-centric districts. This is a critical factor for investors focused on predictable revenue.

The tenant base is not a random mix; it is composed of specific professional and family archetypes drawn to the community for strategic reasons. This demographic overwhelmingly favors stability and long-term leases—a direct result of the community's infrastructure and its location near key economic zones.

The Primary Tenant Profiles

Analysis of 2025 leasing data reveals two dominant tenant segments that consistently drive demand in Al Furjan:

- Mid-to-Senior Level Professionals: This group includes managers, engineers, and logistics specialists working in the employment hubs of Jebel Ali Free Zone (JAFZA), Dubai Investment Park (DIP), and Expo City. For them, Al Furjan offers a high-quality residential environment with a commute time often under 20 minutes.

- Expatriate Families: These tenants are drawn by established infrastructure, including international schools like The Arbor School. They prioritize safety, green spaces, and larger unit layouts (two- and three-bedroom apartments) that are less common or more expensive in central Dubai.

This demographic composition is the foundation of Al Furjan's rental market stability. Unlike areas reliant on short-term corporate lets or tourism, Al Furjan's demand is rooted in long-term employment and family settlement. This leads to lower tenant turnover, reduced vacancy periods, and more predictable cash flow.

Core Demand Drivers for 2026

Several key factors underpin the sustained demand for rental units in this community. These are not just lifestyle perks; they are fundamental economic and logistical advantages that secure the area's value proposition.

The most critical driver is direct connectivity. The Route 2020 Metro line is a non-negotiable asset, providing a direct link to major business districts. Properties within walking distance of the Al Furjan station command a rental premium and experience lower vacancy rates, a trend we expect to strengthen through 2026.

An asset’s performance is directly tied to its appeal to the right demographic. In Al Furjan, the formula is clear: connectivity, family-centric amenities, and proximity to long-term employment hubs. Investors who align their property features with these drivers will outperform the market average.

Furthermore, the growing number of professionals seeking residency under various government schemes contributes to the demand for stable housing. New residents often look for residency pathways, and obtaining a golden visa uae is a common goal. Their preference is for established, well-connected communities like Al Furjan.

Contrasting this with more volatile areas like Dubai Marina, where a higher percentage of tenants are on shorter-term contracts, reinforces Al Furjan's position. The focus here is on creating a home, not just a temporary base. This stability is the core reason why apartments for rent in Al Furjan are a cornerstone of a resilient Dubai real estate portfolio.

What to Expect From the New Supply Pipeline

Any investor knows that the flow of new property inventory is a primary factor influencing rental prices and asset performance. As we look to 2026, it is critical to understand the new apartment supply scheduled for handover in Al Furjan and its neighboring districts. This new inventory is set to temper the rapid rent hikes of previous years, leading to a more balanced market.

This market phase presents a clear opportunity. Investors can use this period to acquire units in new buildings with modern amenities, which almost always command a rental premium over older stock. The key is to differentiate between standard inventory and high-quality assets positioned to attract and retain the best tenants.

Key Developments and Handover Timelines

The supply pipeline for 2026 is robust, with several key projects nearing completion. These developments are not just adding units; they are elevating the quality of apartments for rent in Al Furjan.

- Azizi Central: Scheduled for handover in mid-2026, this project will introduce a mix of studio to three-bedroom apartments aimed at the professional demographic.

- Zazen Ivy: With its focus on sustainable design, this development is expected to be handed over in Q1 2026, attracting environmentally conscious tenants.

- Pristine Residences: This mid-sized tower features smart home technology and is set to attract a tech-savvy tenant base upon launch.

This managed flow of new supply is a sign of a healthy, maturing community. You can get a better sense of how supply and demand are shaping prices in our broader analysis of Dubai real estate market trends.

Market Impact and Investor Strategy

While Dubai’s broader rental market is projected to see increases, the new supply in Al Furjan creates a unique micro-market. Industry forecasts predict rental rises of up to 6% in high-demand areas, but new inventory here will likely moderate that growth, increasing competition among landlords. This creates a tenant-friendly environment that will keep attracting expatriates. For more on these projections, you can read the full forecast on KhaleejTimes.com.

The strategic response to increased supply is not to compete on price, but on quality. An asset manager’s focus must shift to acquiring units in buildings with superior finishes, better facilities, and professional management—all of which justify premium rental rates.

For investors considering off-plan purchases, RERA protections are firmly in place. All developer payments are held in mandatory escrow accounts, which safeguards investor capital throughout construction. This regulatory oversight, part of the wider uae property law, provides a secure framework for entering the market with confidence. Understanding this supply pipeline is fundamental to making the right acquisition decisions.

Understanding the Landlord Legal Framework

A successful investment is a compliant one. Navigating Dubai's rental market requires a precise understanding of the legal framework governing landlord-tenant relationships. For high-net-worth individuals managing assets from abroad, this is fundamental to risk management.

The system is anchored by Ejari, the mandatory online registration platform managed by the Real Estate Regulatory Agency (RERA). Every tenancy agreement for apartments in Al Furjan must be registered through this system. Failure to register renders the contract legally unenforceable, leaving an investor exposed in case of disputes.

Core Legal Components for Asset Managers

Managing a rental property in Dubai means adhering to a clear set of rules. These are legally binding obligations designed to create a transparent market.

- Security Deposits: The law specifies that a security deposit is typically 5% of the annual rent for an unfurnished apartment. This is fully refundable at the end of the lease, following an inspection for damages beyond normal wear and tear.

- Maintenance Obligations: Responsibilities are divided. As the landlord, you are legally responsible for all major maintenance—structural issues, MEP (mechanical, electrical, plumbing) systems, and air conditioning. The tenant handles minor, routine upkeep. These terms must be explicitly stated in the contract.

- Lease Renewal and Termination: If you intend to not renew a lease or wish to change its terms (like the rent), you must give the tenant a 90-day written notice. This must be delivered through a registered channel like a notary public or registered mail to be legally valid.

Rent Increases and Dispute Resolution

The process for increasing rent is strictly regulated by the RERA Rental Increase Calculator. This online tool is the sole determinant of the maximum permissible rent increase, based on a property's current rent compared to the average market rate in Al Furjan. Any increase beyond this calculated limit is not legally enforceable.

A common misstep for overseas investors is attempting to negotiate rent increases outside the RERA framework. This not only invalidates the increase but can lead to disputes that favor the tenant. Always use the official calculator as the sole benchmark.

Should a disagreement arise that cannot be resolved amicably, the matter is escalated to the Rental Disputes Settlement Centre (RDSC). This judicial body is the sole authority for resolving landlord-tenant conflicts. The process is efficient but hinges on all documentation—primarily the Ejari-registered tenancy contract—being in perfect order.

For a detailed breakdown of legal clauses and procedures, refer to our complete guide to the tenancy contract in Dubai. Correctly navigating these legalities is the cornerstone of protecting your asset in this market.

Investor FAQs: Your Questions Answered

When evaluating a market like Al Furjan, having the right answers to the right questions is critical. Here, I address the most common queries from investors, providing direct, data-backed insights to shape your asset strategy for 2026.

What Is a Realistic Gross Rental Yield for an Apartment in Al Furjan?

Based on last year's performance and current market data, a realistic gross rental yield is between 6% and 7.5% for a well-maintained apartment in Al Furjan. Studios and one-bedroom units are driving this, typically hitting the higher end of that range due to solid demand from single professionals and couples.

However, "yield" is not a uniform metric. It is sensitive to the specific asset. The building's quality, amenities, and walking distance to the metro station are major variables. Any competent asset manager will analyze these factors at a granular level before acquisition.

How Does the New Supply in Al Furjan Affect My Investment Strategy?

The new units scheduled for delivery in 2026 are a positive indicator of market health. They act as a stabilizer, preventing the unsustainable rent hikes seen in past cycles. For an investor, this means the focus shifts from speculative timing to asset quality.

A smart strategy now involves targeting units in newly completed buildings with superior facilities or unique layouts that can command a rental premium. This new supply increases competition, making professional property management and tenant retention critical. Owning the property is no longer enough; you must manage it as a competitive asset.

What Are the Key Costs for a Landlord in Dubai?

Beyond the purchase price, you must account for several operational costs. The primary one is the annual service charge for building maintenance, which typically ranges from AED 12 to AED 18 per square foot in Al Furjan.

Additional operational costs include:

- Ejari Registration Fees: A mandatory government fee for every new tenancy contract.

- Property Management Fees: If you hire a professional firm, budget for 5-7% of the annual rent.

- Maintenance Fund: A reserve for routine repairs and general upkeep.

To calculate your true net yield, you must factor in all these expenses. Failing to budget for them accurately is a classic error that erodes returns. We always conduct a detailed analysis of all potential liabilities, including any fees related to taxes on property.

Should I Rent My Al Furjan Apartment Furnished or Unfurnished?

The answer depends on your target tenant. Al Furjan's tenant base is dominated by families and professionals on long-term employment contracts. These individuals typically arrive with their own furniture and seek a place to make their own.

Offering a property unfurnished reduces your initial capital outlay and simplifies the tenant changeover process. Furnished units are aimed at a more transient, short-term market, which can mean higher vacancy risks and more management overhead—a strategy that does not align with the stable, long-term returns the Al Furjan market currently offers.

At Proact Luxury Real Estate LLC, we provide the granular analysis required to align your real estate assets with your broader financial objectives. If you are rebalancing your portfolio for 2026, let's run the numbers. Visit us at https://ritukant.com to schedule a consultation.